Checked Out

A priced in bubble pop, correlations are at the floor, and how to rewire your trading mindset headed into 2026

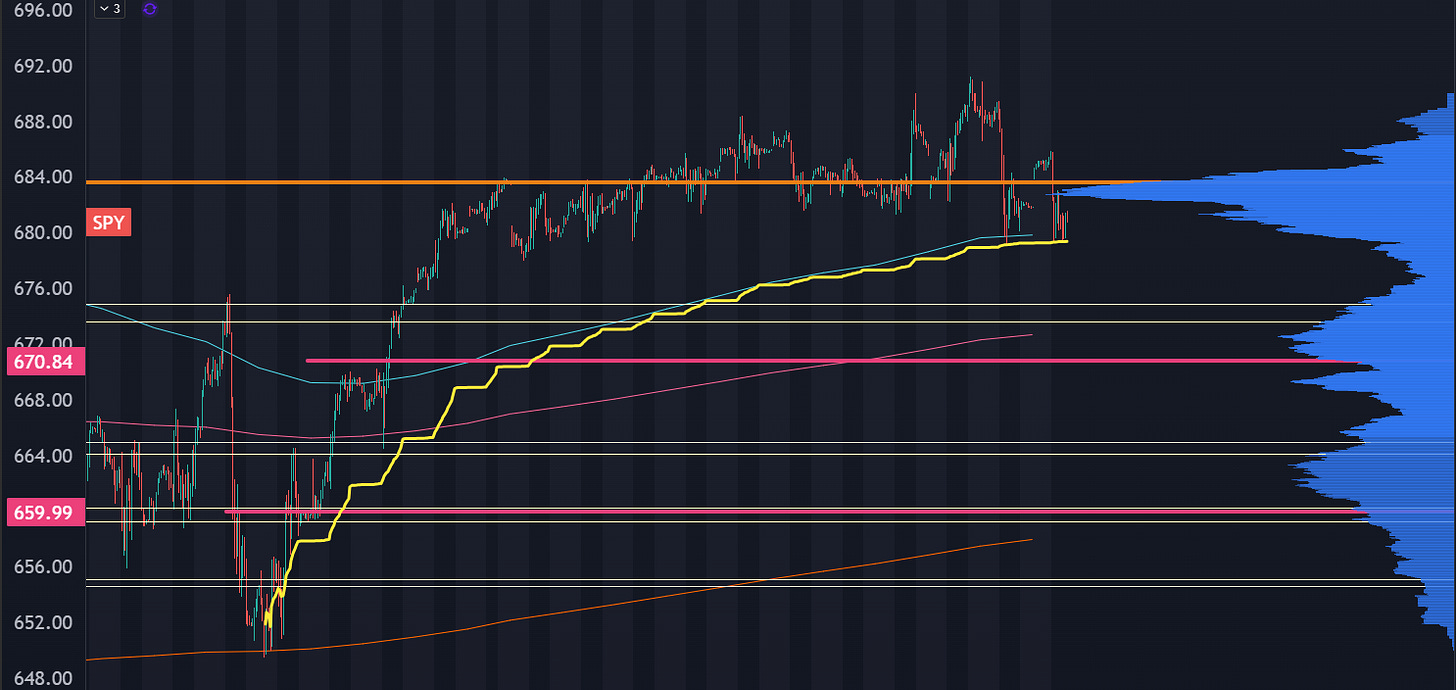

The S&P 500 is trying to hold onto some key levels to open the week. There’s price support, the 20EMA, an AVWAP from the November swing lows, all lined up to where price is sitting.

Problem is… this was the setup for Friday. There was no bounce and we’re back into this level, which gives it a much higher odds of breaking down and trapping some bagholders.

Structure for the Nasdaq is quite different:

It appears that we’ve got a lower high currently knocked out in large cap tech, with clear relative weakness against Friday’s lows.

You could make the case for a support hold, but this is setup for some “back and fill” kind of action. Looking under the hood, that’s already hit. NVDA, MSFT, META, and AMZN are already in decent corrections while TSLA, GOOGL, and AAPL try and keep the market from getting killed.

