Back In The Saddle

The market can keep rallying because investors can't stop scrolling. See what trades are working, the next FutureTech wave, and when hedging runs out.

“Put your phone down, nothing’s going to happen in the next three hours.”

For the first time this year, I attempted to “turn off.” After attending a uranium energy conference, I took my family to Disney to stand in lines and eat snacks.

If you trade, you get the itch. To check the markets, to try and put in just one more trade that’s an absolute lock (I swear!) even though you’re trying to look at charts on a 3 inch screen.

That’s how you end up on the same roller coaster for the third time that day, with a headache and wondering if you should close out your short trade in gold:

A break from the screens can be a good lesson in what your signal to noise ratio is. If you spend 6 hours a day looking at tick charts for signs of a market top, you’re going to get diminishing returns. This week was no different— I didn’t need to be glued to the markets to know exactly how price action would play out.

I’ll go over some of the trades that have been playing out, but first let’s have a look at the FutureTech landscape.

Brand New Governance

OpenAI finished up a major restructuring, where they have a non-profit that’s wrapped around a “for profit public benefit corporation.”

Microsoft comes out the big winner, owning a 27% stake in the PBC at a $500B valuation. Which seems light, but good enough for MSFT to gap up a day before its earnings event:

This is part of the “dumb fund manager” trade. If you are investing other people’s money and you don’t have proxy exposure to OpenAI, you’re going to end up with your inbox full of your clients asking why you’re an idiot.

That means in order to save face, you buy. It’s not rational, but it’s a tidy explanation as to why large cap tech can continue to drift higher going into the end of the year.

When Will The Hedging Stop

We had another good spike in the VIX, cracking above 28.

It was a weird move. Equities barely moved on that Friday. In fact, major indices made a higher low. The panicked hedging could have been in front of trade negotiations, or earnings, or some kind of impending rug pull.

The important part is to consider the timing.

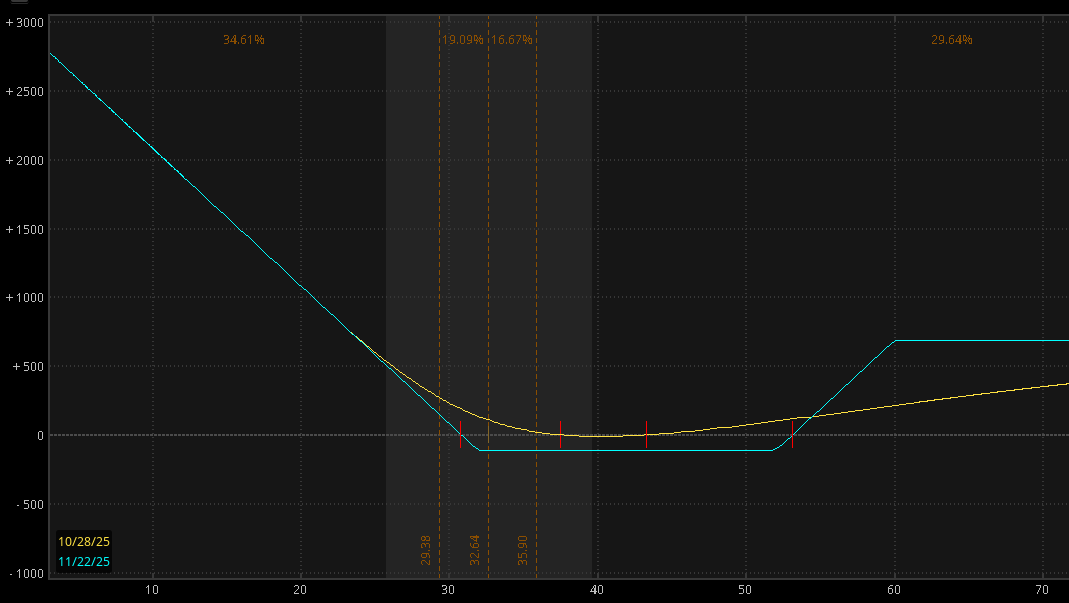

If you wanted to buy puts to hedge, what duration are you buying?

