How I'm Looking To Trade the BYND Parabolic

An options trade that allows you to profit from the downside without taking heat on a further squeeze.

A week ago, Beyond Meat was on its way to zero.

Then it traded above the 1 day VWAP, and the stock started to squeeze. Slowly building, trapping shorts, and then yesterday it jammed from $1 to $3.50.

In ETH, the stock traded up into the 9’s. Looks like we’ve got our meme stock of the month.

This isn’t going to end well for most people. It won’t end well for the meme stock bagholders when they (finally) get caught on the backside. It won’t end well for the 3rd or 4th rounds of shorts who get blown out as the stock somehow manages to jam to $15. It won’t end well for the option traders thinking it’s a “lock” to sell calls when IV is at 400%.

Yet it can end well for us. There’s a specific setup that I like to use in parabolic meme stocks, taking advantage of how volatility is trading as well as the eventual unwind.

Because it will unwind. Eventually.

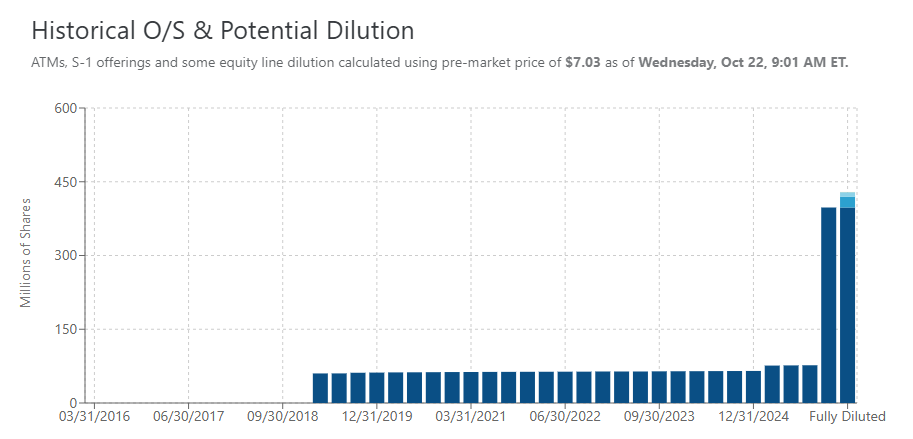

The stock is stuck in dilution hell. Just recently their float went from about 75MM to 400MM. With that kind of supply online, it’s going to be tough for the stock to maintain a bid. I’m sure that’s what the early shorts thought too.

There’s a couple ATM and shelf offerings that the company can tap to raise cash. This is another “known known” and I’m sure the early shorts have been counting on more dilution… which is why the stock is getting squeezed.

On the options side, it’s starting to smell like a gamma squeeze. On the weekly 5.5 calls, there were about 100k options traded, and that’s about 10MM equivalent share exposure just on that one option. The stock traded 2B shares yesterday so it’s still a drop in the bucket, but it can start steamrolling, especially when the stock pushes above $8-$9 overnight.

The options board just opened up $9 strikes, which means it’s high odds we see $10 just to run over the board again.

Here’s my expectation on how this will trade:

With the big gap up today, I expect one or two more traps to be set for shorts. I wouldn’t be shocked if we get one more good squeeze.

If we get a gamma squeeze, on the other side of it is the vanna unwind. These usually kick off on a Wednesday afternoon or Thursday.

Problem is, it requires out of the money options with a ton of open interest for this to happen. We don’t have that yet… but we could soon.

You know what could really screw with people? What if the vanna unwind doesn’t start until next week, because the option dynamics don’t have it setup?

That means all the weekly option traders get burned. Put premiums evaporate and nobody wants to try and gamble the next week.

So it’s very possible that the crush happens later than what people expect. That’s been the theme this year with other parabolics like OPEN, APLD, CRWV, CRCL, RGTI and so on.

With that backdrop, here’s the best structure that you can take to play the eventual unwind in the stock.