Market Feeling Top Heavy? Time To Buy.

A look into concentration risk, option flows, positioning, and motivation. Discover the "value unlock" in pot stocks, and why you should be diving into smallcaps.

Earlier this morning, Virginia Tech’s athletic director submitted a presentation about the future of college football. Because they’re a public university, they’re responsible for full disclosure so we get a look into what risks they see in the market.

This slide provided by Doug Bowman shows us what we already know:

College Football recently had a liquidity unlock in its labor market. Instead of players getting zero (legal) compensation, there’s now pools of alumni money to bid on the best players.

A split has always existed in CFB between the top teams and the rest. Every once in a while a new team breaks through, like when UCF became the undisputed National Champion in 2017. Yet for the most part, it’s the about twenty teams that regularly play at the top levels.

The divide will grow as NIL and TV money converge into something that nobody wants but it will happen anyways.

The Equity Bifurcation

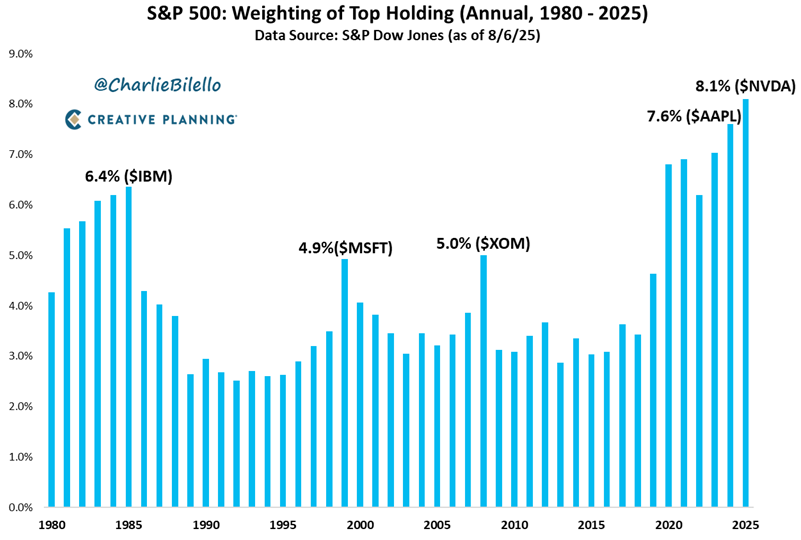

Charlie Bilello shared how the concentration in a single stock is the highest its ever been:

This power law holds true through the top tech stocks. For the Nasdaq 100, there are 7 stocks that make up 65% of the weighting in the index.

Sometimes concentration risk is actually concentration reward. This is the benefit of buying a market cap weighted ETF as it automatically pyramids you into the winners.

And it’s been justified! NVDA had knockout numbers, AAPL finally got off the mat, and META is nearly an $800 stock.

Yet at some point this will break. Some… ok who am I kidding, a LOT… of the liquidity driving the stocks higher has been driven from the options market. Risk premium has been bid as tariffs loom and earnings risk was around the corner. With some of that unwind, it’s marked up these stocks even further.

When the liquidity break happens, it will be ugly, and the first obvious dip will suck in so many market participants that they’ll quickly turn into bagholders as the options liquidity doesn’t show up like it used to.

But that could be another 5% higher, or a few months down the road, before that hits.

Maybe there’s another space we can play…

Look Up From The Cards

We are all seeing the same numbers. The same prices. Yet consider some of the market participants and what they’re thinking.

