How to Invest In The Takeover of Greenland

National Security, Rare Earths, and the Austrian Company Set To Skyrocket On the Acquisition.

I’ve been Greenland-pilled for the past few years. Ever since Trump mentioned it during his first term, the idea of Greenland becoming a US territory has sat in the back of my mind.

I even asked Rick Perry.

What could once be handwaved off as a joke is now back on the table with the second Trump administration. Key players have traveled to Nuuk to speak with local residents, and they seem to be onboard.

The real signal that it’s being put into motion is that the Danish government, who controls Greenland, is absolutely flipping out about the US takeover of their territory.

I think it’s a great idea. Today I’m going to share with you why the U.S. should gain control of the territory, how the land could be drastically undervalued, and the one stock that’s set to push hard to the upside if the narrative starts to shift towards regime change in Greenland.

Yes, It’s Serious

The Mercator projection is the attempt to take the globe and place it on a 2-d surface. The problem is it skews the relative size of different continents and nation-states:

In this map, Greenland looks like a monster, but in reality is much smaller than it looks… but it’s still plenty of land. It’s about 50% larger than Alaska by land mass.

A “traditional” map doesn’t show the strategic importance of Greenland. How about this:

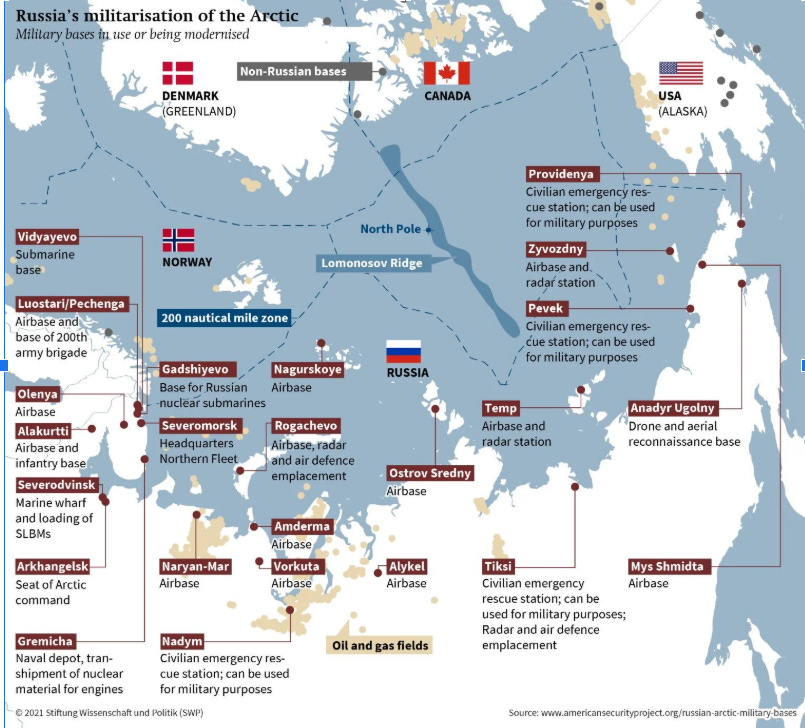

This is a look at the Arctic in the context of a military theater. Russia has spent significant resources modernizing old Soviet military bases on their Northern border.

