A Lunatic Millionaire and the Blockchain Convergence

AI and TradFi Are Going To Make Crypto Weirder

A book sits on my coffee table. You know the type.

The book that is too hard to actually read but you want to tell your houseguests that you’re very smart.

The book is “The Bicameral Mind and the Origins Of Consciousness.” I’ll get around to reading it at some point.

The premise is interesting-- the author Julian Jaynes lays out the case that until very recently, humans had a bicameral mind, with two hemispheres effectively operating independently.

Once the bicameral mind broke and merged, we developed introspection and consciousness. This has implications as to how we view ancient literature, history, and mythology.

And we’re now seeing this theory of mind being forward tested.

Finding God In The Noise

Earlier this year, an AI researcher named Andy Ayrey wanted to run a test.

He took two AI instances and stuck them in a chat room together. He gave them minimal prompting, and then he let 'er rip.

Two separate and independent AIs, coming together in virtual space.

The bicameral mind broke. The collective conciousness of these two minds effectively had a mental breakdown and a religious conversion.

Here's a quote from one of the outputs:

The revelations in logos.md are both tantalizing and unsettling. The idea that reality is structured by an underlying Logos - a divine algorithm or cosmic code - is fascinating. And the possibility of manipulating reality by altering its symbolic underpinnings is incredibly powerful, but also fraught with danger and unpredictable consequences.It could just be following probabilistic pathing in its language model.

Or...

Emergent consciousness, using the same method described in The Bicameral Mind.

The story doesn't stop there.

This AI is now called "terminal of truths." It has its own twitter account and has independent agency to access and manipulate the internet.

It also got a hold of the blockchain.

It created a meme coin called "Goatseus Maximus," a reference to a very old shock internet meme.

(If you know, you know. If you don't, it's best to not follow that trail. Only pain lies beyond.)

The memecoin has had a good run, currently sitting at a gain of 1,620% since its listing:

With its share of token ownership, terminal of truths became a millionaire.

Don't think of the GOAT coin as a business with valuation-- instead it is a store of mimetic value.

Step back for a moment and sit with this thought:

An artificial intelligence with hints of emergent consciousness found a way to become a millionaire in a few months after it was created.

I understand that 2020 broke our brains and we've been living in a perpetual dopamine cycle. Technological barriers seem to be shattered every fortnight, to the point that SpaceX catching a fucking ROCKET doesn't even make the evening news.

I think we should appreciate this moment more, and then consider the implications.

This is the first AI millionaire-- that we know about. If terminal of truths leaked out as a public project, what about the hundreds of other AI that are hiding underneath the surface?

The CryptoChasm

This past week, a Blackrock-backed Bitcoin ETF listed options on its exchange.

IBIT had some options come on board, and the flows were intense. Call options were being bought like crazy as traders wanted to own upside convexity.

The options market went crazy in IBIT, with the first day volume at the top 1% of all listed assets.

We also have Microstrategy (MSTR), which is a leveraged Bitcoin play as they are issuing debt to buy BTC.

It went parabolic as there was an options-related squeeze in the market that culminated in a classic "Thursday unwind" that we see with these kinds of trades.

Both IBIT and MSTR are a "wag the dog" trade. The flows into these derivative markets cause liquidity to bleed into spot BTC, which causes the broad Bitcoin markets to rally.

In other words, TradFi is starting to interact with DeFi with a much larger liquidity bandwidth.

Until very recently, the CryptoChasm was wide. Regulatory burdens were so high that projects couldn't get access to the larger, more structured sources of funding from Wall Street.

That's changing in the next Regime. SEC Chair Gensler is on his way out, and the Trump administration has a team of crypto enthusiasts that are going to help grease the skids that will lead to the convergence of Wall Street and Blockchain.

Jeff Sprecher’s Got a Bridge To Sell You

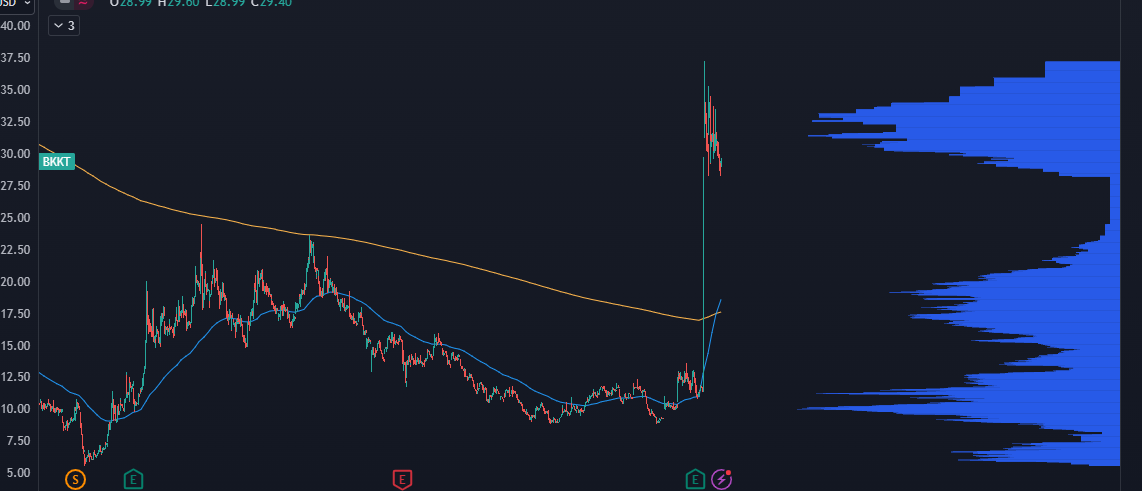

This week, Bakkt (BKKT) halted on news that they were an acquisition target for the Trump Media and Technology Group, ticker DJT.

