Chipped Edges

Smack talk from Jamie Dimon, the volatility crossroads, and the one thing you must have to prepare for December.

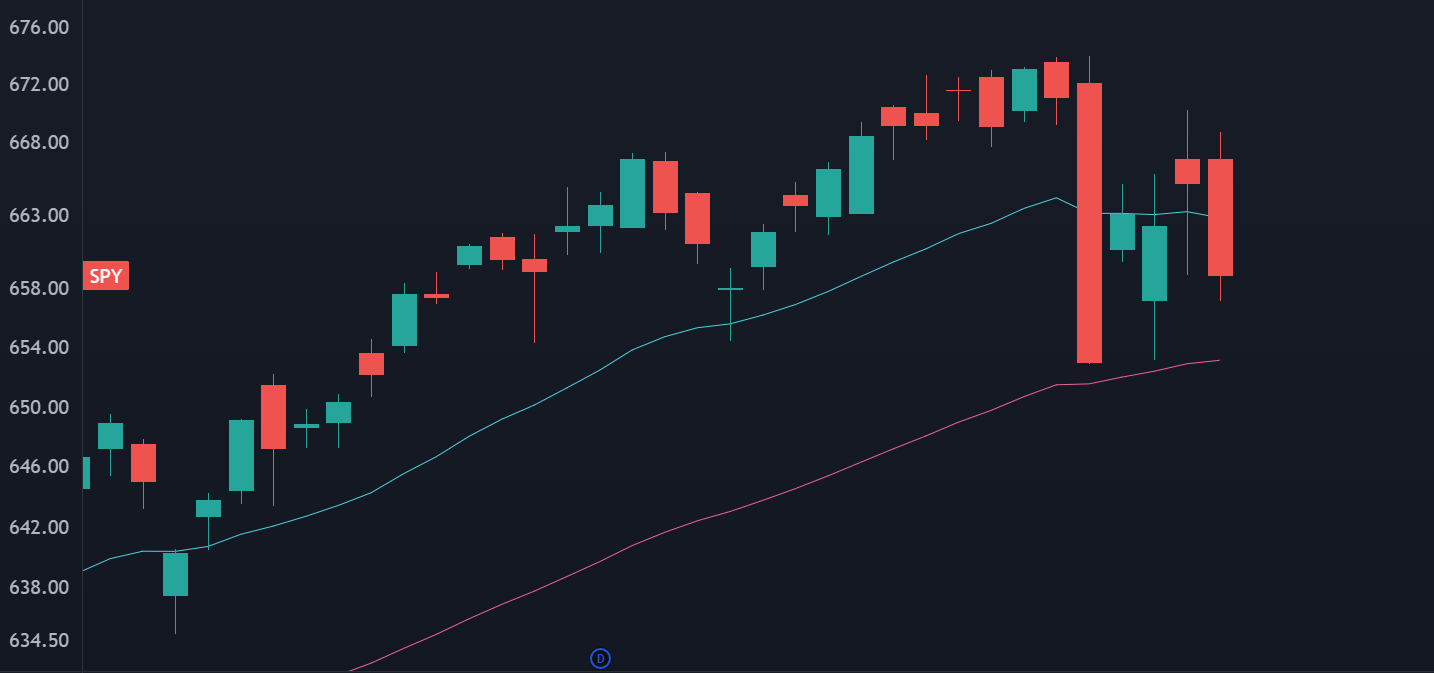

Earlier this week, I put out my primary framework for the broad markets:

That could mean wider ranges and a few nasty stop loss runs, both long and short. Too many have been conditions [sic lol] for small daily ranges, but if liquidity comes out of the market due to deleveraging, then you can’t account for that.

Some dumb, choppy, news driven mess of a range that punishes both sides and burns through a lot of options.

If there aren’t any headlines out of left field, and Tariff negotiations resolve in a not-that-shitty way, and Mag7 has good price reaction to earnings… then we’re setup for a rally into December and a hard push to start the year.

So far, so good:

We’re getting higher volatility chop with no signs of resolution. This is normal, both in terms of narrative and statistics.

