A Healthy Reset

Palantir's headaches. Also, how to plan for the next market bubble formation.

Palantir was in the driver’s seat today. This move felt like a forced liquidation that carried over from yesterday, with solid volume that felt like capitulation.

That selloff was used by dip buyers to sell a bunch of puts, which put a natural bid in the stock.

If you haven’t been focused on momentum land, it was a boring day without a ton of selling breadth. Just some trapped momentum buyers that were over their skiis.

There’s the chance that some investors will use this price action to justify a new narrative, but I certainly don’t see it. Volatility markets are still in good shape and that small pullback may have been an opportunity to reset the “burn the hedges” cycle as we head into September.

Greener Pastures

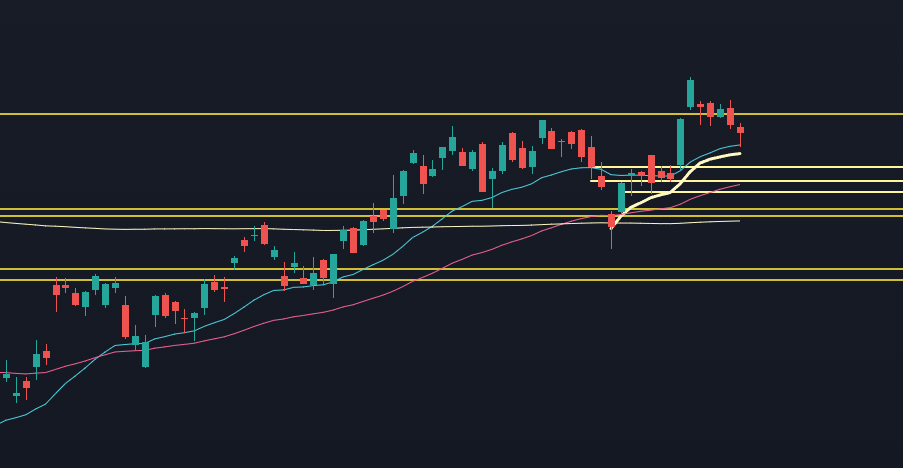

Even the Russell looked fine today.

A normal pull into the 20, and with the context of the large impulses higher, it still feels stable.

The evidence continues to point towards a larger rotation outside of the Mag7 with some solid breakout opportunities.

And I think I’ve discovered The Big One as into the fourth quarter.

Releveraging The System

Grumpy macro traders have been trying to make the treasury market “a thing” since 2022. We hear about minsky moments, debt-debt cycles, and fiscal spending.

The cascade never hit. There’s been two major higher lows in the 10 year, and volatility has contracted this entire year.

It turns out, the US Treasury found a solid source of demand: stablecoins. Circle (USDC) and Tether (USDT) collectively own about $150B in T-bills. It turns out “crypto fixes this.”

There’s a new source of liquidity coming on board. It’s a little technical, and I’m going to miss some details, but here goes:

The Federal Reserve, FDIC, and Office of the Comptroller have upped the leverage for banks. They’re changing the enhanced supplementary leverage ratio (eSLR), which is a capital requirement to help backstop the financial system.

Here’s a quote from Reuters, emphasis mine:

Large U.S. global banks can expect as much as $6 trillion in additional balance sheet capacity and billions in freed up capital under a Federal Reserve plan to relax leverage rules, Wall Street brokerages estimated on Thursday.

Now you can grouse about how this is going to cause a stock market bubble.

Or, you could realize that this COULD CAUSE A STOCK MARKET BUBBLE.