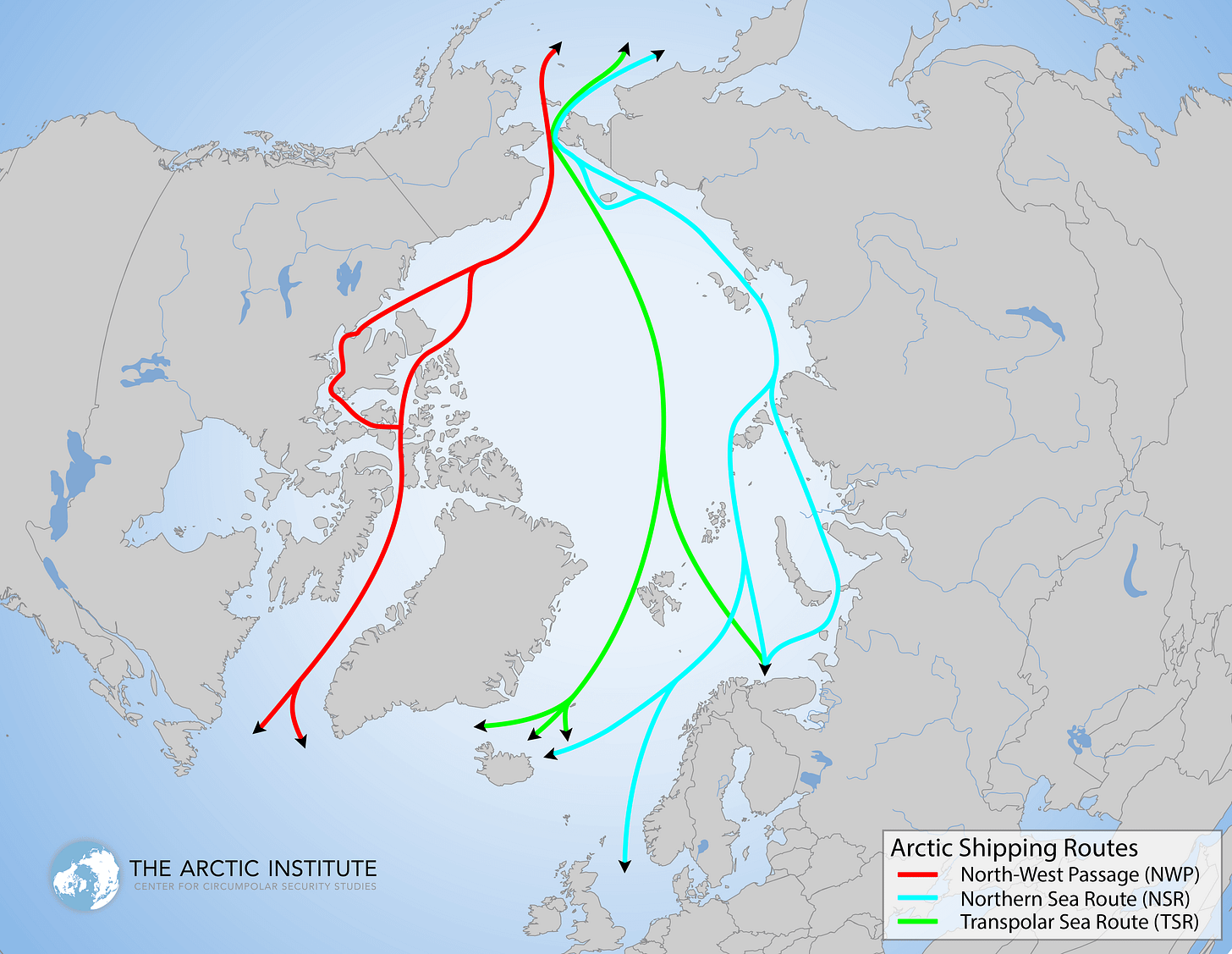

Because if the ice caps melt further, then you’ve got new trade routes and shipping lanes.

This is what Great Powers fight over. It doesn’t have to be a hot war— just a buildout of force projection.

The Trump administration is aware of this. Last week the administration announced they are going to purchase 40 new icebreaker ships, which is the start of the Polar Arms Race.

And Greenland is a vital piece of that Arms Race for America.

Aside from their position, the country has a very large deposit of rare earth elements (REE), potentially the second largest reserve globally. They also have oil, gas, and clean water.

These resources have been underutilized by the Danish government, because they suck. They’re too hamstrung by regulations and CCP-endorsed climate change psyops for them to pull these resources out of the ground.

We can do better.

Space Mirrors and Terraforming

The habitable region of Greenland sits on the West coast of the country, primarily in Nuuk.

The entire country has a population of 50k, and it appears the rest of the land is a giant sheet of ice.

If we had this discussion a decade ago, then it would seem fanciful that we could expand the habitable areas or population size.

In 2025, it’s game on. We’ve got small modular nuclear reactors. Tunneling. Geoengineering.

It’s all possible. The habitable zone could significantly expand.

I’m a member of Praxis, a group that is in the business of city-building. Late last year the founder of Praxis went to Greenland to see what the locals thought of them being taken over.

The entire twitter thread is worth a read, yet one interesting play would be to built out orbital reflectors that would bring more sunlight and infrared to the country.

With the right tech (and people) in place, Greenland could end up looking a LOT different in the next decade.

The Austrian Play

I’m going to share a stock pick with you that is on the “high risk” side of investing. That means you should do your own research and talk to your financial advisor before considering anything.

Austria is a country with some lithium reserves. In the Southeast pocket of the country is the Wolfsberg Lithium Project, which is looking to produce 8,880 tonnes per annum (tpa) of lithium for 14 years.

The problem? It’s in Austria. Think of the hurdles and headaches you have to jump through.

Critical Metals Corp (CRML) is the company that is trying to get the mine going, which could be a fine play on its own.

But that’s not the fun part. I first caught wind of this name off a random tweet from Adam Townsend:

And here’s the news I found:

In June of last year, CRML bought Tanbreez lithium mine. Would you like to guess where the mine is located?

This company acts as the foothold investment into Rare Earth Mining in Greenland, which could accelerate if the United States gets involved.

That sounds fun, but it gets even wilder:

THEY’RE INTO CRYPTO!

Narrative Reflexivity

In the kind of investment environment we have, the merits of the company matter less than the narrative that can be pushed into the stock.

And here you have a Nasdaq-listed rare earth miner that has Greenland exposure, and is also doing crypto on the side.

That gets attention, and this kind of “mimetic” capital can transfer to liquidity infusions into the stock.

And if enough price action hits, then more eyeballs are on the stock. Investors start to research the name, and then they realize it’s a [rare earth | greenland | crypto] play. If that space is still hot, then momentum hits even more.

That’s what makes this a high risk investment, because we’re not even betting on the future earnings of the company… at least not yet. This is a “venture” bet where I am anticipating heightened narrative flows that push liquidity into the company.

Welcome to Investing in 2025.

How About More Convexity??

Let’s take a degen stock pick and put it on steroids.

The company has publicly traded warrants.

These behave like an option, which gives you the right to buy the stock at a certain price. Currently, I feel that the warrants are better risk/reward than the equity, and you get better convexity if things get wild with the stock.

(Disclosure: I own the warrants, and want them to pump, and I could sell at any time.)