Hurtling Over the Wall Of Worry

Breaking down the newsflow out of China and the Hyperscalars. A look at vol, breadth, and what's next for the markets,

It took me a long time to understand this paradox:

Overbought markets are not bearish.

The Nasdaq has just pushed 4% in 4 days after breaking out to new all time highs. I’m sure there’s a few spots you can short the market (like AMD), but on a swing timeframe it’s still risk on.

During this rally, you probably heard about “breadth.”

This should shock ZERO TRADERS. The Mag7 had been in a correction since September 15th, and this was the first lift megacap tech had seen since then.

This is the same kind of cycle we’ve seen before. The markup in names like AAPL and GOOGL drag the broad market kicking and screaming higher, and then smaller names start to find buyers as risk “fills in” the rest of the market.

At some point, the smaller momentum names take a break, and marginal demand rotates back to tech.

Rinse and repeat.

This rotational mechanic is enhanced by the idiots in the hedging markets waiting for that one rug pull that’s “just around the corner,” but has never shown up.

And as the market works through all the headline risk from this week, that risk premium starts to get sucked out.

But that takes time.

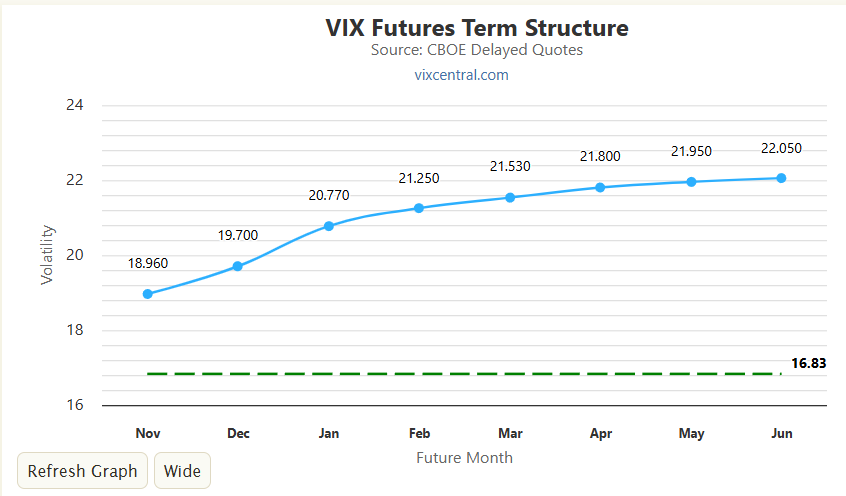

With Jan VIX still in the 20s, there’s a healthy amount of risk premium baked into the market. Some of that is from “upside risk,” with the market gapping up a few days in a row, but the S&P is already headed back down to single digit vol.

That means VIX futures start to tick down towards spot VIX, which keeps a bid in the markets. Who cares about breadth.

Do you know when the market will top? When there’s much less for market participants to freak out over. Then we will see complacency in the risk markets, which creates downside sensitivity.

And that only happens if the markets stick the landing after leaping over the wall of worry.

Unpacking The Headline Risk

In terms of Narrative, there’s a ton of newsflow that investors have been focused on for months, and it’s starting to hit the rear view mirror.

Mag7 Earnings

It’s a mixed bag right now, which is still bullish for stocks. The market would need to see multiple tech names kicked in the teeth to move the needle, and we’re not seeing it yet.

The main narrative driver is going to be “cloud services,” which contains AI products.

First up is GOOGL, which reported $100B in revenue. In a single quarter. My goodness. Gemini has 650MM monthly active users, their AI revenue is up 200% YoY, their Cloud backlog is at $155B which is up 46% QUARTER OVER QUARTER.

Yeah it still feels like its early.

