How (and When) To Load Up For The Crypto Bounce

A full rundown of the narrative and liquidity drivers of the crypto selloff, and the creative ways to play the countertrend rally.

It’s Over. We’re Back

The total crypto markets have shed over $1T in market cap over the past two months. It’s ugly but not an absolute bloodbath compared to other historical rugpulls.

We haven’t seen a “Mt. Gox” event, much less an “FTX” event. Just a systematic unwind that is bleeding out bagholders.

DeFi markets are an experiment of sentiment extremes. We either see a massive hype cycle with gainsposting on twitter, or overleveraged accounts get blown up.

Crypto is a maturing market… not the same wild west trading we had a few years ago. The recent speculative excesses have begun to wear off, and the DeFi-TradFi rails change the liquidity structure of the market that make it much easier to buy the dip.

And that buyable dip is coming. Soon.

Perspective

It’s not 2013. Or 2018. Or 2021. It’s more… boring. Which is what happens to markets when more liquidity is introduced. With the introduction of ETFs and treasury companies, more liquidity rails have been added from Wall Street.

It’s a blessing and a curse. In bull markets it helps to stabilize the drawdowns, but you don’t see the same kind of “up only” markets from a few years back.

It’s maturing. Similar to how the volatility profile of a stock changes when it trades at $1B compared to $100B.

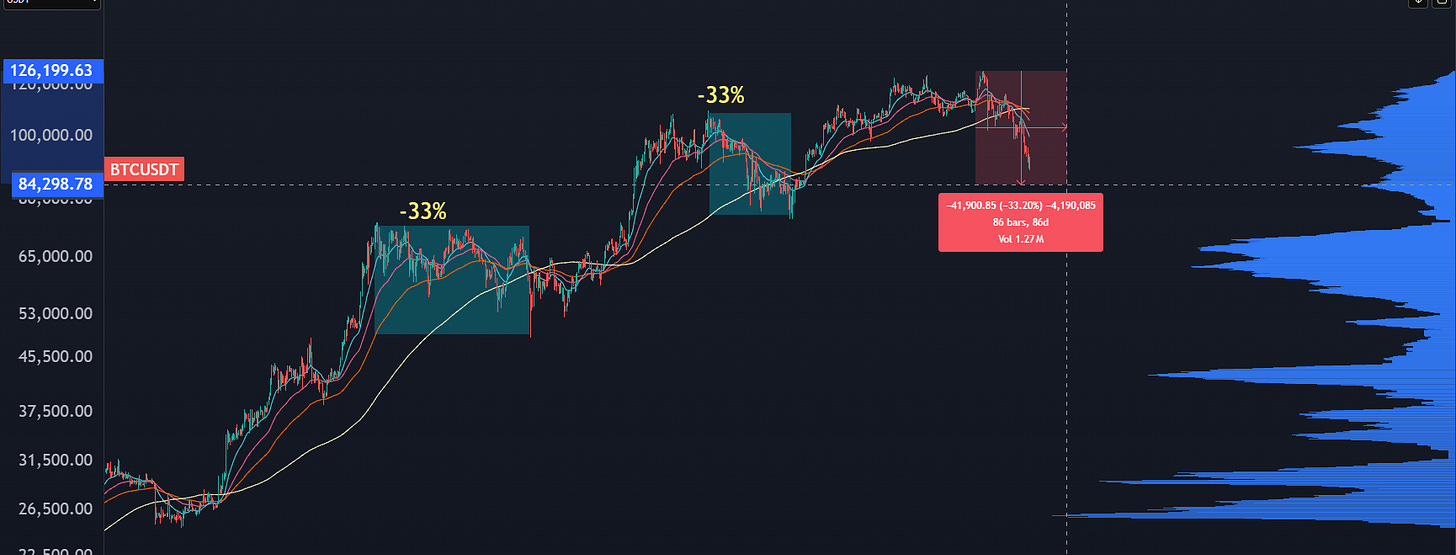

In the past two corrective cycles, Bitcoin has pulled back about 33%, and the token is approaching that same measured move, which is why I’ve got eyes on a potential snapback rally on the entire crypto ecosystem.

But first, let’s dig into the narratives driving this selloff.

Crypto Is Excess Risk Liquidity

It’s a momentum market. Momentum runs both ways.

What’s happened to other pockets of momentum?

They’ve all been killed.

Quantum stocks have been kicked in the teeth, with IONQ 0.00%↑ 50% off its highs.

AI Infra stocks like NBIS 0.00%↑ are down 40% or more.

Futuretech Plays like ACHR 0.00%↑ have been cut in half.

And the China Internet breakout hasn’t hit, with BIDU 0.00%↑ clipped by 30%.

