Don't Put On Your Thinking Caps

Narrative exhaustion is being reflected in price. I've got 3 buckets to watch in the markets, as well as some solid option trades going into the month.

Labor Day is tough on the markets. Historically, volatility picks up on the subsequent Tuesday.

Why is it like that? I’m not sure about other holidays, but I have a theory:

Wall Street doesn’t take Labor Day off.

I know you hear about fund managers taking a long weekend in the Hamptons, but let’s be real, they’re not actually “grilling out.”

We’re all still strapped in, and we’re thinking. And in this market environment, thinking is bad. You can’t act on price because markets are closed. That means you spend hours in the financial rabbit hole of hypotheticals.

And then investors end up with cold feet. They start worrying about silly things like “the deficit” and all of a sudden everyone’s a bond market expert. Then, some headline about tariff revenue being rescinded by a judge, and you get a market gap down.

Then the Nasdaq tags the 50 EMA, bounces hard, and Google gets a favorable court ruling that drags the entire Megacap tech complex higher.

The New Narrative

Tech momentum is fading. It’s not because of tariffs or fed cuts… it’s because we don’t have a Narrative that’s fresh enough to introduce new liquidity demand from fresh buyers.

And there’s no new dominant Narrative just yet. I’ve made some guesses, but nothing has emerged out of the financial noosphere to take hold of price action.

Here’s what will happen instead. Price structure is going to evolve, and we’re going to have a liquidity break. When that happens, a new Narrative will attach itself to explain the price action, and a new reflexive loop will take hold.

So let’s talk about price.

How to Identify A Market Top

Since the Tariff Tantrum bottom, traders and analysts alike have been trying to “nail the top,” looking for retracements and resistance and catalysts and headlines.

No such luck. In a past life, I would have been one of those, trying like hell to play the eventual rollover.

Now, major markets are coming into inflection points and it’s worth setting up a framework to see if we’re going to get a decent correction.

First off, a quick caveat: we do not have enough information to call this a market top. But the paradox here is that by the time the “top” is obvious, then position has already been cleared out and you’re not going to catch a ton of juice.

Second, some perspective. If the Nasdaq were to retrace about 25% of this recent rally, which seems to be “normal,” then it would be a full round trip of the June rally and about an 8% correction off the highs.

That’s a reasonable downside target and would be a solid reset of the recent move, but market participants would view it as a financial apocalypse.

We can also use the disparity index to get a feel for where the market would get stretched.

