A "Here Or There" Setup In The Russell 2000

A look at the liquidity structure in smallcaps and why it's either going to bounce hard or get killed.

For the past few weeks, my base case for the market has been a “flaming hot garbage trading range.”

You know the kind. Where traders are ground into dust chasing statistical noise while larger players start to re-position into the next market leaders.

And it’s been a good call…yet when the market can’t catch a bid after a strong Friday bounce, it’s tough to bet on range because it means you have to be bullish and fade the market when it looks like the bid is about to be yanked and we see a 3% down day.

Yet breadth looks OK, and some key names are resetting after their short term excess.

The best example right now is AMZN. The news hit today that they’re going to do a $15B bond sale, their first since 2022.

Traders got beared up in the early session, and I have a feeling that many are looking for the earnings gap fill, similar to what happened to ORCL.

Instead, it knocked out a higher low. Combine that with the catalyst, and how AMZN should have tanked, and that’s telling me we’re getting higher odds of reversion in the markets.

We’re close to carving out a low, but we could have one or two more rugs before a bounce.

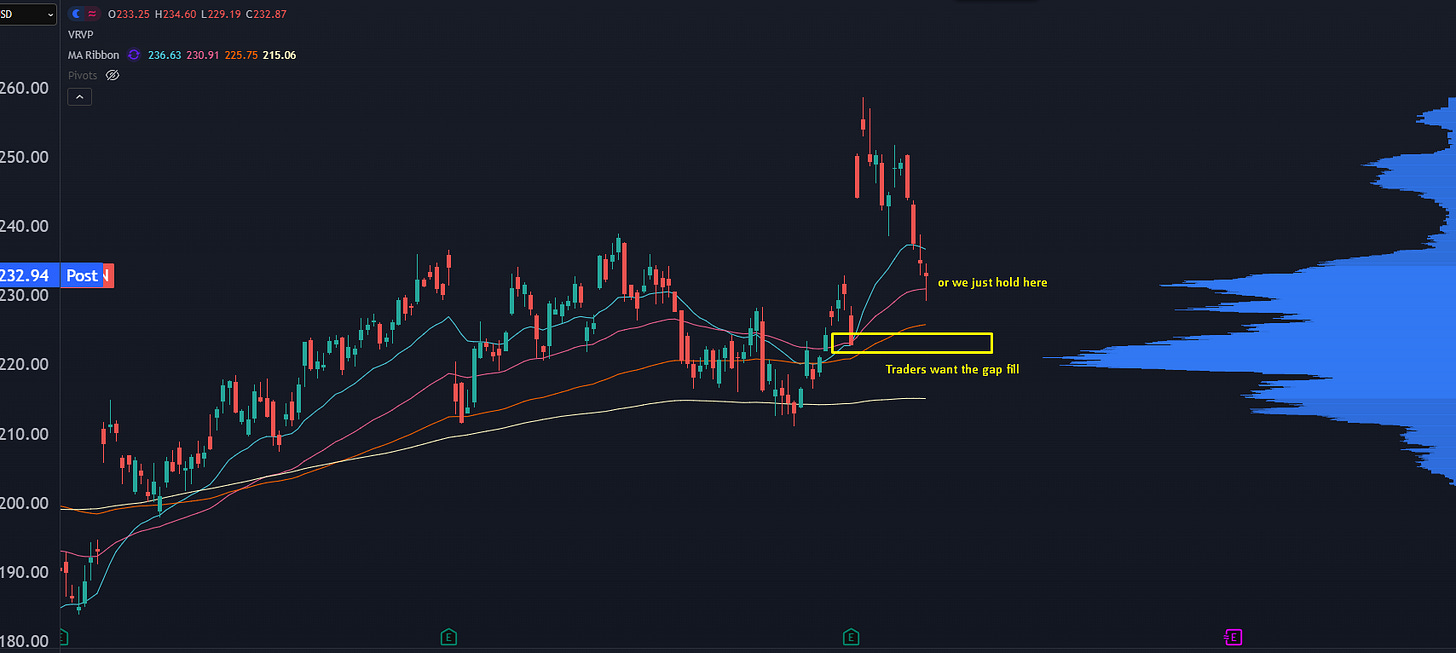

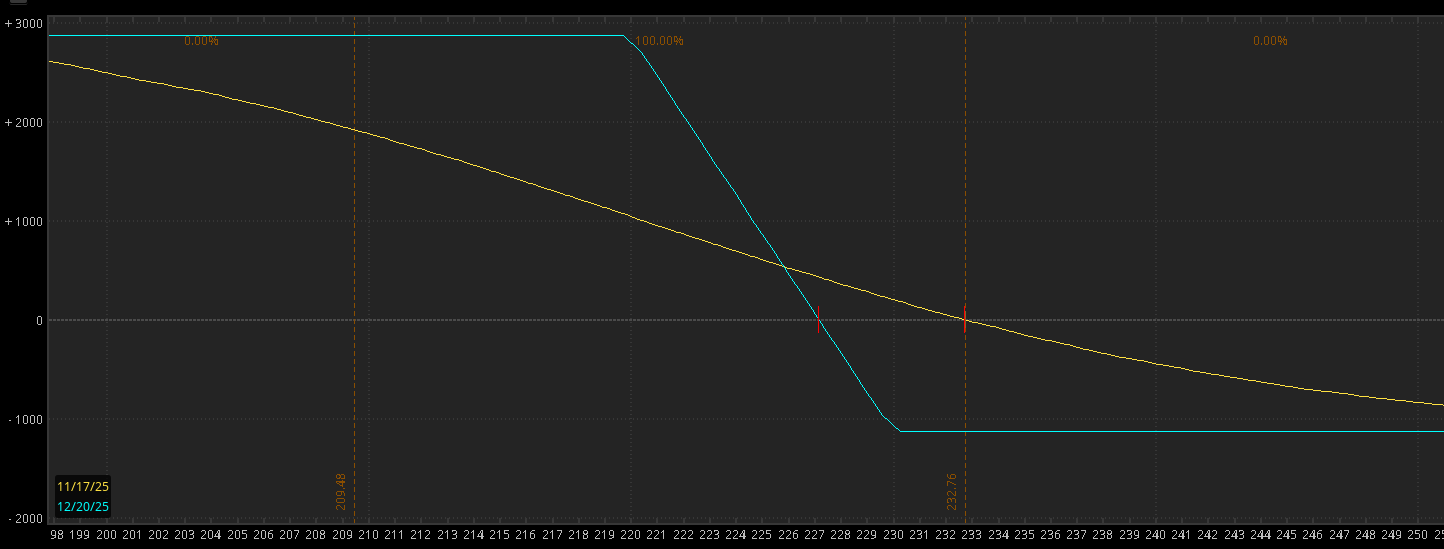

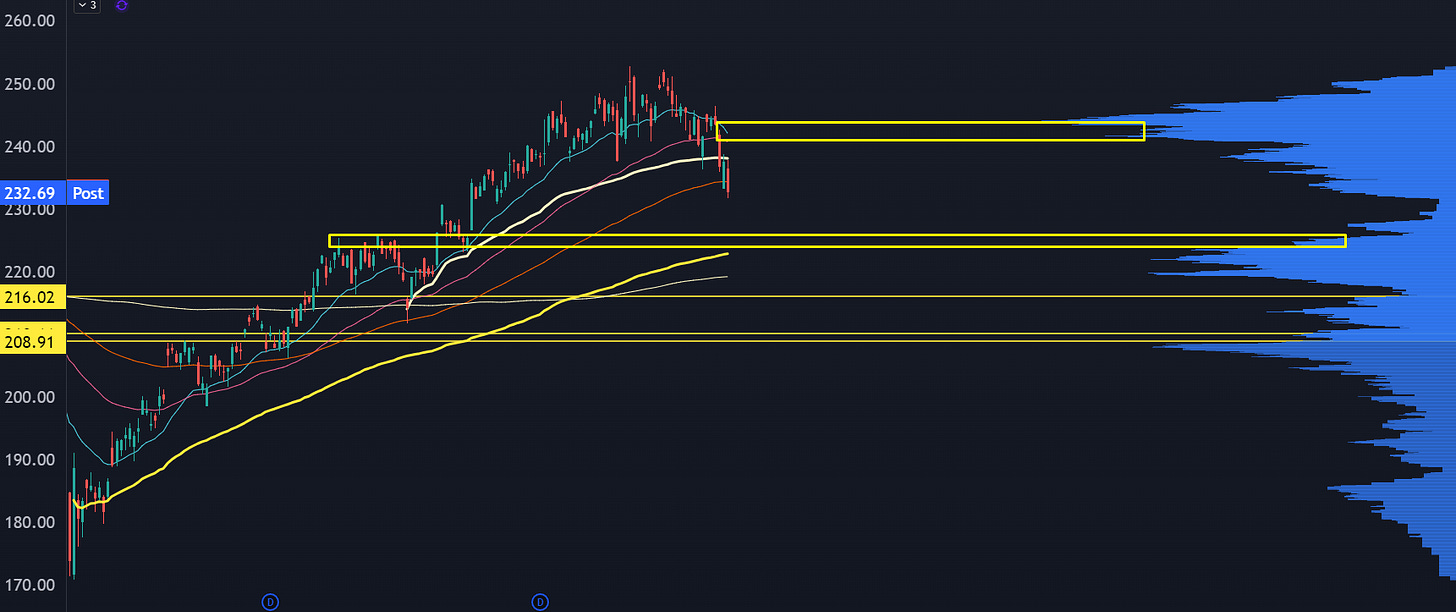

Like what I’m seeing in the Russell 2000 index:

We’re right on the edge of a liquidity cliffside. When we see a large gap in volume, there’s a tendency for a swift move through into the next level, which would be right around 228.

If you have one more push below that, then you have the market testing the swing AVWAP from the April lows around 224.

But if the lows hold here, then you’ve got an easy short cover rally up into 240.

It starts to sound like a zen koan:

“The market could go up or down.”

That doesn’t seem actionable, does it?

Given where we sit, and the cliffside the Russell faces, we’re not going to stick around at this price level that long. It’s not sticky, and soon we will see a fast departure away from it.

That’s where the options market comes into play. You can structure a bet that profits on a fast move in either direction.

For Convex Spaces clients, we’re going to build out a trade that takes advantage of the fast move that’s about to hit the markets, and I’ll step through all the trade adjustments and why we get an extra edge in the options market.