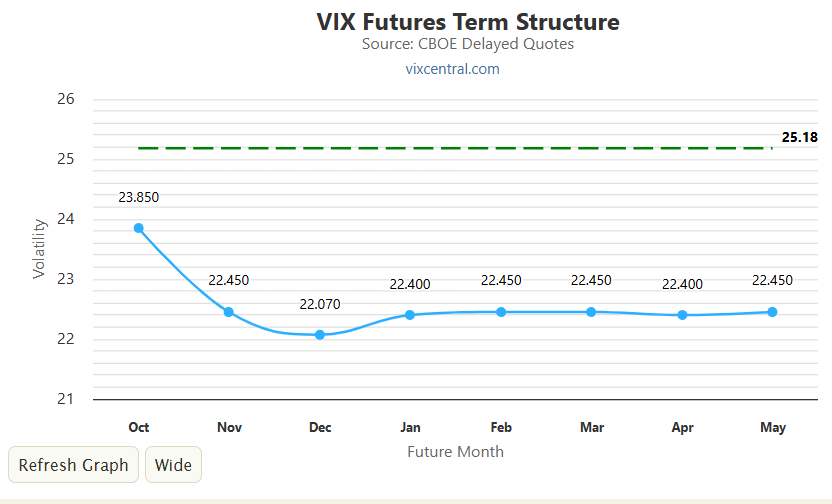

The vol markets started to perk up today too:

Spot VIX is now trading at 25 with a close near the highs.

And the VIX futures market just pushed into backwardation. When we have these kinds of market conditions, it can be tempting to call it capitulation.

For now, let’s consider it an anticipatory overreaction. The VIX is a 30 day window of the expected volatility (aka liquidity) in the market. The bid we are seeing here is likely a combination of Mag7 earnings, China trade talks, and some macro/Fed action coincident with a parabolic spike in gold.

There’s also a new downside “kicker” out with regional banks like ZION and WAL holding the bag on some debt. More on that in a moment.

We are in a “known unknown” market where option traders are adjusting to the potential risk events in the near term.

It rarely works out like that.

Downside Convexity

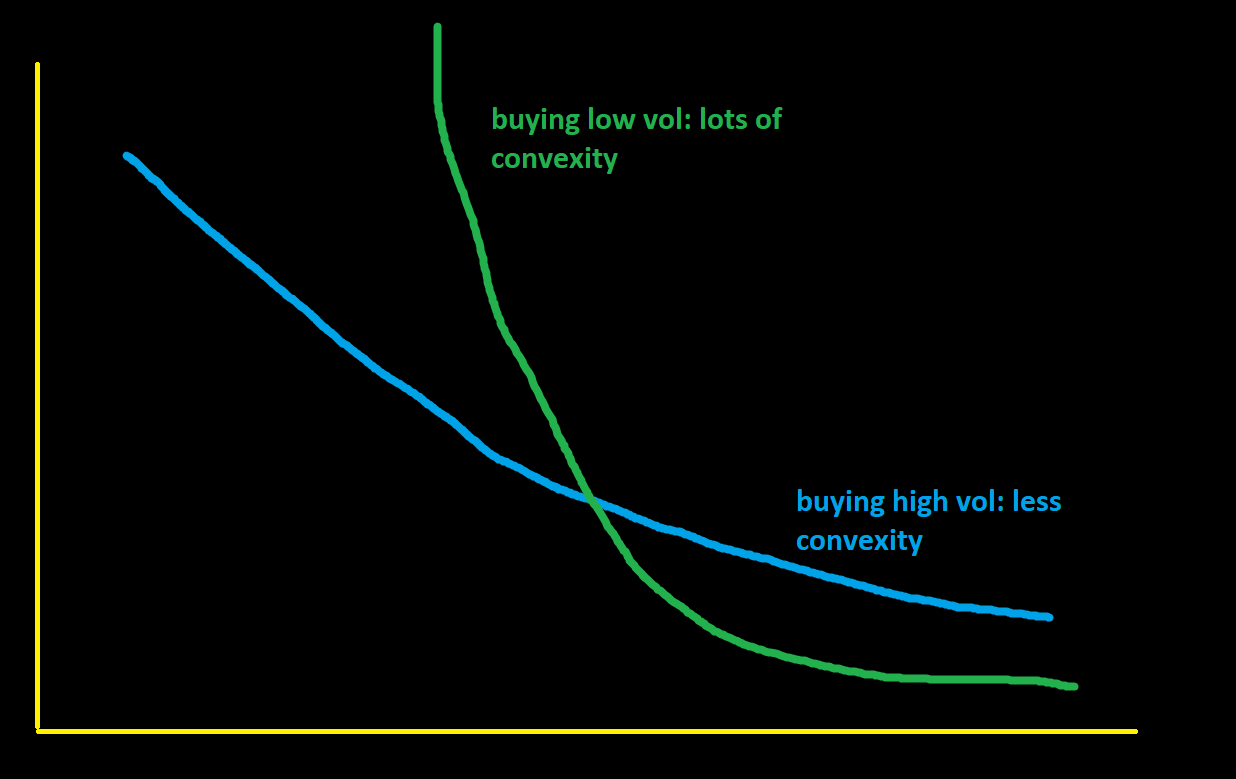

If you buy a put at an implied volatility of 25%, and the market sells off, you can make some money.

