How To Trade The Fed Next Week, At Home And Abroad

China, rates, and the volatility market that won't stop crying wolf.

The Interesting Macro Trade In China

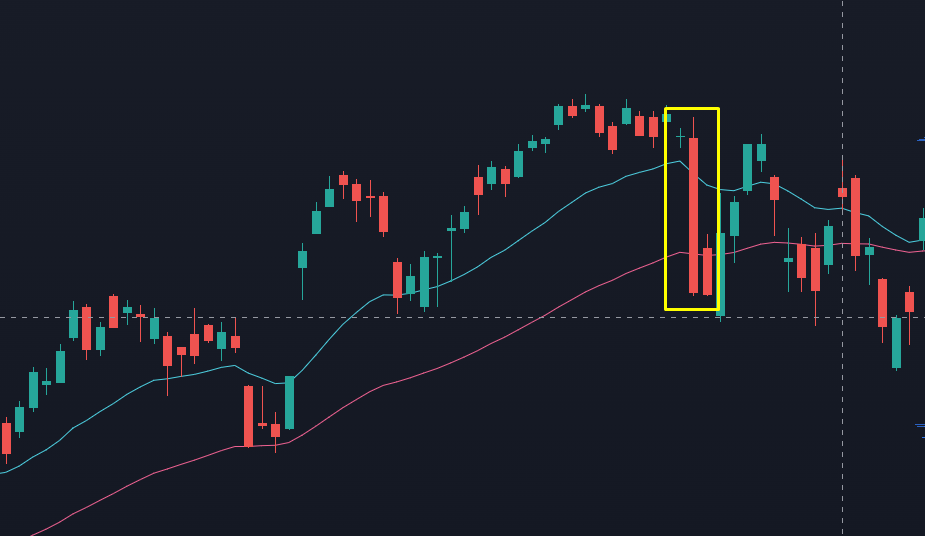

The top chart is the 10 year treasury, the bottom is in BABA.

I’m sure there’s a solid explanation. I don’t particularly care. All I know is that if you expect the Fed to ease as we head into the year, China internet stocks are absolutely in play.

Convex Spaces Clients were alerted to the Oct $140 calls in BABA at $3.50, and they’re trading up at $18 for a solid 414% runner.

Don’t Forget to Sell The News

The next Fed meeting is 5 days from now.

September Opex is a few days after that. The market’s pricing in a 90% chance of a rate cut, so the next question is what their guidance will be as we head into the end of the year.

We’ve seen some jobs report revisions that appeared to be ugly, and the “tariff inflation” that was consensus on Wall Street never showed up.

I don’t have a crystal ball on what their plans are, but I would like to show you a chart of the S&P from last December:

See that kill candle? It was a gnarly day. I managed to nail the top on TSLA that day, but missed out on the juicy play in SPX options.

The selloff had little do with the Fed cut. It was a combination of positioning, liquidity, and an unwinding of the options complex.

It’s very reasonable to slap on a hedge to cover you through the event. History doesn’t have to repeat, or rhyme, or even make sense. It’s a very well telegraphed event, and those have a tendency of shaking people out after the fact.