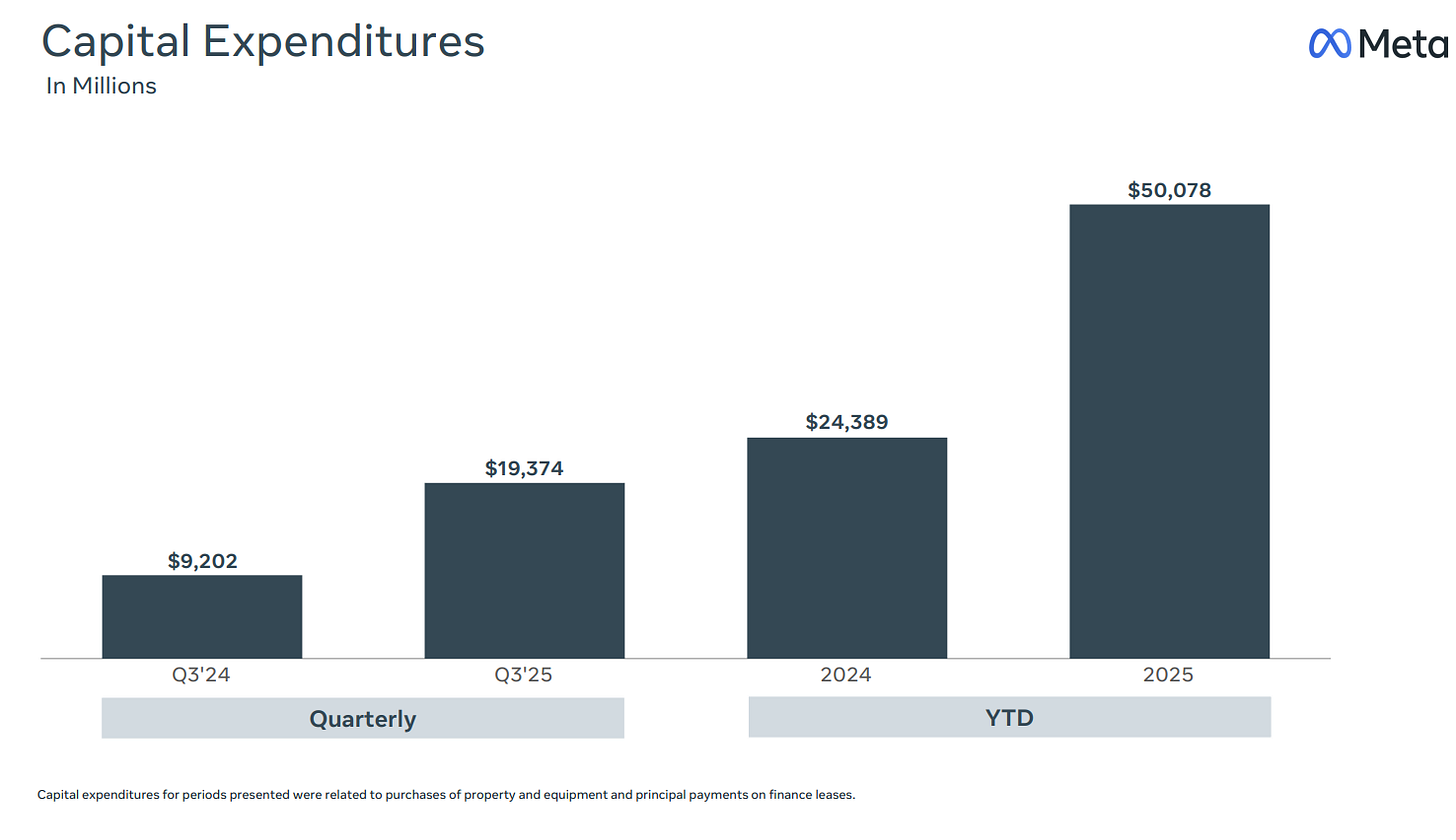

Next is META. Nasty gap down today. Their earnings would be a beat but they had a one time charge. Their current risk is that unlike the other Mag7 stocks, they don’t have a pure AI offering that they’re selling… so the big question is whether their massive CapEx spend is going to be worth it, or if this will be another flop like the metaverse play:

That’s $50B YTD. And that’s going higher next year. It’s a signal that the AI ecosystem play is also still early.

For now their narrative is more about hardware, but their wearables aren’t going to hit until next year. If consumers start transitioning away from smartphones and into some kind of glasses + watch combination, then they should start to recover.

