Pavlov's Reindeer

Waiting for Santa, Mapping the AI Hangover Trade, and Finally Taking a Silver Short

The Santa Claus rally. It’s all we’ve heard about this entire month:

And with the small rugpull a week ago, traders were screaming that their “guaranteed” statistical edge refused to show up.

The Santa Claus rally has a very specific timeframe— the last 5 days of the year and the first 2 of the next. The window opens tomorrow and goes until January 5th.

Market participants are grasping for Narrative straws. We’re in a kind of news vacuum, where the Fed’s out of the way and the AI hangover has already pushed through with hard pulls in anything with a little too much leverage or not enough perceived upside.

And with all the noise, hype, crashes and commentary… the Nasdaq has now been in a time-based correction for at least two months.

What if the sideways move has built up energy for the next leg higher? It’s sexy to call a top right now, and I’m sure there’s some January liquidity dynamics that could be a good shakeout.

But what if that was it? MSFT, NVDA, META, and AMZN have all had solid pullbacks. Even a normal bounce puts the Santa Claus rally on the board for large cap tech.

Higher is still the contrarian take. Yet I do want to gameplan how sentiment could play out in the Futuretech space as we head into next year.

AI Curves

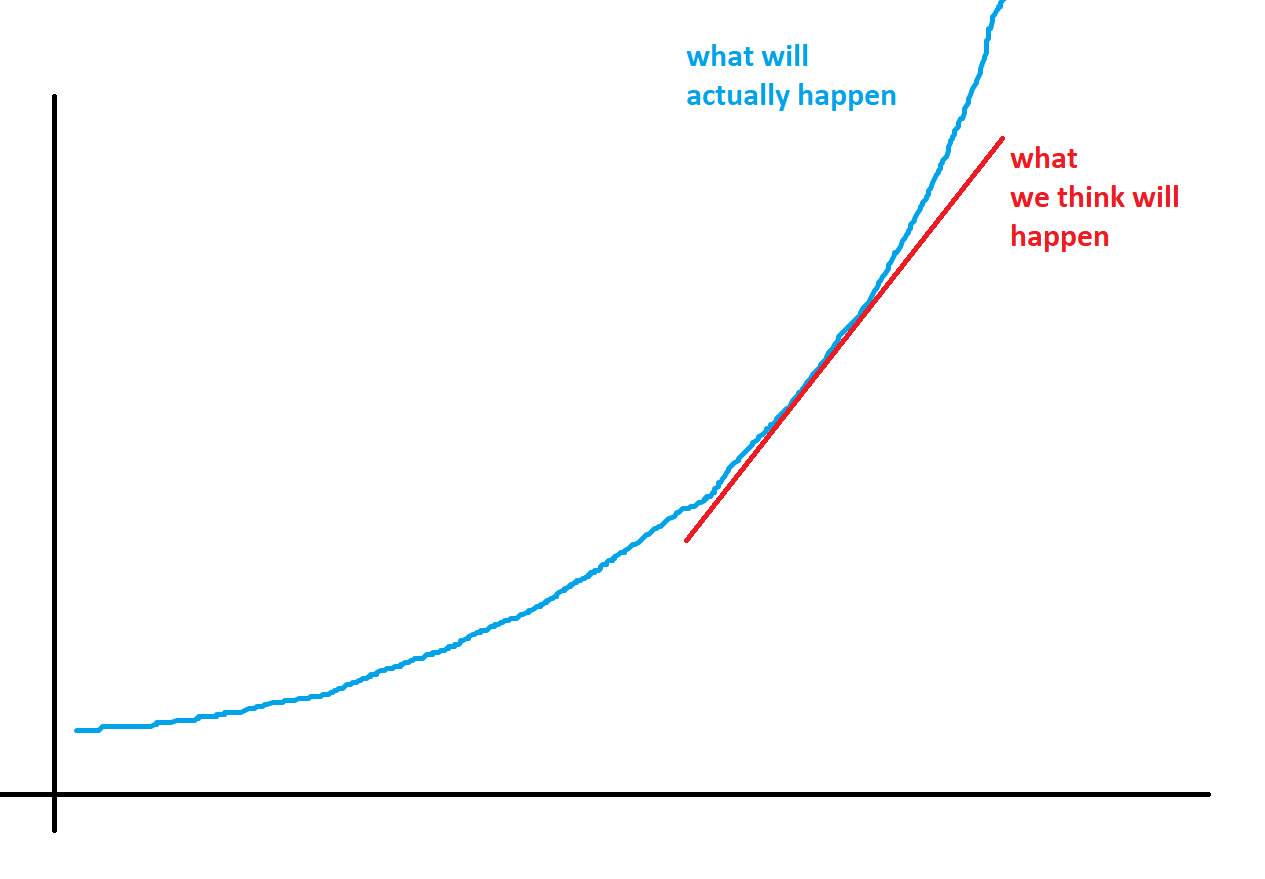

Humans are linear by nature. We have a hard time understanding the convex nature of things like compounding and Moore’s Law.