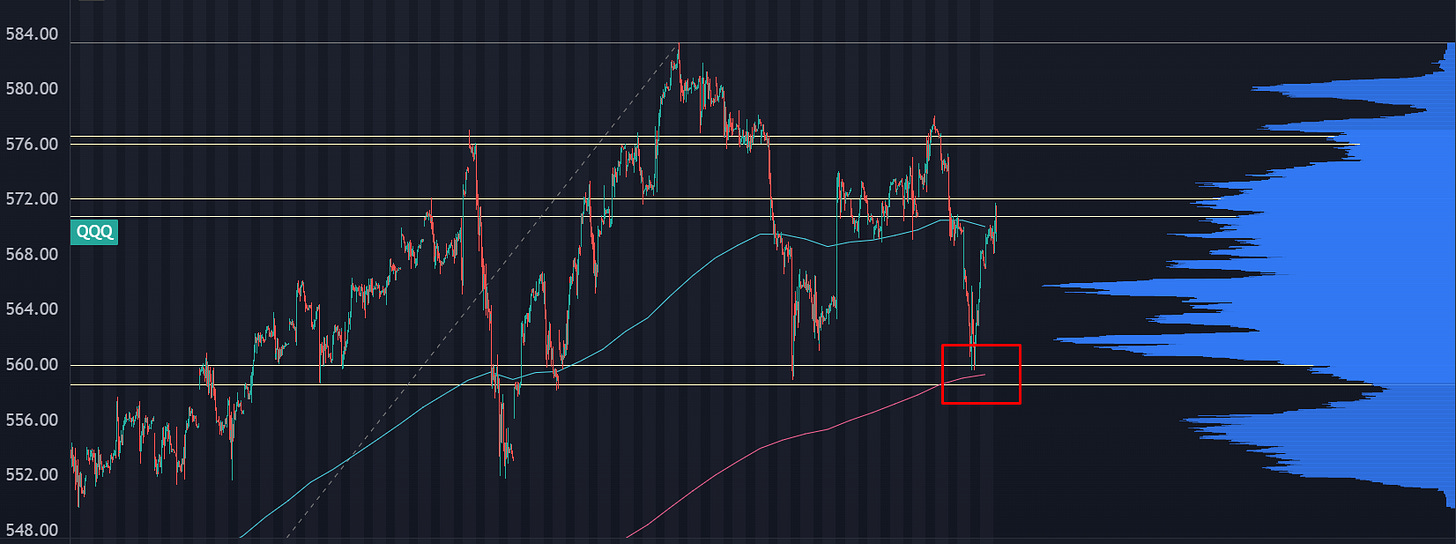

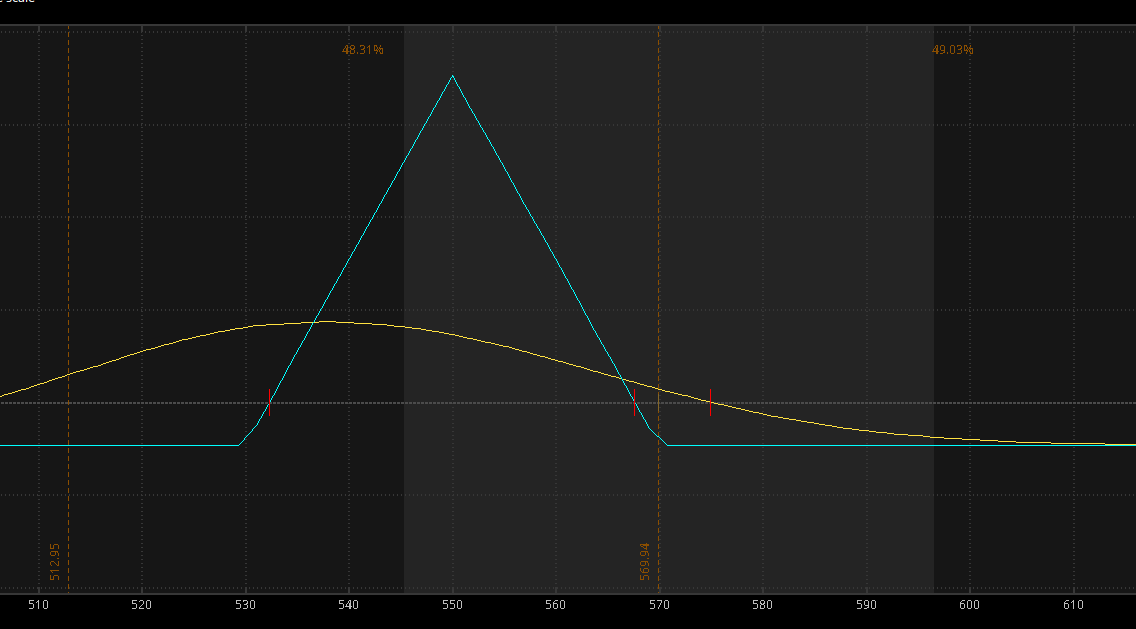

A correction with a lower case “c” is about 4% under the 20 EMA. That’s sitting at about 570, so downside target would be $547. That would be an undercut of the Jul/Aug support levels.

A Correction with a capital “C” is about 7%. This normally happens when price is under the 200EMA, so I wouldn’t look for that on the first push lower.

Track Your Breadth

There’s three “buckets” that I’m watching for corrections.