One very interesting piece of news on META hit this morning, with the announcement of a jumbo bond offering to the tune of $25B. This is the first big debt deal I’ve seen in the hyperscalars… and this is where risk could get weird in the future.

Stock market bubbles, and I’m talking about the BIG bubbles, require some kind of leverage in the debt markets. We had mortgages in 2007, Telco debt in 2001, and balance sheet problems in Japan in the 80’s.

BUT IT’S STILL EARLY.

Onto MSFT.

Azure revenue is up 40% YoY, but they talked about “capacity constraints” and they plan to double their data center footprint over the next 2 years. You’ve got 900MM MAU’s of their AI products with 150MM of Copilot users.

Including TSLA from last week, that’s 4 of the Mag7 out of the way with earnings. AAPL and AMZN are tonight, and then NVDA is a few weeks out but their risk is probably known after all the other names report.

That takes Mag7 earnings risk off the table. What’s next?

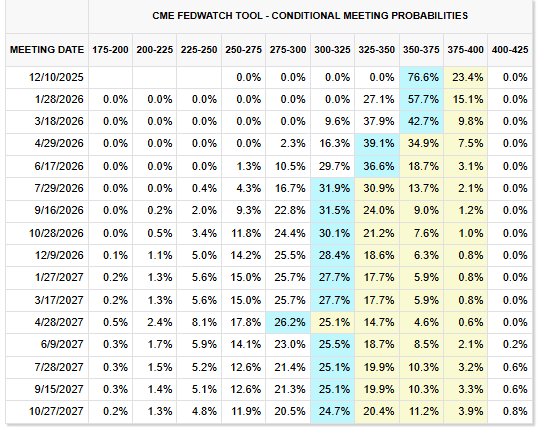

Stupid Fed Macro Stuff

The Fed cut. Which was expected, and Powell did his best to throw a little more uncertainty into December because that’s what he likes to do.

So there’s some more data dependency going into December, but for the market to get weird you’ll need to see a larger deviation of econ data than what’s expected.

One of my broader macro takes is that the suits at the Fed don’t understand how real world inflation will come down when you deport people out of the country. This will be the first year since 1918 with negative population growth, which helps bring down shelter costs, and just like that CPI starts coming in lighter.

There’s two other narratives around “market plumbing” that aren’t accounted for. The first is the balance sheet runoff ending, which is effectively ending Quantitative Tightening. This (probably) puts liquidity back into USTs, which helps keep equity volatility lower.

The second is regulatory changes. Fed governor Bowman is looking to loosen the leash on smaller banks, and looking to change how the supplemental leverage ratio (SLR) is calculated by removing USTs and reserves, which gives the banks more leverage.

Again, that leads to more liquidity.

I don’t trade macro, I think it’s boring and you can curve fit your way into the opinions you already have. I’m bringing this up because these could change the structural liquidity in the markets, and that’s not priced in.

The China Deal

We’re getting a one year armistice in the Trade Wars.

tariffs reduced

rare earth processing back online

soybeans being bought

The details don’t matter as much as perceived risk going away, even if temporarily. Everyone still has shell shock from April and it’s kept a bid in hedging, so if everyone can walk away somewhat happy, then you end up with a VIX sub 15.

The juicy action wasn’t in China, it was in other Asian countries. A trade deal with Japan guarantees a $500B investment into the U.S., and Korea is putting in $350B with a good chunk of that going into shipbuilding.

Still early.

What Happens On The Other Side?

…as we know, there are known knowns; there are things we know we know. We also know there are known unknowns; that is to say we know there are some things we do not know. But there are also unknown unknowns—the ones we don’t know we don’t know.

This was a justification that Donald Rumsfeld used to invade Iraq. Which was stupid, but it has a ring of truth when it comes to the markets.

When we know what the unknowns are, the market tends to rally.

When a “new” unknown comes into play, the market tends to selloff.

What happens when we run out of unknowns? What happens when all of the perceived risk comes out of the market?

That’s when the market tops. But we’re not there yet.