If you’re primarily a trader in DeFi assets, just understand that you aren’t special. This is how markets operate. They go up and down. If you want the “up only” glory days then you’ll need to take a time machine back to when crypto liquidity was much thinner and could be pushed around by smaller buyers.

“Liquidity” in this sense can also be viewed from a macro lens, and there’s probably some hangover from the Federal Reserve keeping rates elevated, which through a series of convoluted steps causes risk assets to correct.

Stablecoin Demand Reduces BTC Demand

This is a bitter pill to swallow for any kind of maximalist, but the demand for dollar-denominated stablecoins are massive. Liquidity used to pile into BTC for transactional utility, but if you’re conducting trade, you really don’t want to own an asset with a 40% vol.

USD has a vol of 5%, which is much easier to manage.

Yes, I know all of the “advantages” for owning a currency that’s limited by mathematics. But a LOT of people around the world want access to dollars, and the USG is more than willing to give it to them as the stablecoin issuers become a new marginal buyer of US treasuries.

TradFi-DeFi Derailment

Crypto ETFs sound great until investors panic. The liquidity flywheel that was working well earlier this year has started to unwind.

A structural issue is that crypto trades 24/7 while liquidity access in ETFs is available only during market hours.

So you’ll have a hard selloff overnight, and the gap down will induce more redemptions, which forces the ETF custodian to sell more spot, which causes crypto to drop even more…

And it gets worse when you look at the treasury companies.

Eyes Are On Treasury Unwinds

Bitcoin can’t bottom until Saylor stops cringeposting.

Stop it. Just stop. This isn’t helping. If anything, it paints a giant target on your back.

Because every fund on Wall Street knows the holdings of MSTR 0.00%↑. It knows where the pain points are, and I’m certain a few large traders are trying to find a way to induce some kind of negative convexity trade where crypto treasury companies end up being forced sellers.

Unlike the ETFs, treasury companies don’t necessarily have forced liquidations through redemptions. So far, that seems like a smart play… but there is always the risk of dilution.

Some of these treasury companies trade at a premium to the assets they own, and I think the convergence trade has created some of the negative feedback effects in the crypto markets.

Stupid Leverage

On Friday, October 10th, there was a forced unwind on some crypto exchanges. The stock market had a decent selloff which reduced liquidity supply in the crypto markets… but there was an incredible trade where some players pressed the screws on fragile crypto exchanges and caused a forced deleverage in the crypto markets.

Because the ledger is public, we can track how many accounts are getting liquidated.

The perpetual futures market has induced instability in the crypto market, where traders are opening wallets to try and nail the dip on leverage hoping to score it big, and then blowing out when it doesn’t work in their favor.

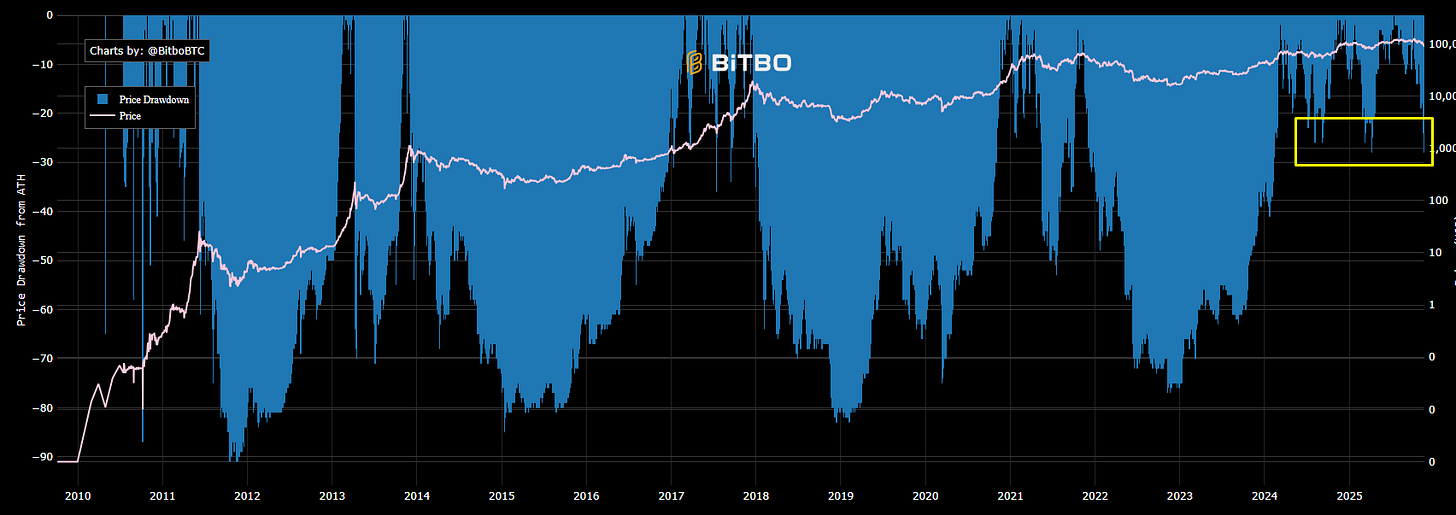

It’s Different This Time

Bitcoin has seen some ugly drawdowns in the past, and many participants are wondering if we’re going to have another Big One.

