How To Exploit "Work From Home," In Reverse

Celebrating Jamie Dimon's rant, how housing is about to get weird, and why you should be looking into one market sector that's been left for dead.

When you shut down the world economy for a pandemic, there’s going to be ripple effects. Back in May 2020, the oil facilities in Cushing, Oklahoma were completely at capacity, so it was impossible to take delivery on crude futures at settlement.

Crude traded down to negative 40 on that crash.

Other ripples take time. Sometimes years. Systemic inflation started to trickle in, and even though the Fed swore it would be transitory (lol), it’s been sticking around for years… especially in shelter.

We’re starting to see a shift.

This is a chart of home listings in the State of Texas, which is now at multi-year highs.

Housing is about to get weird. Not “expecting a crash” weird, but a reset of housing affordability from rate cuts and price cuts.

Will some of this be due to a Fed cut? Sure. But it helps when 1.6 million migrants leave the country.

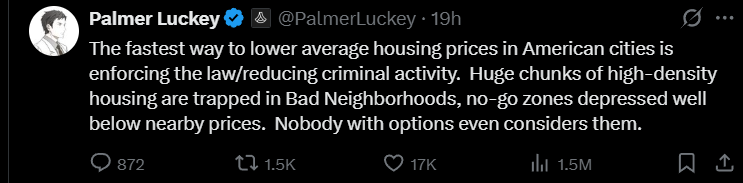

Law and order helps as well:

It’s still about men with guns, enforcing laws. That’s a deflationary source not priced in by the bow-tied economists.

There’s another space that will soon offer solid upside for investors willing to step in when nobody else wants to.

This Sector Has a Case Of The Mondays

Office. Space.

This is not a hot market. Analysts are calling this “structural oversupply” due to work from home and uncertainty from tenants.

The reasons stated are pure cope. The real answer is that major metro areas are completely full of violent homeless vagrants and drug dens. Employees don’t want to step over literal human shit on the sidewalk in order to go to their office job.

How does this get fixed? Men with guns. Right now Washington DC is running a law enforcement op… and crime follows a kind of power law, where if you lock up 20% of the worst offenders, then 80% of the crime disappears.

Once the streets get cleaned up, then employees have fewer excuses to get to the office. And I don’t buy remote productivity numbers.

Jamie Dimon said it best:

And don't give me this sh-t that work-from-home-Friday works. I call a lot of people on Fridays, and there's not a g-ddamn person you can get a hold of...It simply doesn’t work...And it doesn’t work for creativity. It slows down decision making...The young generation is being damaged by this. That may or may not be in your particular staff, but they are being left behind...They’re being left behind socially, ideas, meeting people...There is no chance that I will leave it up to managers...Zero chance. The abuse that took place is extraordinary.

I’m expecting that within the next year we’re going to see a ramp of office workers going back into actual office buildings.

Here’s where the opportunity can stack:

This chart is floating around, showing how data center construction is about to eclipse office construction.

That tells me there could be supply constraints in office space, giving REITs more pricing power and the ability to remark their assets.

How To Trade The Office Space Theme

Here’s a look at a monthly chart of Boston Properties (BXP) on a total return basis:

It’s got a range between 60 and 80 that’s been in play for a few years. It could be a good long term hold, but this doesn’t have the kind of sensitivity in case I’m right on the bet.

Instead, I’m looking for beaten down office REITs. Maybe they cut their dividend, maybe they eliminated it. But if they made it through the office space collapse and interest rate hikes, then we’ve got the chance for some massive upside.

Today’s deep dive for Convex Spaces Clients will reveal a stock that fits that criteria. It’s been in turnaround mode this entire year, price action has improved, and it has multiple tailwinds where I expect it to be an easy double from these levels.

The Deep Dive is available to Clients below. If you currently aren’t a Client, you can subscribe and get the best investing and trading setups on the internet.

Stock Pick: Hudson Pacific (HPP)

Market Cap: $1B

Dividend: Nope (lol)

Spreadsheet of Properties (I think this is accurate, but no guarantees)

Hudson Pacific is a REIT that specializes in office properties and film studios on the West Coast.

Their primary focus is in San Francisco, as well as LA, Seattle, and Vancouver.

You can just read the two sentence above and you know how well the stock has done:

Peak in 2020 around $30, get killed with rate hikes in 2022, and a slow bleed all the way down under $3.

HPP’s office occupancy went from 88% at the end of 2022 to ~75% in early 2025 as leases expired.

San Francisco accounts for 62% of HPP’s office rent base. And that town has been a trainwreck for a long time. Local leadership was full of commies who have zero problems with crime and disorder. And this is where the opportunity sits.

Everyone’s watching Trump and Federal law enforcement clean the streets of D.C., but they’re ignoring what just hit in SF. Led by a few moderate tech entrepreneurs, the governance of San Francisco changed at the end of 2024.

Daniel Lurie, heir to the Levi Strauss fortune, beat out Mayor London Breed for the leadership spot in the city. Moderate challengers also took over two seats on the Board of Supervisors, which drastically realigned the power dynamics in the city.

Since that election, the city has been increasing police patrols, using license plate readers, and taking out open air drug markets. It appears to be working with violent crime numbers down.

San Francisco is the crown jewel of the West Coast. The demand to live in work in that region isn’t going away anytime soon. And if they continue to have governance that simply works, it does a lot for the rest of the economy, including prospects for HPP.

The Funding Gap

HPP’s stock looked ready to fully kick the bucket:

The company’s leverage became a serious issue, and it was possible that the HPP’s interest coverage was going to go under 1, which is a huge red flag for any REIT.

Earlier this summer, the company announced dilution to help deleverage the company, offering 197MM shares at $2.23 and some prefunded warrants.

Thirteen company insiders participated in that equity raise. That’s a big signal for me.

Tailwinds

We’re at Peak Narrative with the office space trade, and the unwind can create a ton of value for investors willing to look into the void and find some value.

The company will benefit from interest rates being cut, a continued Return To Office culture at large tech companies, and less crime that surrounds their properties.

The stock is still in a downtrend, but a hold above $3 could be enough of a signal for the narrative to shift and bring in fresh liquidity.

I like this stock for a long term hold, almost treating it like an option where I expect the equity to run 50-100% just on a re-normalization. And we may get lucky and the company reinitiates a dividend, which could lead to a nice yield over a few years.