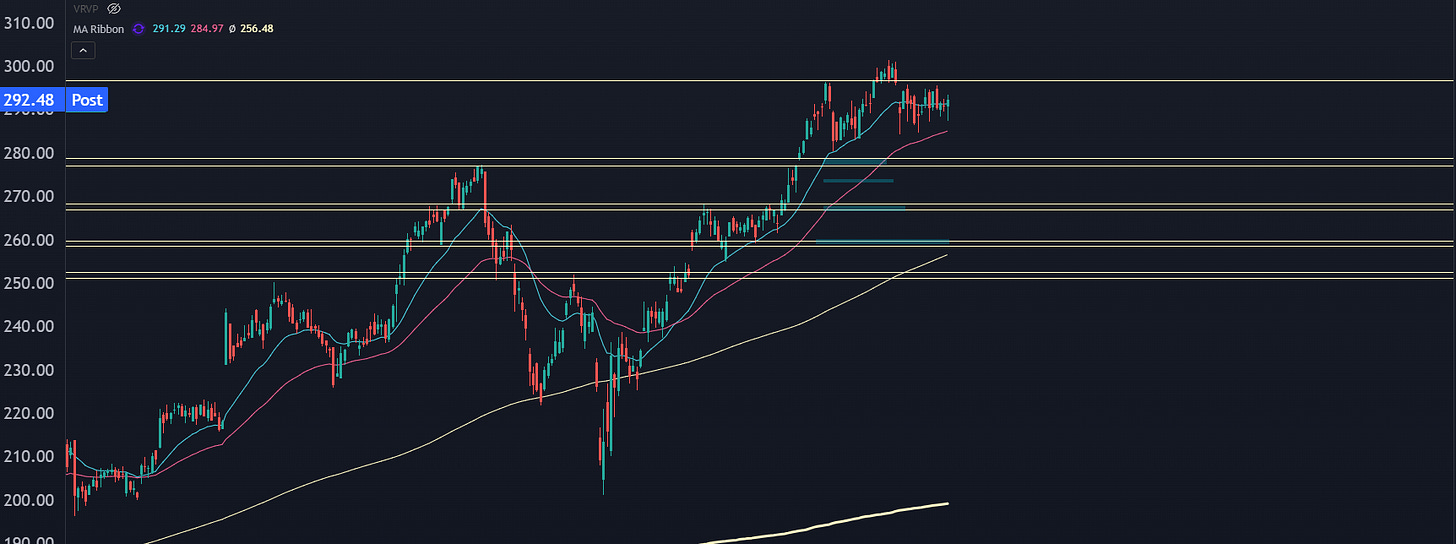

And while momentum got killed today, JPM looks ready to take out $300:

With the Fed set to cut rates next month, this could end up being gas on the fire. Big banks start kicking out more cashflow, liquidity continues to show up in risk assets, and while everyone’s still trying to find the next AI hyperscalar play, you just bought some LEAPs in Citigroup when you realized how aggressive the wicks are on the daily chart:

Don’t sleep on this narrative. I don’t think it’s priced in. The rule’s comment period ends on August 26th, a week from now. The final rules may not show up until 6 months from now.

And when you have an “obvious” catalyst that’s half a year out, it lines us up for a solid “buy the rumor, sell the news” event.

I’ve got some solid setups lined up for Convex Spaces Clients including the exact option trade to consider. We’ve got a setup in PLTR, along with an Industrial stock will surprise you.