It’s possible, but unlikely.

The liquidity profile of crypto markets are completely different than the past. The “plumbing” is much more robust. There’s hedging markets both on chain and on Wall Street.

The correction that crypto markets are experiencing a more like a momentum market resetting rather than the end of a giant digital experiment.

That means it’s time to buy the dip.

The question is, when, and how.

Math Lines

Now that we’ve nailed down the squishy narrative angle, let’s take a look at the structure of the markets.

First, a little magic trick:

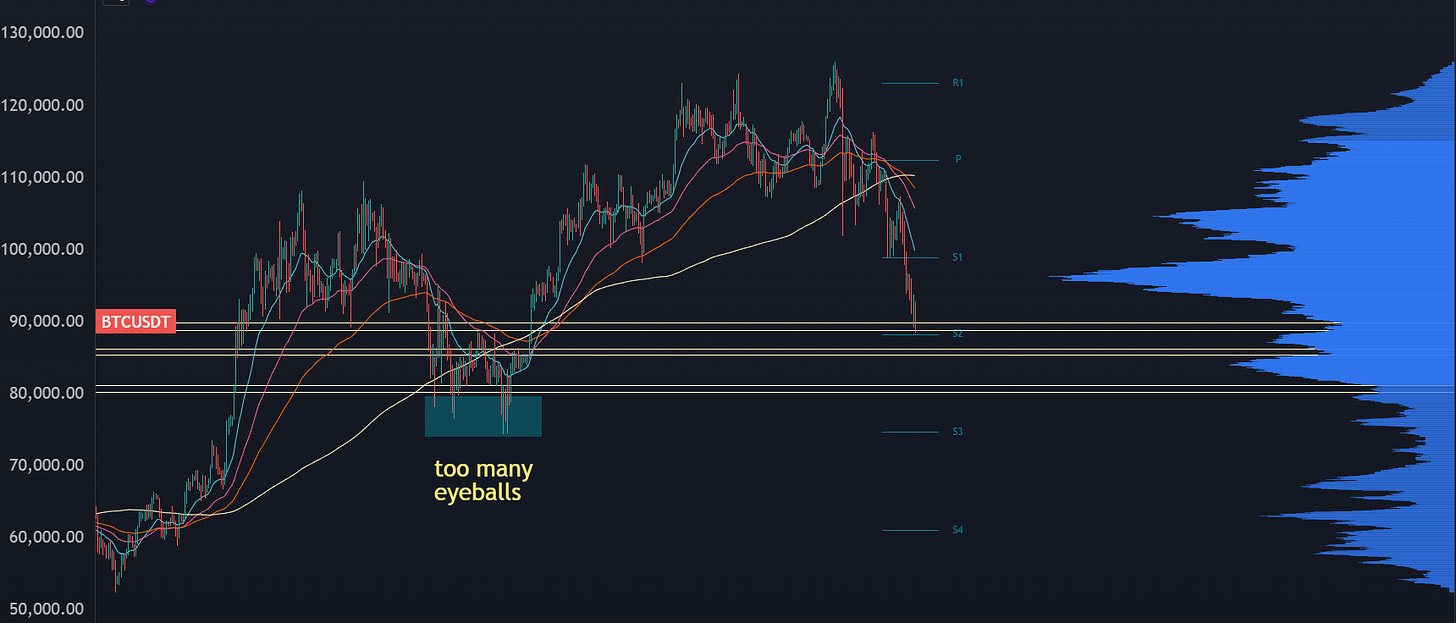

That blue line, where BTC aggressively bounced in early November, is a monthly pivot level. We’re talking “old school pit trader” calculations.

That retracement high is the 20 exponential moving average.

No rocket science involved.

It’s shocking how well traditional technical analysis works on a “modern” market. It may not guarantee an absolute high or low, but some pivots, moving averages, and volume by price does an incredible job of creating the pathing of how price moves.

On first glance of the BTC daily chart you immediately anchor onto the 75k level given the violence of the move after that. It also coincides with the breakeven price of MSTR 0.00%↑ holdings, which suggests to me that we aren’t going to hit it. Too many people want that price.

Instead, we’ve got a clear support level here, which saw responsive price action (both higher and lower) in late 2024 and spring 2025.

Underneath that is a low volume node around 86k, and if that doesn’t hold then the 80k-75k test may be up on deck.

Disparity

Looking at the distance from the 50 EMA, we’re coming into a key stretch level that has been a statistical reset point over the past few years. It could get worse, but we’re not in the same kind of macro and liquidity environment from those stretches.