Handicapped Programmers

Earlier this week, OpenAI’s programming tool started to degrade. Reponse times drastically increased, the software crashed, and the output quality fell off a cliff.

For some software engineers, it was almost like a work stop.

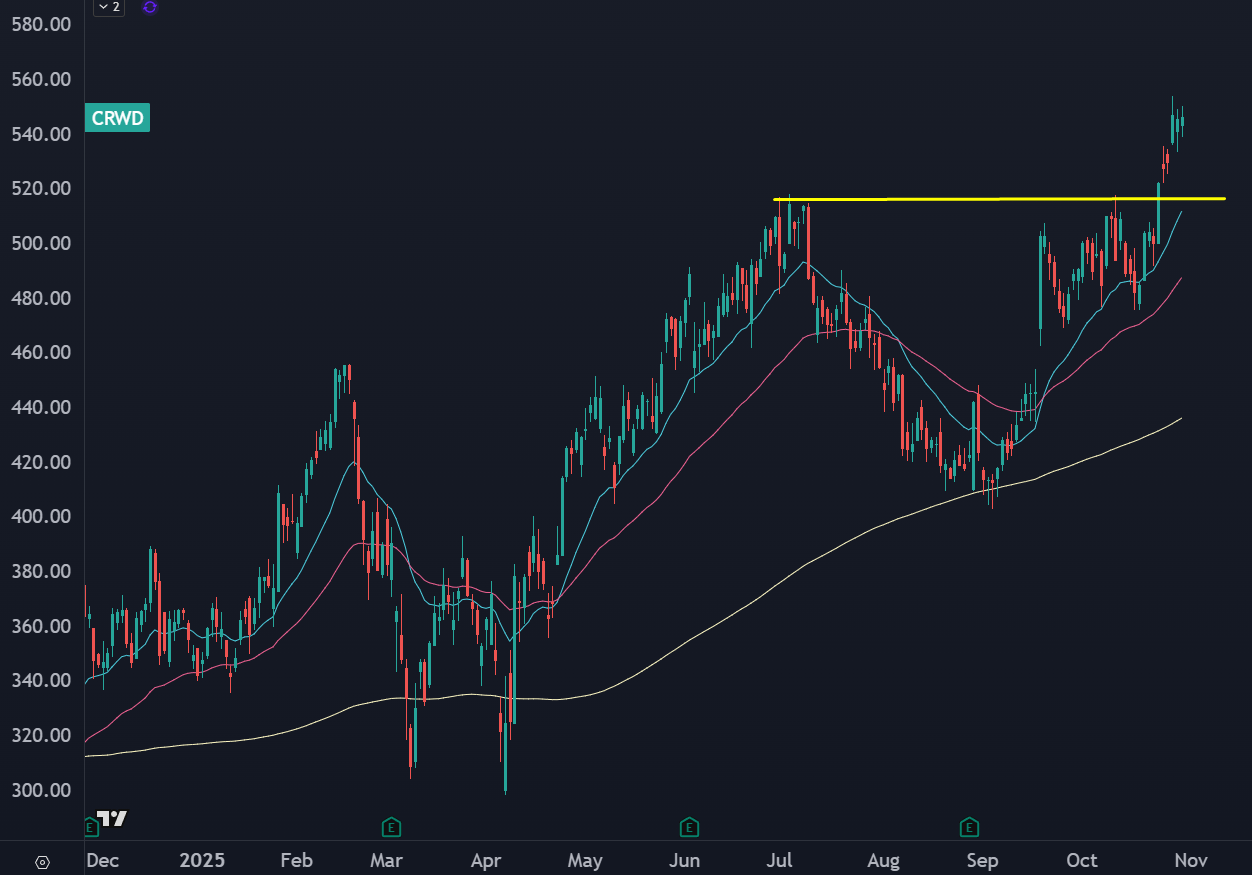

There’s going to be second-order effects from vibe coding, especially on the cybersecurity side. Which is the most AI-proof subsector in technology.

We’re seeing some solid breakouts in this space. CRWD had a clean breakout above 520:

And we have a solid trender in PANW, with a multi-year breakout hitting:

I recommended the March $230/$250 call spread and it’s a solid winner.