Our linear assumptions do adjust as technology accelerates— kind of like riding the tangent on the curve.

Sometimes there is a kind of “step” in our perception of what will happen. This can be from a headline or a new GPT version release:

We absolutely saw this in 2025 with the “buy anything related to AI data centers” rolling bubble that came and went in the second half of the year.

I’m still very bullish on this space. The innovations that are going to come out of this haven’t been pulled through yet.

But there’s one problem— AI is hitting a series of bottlenecks at the same time. Power, memory, GPUs, data centers. The Stargate data center in Abilene won’t be done until summer 2026.

That means the Futuretech exponential curve could have a small divot in it.

In the first half of the year, the AI hype cycle could invert. It’s not because new innovations are completely halted, it’s that the perceived incremental gains from AI tech will be much lower than what’s actually happening underneath the surface.

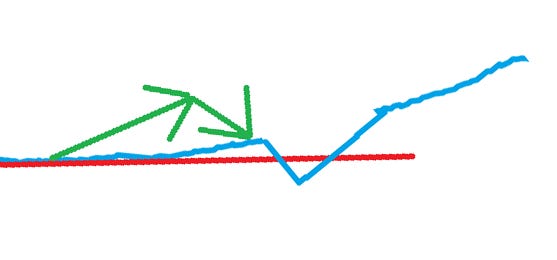

If we “normalize” this curve, then it lines up with the current narrative cycle:

Yes, I know my MSPaint skills are incredible.

The green hype cycle finished sometime in October. It’s now reverted back towards the actual expectations of the AI bull market, but if we’re hitting physical limits on making better models, then the collective psychology inside the market could throw a tantrum.

That’s the risk. It’s not inflation or the Fed, it’s that we’re going to be a bunch of crybabies if AGI doesn’t show up in the next 3 months.

And there’s one more part of the market that could help reinforce that action… but not for at least a month.