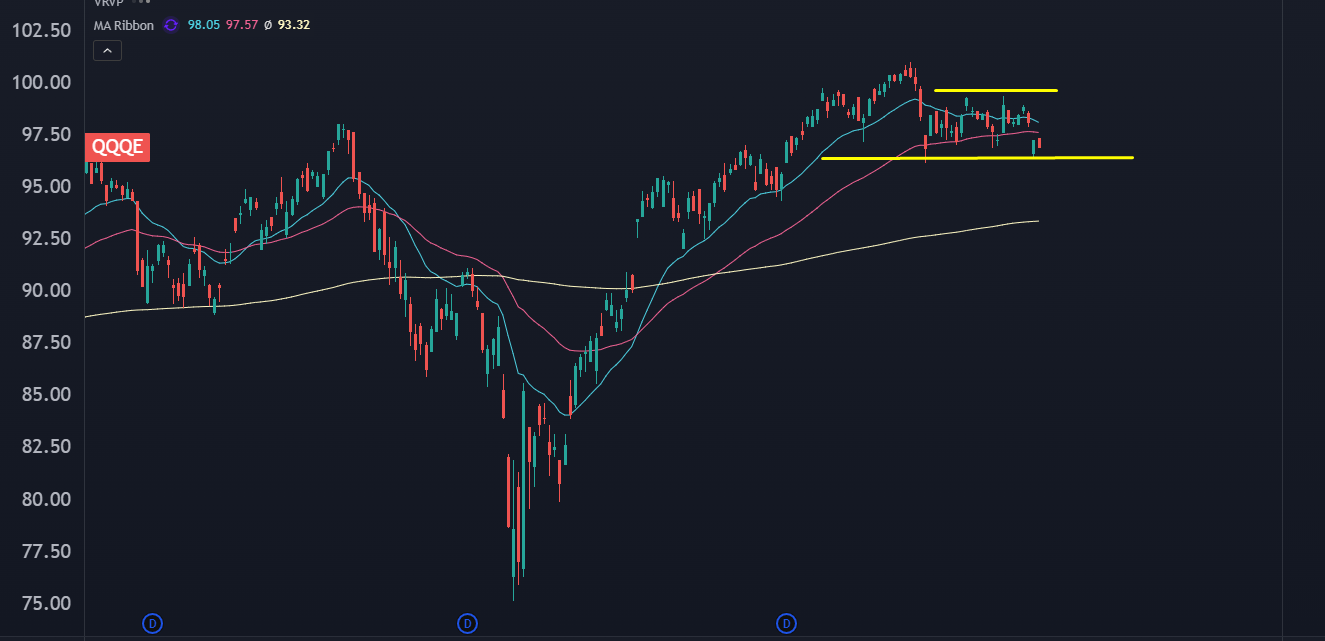

The first bucket is the tech complex. This goes beyond QQQ. In fact, a better view of the health of the market leaders is to look at the equal weight Q’s, ticker QQQE:

You can also throw in SMH for good measure.

The second bucket are continuation plays. These are names that had solid moves on earnings this summer and, if market participants still have risk apetite, they’ll see second pushes. And if they start falling apart, that’s your early warning signal that equities are due for a rotation lower.

Here’s an example in ALAB:

