Make This Line Go Up To Fix The Economy

Repairing deindustrialization and deficits with this one weird trick.

Politicians and policymakers end up overfocusing on GDP. They think if they can keep the economy rumbling, then it gives them wiggle room to make mistakes, like exploding the deficit or going to war.

And to a point, it works! If it’s all about bread and circuses, we’ve got the latter part already covered with our Netflix subscriptions. We just need to keep people well-fed and there won’t be many revolts.

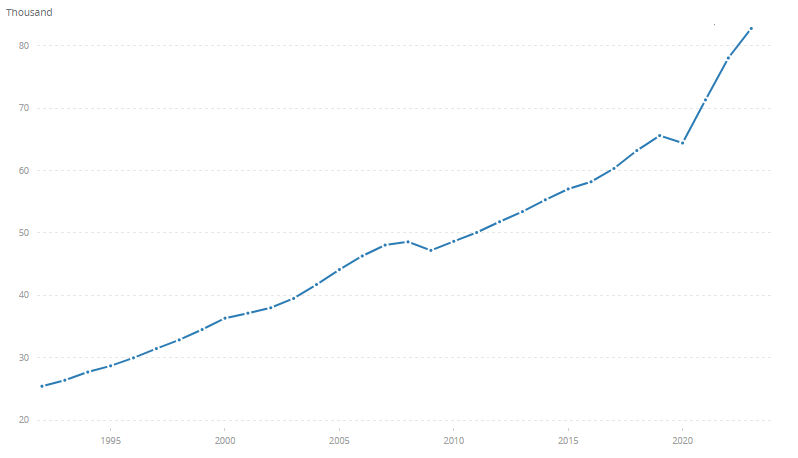

Yet there’s been a multi-decade Stagnation in the United States… if you’ve been only watching national GDP then you’ve missed it.

America’s GDP growth is not evenly distributed. It has been concentrated in coastal cities while the Rust Belt decays. Growth is exploding in the Sun Belt but deaths of despair have more than doubled since 2000.

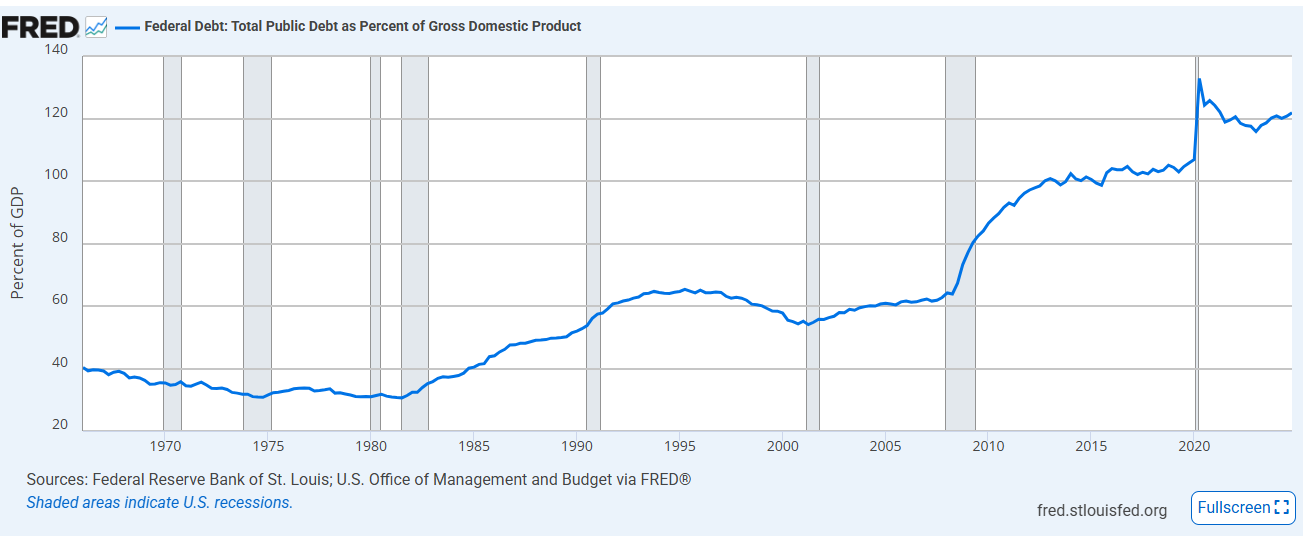

It gets worse when you factor in how much debt is used to “push the string” of GDP higher:

The first half of the 2020s gave us a collision between “virtual” GDP and the real economy.

It doesn’t matter how productive your financial sector is if you can’t get antibiotics shipped in from China.

Employment numbers are little consolation when they’re all migrants.

And all the software companies in the world can’t keep food prices down when Russia invades Ukraine.