The Vol Crush Finally Hit

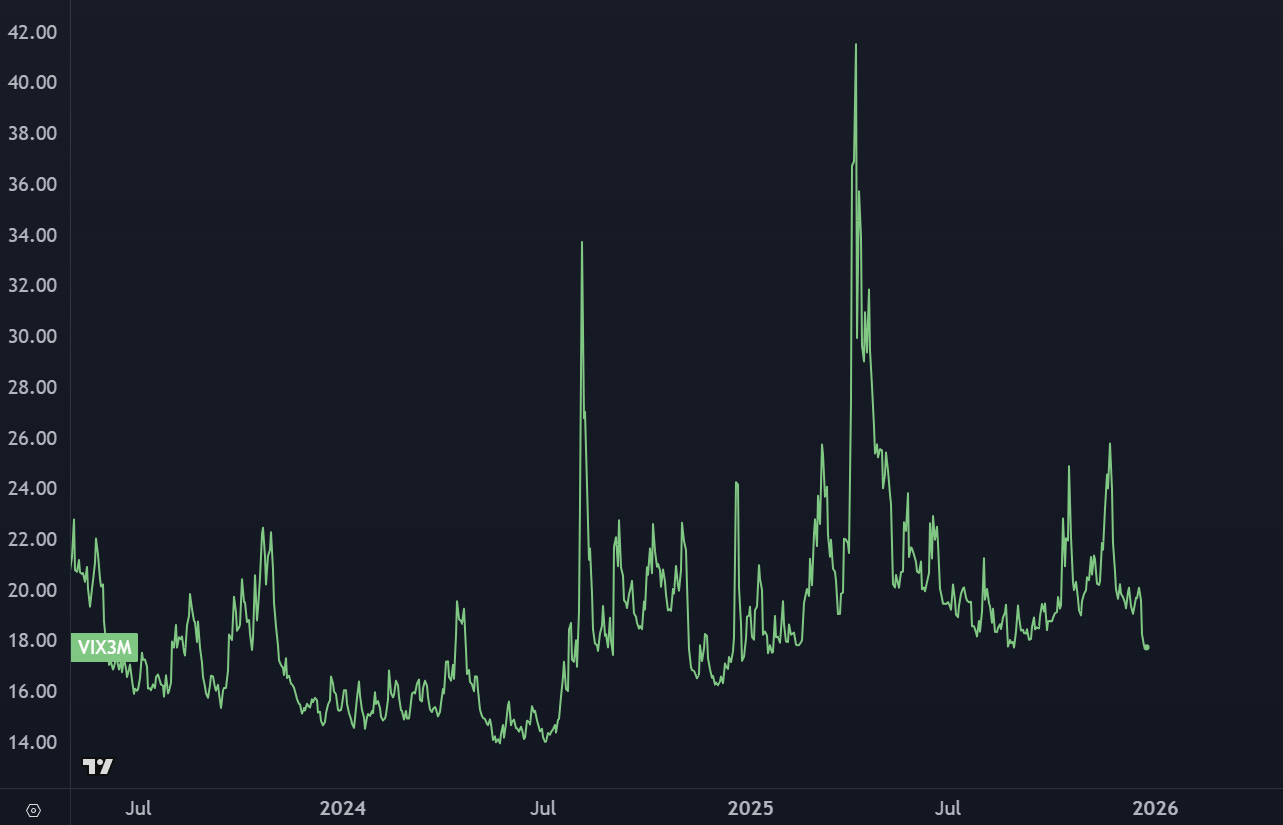

Spot VIX has cracked 14 and looks ready to find a new floor. Some of the risk pricing is from holiday trading, so I’m showing you the 3-month VIX above, and it’s also getting crushed.

The market has been resilient since the Tariff Tantrum due to a sticky (and naive) bid in volatility markets. Everyone wanted to own protection and keep one foot out the door, which led to a market that was overprotected to the downside.

If we get a VIX that finally trades into the 12s… it’s not bearish, at least not at first. If we stay in those levels for a full opex cycle, then that’s when hedging is going to pay off.

We’ll worry about that next year. For now, let’s take a look at the Fat Pitch to end the year:

