Asleep At The Wheel

Looking for a triple digit winner in an AI stock, and getting a little bearish on PLTR

The S&P 500 saw its first bearish sign in quite a while. After a gap up into new highs, there were aggressive sellers that have brought it back within range.

When this happens, there’s usually a push to the other side of the range… but the range is so tight I wouldn’t be shocked if we overshoot and test the gap AVWAP.

A pullback will come at some point. It’s normal and it happens all the time.

But the reaction will be predictable. Rendering of garments, gnashing of teeth, and plenty of leveraged losses. Keep perspective, this will be a buyable dip.

The “Back On The Radar” Setup

When there are too many eyeballs on a name, sometimes it can’t get enough juice for it to run higher.

This is often due to option positioning. If implied vol is already through the roof, then it’s tough to get energy for a trend as the other side of the trade (dealers) can help keep the stock price capped.

We saw this with ASTS, which didn’t have a breakout for a full year after it hit everyone’s radar:

I’m guilty of this as well! If a breakout doesn’t work then I’ll stop watching the stock and then it runs without me.

I’ve got a name that is back on the radar - NBIS:

This is an AI infrastructure play. It looked ready for a hard breakout two weeks ago, only to fall out of bed and stop everyone out.

The structure of the stock tells me that it has thrown off as many momentum traders as it could. Fewer traders have this on their primary watchlist as they got burned trying to play it twice.

You can see it even better when looking at the Implied Volatility, which shows us how many traders want to buy the options:

Maybe third time’s the charm? I like the August 65 Calls.

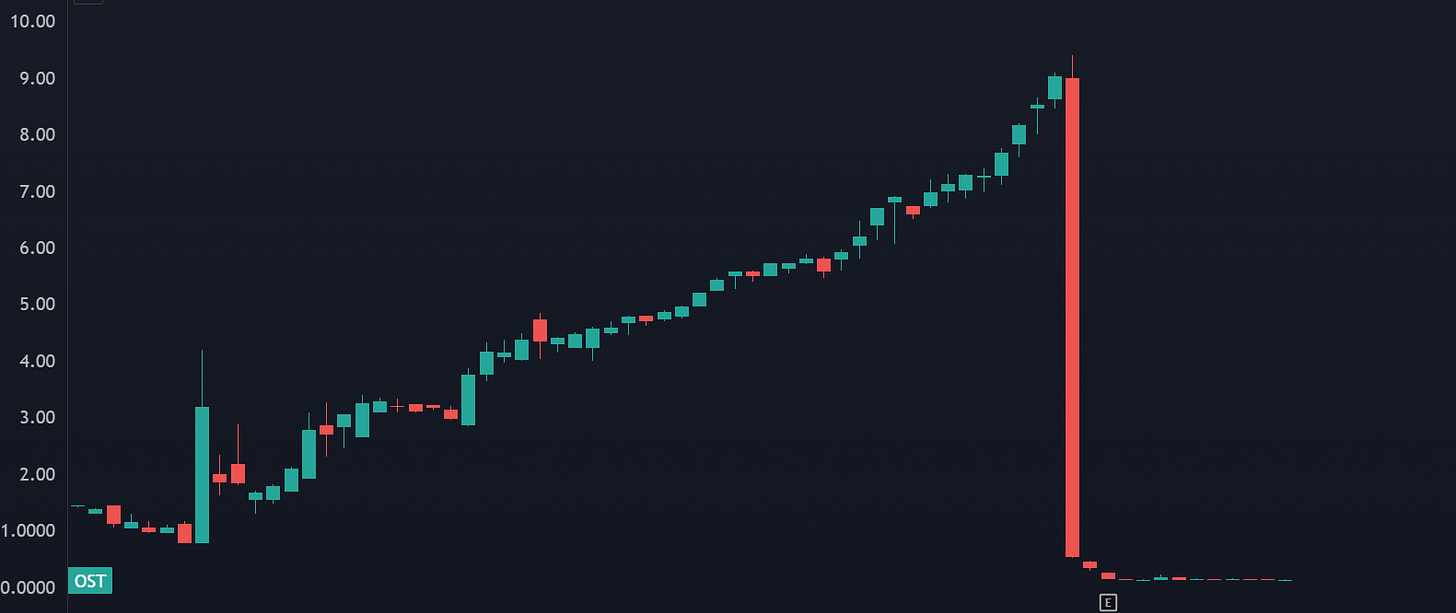

上楼梯 - 下电梯

There’s been a liquidity trap trade going on in some Nasdaq ADRs. You’ll see the stock jam higher, trap shorts, and then continue to march up until one day, they dump shares and longs get killed.

Here’s a sampling of some of them:

OST

PCLA

PHH

A few traders are making a killing on these names, but net-net it’s bad for American markets and exchanges.

These pump and dumps are not some shady pink sheets… they’re trading on the Nasdaq.

Regulators, both on the government and private side, are nowhere to be found. Know what you’re trading!

Does Palantir Stink?

In 2018, a “healthcare” stock called Tilray went public. After listing around $20, it traded up to $280. At the time it had a higher valuation than TEVA.

But they sell cannabis. You know how the story ended:

In hindsight it was a clear squeeze and unwind, but at the time you had momentum chasers that were telling us how weed was going to revolutionize the healthcare industry and it was actually undervalued.

But when it has a value equivalent to Abbot Labs, then you know there’s a mismatch.

This is my sniff test. When a stock blows past valuations relative to its peers, we need to consider whether it’s justified.

Palantir is not a pot stock. It’s a very innovative defense company that moves faster than the other players. It’s also an AI/software play, with better margins.

But let’s just think about this for a second. How does it compare to the big defense contractors?

Is Palantir’s valuation justified relative to what we’re seeing compared to Lockheed?

Really?

Now I’m not one to blindly short momentum. PLTR is at all time highs, investors are happy and there’s no evidence of a top in price action.

Yet at some point they’re going to need to justify their valuation. And it could come true! They could have some hypergrowth defense platform that becomes a de facto arm of the Federal Government. Almost a sovereign entity unto itself.

But it’s not passing the sniff test.