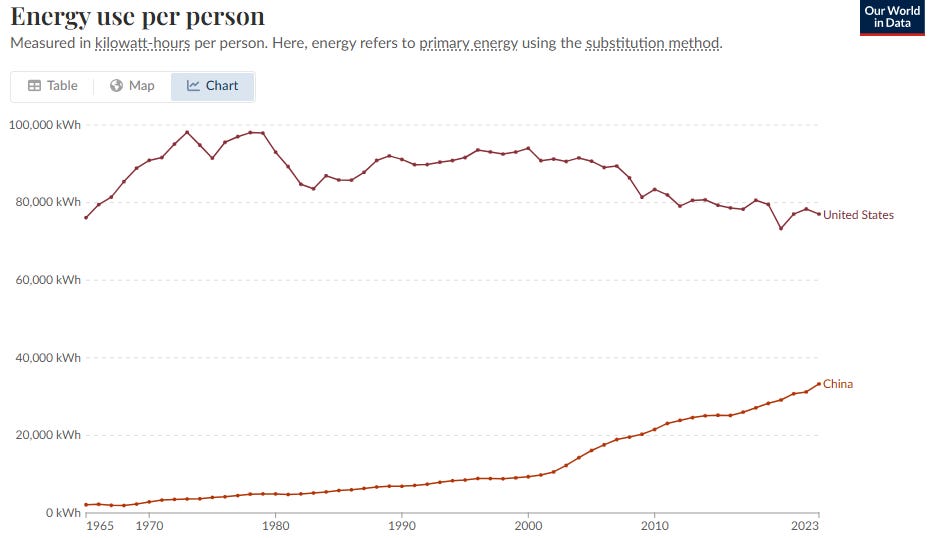

The fix is staring at us in plain sight. If America’s going to make the Big Pivot back into { automation | robotics | AI | onshoring | manufacturing }, there’s one chart that should be the focus of our political culture.

The U.S. is starting an arms race for electrons.

We can’t compete with China on labor. If you back out China’s exports and number of people, the only way it works is if they use slave labor. They’re a communist country so definitionally they’re going to force people to work without allowing a free market for labor.

Our only way out is to make power too cheap to meter.

Everything Gets Fixed. Seriously.

By drastically increasing power capacity in the U.S., that allows more manufacturing to onshore. Semiconductors can get out of Taiwan, so the U.S. isn’t militarily on the hook anymore for some boondoggle in Asia. Productivity can explode with robotics and AI, which turns the looming Entitlements crisis into a small hiccup.

It reduces trade deficits. It reduces the actual deficit.

We Can’t Reshore Without Rewiring

The Energy renaissance has already kicked off, but we are still very early.

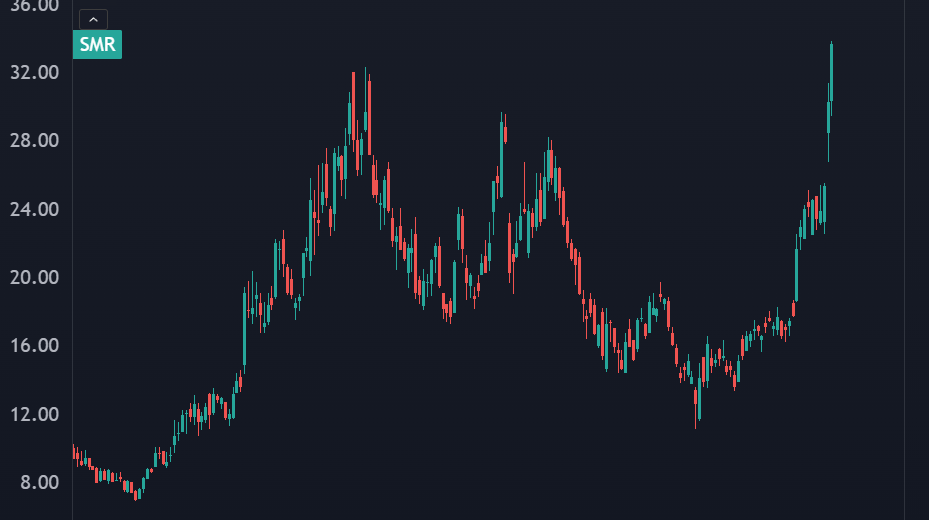

The US House passed the “Big Beautiful Bill” which included best on nuclear. Names like SMR went nuts on the headlines:

Yet we can’t rely on Nuclear alone. The electrons arms race is going to require every single power source that isn’t nailed down.

When I say everything I mean everything. Coal, hydro, oil, solar, wind, geothermal.

Many of these spaces have been left for dead. The entire market cap for the entire energy sector is less than Microsoft. There are deals if you look for them.

Buy the Bottlenecks

NVDA has been a hot play because it’s the primary bottleneck for the AI revolution. They’re the only game in town, and there (currently) isn’t an alternative.

Power is going to be the major bottleneck for the Soaring Twenties. And if you think creatively enough, you can identify where they key second order plays are going to be.

For example, if we’re going to build out power, that means transmission. Copper is in play as it’s used for wires, but aluminum is used for more high-voltage applications.

That could put Century Aluminum (CENX) back in play:

There’s also the need for large electrical components like transformers. I don’t know if you’ve looked at General Electric (GE) recently, but it’s now behaving like a degen momentum stock:

The best stocks for the second half won’t be the stocks from the first half. And while passive investors face concentration risk from having 7 megacap tech stocks overweight in the broad indices, there are better investments out there with much less risk involved.

I’ll be sharing my full investment report on the Electric Arms Race soon, so make sure to subscribe.