With Mag7 correlations low and clear rotational dynamics hitting banks and smallcaps, we’re setting up for a (continued) chopfest into the end of the year. T

Here’s how I’m playing this market:

Preserve financial and psychological capital. If there’s a swing setup out there, it better be pocket aces because I don’t feel like being tossed around in random price action.

Play Reversion. Don’t chase breakouts or breakdowns. Instead look for names that are stretched (on either side) and look to fade. That means if AAPL or GOOGL get killed on a liquidity pull, that is good for a bullish setup.

Place moonshot bets. There are some solid narratives developing into next year, and many of the option boards are “bored” which means you can pick up some cheap convexity by buying 3-6 month calls.

The Bubble That Never Inflated

Have you ever heard of the “Pumpkin Spice Latte” investment thesis?

It’s where you find a narrative or trade setup that is incredibly obvious. In fact, it becomes so obvious that the investor zeitgeist seizes onto the idea. Often the PSL thesis is an incredibly surface level observation and not rooted in reality, but we are talking about the stock market here.

If a PSL thesis gains enough steam, then it affects pricing and there’s no longer an edge to take, regardless of whether the PSL thesis is true.

With that frame in mind, think about how everyone and their mother is talking about the AI Capex Bubble.

But if prices have already reset, can there be a bubble? If a tree fell in a forest two weeks ago, can it still make a sound?

ORCL has been cut in half since their AI capex announcement. Even if the AI Capex narrative has legs, how much juice are you going to get out of the trade?

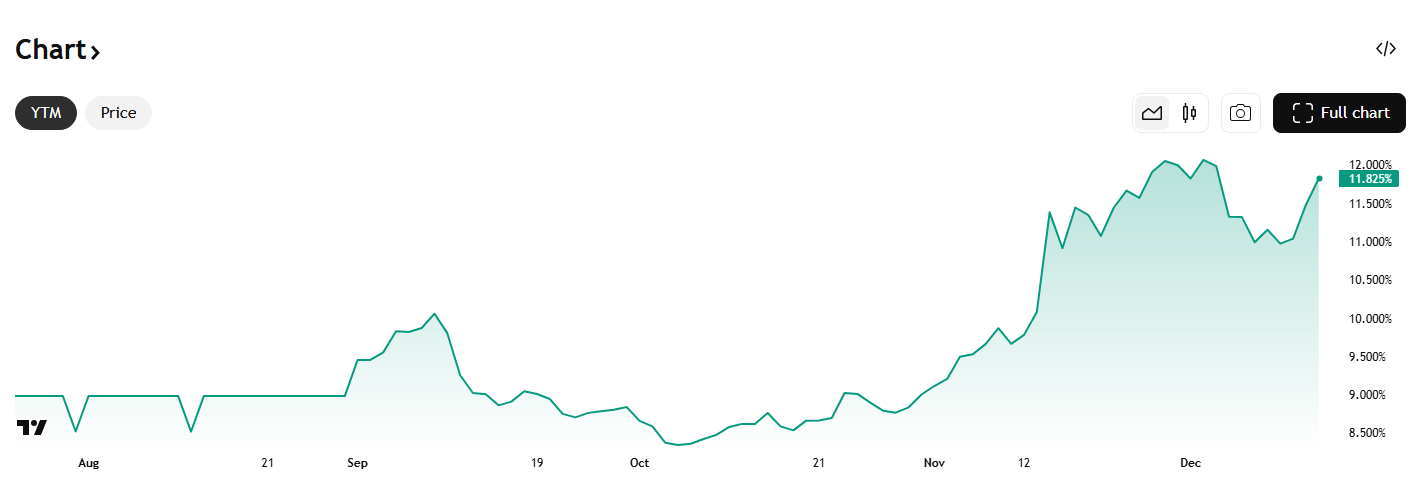

How about CRWV bonds:

These are trading like they’re junk. But the AI Capex trade hasn’t had any material changes to the outcome. The data centers are still getting built, and it appears growth is still sticking around.

I’m warming up to the idea that the AI bubble could never happen because we’ve already had a reset. Infra names like NBIS and APLD are getting taken out to the woodshed.