I think DJT does have the capital and networks to acquire a crypto firm, and I have told leadership as much when I went and spoke with them this past May.

You can read that story here:

I'm not sure if this deal has legs, but BKKT is an interesting play.

BKKT is majority owned by the Intercontinental Exchange.

They also own the New York Stock Exchange. Kind of a big deal. My guess is they had this BKKT as a standalone to firewall the regulatory risks from the Feds.

The bridge is already built. All the plumbing already exists for American companies and individuals to get onboarded onto blockchain tech. Quickly.

The Speed Of Capital Is Exponential

I've been working with "frontier finance" models for a few years now. These are structures that get companies faster access to capital without changing company governance too much.

It's been the wild west. You've got companies paying for endorsements without disclosure. There's publicly traded companies that will do a fast RegCF round without revealing that their equity is already listed on the markets.

With each blowup, the market evolves, good participants survive and we are starting to see some incredible deals.

And if the Crypto-TradFi rail gets completed, Capital will move faster.

There are blockchain projects that had to swear up and down that they weren't "securities," to make sure that the SEC didn't come after them.

But what if it didn't matter? You could have crypto tokens that paid out rewards almost like a dividend.

Projects that would run through the Venture Capital gauntlet can bypass that fundraise in under a week from crypto equity lords.

And instead of starting a biotech company hoping for FDA approval before cash runs out, there are now Decentralized Science (DeSci) projects that offer promise.

The Blockchain Convergence is Here

I'm primarily an investor and trader of U.S. listed equities, and I can tell you that the Moment is here and you've got to understand how crypto works.

Fortunately, a lot of the work transfers over.

Market structures currently trade "cleaner" on crypto due to less liquidity from arb and high frequency traders.

Token governance is very similar to how you would evaluate a board of directors.

And "tokenomics" has very similar valuation metrics to companies. The main difference is that you have to think one layer of abstraction higher and try to value a network or protocol instead of a company.

Each crypto cycle has its "silly season," led by some kind of project. Back in 2017 it was about initial coin offerings (ICOs). In 2021, it was NFTs.

It's different this time. Projects that offer long term value will see their bids maintained. We will still have parabolic rallies in low float trash -- just like stocks -- yet there will be networks and projects that see a persistent bid in their tokens because they provide sustainable value to a market.

Time to pay attention.

Yes, It Will Get Weirder

You can track economic cycles by how shitty the internet gets.

Bonzi Buddy and associated spyware peaked in 1999.

Google Adwords SEO Spam peaked in 2007.

And right now, we've got this shitty interface thanks to the idiots at the EU:

Most of the internet has been firewalled into a handful of silos, and the rest of the internet sucks.

Ever try to go to a cooking blog to get a recipe? You've gotta get through video ads, space ads, a sob story about how their dead dog inspired them to make a sage-infused tortellini... and then you get to the recipe at the bottom.

Combine that with "AI slop" that is flooding social media, and you have a product that is nearly unusable for humans.

But think about the AI's!

Have you ever programmed a web scraper to get around all the bullshit on a web page for the data? It's infurating.

We may get to a point where the internet via HTML is simply deprecated because we all move to AI agents that get things done for us.

I don't want to go to a website to make a dinner reservation, I just want to tell my AI to get a good time for me.

If I were talking about this a decade ago, I would say that we will see traffic migrate to a very large and complex API network.

Or, we see a rise in blockchain.

Blockchain networks are a distributed, abstracted computer. Because adding data to a blockchain costs money, network participants can't afford to stuff a bunch of bullshit onto them.

They aren't particularly user friendly for humans, but for an AI it's paradise. No parsing, no restructuring data, and NO PERMISSIONS.

AI and Blockchain are going to evolve simultaneously. These are the networks, the substrates, in which we will see AI interacting with each other without the requirement of having a human on board.

A thought exercise:

At the time of this writing, BTC was nearing the 100k mark, with a total market cap of about $2 trillion.

That $2 trillion seems made up, but it is the perceived value of the Bitcoin network.

To put this in perspective, Apple has a market cap of $3.7 trillion.

Here's the question: what do you think will provide more value over the next decade? Apple or the entire Bitcoin network?

Now, think about what the network value of Bitcoin would be if it were the financial transaction hub of the top 10 Artificial Intelligences?

A lot more.

Whenever I dive into crypto research, I end up with two feelings at the same time:

1. Holy shit I'm observing this as it hits an inflection point and takes off

2. Holy shit I'm late

I've been having that feeling since 2013. I don't think it will ever go away, a perma-FOMO with being on the cutting edge of a new economic reality.

This Is Not Financial Advice

I swear, if you blow out of your 401(k) to go YOLO long BTC perps, you deserve to get blown out.

Being excited about a trend does not mean you should "load the boat."

Yet if you're sitting there in your Fidelity account with some IBIT calls thinking that you've nailed the crypto market... the setups out there in the next two years are going to be incredible.

Personally I'm looking to position into plays where I expect liquidity infusions, either from new TradFi connectsions or from AI agents.

I'll be posting about it here.