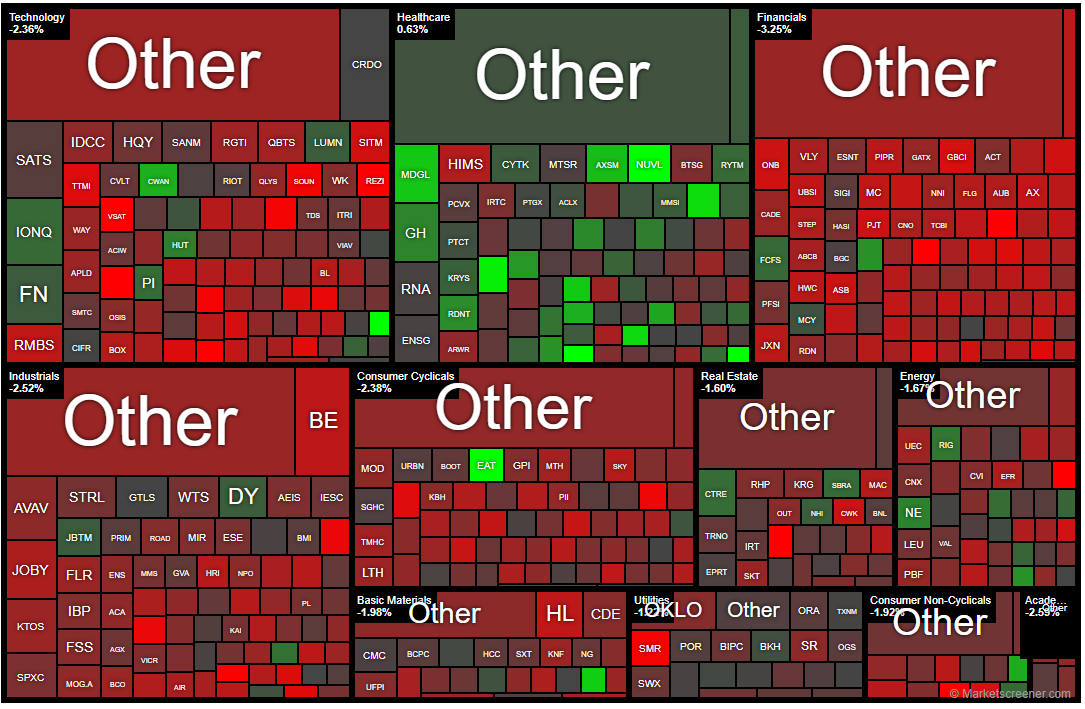

Under The Hood

Before I get to the trade, understand that the Russell is not going to have the same kind of trade action as the market-cap weighted indices.

The big sectors are tech, healthcare, financials, and industrials.

Healthcare is basically biotech, so we can look at XBI for a feel for that trade:

It’s been a surprisingly healthy market and showing a ton of relative strength. If we do get a liquidity rugpull in the markets, then this will most likely get taken out and test the lower end of the range around 107.

But it’s possible we just see a shortsqueeze as it’s stubborn near the highs.