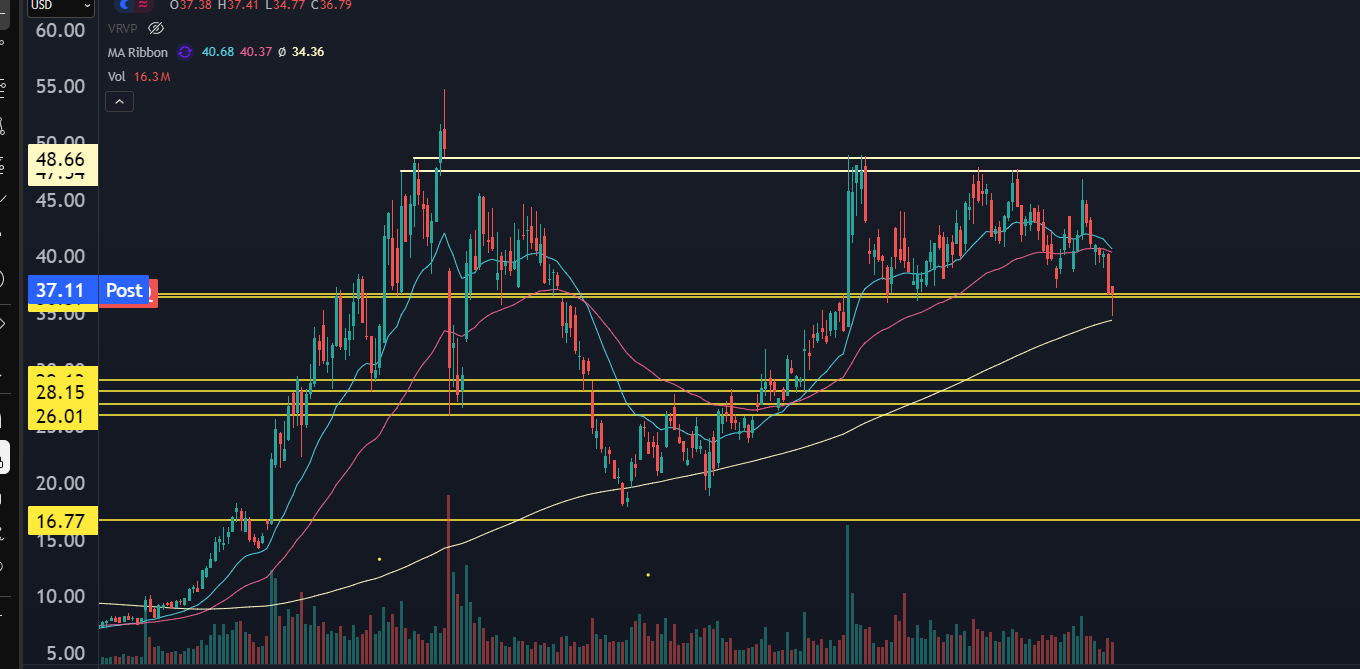

IONQ Failed Breakdown

Quantum never had its push with everything else this summer, and there’s a bit of a hangover. The stock broke down underneath a key pivot level (36.50) but reversed back above it today.

There’s a possibility that the unwind isn’t done, but if the stock continues to hold today’s low, and then keep above 37 into the end of the week, then it’s setup for at least a move to the other end of the range.

I like the October $55 Calls (ref: 0.74) as a good lotto ticket trade. You can sell half on the push to $47 for a good clip, and then hold the rest just in case it does manage to breakout.

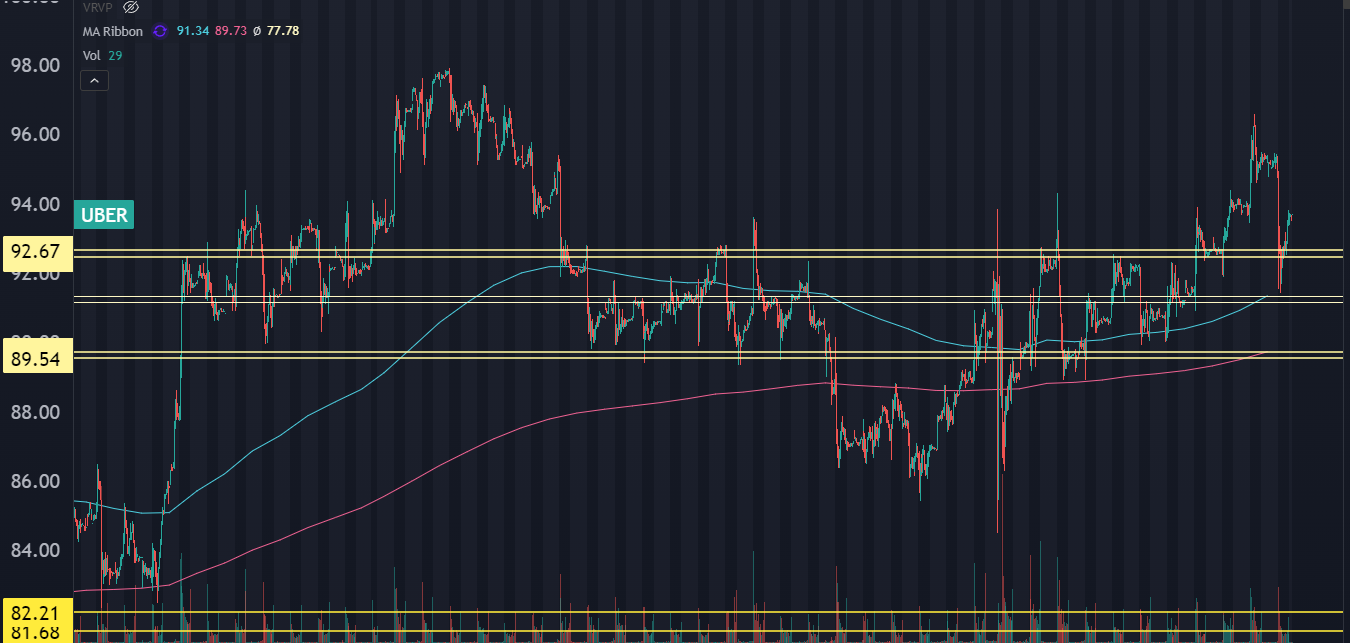

UBER Reclaim

Did you know that this is considered an industrial stock, not tech? I guess they’re in transport and logistics but this is more of a company that needs to get some robotaxis leased to pump the stock.