Silver Is Ripe For Reversion

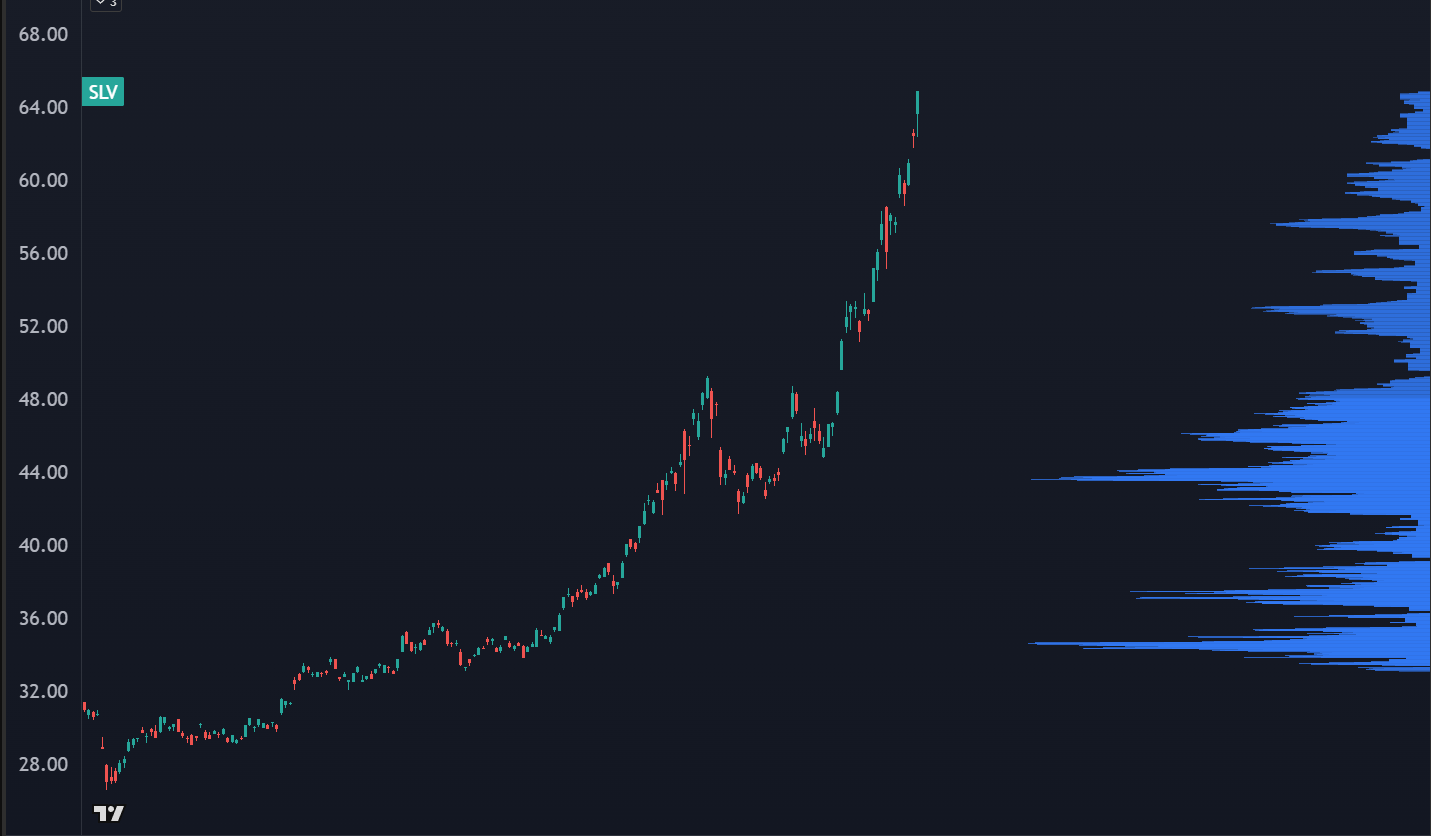

I have somehow have not tried to fade this yet. But we’re coming into rarefied air for silver where a well-structured fade trade should pay out nicely as we head into next year.

I don’t think that we have fully topped out yet. Ideally there’s some kind of exhaustion gap during holiday trading that traps some shorts and starts the unwind.

But we’re close.

For the silver permabulls— congrats, take your victory lap, and don’t get butthurt when I get bearish. I’m not making a bet on the global financial system or money supply or any other macro trade… it’s just math.

Like how silver is very stretched above its 50EMA on a weekly chart:

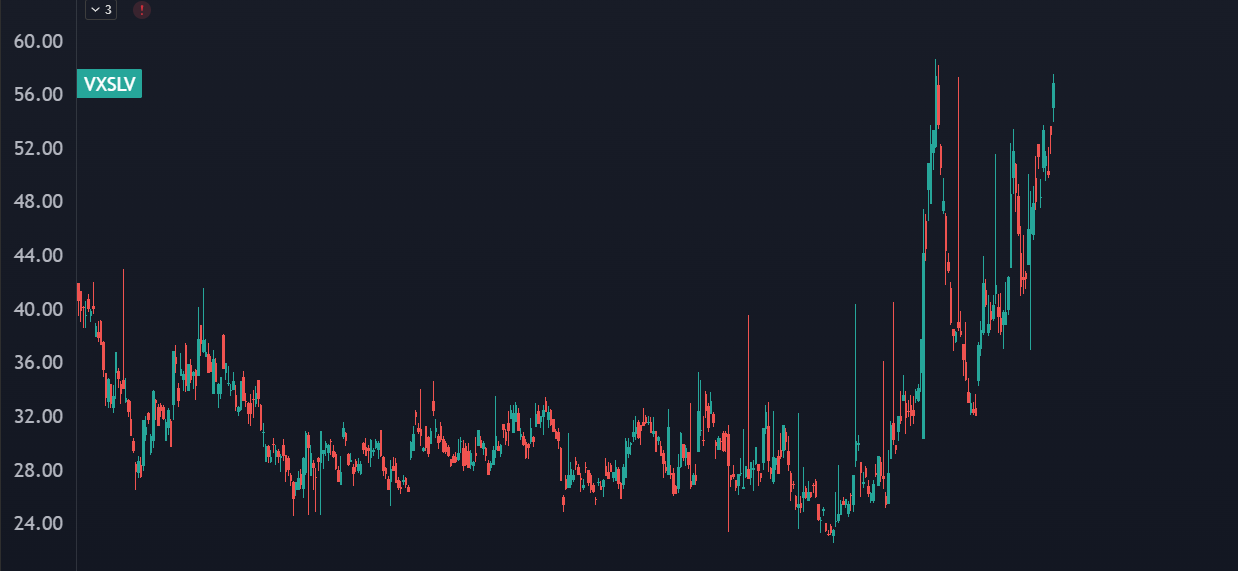

The last signal I’ve been looking for has been a blowoff in silver options:

The silver VIX is getting close to 60, but it’s been a grind higher and not a blowout.

Can silver top out without a bang? I think it’s possible, but a 3xATR move with vol tagging 70 can work just as well.

If you’re going to short, don’t be an idiot. If you know how to trade uncapped risk with shorts or short calls, then your risk is some kind of overnight “f-you gap.”

If you’ve never tried to fade silver parabolics with uncapped risk, then do not do that. There’s better structures that give you solid risk/reward payout, and now’s a good time to start scaling in.

Our SLV trade is available to our Convex Spaces Clients, to whom I wish a very Merry Christmas.