I'm Bullish, I Swear!

Warning signals are stacking up and rotation is hitting large cap tech. Here's why you still need to buy calls.

Today I’m sharing some headlines that I think have intermediate term implications and are not fully priced into the market.

The implications are bearish. But that doesn’t mean to go and load the boat on a bunch of puts. Price action remains strong and post-earnings breakouts are continuing to see followthrough.

Yet these are the three primary Catalysts that I’m following as we head into the September rates cut. If anyone of these becomes a primary Narrative, it’s going to change the Liquidity in the markets and we may finally get that pullback that hasn’t happened since May.

(If you’re wondering why I’m capitalizing those words, my full framework is available here.)

Lumpy Jobs

The layoffs are starting. Microsoft, Oracle, and Salesforce have all announced job cuts. Conocophillips is letting go nearly a quarter of its employees.

And don’t forget about the Fed-NGO complex that’s made its way through the courts. About 10k USAID jobs were cut, and there were massive downstream effects in the NGO ecosystem. Loudon County might experience its first recession in a century.

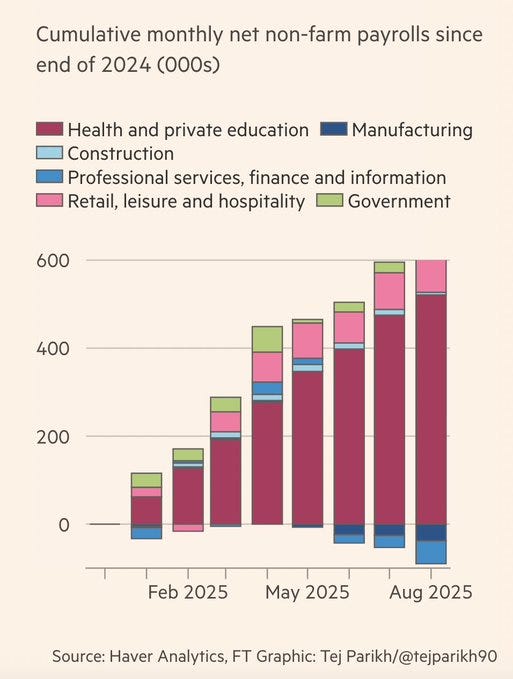

Headline data does a terrible job of showing how uneven the economic picture is.

At some point these are going to add up to a more systemic effect on the economy, but if you crack open the hood the employment picture appears worse than it appears.

The bulk of the job gains are coming from the healthcare sector. You could talk about the aging population and future needs, but I’d wager that a good chunk of these jobs are fraudulent.

Home health care is ripe for abuse. These jobs are funded by government programs, and the OIG has already claimed that we can run at $10 billion in fraud in the home health care sector.

If we strip away the shadow jobs, then the Fed isn’t seeing the full picture, and they’re (once again) on the back foot with setting rates.

I’m still bullish on the market due to the quality of setups, the kind of followthrough we’re seeing in momentum stocks, and the dampened momentum provided by short term options.

But as we head into the end of the year, I think we’re going to see a collision between the financial/AI economy and the real economy.

Lowering the Nose

When you talk about smallcap stocks or startups, you hear about “runway.”

How long does the company have before they run out of money, and can they raise more capital or generate more revenue to extend that runway?

You’ve probably seen a movie where a fighter jet is headed towards the ground and they’re screaming “PULL UP!”

When a plane is in a stall and headed towards the ground, you have to lower the nose. That means pointing the plane towards the ground, and accelerating so you can generate lift.

In the AI arms race, OpenAI is lowering their nose. They just announced that their expected spending through 2029 will be $115B, which is a smidge higher than their guidance of $80B.

I’m sure the other hyperscalars have been following suit, and this makes for some very nice plays in the AI picks and shovels race, like CRDO and SNDK.

The fate of the bull market rests here. This is the game. The stock market can absorb job losses if they are commensurate with productivity and margin expansion, but there’s the risk that the ground moves up and the runway is a lot shorter than what we’re pricing in.

King Banana Looks A Little Less Apeeling

NVDA has put in a clean head and shoulders top, and has recently broke the 50EMA.

It’s tough for the market to hold up when the primary indicator of the AI boom is starting to falter.

Right?

Nah, it feels like a trap. It could be a viable short, but it’s not going to be “clean.” Look for something like this instead:

I’m watching for a failed breakout above 172. If the stock bounces, noses over but is rejected swiftly, then you’ll get a solid opportunity to take a shot at the king.

Member Setups

In August, I called out how a rotational correction could hit the markets, and how investor excitement could wane in NVDA even if they post knockout numbers.

Yet most of our plays have been bullish setups. Because they’re working.

Convex Spaces Clients were alerted to an ALAB breakout with the Sep 205 calls, which have traded from $4 to $15.

They also had the chance to make a killing on a GLD strangle, trading up from $9 to $22.

We’ve got short setups lined up in QQQ, QQQE, XLK, and a few other high beta names.

If you’re involved in the markets and want to find a way to juice your edge even further, consider joining up and get the best setups that come across my desk every day.