Larry Ellison's Segway

Tech rotations, sensitive narratives, and macro policy at the tip of a sword.

Since the Thanksgiving holidays, the S&P 500 has been dead.

Hard reversion, failed breakouts and breakdowns on both sides. Under the surface it’s starting to perk up— the Russell just tagged new highs and sectors like financials and industrials are following as well.

Yet if your primary exposure has been in market-cap indices, it’s been a paint drying kind of week.

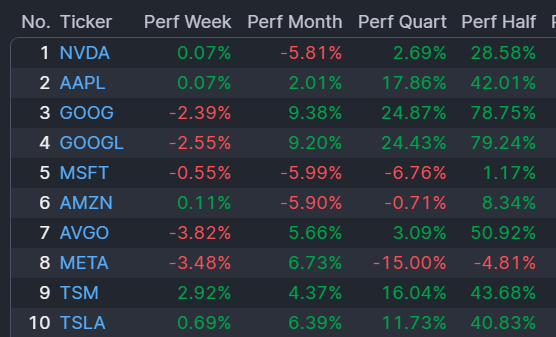

This is rotational, and there’s signals embedded within:

Apple appears to be betting on the hardware layer while the hyperscalars battle it out. Google announced their TPUs and it’s been a hard rally since.

Yet anything that appears to be tied to the OpenAI CapEx trade has been punished. Nvidia’s weak, Broadcom just got killed on earnings, and Meta is still licking its wounds from the last earnings report.

Thsi is still the primary narrative in the market. So when Oracle announces, TWO DAYS AFTER THEIR EARNINGS EVENT, that their AI datacenters are going to be delayed, you get a move like this in the Nasdaq:

Is Larry Ellison Building An Overpriced Scooter?

In 2001, the Segway was released to the public. It was going to be the new revolutionary mode of transport for the low price of $5,000.

There were multiple problems with the product. You look like a giant dork riding it and for actual use cases they just didn’t make sense.

And it was early. Cities are now full of e-bikes and scooters with a much smaller form factor than a segway, even though you still look like an idiot on them.

AI models are still on the exponential curve, with each release having some order of magnitude improvement.

But if you’re in HR and just need something to help you get through your emails… that’s already a solved problem and doesn’t require any new frontier research. This is the risk for the AI CapEx trade. The infrastructure buildout will create new models as we aren’t near the limits of physical scale… but who wants to buy the newest models?

I’m not predicting that the AI trade will fall short, but this is the emergent perception that’s building up a new risk premia in large cap tech.

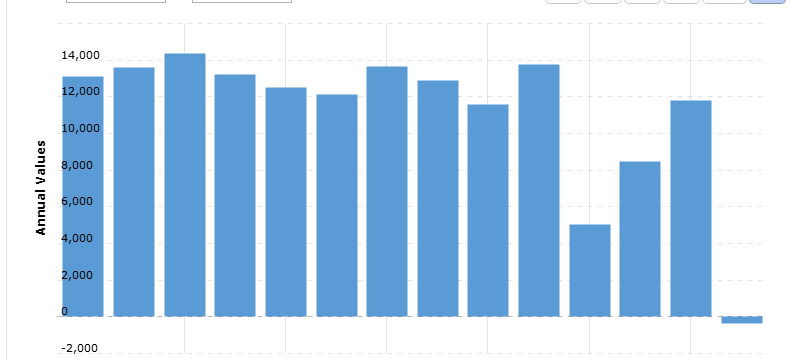

The new models are in the “prove it” phase, and debt issuance from firms like ORCL create a kind of narrative sensitivity where delays are punished, especially when you’re spending money like crazy:

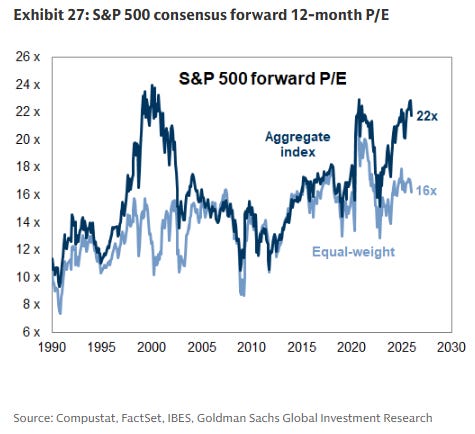

The upside for the hyperscalars is still there. After this next big CapEx buildout, they can offer the same product to multiple customers, and if it turns out that the new models have a breadth of value that makes it more like an F-150 than a Segway, then maybe the Forward P/E on the market will be justified:

Satellites and Scale

The new Space Race is running a similar narrative pattern as the AI trade. You’ve got firms that have blown through a ton of cash getting their satellites up into orbit.

But you only have to pay for that once. And if your sat network provides enough value, then you can sell the same product to multiple customers.

Planet Labs appears to have unlocked that theme:

The company got to breakeven on their earnings and guided up on revenue. This is not the first monster earnings beat, and probably won’t be the last.

There’s some interesting tech coming down the pipe for space, but the way I’m thinking about these stocks is that they’re now defense companies in a domain that the USG is spending a ton of money on.

It’s easy to test. Go on google and search “defense contract award {your favorite space name}” and you’re bound to find some recent news.

VSAT won a defense contract in October.

SATS has ongoing contracts with the Navy.

IRDM just inked a deal with the Space Force.

The United States isn’t finished being hegemon, and the space trade allows the military to have “map hacks” against its adversaries. There’s a reason Russia can’t make any inroads in Ukraine, because we can see down to the individual soldier where the troop buildups are.

And it’s how the US can blow up small drug boats.

Missiles and Macro

If you’re a poor fisherman in the Southern Caribbean and you’re running a boat with 4 Mercury outboards each worth $30k…

… you’re going to have a bad time.

Venezuela is in play. The US just seized an oil tanker as a way to enforce sanctions, and don’t be shocked if Maduro is out by next summer.

But let’s talk about the drugs. The US now has aggressive surveillance on any cartel traffic. This includes the Pacific, Caribbean, and overland.

Take away the externalities of drug overdoses and societal costs, and just think about the numbers. China sells the precursors to the cartels, who then traffic the drugs into the US in exchange for dollars.

Those dollars are then laundered through CCP money laundering networks, like the entire city of Vancouver.

The US spends about $200B per year on illegal drugs. A good chunk of that cash doesn’t stay in the US— it’s laundered out. And in exchange for that spending, the US receives a commodity with zero consumer surplus and a ton of negative externalities.

Due to the size of the market and trade, the drug war is part of the trade war. Which means if enforcement does hit, then slowing the spigot of USD exiting the country from drug sales could end up having larger macro impacts into next year.

Blow up enough boats and the Fed can cut.

Up Next

We’ve got another EV play lined up, an oversold peptide call buy, and taking a fade on the strongest stock over the past 3 years.