How to Trade On Both Sides Of The Bell Curve

Trading on limited information, calling a bottom on the worst AI stock in the market, and taking bets on people dying.

By the time you get all the information you need to make a “fully informed” decision, the market has removed some of the risk premium out of an investment.

You can do all the research in the world. You can slap every single indicator on your chart to line up the perfect entry.

Yet when it comes to the hard right edge of investing, where the outcome is unknown, you need to trade stupid.

Sometimes, many times, the best edges are when the setup appears exceptionally stupid.

It’s why momentum trading works, because the “mid” take would be to wait for a pullback for better prices, because you are scared of buying the highs.

It’s why the contrarian trade is rarely that because too many midwits are thinking the same thing, and they have to get blown out of their position before edge actually shows up.

And it’s why some of the stupidest ideas end up working out the best.

I say all of this to give you a little mental priming so I can ask this question:

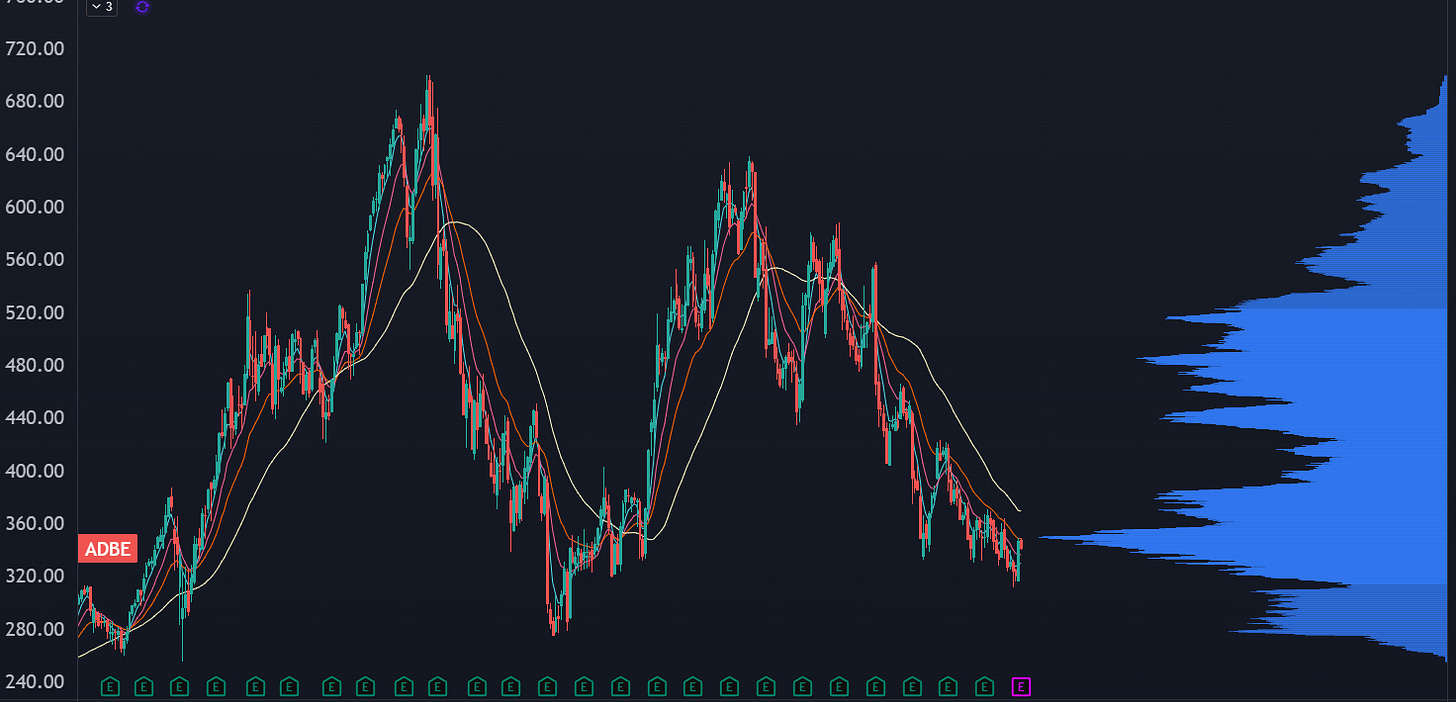

Why Not Adobe?