It’s probably not weeklies. Most likely, you want to capture any volatility as we head into the end of the year:

If you want the market to selloff, the hedgers have to stop being so panicky on every downtick. The hedging exposure (probably) doesn’t come off until December, or potentially January expiration.

That means we could be operating in a tame environment where dip buys are not necessarily from capital coming off of the sidelines, but from derivatives math that keeps a floor in stocks.

If we head into January and we haven’t had another round of hedging, that’s where I expect the market to get loose.

Another Preference Cascade

A new consumer robot just dropped their Press Release. This time, it’s Neo at a cost of $20k.

Here’s the WSJ demo video from it:

It’s a little clunky, and you’re going to have human interventions where more complex tasks will be completed remotely so that they can get better training data.

This looks a little creepy, right? That consensus is going to get shattered when it puts away your dishes.

Because if you can finance a 20k robot for $500 per month and they fold your laundry? I’m in.

If you’re reading this, odds are you know about the robotics revolution. Yet the vast majority of consumers have no freaking idea what’s about to hit.

Legacy media is going to look an awful lot like this:

The vast majority of investors are also in the dark, because we haven’t yet had the robot moment hit legacy media. Robotics stocks have been pulling back with the rest of the momentum basket, but it’s still very early in this trade. This is shaping up to be one of my big investing themes headed into next year.

What’s Been Working

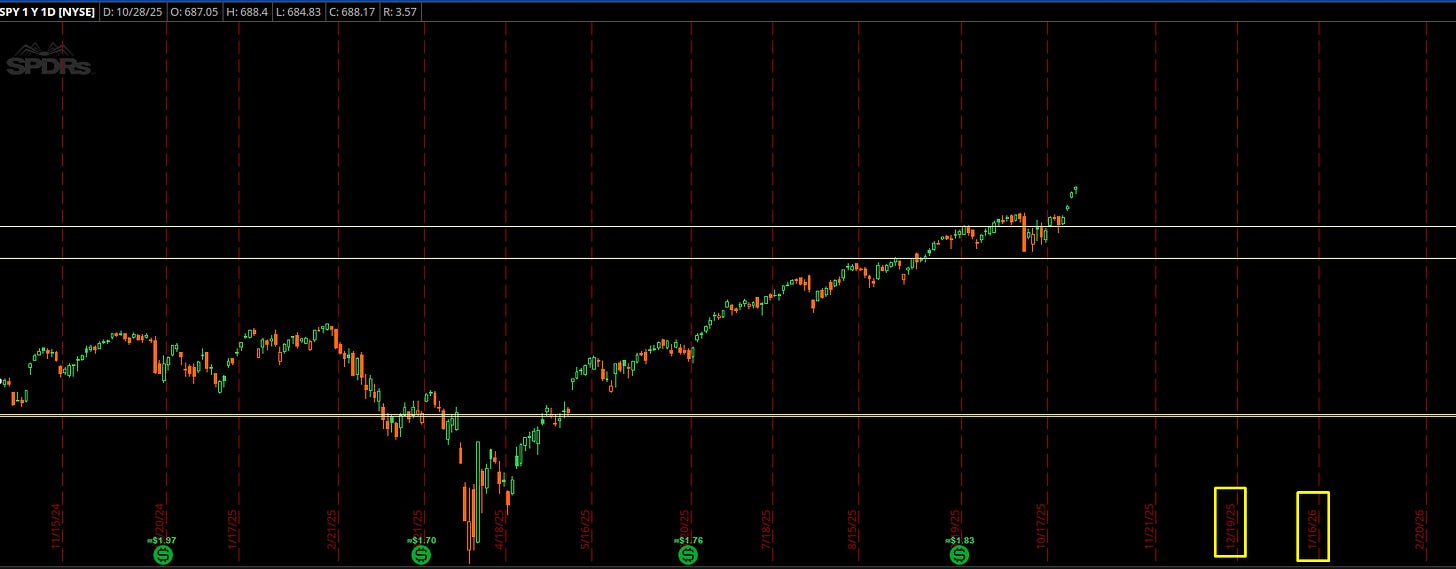

My primary trade hypo is playing out exactly as I expected:

Momentum sectors are resetting

The VIX spike to 28 reset the hedging environment

Large cap tech rips

MAGS, an equal weight ETF of the Mag7 stocks, had already been in a correction for a month. After one scary day driven by 0DTE and hedging flows, the market recovered and started to rip to new highs.