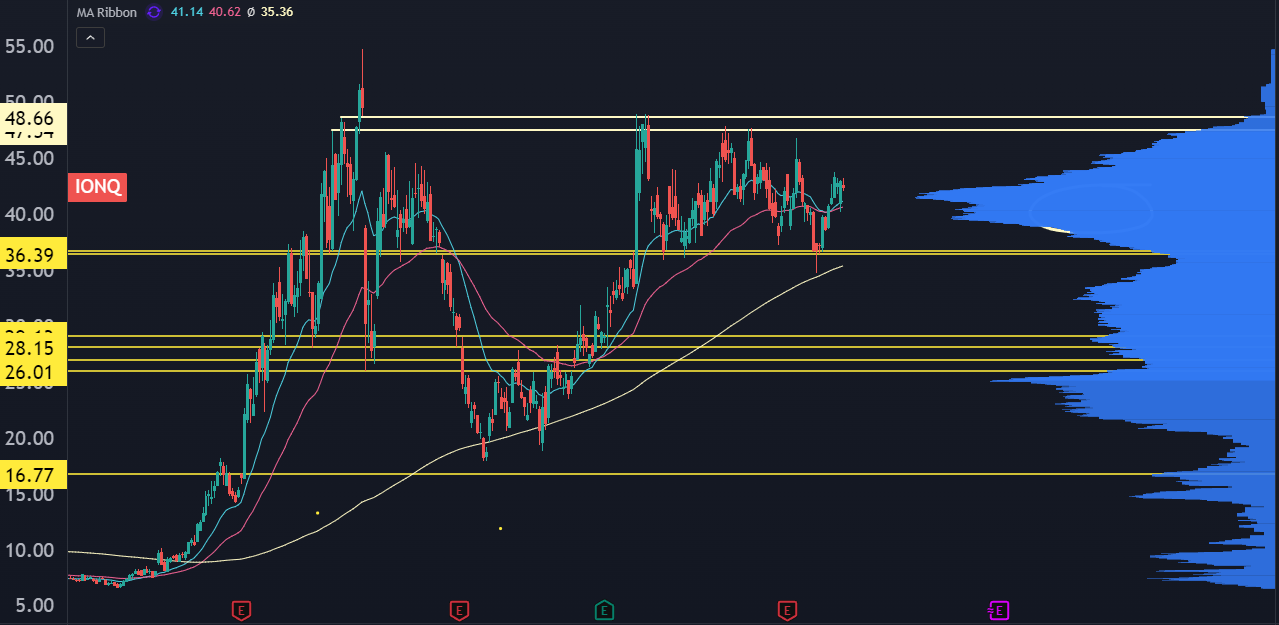

The third bucket is the momentum laggards. These are stocks that had a solid first half of the year, but have been rangebound for a month or two or had recent rug pulls.

If this group starts seeing breakouts that completely fall apart, that’s a big warning signal for me.

This would include some of the momentum darlings like PLTR, HOOD, and HIMS.

Other sectors to watch would be Quantum and Nuclear. I’d really like to see how IONQ acts as it runs into $47-$48

How To Trade The Pullback

If risk gets pulled, what’s going to be the most sensitive to it?

Crowded themes and crowded trades. That’s going to get you better juice to the downside compared to trying to nail a short in the SPX.

There’s also rotational considerations. If industrials and banks do OK, and the options market keeps short term liquidity juiced, then it’s tough to get a hard rug pull.

That means a little creativity is in order. And we’ve provided plenty for Convex Spaces clients.

I showed how to exploit the coming breakout in gold with a GLD strangle, which is now a double.

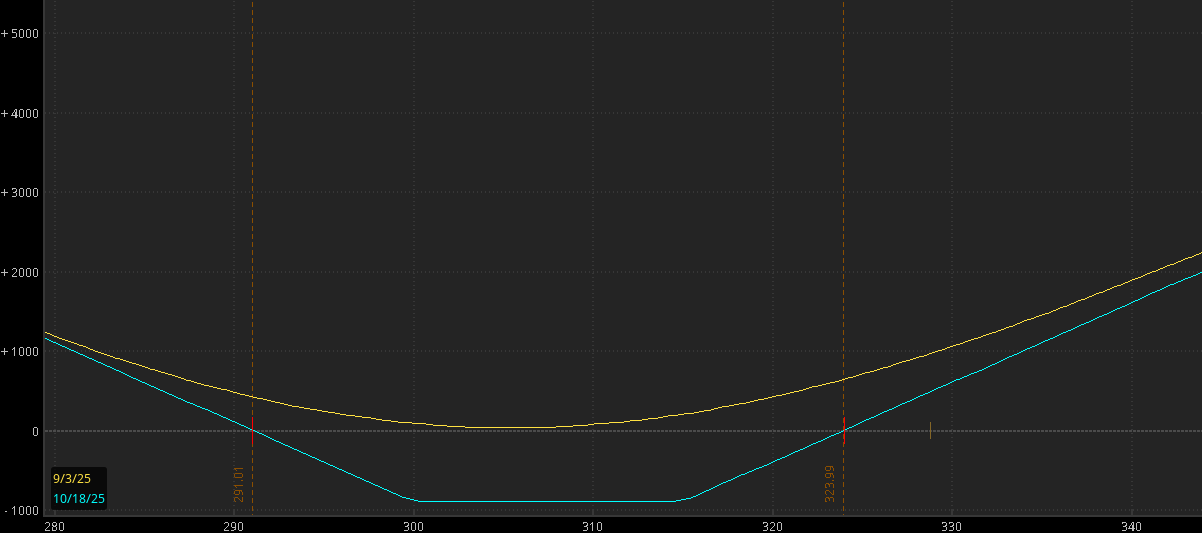

And I planned out a hedge in QQQ that hasn’t taken any heat and offers a solid payout if the market does take a hit into September opex.

And I noticed that LYFT Jan calls were hilariously underpriced. The Jan $20s were going for 0.45 when I let Convex Spaces Clients know, and those options traded up above $2 today.

Today we’re going to take a look at a few bearish setups, attempting to anticipate that rug pull. I’m still viewing these more as hedges, which gives me some breathing room to keep following the trends that are still sticky in the market.