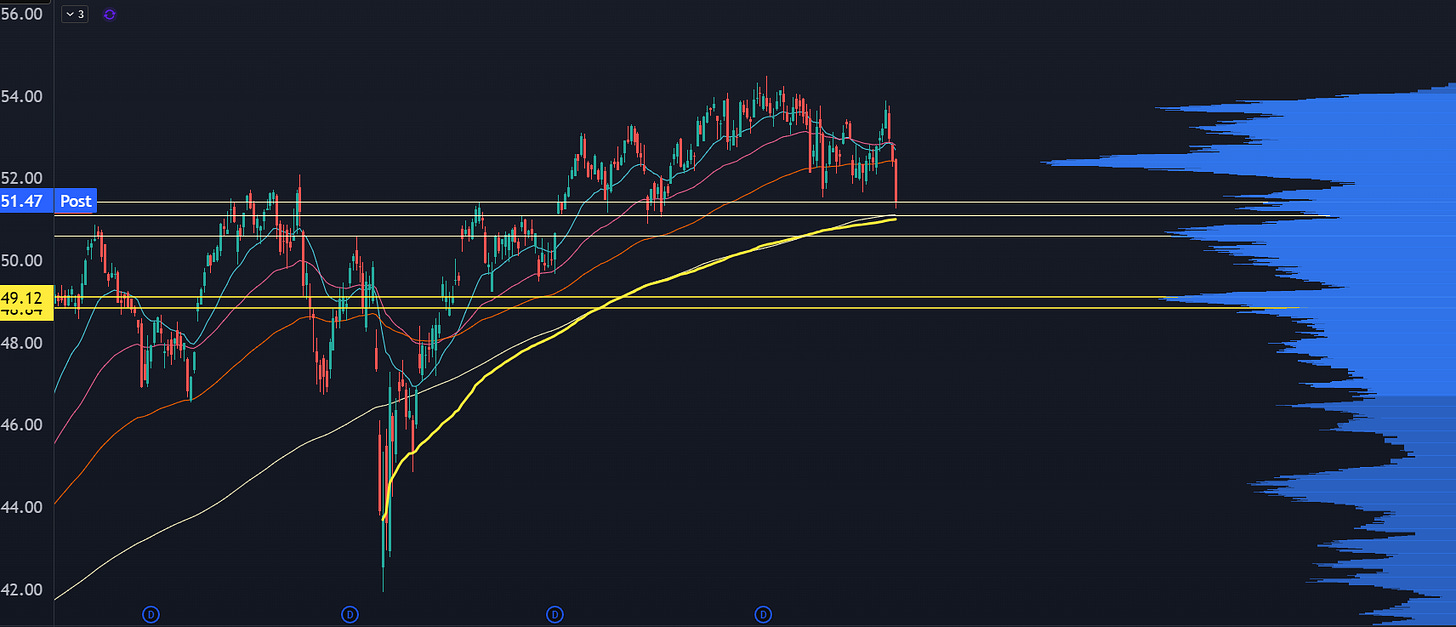

For financials, most are regional/commercial banks, and we can look at that with KRE:

Regional banks are rolling over with an ugly day today. The sector had some nasty writedowns back in October and we’re back near the lows. Either we get a support hold and bounce, or we probe down to either the HVN or the summer support levels.

Then you’ve got smallcap tech, which is full of the usual degen candidates like IONQ, REGTI, SOUN, RIOT, and APLD. There’s no straightforward ETF to track this, but if you know what the price action looks like on these names, you know that they’re deeply oversold and either have a short covering rally or they’re about to get kicked in the teeth with one more washout.

In aggregate, there’s a ton of fragility at current prices. Either a bid shows up, or we grab lower levels… and into those levels I’ll want to be more aggressive for a reversion trade.