Our trade calls got a little more complex after that one day selloff.

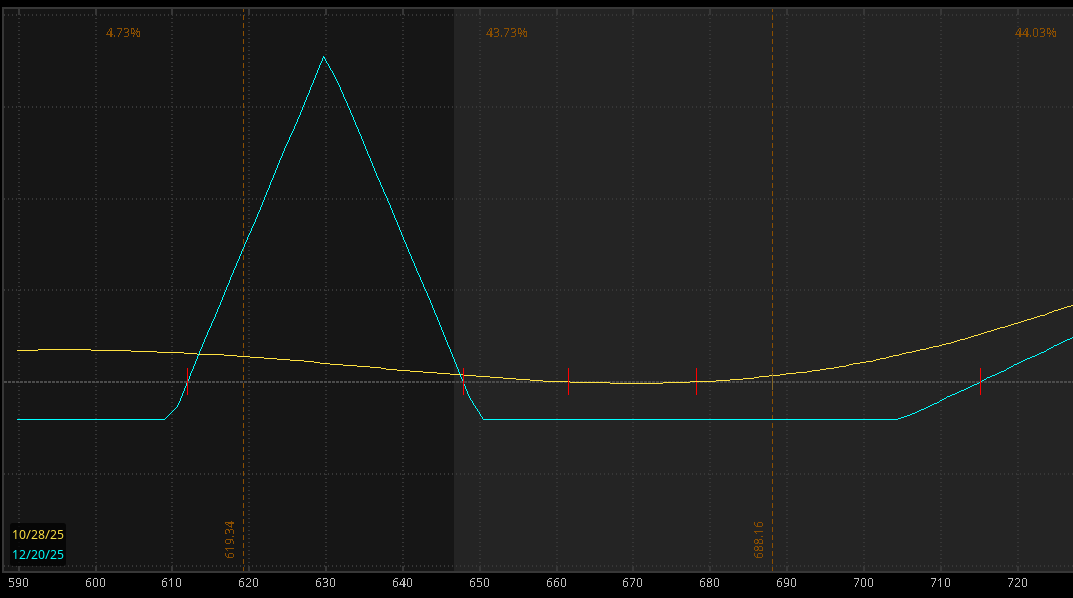

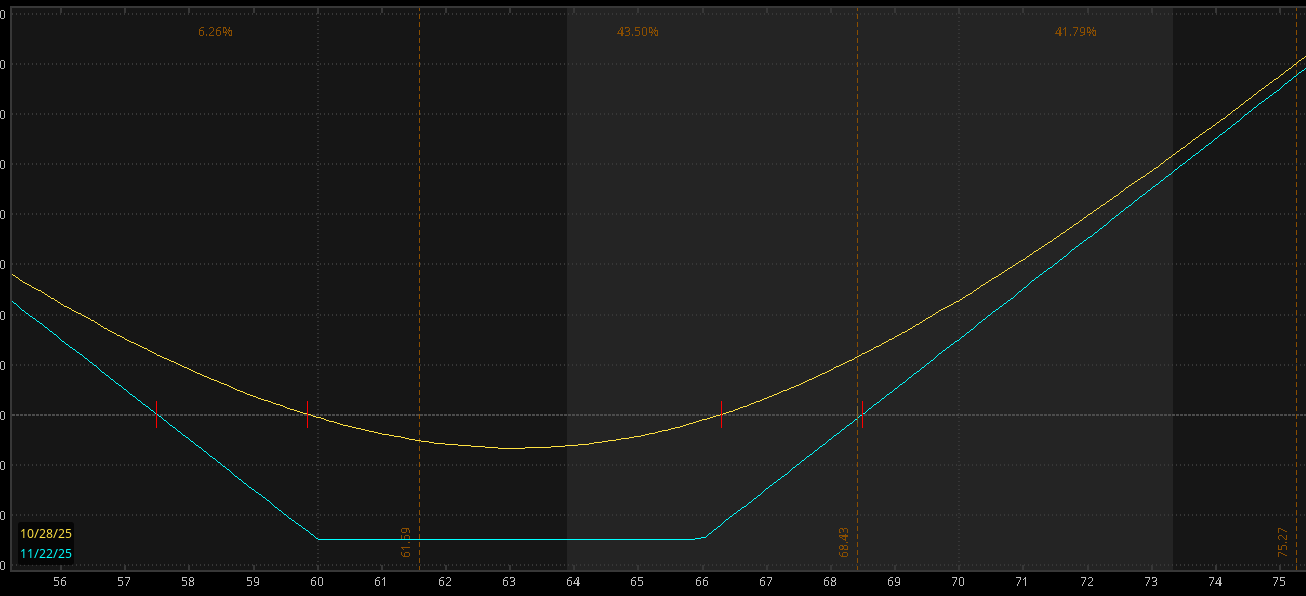

For example, here’s a combination of a put buy and call spread buy in VXX, which is now up about 90% as volatility cratered:

We also checked out a put fly and call buy for SPY, which is up a small amount:

And I called out a long strangle in MAGS that’s sitting at a 40% gain:

Why didn’t I just load up on index calls at the lows? Sure, it was a good call, but when you have a kill candle like we did a few weeks ago, you always wonder if we get a second run to flush investors out of their positions.

With a little options magic, I can capture some upside as the call options are cheap-ish while keeping some hedges on.

On the single stock side, I called out some call calendars in AAPL and TSLA, which are now up about 46% and 37%, respectively.

You couple those setups with some parabolic shorts in the {quantum | AI | nuke} trade, along with a few gold shorts, and this month turned out pretty good.

It wasn’t all smooth sailing, especially compared to the monster runs we had in the early fall. I was looking for a breakout in GEV, and it got kicked in the teeth with the AI infra trade:

