Hitting the Reset (Not Panic) Button

Clearing out the speculative excess while long term investors don't notice.

Imagine that you’re a passive investor with a 401(k). Employer matched, of course. You’re not paying too much attention to the markets because you’re too busy creating value and watching sports.

Your exposure to the market is from checking your balance every once in a while, or seeing where the Nasdaq is trading.

Up 19% YTD. Not bad, considering you’re expecting about 8% annualized. And the Nazz is up 50% in about a 2 year period.

Do you have any reason to sell your stocks? Any reason to panic?

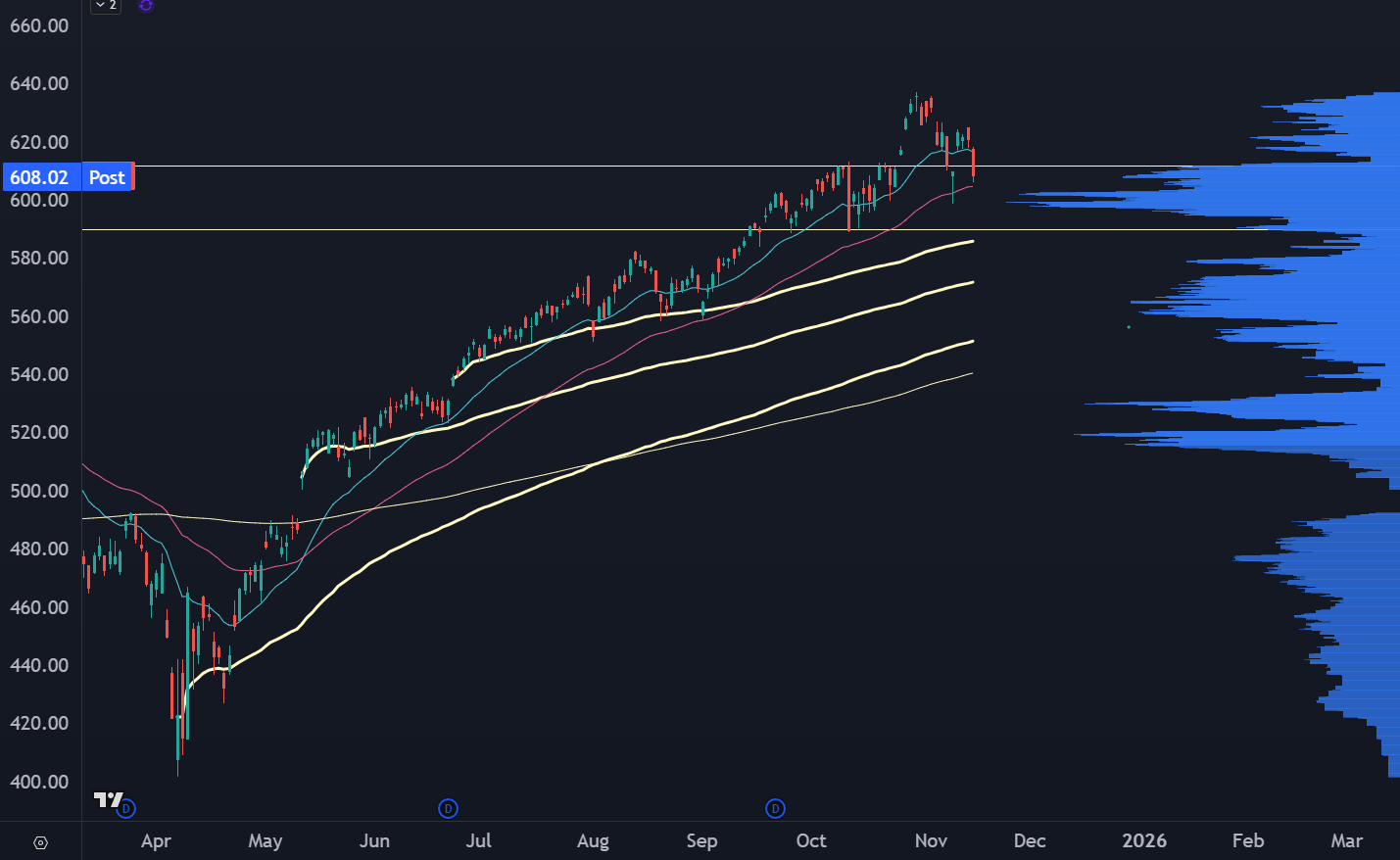

Look at the chart above and check the Anchored VWAPs against key pivots. The average buyer is still up big.