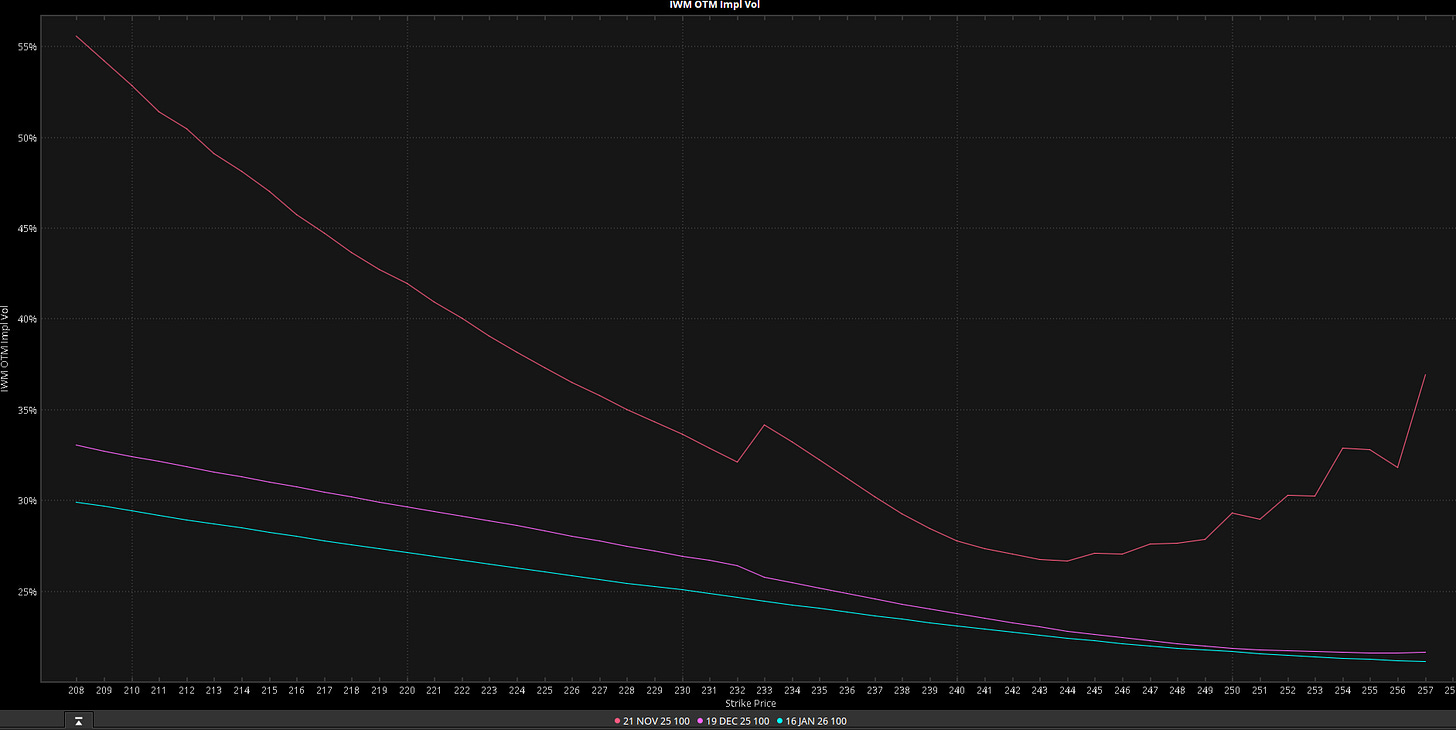

On the volatility surface, we’ve got a healthy negative skew:

This can help us get a bigger advantage on a complex options trade.

That leads me into this trade setup:

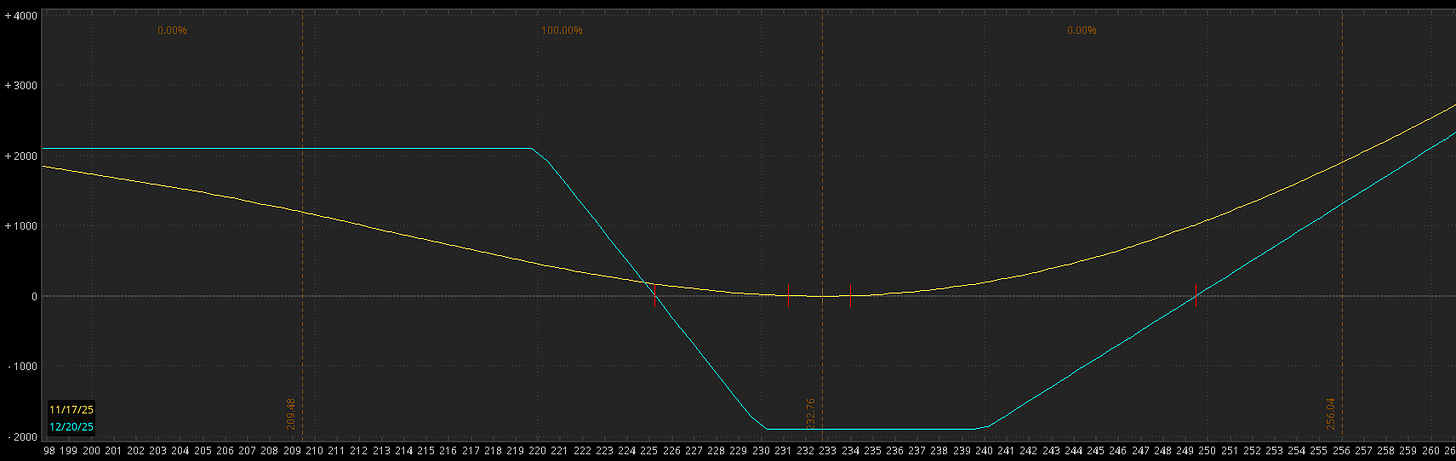

IWM Goofy Strangle

Buy +4 IWM Dec 230/220 Put Spreads

Buy +2 IWM Dec 240 Calls

Here’s the thinkorswim orders:

BUY +4 VERTICAL IWM 100 19 DEC 25 230/220 PUT @2.84 LMT

BUY +2 IWM 100 19 DEC 25 240 CALL @3.83 LMT

You take these on a 2:1 ratio to start with a delta neutral trade.

Here’s the risk profile:

Don’t view this trade as a single position, it’s really a combination of three separate trades.

