Back and Fill

Being Terminally Online has some benefits when watching market sentiment for timing.

Sometimes you see traders and lower information participants get super beared up, anchoring off of one headline. Like how everyone wants Bitcoin to trade to $75k to force Microstrategy to sell, which means instead we get a face-ripping rally:

What about stocks?

There’s not a whole lot going on. Just a bunch of nerds arguing about the benefits of TPUs (GOOGL) vs GPUs (NVDA).

The markets are adrift, in a choppy, noisy range that only has edges at the extremes:

I wouldn’t be shocked of a little selloff here. Nothing crazy, just enough to fill a gap and a little more to get traders positioned on the wrong side of the market.

But it’s not bearish. It’s a boring market, and tough to short.

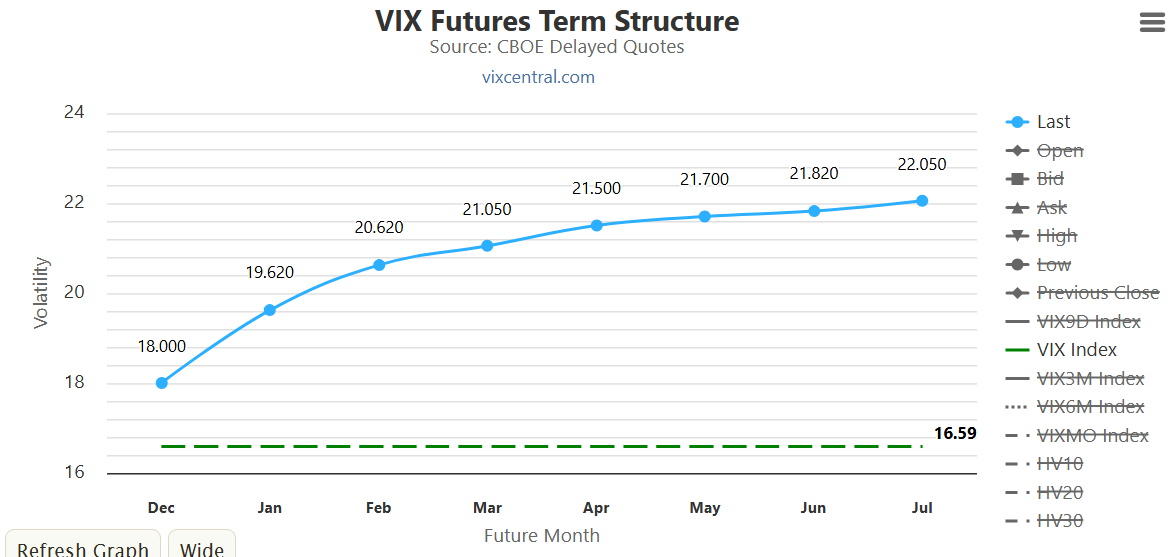

You’ve got a spot VIX at 16.5 going into holiday trading. And while the market vol has been in the 16s… the past 5 days are back into the single digits.

And if you want to know why the liquidity flywheel keeps a bid in stocks, you can read more here:

Fire and Forget Options Trading

Here’s a fun secret: the market makers aren’t out to get you. In fact, they don’t care about you.

It’s cliché to talk about trading in casino terms, but I did see a great concept this week about EV on both sides of the trade.

When you’re a “dealer,” your edge is from spreading your bets across many different outcomes as possible. You want as many people at the roulette table betting on every single number, because the aggregate payout relative to the risk you take gives you an edge.

You can have a few lucky players strike it big, but you still maintain an edge and the dopamine hit of the big payout keeps people at the table.

When you’re a retail trader, your EV goes down the more numbers you bet on. Concentrated bets work more in your favor rather than a “spray and pray” method.

There’s some nuance to this idea, but the idea still holds that if you’re going to be on Red 5, it needs to be an absolute lock. Because unlike a casino that has random chance, you can skew the odds in your favor… but the casino doesn’t care if you get paid because they’re managing all the other (terrible) bets.

Market makers also don’t care about you because you are trading a completely different market with respect to timeframe. Citadel is too busy gobbling up orders on 0DTE options to care about some call options you bought 6 months out.

When you combine these two— bet concentration and timeframe— you can build out a solid edge by buying longer dated, out of the money call options on stocks that you think are going to go up.

These tend to be smaller bets initially, but if you’re right your exposure increases. And there’s no conspiracy to keep price levels suppressed, because the dealer on the other side of the trade hedged off the counterparty risk weeks ago.

We’ve got two “fire and forget” bets that are working well for us.

Rocket Mortgage (RKT) is taking a shot at the summer highs, with some juicy tailwinds surrounding the Fed balance sheet and more (potential) rate cuts. If it manages to stick, then this can run to $25 into next year. Our March $22 calls are about a double from calling them out on November 23rd.

Unity (U) is another one with a monster base and an AI layer trade. Sellers have shown up at $47 for years, and this may be the time the breakout finally sticks.

The April $60 calls are up a bit, but we are shooting for the moon on this one.

Up On Deck

With lower volatility comes lower correlations, and it becomes more of a stockpickers market. We’ll let the nerds fight it out over who has the best AI semiconductor architecture and go into some spaces with fewer eyeballs but clear-as-day accumulation.

If you aren’t yet a Convex Spaces Client, we’d love to have you. You can subscribe here.