The Vol Squeeze That Can’t Happen

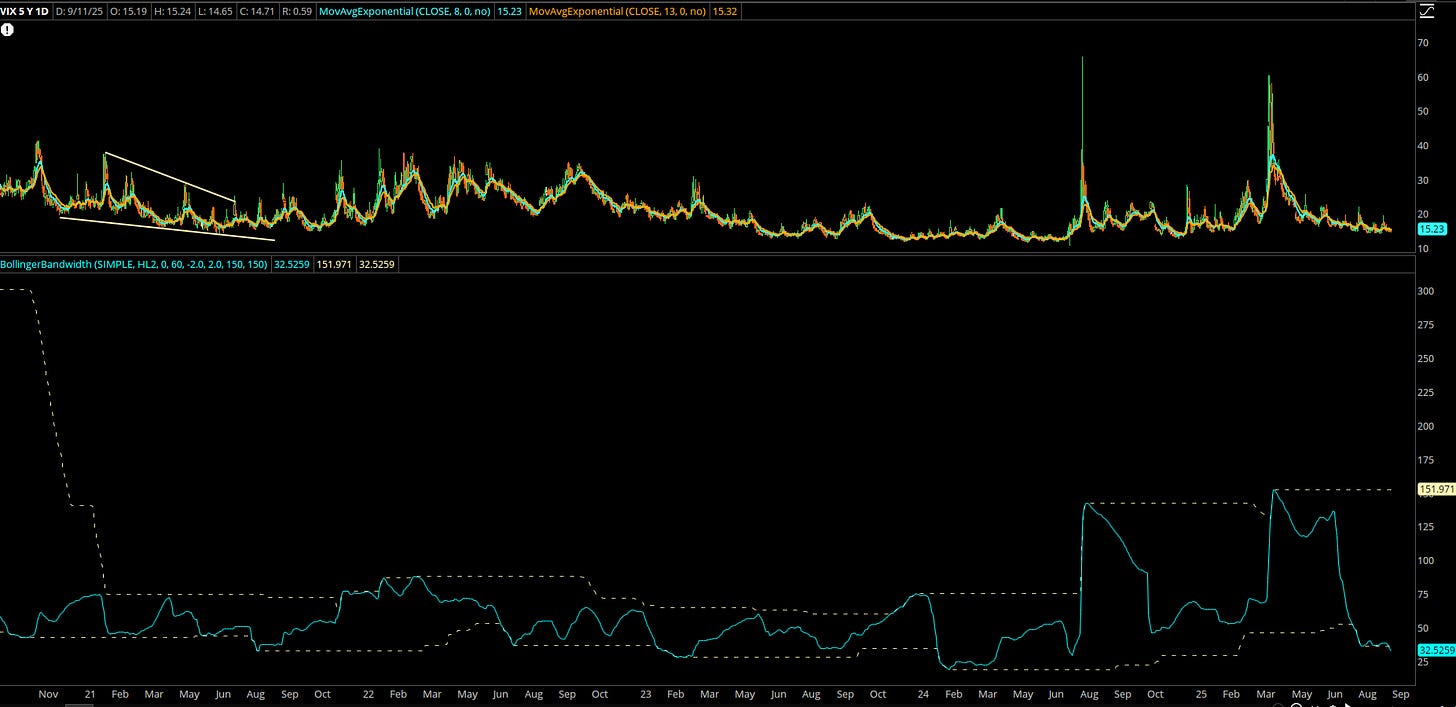

We’re going to nerd out on some VIX data.

There’s a whitepaper floating around called “Forecasting the Volatility Tsunami” by Andrew Thrasher. The idea is that you don’t wait for the VIX to get low— you wait for it to end up in a tight range for too long.

I’ve modified the idea, focusing on both the high and close instead of the close on its own. I’ve also changed the lookback window to 60 days.

This reading is coming down to levels where it appears that we’re setting up for a squeeze. It’s been a while since we’ve had some kind of an ugly move in the markets.

Again, a few hedges are reasonable… but in context it doesn’t make a sense to be full blown bearish.

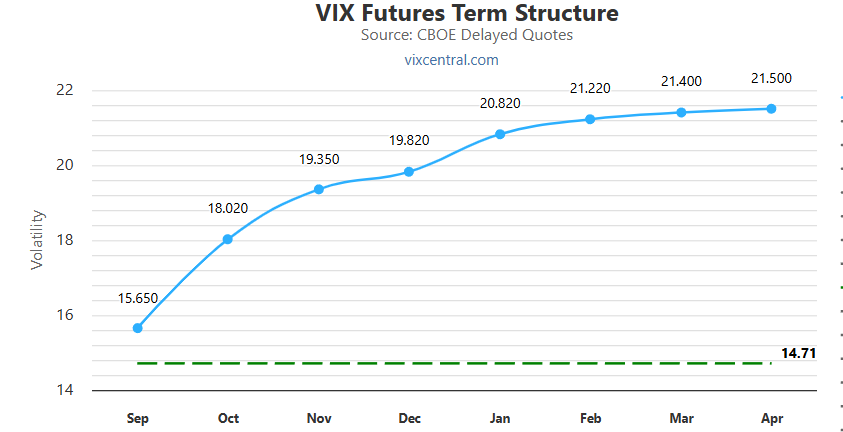

Aside from the strength in nearly every momentum stock I follow, if you look at the VIX complex, it’s still sticky:

Here’s the math…

Spot is trading at 14, front month VIX future is still at a decent premium, and the October future is still at 18.

And the actual vol in the market is at 9. It’s difficult to get the market to have a hard selloff when VIX products are so elevated and the market is just grinding. In fact, it helps to keep a bid in the markets.

Party on.

The Storage Trade I Completely Missed

The AI trade is still alive and strong. I’ve been focusing on applied AI like in Tempus (TEM), where I alerted Convex Spaces Clients the Oct $80 calls for $4, and they’re now trading at $13 for a nice 225% win.

But there’s one area that I completely missed. Two stocks that I forgot even existed and are having a moment in the sun.

Sandisk (SNDK) and Western Digital (WDC).

The Storage trade. Data centers need hard drives to capture the AI demand. Both names are seeing improved margins and are now on the exponential growth curve with the Hyperscalars.

One reason I didn’t think about this is because SNDK was bought by WDC in 2016. Then they spun off the flash storage business and listed again in this past February:

Incredible price action.

Setups for Clients

We’ve got two new momentum trades lined up, a straightforward way to play the Fed news, as well as a game plan for fading OPEN tomorrow.

If you aren’t a Convex Spaces Client yet, you should be.