Crypto and Copper Mines

Breaking down the "reverse unwind" in the S&P 500, a semiconductor momentum play, and a degen way to play the copper tariffs.

Let’s start with a 30 minute chart of the S&P 500

Back in June, we had whippy action and plenty of failed moves out of the range. While volatility wasn’t high, it was enough action to keep people interested.

Since the breakaway gap on June 24th, price action completely changed.

Any push that gets ahead of itself is punished, but after that it’s just a slow grind higher.

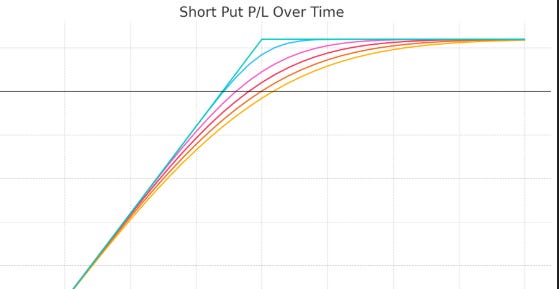

Do you know what this feels like? The payout you get on a short put option.

You’re not getting a big win, but your P/L just drifts higher every single day.

There’s a reason we are seeing this price action in the markets:

The market is trading at an 8% volatility. Spot VIX is at 16%, and Jul VIX futures are at 17%.

That’s a massive spread. And each day that the market doesn’t get killed, a reverse unwind occurs.

Because as the vol market gets pulled lower, every single day, that bleeds back into the S&P in the form of marginal demand. Which is how you get a grind.

At some point this will stop. But until then, UVXY puts are up on deck.

Is It Finally Time For The BTC Pump?

Bitcoin is within spitting distance of all time highs, and a new push would renew a narrative as headlines spread into “low-information” market participants.

I think the breakout will hold, but I’m not sure we’re going to get the speculative fervor that we used to have. There have been plenty of bridges built into TradFi, and those participants have different risk profiles and may take off profits early.

There’s also the problem that many crypto-adjacent traders have been playing with Degen runners like BMRN and SBET so there’s almost a pre-exhaustion before the underlying starts to make a move.

Either way… Bitcoin vol is cheap. Lowest in well over a year, so that means IBIT calls are a good way to position for a continuation.

SuperMicroBreakout

I’ve been in some OTM calls on SMCI for a week, watching them bleed lower. The stock hasn’t been killed… just holding up well.

It’s coming close to a breakout, and if it clears we may get a solid push to $60.

Doctor Copper Bought a Porsche

With the US announcing new tariffs on copper exports, futures had their largest one day rally in over a decade, possibly ever:

This is not an easy trend-following trade! It’s not that copper prices are up, it’s that copper prices in the U.S. are up. There are COMEX warehouses where you take delivery of this copper, and the tariff rate is what got priced in, not any new fundamental demand.

But there’s still a play, just not in the obvious trade.

Freeport (FCX) tried to push on the rally, but it completely faded:

This is the tricky part! You have copper miners, but there’s a reason copper futures are ticker HG— it means “high grade.”

You have to refine the copper. This is the same problem the US currently has with rare earth minerals… we don’t have the processing capacity, so it still has to leave US borders and come back in.

There may be a play in Hudbay (HBM) as it’s clearing 52 week highs, with room to run 50% before hitting its next big level:

But I’m looking for something with a little more upside kick, and I’ve uncovered a small cap copper producer that may be set up to take advantage of this tailwind.