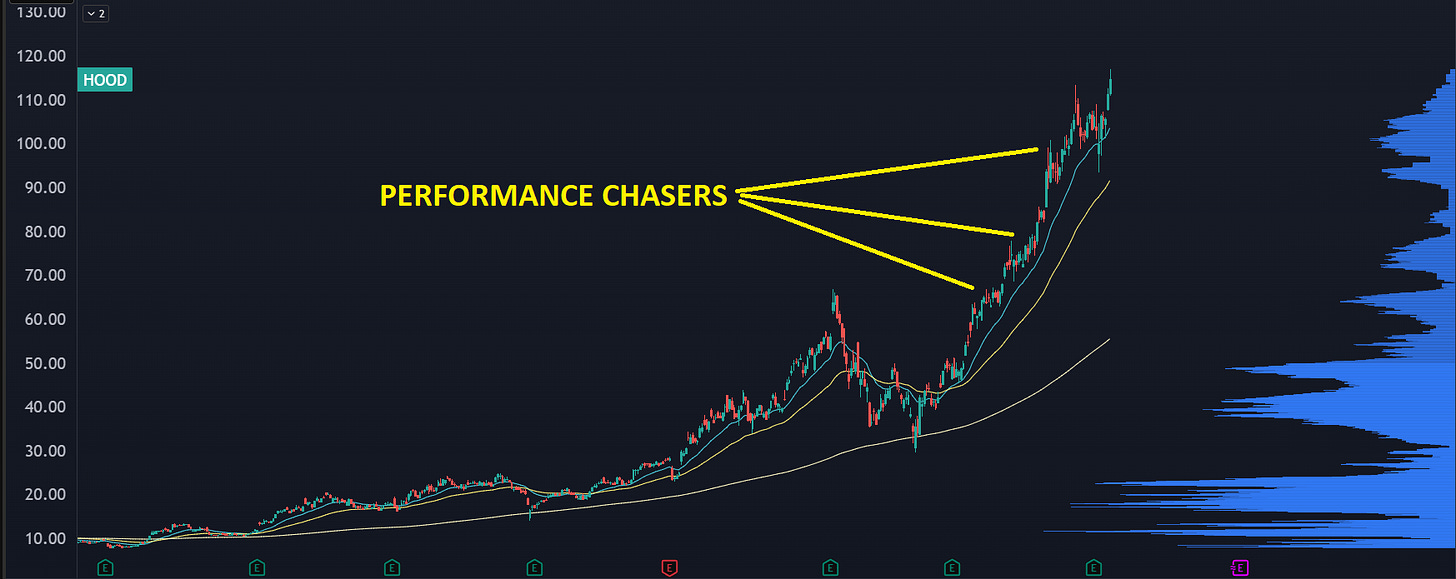

You still have funds underperforming. They overallocated into cash and hedging at the worst possible time in April, and they’re trying to play catchup. The runs in Mag7 have led to drastic benchmark underperformance.

What are they going to do? Park money in bonds? No, they’re going to chase. That’s why we are seeing big markups in names like HOOD and PLTR:

You also have large participants that have been sitting pretty on their Mag7 trades. Honestly that’s been the “most hated” trade this year.

What are those winners going to do? Reallocate into bonds? C’mon.