Similar to IONQ, just never had a lift and the stock got hit today. I’ve got a bigger level at 92.67 that was reclaimed today, and the daily chart is setup for a $100 roll.

Provided the stock can hold above 92.67, I think the Oct $100 calls are a good trade. IV is 34% which feels cheap as well.

PLTR Volatility Fade

This is a tricky one to execute, so make sure you know what you’re doing if you want to be net short gamma on the most headline name in the market.

Which is precisely why I like the idea. It is the most followed stock right now, and flows suggest there’s still institutional demand for the name.

But there was a solid amount of damage done. That kill candle yesterday has plenty of bagholders in it.

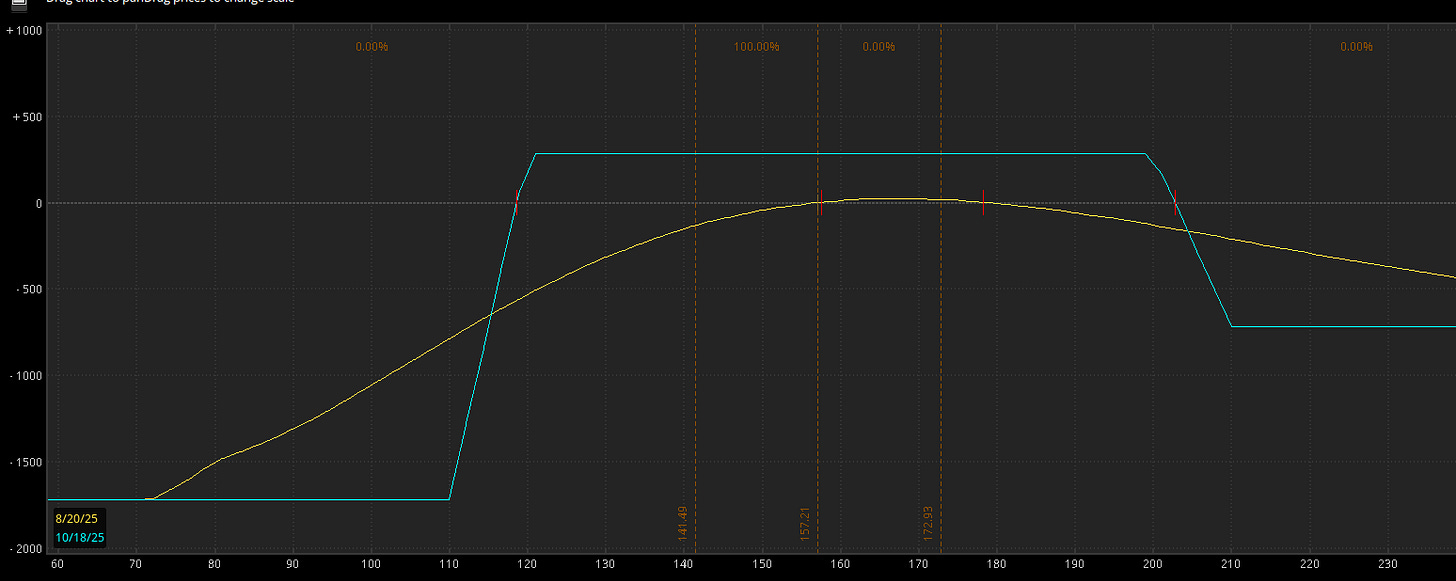

The bet is range, reversion, and falling vol. It’s a good case for an unbalanced iron condor.

Sell 2x Oct 120/110 Put Spread @ 1.10

Sell 1x Oct 200/210 Call Spread @ 0.70

I like this unbalanced because on iron condors you can get way too net short initially after an oversold move. While I think the top is in for PLTR there’s always the possibility of some idiot fund that jams their way in over the next two weeks.

Price insensitive knuckleheads.

Either way, capturing about 70% of the premium works, and you can treat each leg individually. So if the stock bounces and you can take nice profits… solid. You may have the ability to resell those spreads as well.