If you’ve been neck deep in the AI market narrative, you know that Adobe has been the clown in the room. If you can have GPT edit your photos from you, why do you need to buy a license for Photoshop?

LINE GO UP!

Company leadership recently raised full year rev and earnings guidance. Apparently not by enough to make the market happy, but the “mid” take here doesn’t seem to be lining up with what’s actually happening at the company.

And to tie it all together, the stock has seen failed followthrough on the recent downside pushes:

It’s still in a downtrend, and there’s some trapped “value investors” from earlier this year. But I wouldn’t be shocked if the stock is hilariously underowned due to a naive understanding of how AI will affect the company.

Does FutureTech Needs More Time

This daily chart of OKLO is typical of how the AI pick-and-shovels trade is playing out. Great run in October, then a crash and unwind into November opex, and now some signs of life with some decent momentum.

Is it time to load up the boat? I still think it’s too early to tell. Here’s an example with CRCL after its IPO parabolic:

After resetting, the stock went into a range and had a hard bounce, which was met with aggressive sellers and bagholders looking to exit. The narrative was played out and valuations were too high, leading to a grinding bear market and a roundtrip to the IPO trading levels.

The Futuretech trade is going through a wheat/chaff moment, where the players that have sustainability (and maybe increased backlogs) will continue to push higher while others get taken out to the woodshed.

As a not-so-hypothetical example, maybe the memory play is still early, and while the chart of SNDK looks extended, it’s still just a 30B company:

Meanwhile, RGTI doesn’t actually sell anything and may need to raise capital to keep their science experiments turned on:

If you have your AI basket watchlist, you can start monitoring the relative strength/weakness within the subthemes. The ones that hold up into 2026 have high odds of momentum continuation.

Breaking Down the Knifecatch Setup in IWM

Post Tariff Tantrum, the indices have been a grind higher with a couple “one-shot” bear markets thrown into shake off the excess. There’s been harder resets under the surface, but the high-correlation-run-you-over kinds of trades have lasted a day or two.

There’s a trade setup that I love to take in this kind of environment. During a downside liquidity break, you don’t know if it’s going to be a durable low, or if we’re going to finally see the market get killed as too many are leaning one way.

Either way, it’s practically guaranteed that price will not be “sticky.” Price will rapidly move away from price.

This is where it gets fun.

The options market has been incredibly sensitive to these kinds of liquidity events. The VIX spikes and the offer lifts on out of the money puts because nobody wants to pick up nickels in front of a steamroller, they at least need a dime.

On the call side, you have investors that start selling calls in their positions, and the degen call buyers are nowhere to be seen. This leads to calls becoming a little cheaper.

This is where the “knifecatch” setup comes in:

Here’s how the trade works:

You buy some cheap calls

You buy some kinda-expensive puts that are close to price

You sell some more-expensive puts that are further away

It’s a combination of a put spread buy and a call buy.

So if the market gets killed, you make some decent profits, and if the ATM skew starts to get sold into a hard pullback, then you get an extra kicker from the spread you bought.

If the market rallies, then the skew drops which helps blunt the losses from the put spread, and the cheap call option is now making bank on some kind of a rally.

The only risk you have is if the market goes in a range… but when we have a downside liquidity break the odds of that happening are quite low.

Two weeks ago, I built out this exact trade setup for the Russell 2000 (IWM). Assuming no adjustments, the trade is up 24% without taking a whole lot of heat.

I’ve unlocked the post so you can see the entire thing:

Threshold Trading With The Russell

I’ve got a confession.

I talk a lot about index weightings, especially with the S&P 500 and the Nasdaq. When the Mag7 move, the market will get taken for a ride.

That’s what happens when your favorite index is market-cap weighted.

Just like the Dow. Right?

I’ve been in the markets for a long time, and while I don’t often look at the Dow, I have a pretty good feel for how it trades. But it’s not cap-weighted. It’s price-weighted.

I never knew this because any time I saw the specs for the Dow, I just assumed that price weighted simply meant the value of the company.