Kicking and Screaming Higher

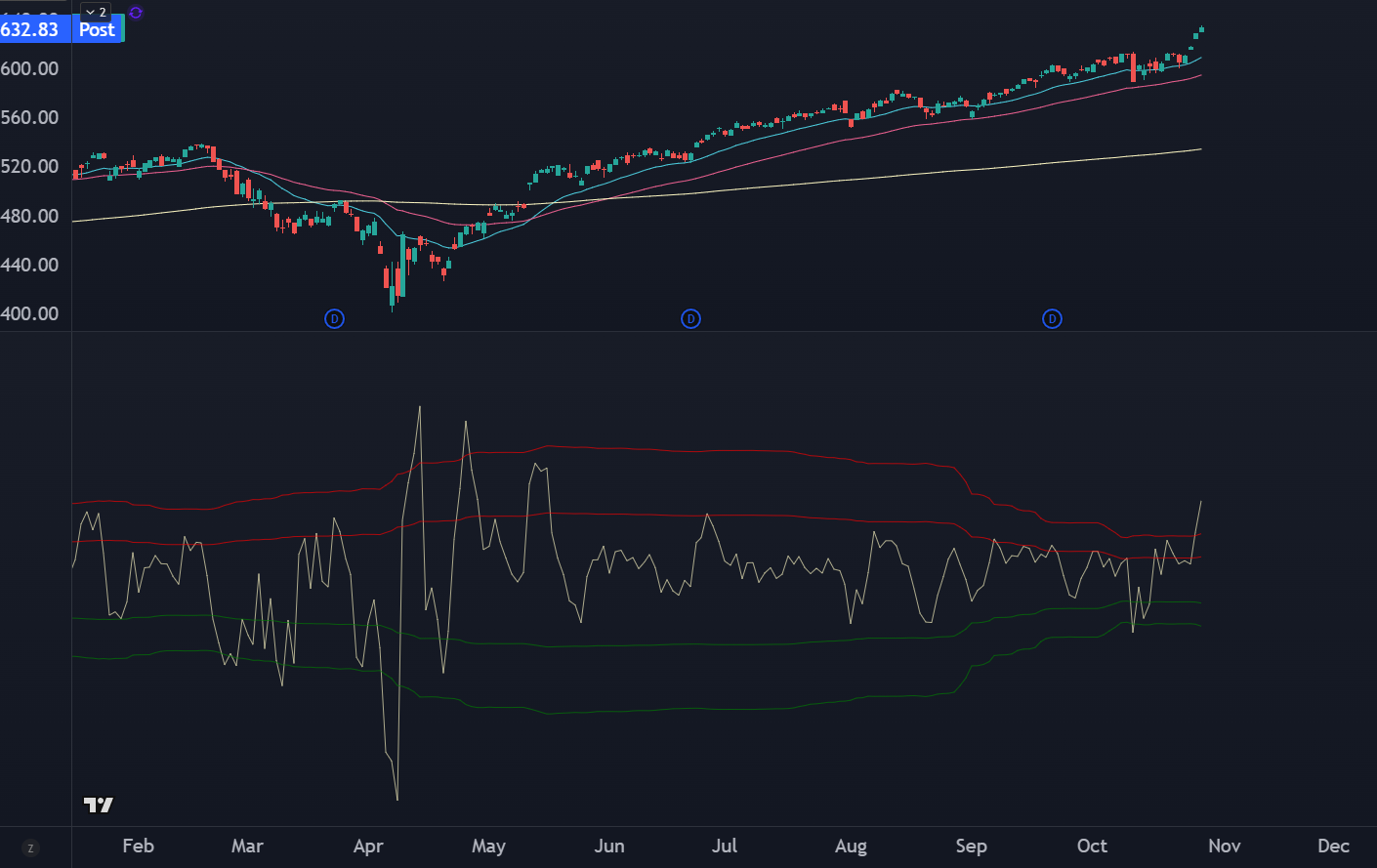

Over the past few days, the Nasdaq went parabolic:

Below is the return over a 4 day window, currently sitting around 4.5%. This is the strongest rally in this timeframe since the tariff tantrum. Overbought in the short term? Sure, but I have a feeling if you backtest this and filter for price above the 50EMA, you’ll see that the market tends to drift or correct through time instead of having a hard pullback.

The market still has tech earnings coming out, but because of their weightings and how much hedging hit 8 trading days ago, it’s likely that there’s a synthetic floor that will prop up a single name into a bad earnings event.

The Narrative Cycle Is Still Rich

The vibe certainly doesn’t feel like a disaster. I think with how our brains are broken from social media, we have such a density of information that hits us that it feels like years can pass by in weeks.

Everyone’s looking for a bubble, but they’re early. The business cycle is not the same as the stock market.

The Stargate Project is a new company which intends to invest $500 billion over the next four years building new AI infrastructure for OpenAI in the United States. We will begin deploying $100 billion immediately. This infrastructure will secure American leadership in AI, create hundreds of thousands of American jobs, and generate massive economic benefit for the entire world. This project will not only support the re-industrialization of the United States but also provide a strategic capability to protect the national security of America and its allies.