If you buy a put at a vol of 9% and the market crashes, you make a ton of money.

That’s because your convexity… your gamma… your sensitivity to price movement… is much higher with cheaper options.

And with vol blowing out before a risk event even happens, it’s hard for the markets to get crushed. We would need to see liquidity get pulled out of risk so hard and fast that it overwhelms what the market’s currently pricing in.

Which is possible! In a past life, I would be saying the VIX is “overbought” and it’s time to load up on selling put spreads.

But the market hasn’t moved yet! The Nasdaq is 3% off all time highs and the VIX is at 25.

This is a “something has to give” kind of trade.

We can get through the next few weeks of earnings and macro risk, then these hedging instruments are going to start burning off, and that vol unwind has a tendency to put a bid in Mag7 stocks.

Yet there’s the possibility that the options market will actually get it right (for once) and equities take a dive on whatever the headline hits the tape first.

I don’t know how it’s going to play out. Nobody does. There are some trade structures that can take advantage of how things are laid up, but until proven otherwise the base case of “stop loss reversion” for the indices until headlines start to hit.

Deploy the RAID Spray

I love some financial drama. About a month ago, the First Brands bankruptcy turned into a dumpster fire, where nobody can find the cash they thought they still had.

Jamie Dimon came out and said “when you see one cockroach, there’s probably more.”

The CEO of Blue Owl clapped back and said “I guess he’s saying there might be a lot more cockroaches at JPMorgan.”

Grab the popcorn, and ask for refills, because this isn’t over.

Another word for cockroaches is contagion. I know everyone’s watching China and Hyperscalars, but if things start to get weird in corporate debt, that will bleed over into stocks.

The fastest way to keep an eye on this is to track the relative performance of JNK (junk rated bonds) to LQD (corporate grade bonds).

You can also setup a watchlist… not to trade, just to monitor, of names directly implicated. That would be JEF, ZION, and WAL. Maybe throw VLY and SNV into the mix.

If this theme gets loose to the downside, that’s going to be a warning signal that most people aren’t currently watching. I’ve heard whisperings of some other busted deals, but this is still an emergent narrative.

Here’s a thought: yesterday, Jerome Powell announced that the Fed was ending balance sheet runoff. It wasn’t during an official meeting, but during an awards ceremony. Why the rush?

Maybe he’s seen the cockroaches.

You Need To Be Prepared…

… for Christmas. We’re two months away, which is still enough time to make a good eggnog. And you need to start now! Don’t put it off until the day of, because the ‘nog will be too hot from the booze.

The longer the ‘nog sits in your fridge, the better it gets.

This bottle is well over a year old that I’m looking forward to busting open in a few months. Remember, if you put enough booze in it, there’s no way bacteria can grow.

Just like financial speculation, there is no perfect recipe, but there are some principles that can elevate the drink.

Keep the egg whites out of the aging process. You want to have a fresh set of egg whites that you whip up to build volume when you serve the dish, but not while it’s cooking.

Have some cream for presentation, too. Whipping up some cream gives you a sugary floaty lump in your drink that you can top off with some fresh nutmeg

Black spiced rum is a great accent taste. I use Kraken because it’s got a good flavor and is pretty cheap.

Make a double batch. That way you can put the second bottle in the back of your fridge for the next year. You’ll thank me.

Here’s the basic structure I use for my eggnog:

12 egg yolks

a crapton of sugar

cream

milk

brandy

bourbon

rum (smaller portion)

If you want to get cute, you can take a couple splinters of cinnamon stick and a few cloves to infuse the bottle. Just don’t overdo it.

When it comes time to serve, whip up the whites and cream and have grated nutmeg to go on top.

It’s worth the wait.

What Else We Have Cooking

Because of how goofy vol is acting, there’s some very specific trade structures that can exploit the difference between how risk markets are behaving compared to the relative quiet in equities.

We’ll look at that, as well as some solid volatility structures to trade as we head into “silly season.”