Now switch characters. You went all in on the AI trade, buying infrastructure names like IREN and CRWV. Power plays like Bloom Energy (BE):

And the last momentum darling, SNDK, finally took a hit:

Your belief system of how the market is doing is a function of the market that your watching.

Unleveraged index investors are doing great. Late players to momentum trades think it’s the end of the world.

In reality, we’re seeing a hangover from some of the speculative excesses during the Aug-Sep rally.

Trading the AI Blackbox

It’s a rotational market. The Mag7 have the look of a failed breakout:

Meanwhile banks, healthcare, and energy all look healthy.

It’s all still part of the AI trade. I know that this is reductive but that’s the narrative we’re going to see into next quarter.

You have AI inputs, and spaces like nuclear and infrastructure were part of the big bull runs in the fall. But we’re now seeing that these data centers are going to require natural gas. Lots of it.

Then there’s the outputs. There’s not much of a value proposition in generating AI cat videos, but the effects of applied AI are still lagging the technology and have yet to be reflected in the fundamental reports of other parts of the economy.

Big banks are seeing some leverage expansion due to deregulation, but they also can make better decisions, cheaper, which leads to improved margins.

Here’s the problem I’ve been chewing on… given the weighting of large cap tech, can we have rotation to other sectors without an NVDA selloff clipping the broad markets?

In other words, can GS and JPM manage to rally if the Mag7 names get kicked in the teeth?

That’s what the current price action feels like. And for the next few weeks, we could see the market start to test if there’s fragility in this kind of rotation.

Fed Up

Uncertainty pulls liquidity, which leads to volatility.