And a week ago, we were looking for a clean breakout in ZS, which is now at all time highs:

The Feb 360/370 call spreads are up about 50% from entry.

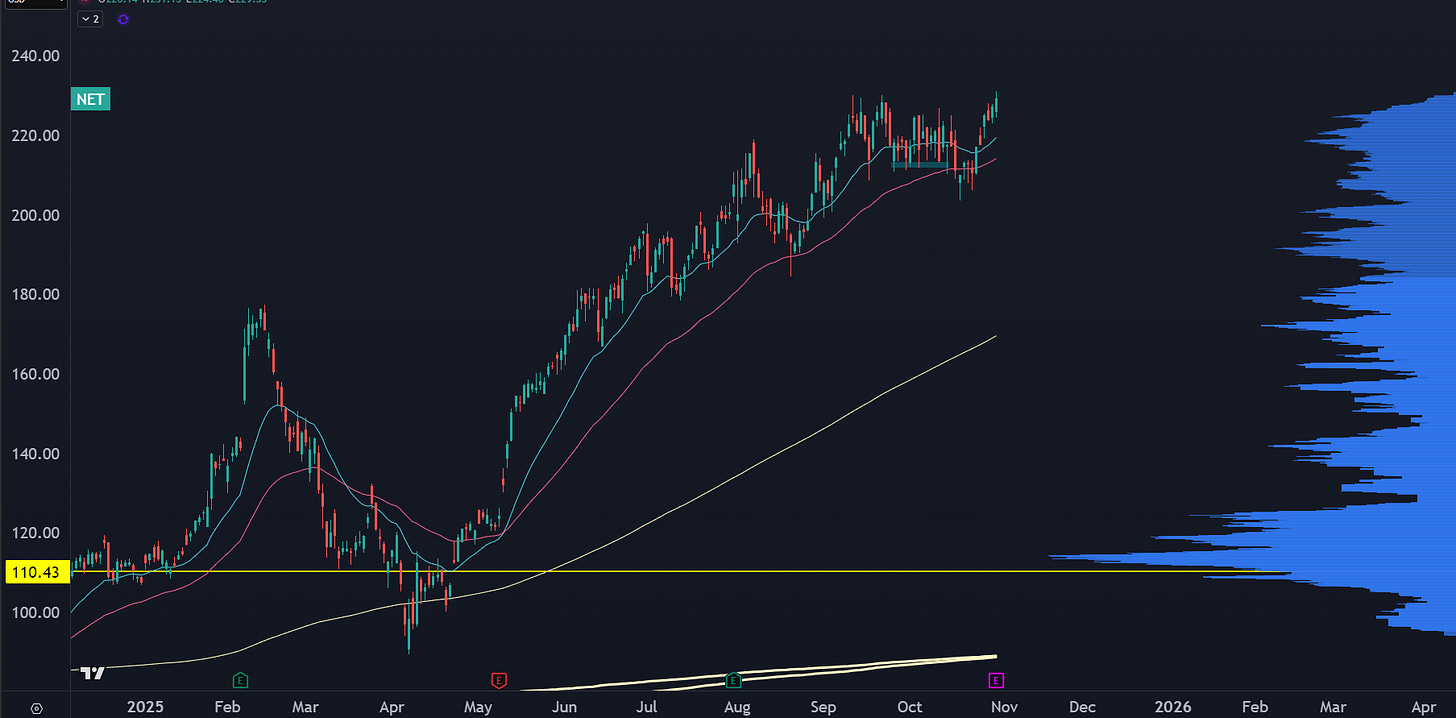

Another one to consider is Cloudflare (NET):

It effectively owns an entire layer of the internet, and they’ve got some agentic AI upside that should start working next year.

Round Trip Income

One of my favorite “layup” trades is finding a parabolic stock that has given up all of its gains… and betting on a range.

GME post 2021 is a great example:

What happens here is that investor enthusiasm disappears, along with the options volume that drove the stock higher.

The stock doesn’t die, it just sits. That allows options premiums to decay.

And with the recent China news, there’s a setup lined up in one name I’ve recommended before.