Here’s what I’m seeing…

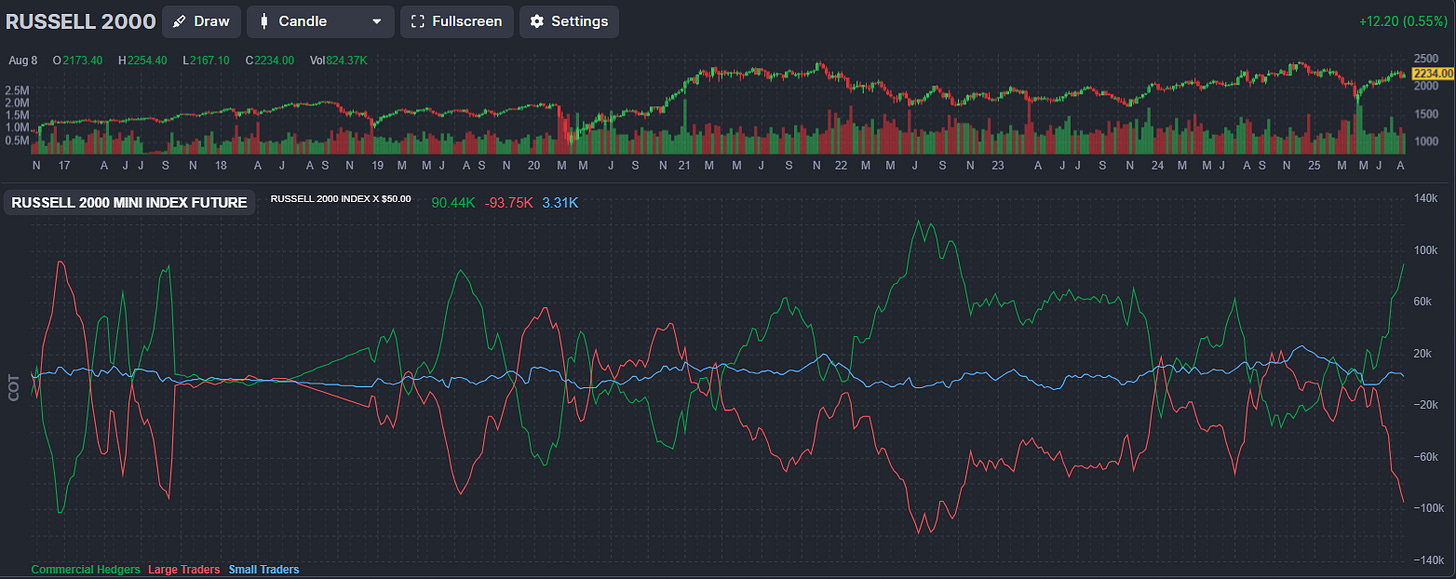

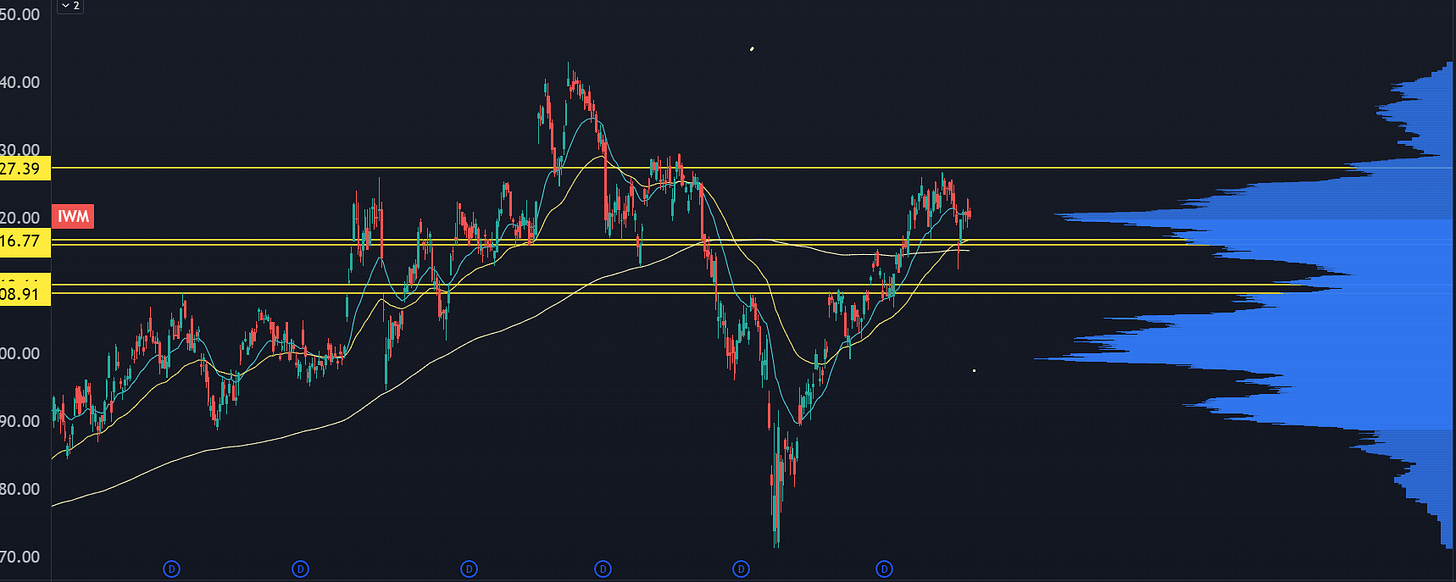

The Commitment of Traders (COT) data is showing us a large buildout of short positioning in Russell 2000 futures. And so far, it’s been justified as there’s not been enough broad liquidity to support prices:

Yet underneath the surface, some of the smalls are on fire.

KTOS is parabolic:

CRDO can’t catch a pullback:

STRL just pushed $300 after earnings:

There are quality moves in smallcaps that aren’t seeing rugpulls. That’s a sign!

Markets are currently pricing an interest rate cut, which can be a narrative shift for smalls. Couple that with current positioning from chasers, rotators, and shorts… and you’ve got the recipe for sustained moves.

The Cannabis Recovery

MSOS is an ETF that tracks the pot stocks, and it just put in a double bottom.

This ETF is down -46% over the past year, but it’s starting to show signs of recovery. And I think there’s an additional edge that we’re not considering.