Adjacent names like OKLO had a mini squeeze two weeks ago and have now fully unwound:

My squishy feel on sentiment is that everyone wants to feel smart at the holiday cocktail parties and the best way to do that is to be bearish. You’re the smart contrarian!

But the move has already happened in the markets. We’re close to a point where the PSL thesis has run its course… and many of these names could have solid oversold call buy setups on just one more flush lower.

New Year, New You. And a New Market.

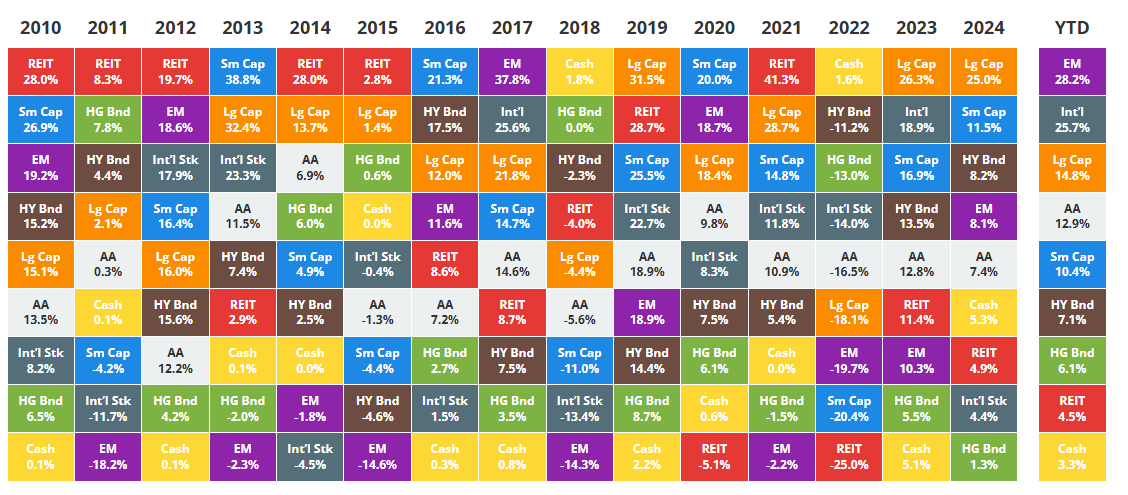

The AI trade is sucking all the air out of the room due to the sheer size of the Mag7 trade. If US investors are focused on indices, then they’re focused on the AI trade. But that wasn’t the best play this year:

Every year a chart like this rolls around showing how disparate returns can be. The Nasdaq is up 20% on the year, which is right on the edge of “unusual.”

What if the trade isn’t “up only Mag7” next year.

What if it’s not even in the US?

This is the relative performance of emerging markets relative to an equal weight Nasdaq, which has been a drag for years. We’re in the middle of a Fed cutting cycle and energy prices are low.

It’s time to pull the blinders off and expand your watchlist. Banks and industrials have started to rip, and international may get us some great momentum setups into next quarter.

One opinion I’m testing out is a market’s sensitivity to upside due to changes in AI and robotics. Capital has flooded into US hyperscalars, but what about the Chinese? What if Asian economies rollout physical AI infrastructure faster due to governance and population density?

Maybe BIDU will finally get that second leg:

The Danger of Being On-Chain

Missing from the matrix chart above is crypto and how it’s one of the worst performing asset classes this year.

Welcome to Wall Street, where the HODLers turn into paper hands overnight and the liquidity flows end up being a risk for the assets.

Bitcoin still has some hangovers. Everyone’s waiting for the Microstrategy squeeze, and I’m sure tax loss harvesting is providing some negative drift, but there are structural elements at play as well.

If you used BTC as a way to move cash around, especially if you operate outside the SWIFT system, then you may not want an asset with a 40% vol. The issuance and growth of stablecoins from Tether and Circle have shaved off some of the marginal demand from BTC.

A good way to view the crypto market is that the value of the token is a function of the utility of the protocol. As perceived utility unwinds, so does the value of the token. This perceived utility could be related to stablecoins, or other layer 1 protocols, or even just price action in the token itself… a little reflexivity gets baked in.

And Bitcoin doesn’t really do much. It’s a self-reinforcing network that stores and moves value.