The initial equity funders in Stargate are SoftBank, OpenAI, Oracle, and MGX. SoftBank and OpenAI are the lead partners for Stargate, with SoftBank having financial responsibility and OpenAI having operational responsibility. Masayoshi Son will be the chairman.

Arm, Microsoft, NVIDIA, Oracle, and OpenAI are the key initial technology partners. The buildout is currently underway, starting in Texas, and we are evaluating potential sites across the country for more campuses as we finalize definitive agreements.

This is from OpenAI’s Stargate announcement from January. We’re not a quarter into the project, and the economic effects haven’t yet been pulled forward into earnings.

Yeah, the stock market is a discounting mechanism, I get that. But you need 2 quarters of “not-perfection.” That takes time.

Meanwhile all of this should hit within the near future:

Rapid expansion of Robotaxi networks and the reimagining of transportation

VTOL shuttles taking people from Manhattan to nearby airports

Lagging AI effects leading to profit margins mantaining

Electric infrastructure buildout, probably financed by USG

META finally nails wearable tech

An LLM inside of a children’s toy that goes viral

Any of these can generate incredible memetic energy that pushes into the financial markets. This will create more mini-bubbles like we’ve seen recently in quantum and nuke. We’re just on the tailend of a few broken momentum trades, so it may take a few weeks for a new one to build up steam.

If we get enough time and reduced speculative fervor in the options market, then January expiration calls end up very cheap.