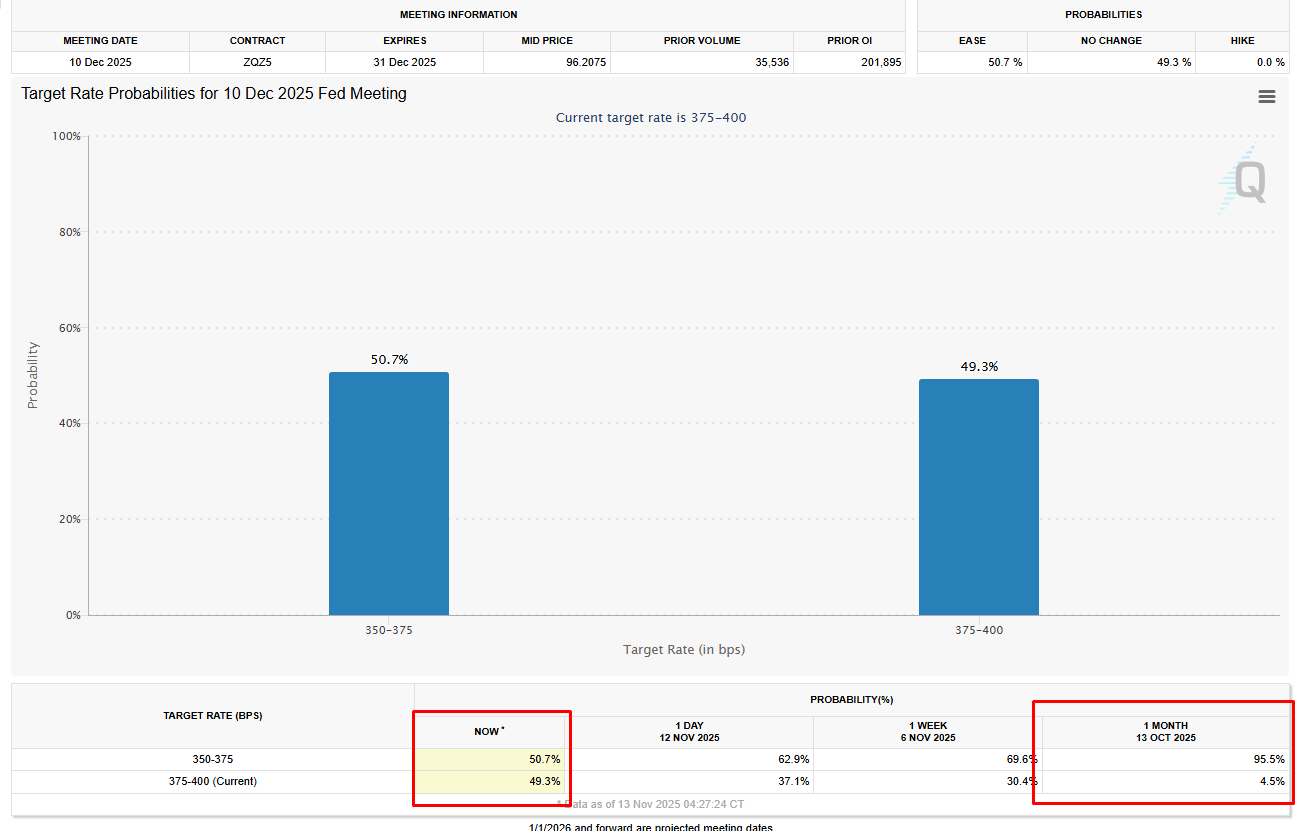

A month ago, it was a lock that the Fed was going to cut in December. Now we have the Federal Government telling us that the shutdown has broken the data reporting that the Federal Reserve relies on to make their “data-dependent” decisions.

Odds are now a coin flip.

We may have (yet again) a dynamic where the best risk/reward long is when we approach max uncertainty. You don’t buy after the report, you buy a week or two before when everyone on Bloomberg is hand-wringing and the VIX keeps a persistent bid.

A Unique Spot In the VIX

One “green shoot” in the market was the small unwind that the VIX had into the close:

Remember, you can’t trade the VIX, it’s a statistic. It’s telling us that there wasn’t a ton of panic buying in SPX hedging into the end of the day.

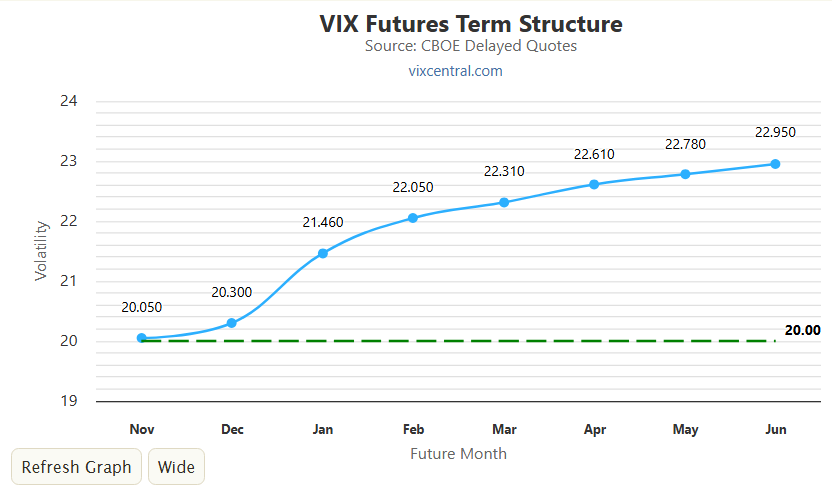

But there’s an interesting dynamic that we don’t see very often:

The way VIX options work is that they don’t trade based off of spot VIX, they trade off the VIX futures market, which rarely trades equivalent to spot.

In a calm market, the futures trade above spot, and vice versa for a panicky market.

Yet into the close today, the VIX futures were trading at nearly the same price as spot.

That gives us a very fun trade that can serve as a hedge through the weekend session, just in case things get loose.

Our VIX trade today is available to our smart (and very attractive) Convex Spaces Clients