Digital gold.

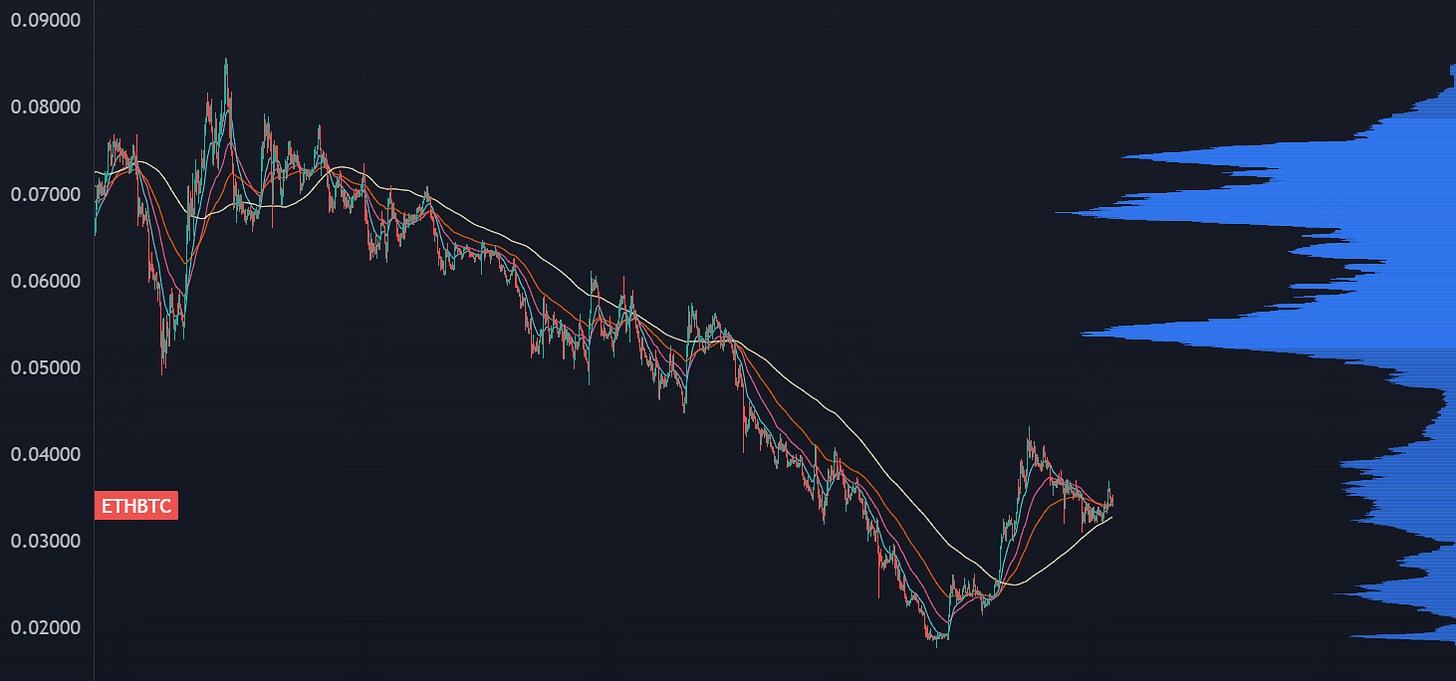

Ethereum, on the other hand, still has the potential for skyrocketing utility. That case has been early for years, but price action is starting to confirm this idea:

This puts ETHA and BMNR in play into next year.

Up Next For CS Clients

There’s a chart structure that I’m seeing on a few futuretech names, and I’ll use Planet Labs (PL) as an example:

It’s the “why won’t you die” setup. The stock clears a very large base, and instead of going straight shot higher, it consolidates for a month or two before starting its next big move.

If you can find some of these names and buy some OTM calls, odds are a few will pay and the gains will blow past any of the papercut losses you have the others that don’t hit.

We’re going to look at two names with solid narratives behind them and the “why won’t you die” setup…

… and I’ve got one name that is, quite literally, a moonshot.

If you aren’t a Client of Convex Spaces, we’d love to have you. Subscribe to get the option trade setups.