Protectionism for Drug Dealers

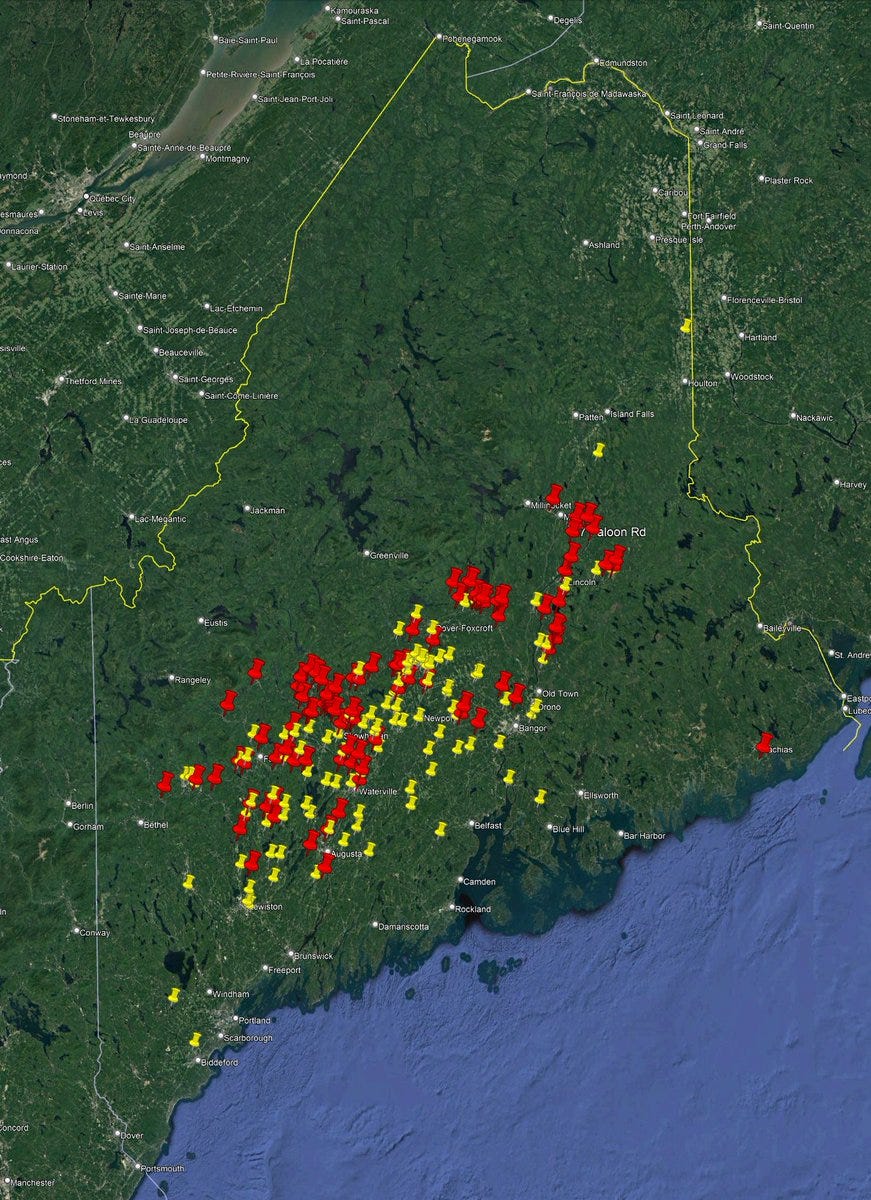

This is a map from the Maine Wire that shows sites of alleged illegal grow operations run by the Chinese Communist Party.

Bet you didn’t have this on your bingo card. The excuse here is that burdensome state and national regulations make it hard to operate legal growhouses, and provide incentives for illicit activity.

This isn’t a free market. The United States should not tolerate the CHINESE COMMUNIST PARTY of all things to operate illegally and flood our markets, whether its solar panels or weed.

I expect the Feds to crack down on this as this is also an immigration issue. If that happens, that means the legal operators will do better in the market, improve their pricing power, and eliminate illegal competition.

This is a hidden risk premium “baked” into these stocks, and there could be a large value unlock… not from legalization but from removal of competition.

The New Bottleneck

If you haven’t had a chance yet, I wrote a deep dive into the next big AI play hiding right under our noses. It’s available here:

Enjoy your trading this week!