And we’ve seen other instances where BTC jams 50% under the 50, which were COVID and the 2018 tech wreck. It’s possible, but not probable.

Other Layer 1s

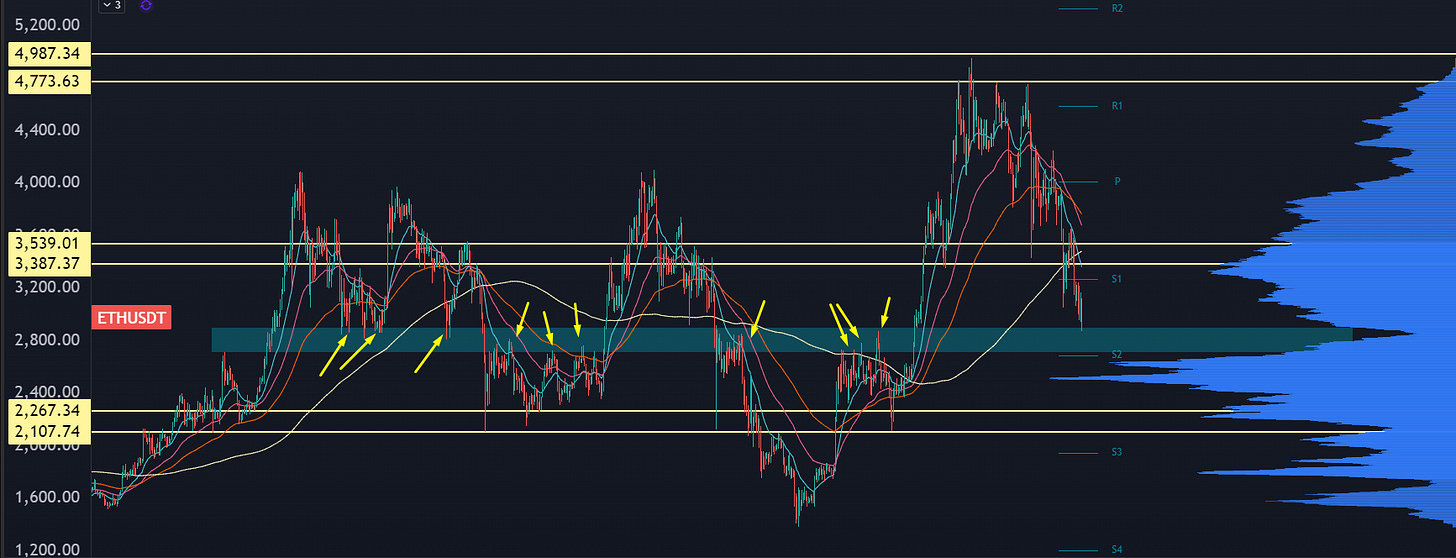

ETH

Ethereum is arriving at a massive pivot zone around 2800. We’re not looking for precision within a single dollar, this is still a wide range. Yet given the speed the token has seen into this area, it’s reasonable to look for a turn.

SOL

Similar to ETH, where a major zone is coming into play.

We’re Close… How to Trade It?

This is not a recommendation to go “full port” with leverage into your favorite crypto assets. This is not even a call that a bull market has started. It’s about reversion and positioning. If you get enough participants liquidated, if fewer people are on board, then you have higher odds of a bounce.

If you’re a long term investor, yeah, you can probably scale in or at least run some dollar cost averaging to build out a position. Don’t overdo it, and don’t be an idiot.

But what kinds of creative trades could we look at to get us a little more juice?

Trade Setup #1: MSTY

With MSTR 0.00%↑ closing in on parity so it’s effectively a straight up BTC trade without any of the fancy premium that the stock has sported for the past year.

Here’s some easy math…

IBIT, the bitcoin ETF, currently has an implied volatility of about 60%.

MSTR has an implied volatility of 104%.

That means if you’re going to sell options, if you’re going to try and extract some yield out of these trades, then it selling options on MSTR is going to be a better bet.

MSTY 0.00%↑ is a YieldMax ETF, and they own Strategy and then sell covered calls against it. If you own the ETF, you get access to some of the gains from the covered calls in the form of a dividend.

As an example, they’re kicking out a distribution of 0.1475 on a cost basis of 7.55, which is about 2% in a week. Combine that with some reversion in BTC and MSTR, and it seems to be a straightforward bet.

For ConvexSpaces Clients, we’ve got a few more upside bets that could be exceedingly lucrative. We’re looking at a trade structure in IBIT, a cheap options bet on a former crypto high flyer, a brand new treasury company that is about to hit the radar of many people, and some degen SPAC warrants that could be a quick double.

If you aren’t a Client yet, we’d love to have you on board.