That means if you have a company with a $500 price but half the valuation of a $10 stock, it doesn’t matter. It sounds stupid until you remember that a century ago they probably needed a quick and dirty method, and it stuck.

So what about the Russell 2000? It’s easy to think it’s “equal weight,” but just like the S&P and Nazz, it’s market cap weighted.

You just don’t know it because they reset the weightings through a “reconstitution” process. There’s some plumbing involved and you may be able to find some seasonal edges in anticipation that event…

But here’s where it gets interesting.

This is the top 20 stocks by weighting in the Russell. You’ve probably heard of some of these names. And the reason they’ve got a higher weighting is because they’ve had monster runs this year.

Here’s the research I’ll be doing into the new year. I want to see the shape of the weighting distribution to find out what is “statistically significant,” and then I want to place a “threshold” alert whenever any individual name crosses above, say 0.20%.

The reason you’d look at this kind of alert is that if broad markets are getting killed, you can start hunting down some relative strength plays hidden under the surface.

Polymarket Death Maps

The betting markets are hitting escape velocity, and Kalshi just had a $1B funding round at a $11B valuation.

And you can bet on anything. It’s the wild west. You can bet on sports, politics, words in statements and government overthrows.

The dystopian side of this has already hit.

A few years ago I had the idea for a short story about private military contractors that helped the uber-wealthy monetize their “death odds” whenever they spiked. If you have someone plotting an assassination attempt, and the decentralized markets start to see some action, then you take the other side of the contract and then go hide out in a bunker until the contract expires.

We haven’t yet gone that far, but holy shit we’re close.

This is Polyglobe, an app that overlays prediction markets and geopolitics.

That’s right, you can bet on the frontlines of the Russo-Ukranian war.

And it’s going to get weirder. People in intel agencies will start leaving footprints in the markets, which is then a kind of “meta-intel” for both sides of the battle.

And soon, AI agents can buy a contract and then deploy autonomous drones to guarantee the outcome of the battle.

I don’t want to debate the ethics of it all… instead let’s look at another part of the globe:

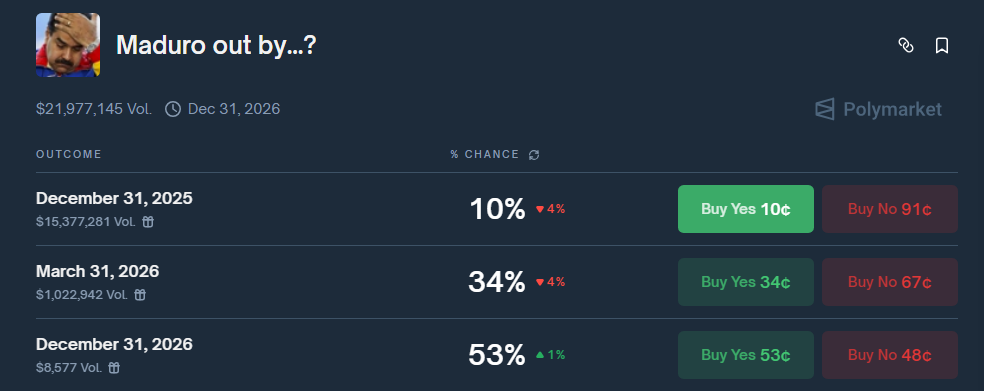

WTF Is Going On In The Caribbean

Venezuela appears to be in play.

The USS Ford carrier strike group is now in the Caribbean and the US is taking out drug boats every week.

Current odds are a coin flip that Maduro will be ousted by the end of next year. It’s still a guessing game… but I think there’s an edge to be found in the “old school” stock market.

Venezuela has lots of oil, but terrible infrastructure. Some of that is due to US sanctions, other parts from it being a nationalized industry run by absolute idiots.

But if their oil fields get access to the free markets again, then I’m anticipating that oil services stocks are going to have a good 2026.

Up On Deck

We’re going to take a look at an energy stock that has all the right tailwinds— US policy changes, international partners, and some upside convexity that’s not priced into the stock.

We’ve also got a structure on how to play some of the futuretech names, and another look at a moonshot trade that looks ready for a fast double.

If you aren’t a Convex Spaces Client, we’d love to have you on board.