You’re buying out of the money calls with a 23% vol

You’re buying slightly out of the money puts at a 27% vol

You’re selling deeper out of the money puts at a 30% vol

This helps you capture some additional benefits from the skew.

Adjustments

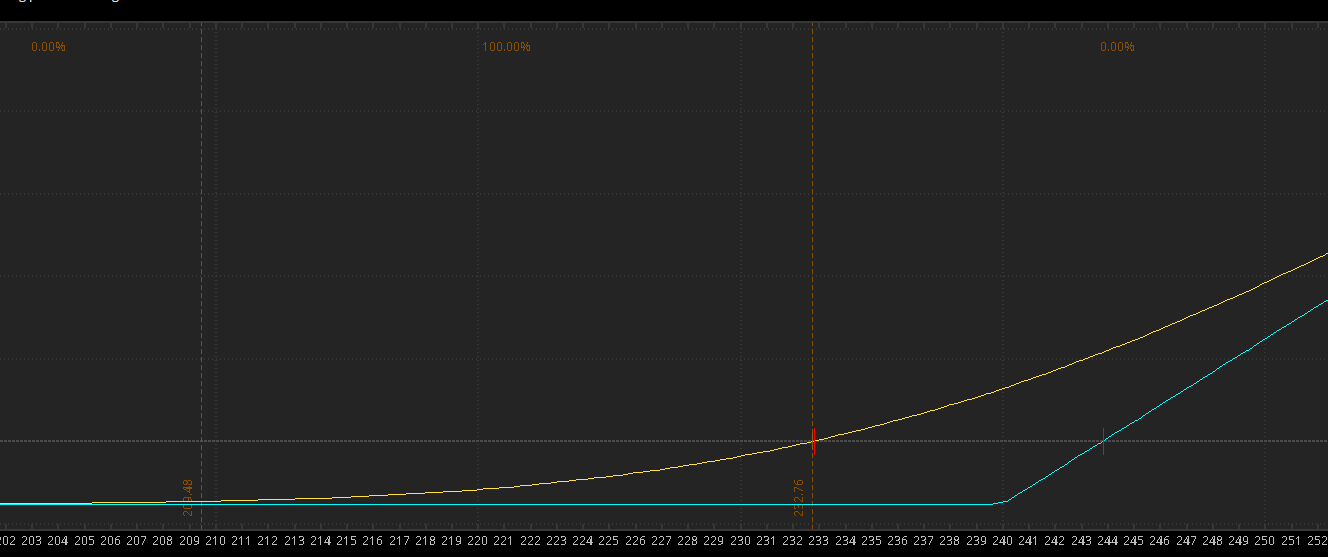

Here’s how I view the trade. You’ve got the long put spread:

And then you have the long calls:

The adjustments on the trade hit on a big move in either direction.

If the market jams back up above $240, then I can start closing out some of the 220 short puts to start leaning a little more bearish on a retracement short.

And then if the market pulls down to $225, then I will roll the $230 put lower to the $225 put, which takes cash off the table and gets me leaning a little more bullish.

Ideally I am looking to capture 30% of the cost of the trade, ideally a little more.

Given how this is a short theta trade, it makes sense to scale into the setup, so you can enter at current prices and look to add about 20% lower on the total cost of the trade.

“This Is Hilariously Complicated”

Which is true. The alternative here is to be patient and wait for either 224 or 240 to get hit, then fade the move with straight up puts and calls. And there’s nothing wrong with that.

With that in mind, I’ve got a dead simple BTFD trade that I think offers some solid risk/reward.

XLF Call Buys

Maybe just avoid the tech wreck altogether and play the big banks. We’ve got the April AVWAP in play, along with the 200MA, prior price support, and a gap fill down at 50.65.

Ideally on a gap down or one hard flush, pick up the Jan $53 calls. Into that dip, they should be going for 0.75.

You buy some, add a little more at 0.60 because we’re early, and then scale half position at 52.40.