Profit From Elon Musk's Next Play?

Brazilian Judges, Edward Snowden, and the SWIFT Banking System

Here Be Disclaimers

We’re going to dive into a bullish call on a high risk asset. You should view this as a fun story, not investment advice. This is not a recommendation to invest. Do your own research. I’m not your financial advisor.

“Free Speech is a Threat To Democracy”

Take a look at this asshole:

Alexandre de Morales is a Brazilian judge that just seized $3 million from Starlink’s Brazilian bank accounts.

This was to pay for fines levied by his courts against both SpaceX and Twitter for not properly censoring the platforms.

But this doesn’t seem like a huge deal right? It’s yet another strongman in a Latin American country, right?

Here’s asshole #2:

Thierry Breton is a commissioner in the European Union.

In August he sent a sternly worded letter to Elon Musk, warning him that unless they had more censorship control, “very bad things” would happen.

The Empire Has Lost Narrative Control

These two assholes are not coming up with strongman tactics independently— they are the henchmen for the U.S. Empire.

Four years ago, the prior sentence would be considered a fringe theory. Yet it’s been proven. It’s out in the open.

Big tech firms have been used as a tool for censorship. Firms like Meta and Google now act as agents of the state.

I don’t blame them— if you don’t cooperate, then you may find that your CEO now has to sit in D.C. for an antitrust hearing.

Musk has not played the game, and he’s been punished for it. Attack vectors come in from DoD, State, foreign governments, and the mainstream media. All the best people.

It’s clear that Elon knows the stakes and who the players are at the table. And he was early.

The Trojan Horse to Bypass the Hall Monitors

The internet is not a series of tubes, but layers of a cake. The “OSI” model is the most well known, where you start with the physical wires and work your way up to the application layer.

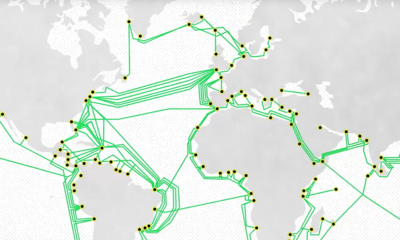

And every single layer is under surveillance and can be censored. This was why Edward Snowden got in trouble, as he disclosed the PRISM program and how the NSA directly tapped into undersea cables.

Various layers of the internet have seen cryptographic tools to help reduce the risk of surveillance and censorship.

Starlink achieves that at the physical layer. When your data pipes are distributed throughout thousands of satellites, it becomes much more resistant to nation-state level actors.

And those actors are pissed.

It’s why Brazil has seized Starlink’s assets.

It’s why the European Commission is rattling its sabers.

It’s why Musk had to relocate his business structures into Texas.

Think Laterally

Elon is building out a three-legged stool. One that is resistant to nation states.

The first leg is at the application layer with Twitter (X).

The second leg is at the physical layer with Starlink.

The third leg? The financial layer.

The ability to move capital around is the last piece, and the hardest one.

Remember! Musk is killing it with Tesla and SpaceX, but he was the cofounder of Paypal, which promised its users the ability to move money on the internet.

Do you know what the original name of Paypal was?

X.com

Elon Musk did not just buy twitter (rebranded X) to maintain free speech in the West; he did it as he is going to re-imagine what Paypal could have been.

Paypal never achieved what it could have for a few reasons. It was still tied to existing banking systems, it was hard to detect and manage fraud, and if it got too successful, the Feds would just shut it down.

Paypal was early. We didn’t yet have a distributed physical network or cryptographic protocols in place to enable the free movement of capital.

We do now. Crypto and blockchain tech have already been built out where you can simply adopt a protocol, slap it onto X, and allow payments on Starlink.

The Most Telegraphed Catalyst In The Markets

Musk has been known to move markets. He’s tweeted out a couple bangers that affect the liquidity of Tesla’s stock, and he’s been scolded for it.

In 2021, in order to buy Twitter, he put out a Twitter poll on whether he should sell 10% of his stake in TSLA, causing the stock to dump.

There’s precedent that Elon will leave bread crumbs in his social media about his next big moves. He’s done it with SpaceX, Starlink, Tesla, and his buyout of twitter.

Maybe we should pay closer attention when he does this:

The Obvious Play Is Not Priced In

When twitter changed their logo to Dogecoin, maybe you should pay attention.

When Musk calls himself “The Dogefather,” maybe you should pay attention.

When Musk mentions Dogecoin on SNL, maybe you should pay attention.

A lawsuit just wrapped up, where the plantiffs were accusing Elon Musk of pumping Dogecoin.

Here’s the quote from the judge, with my emphasis added:

These paragraphs allege statements by Musk on ‘Twitter’ to the effect that Dogecoin might be his favorite currency and that he had purchased some for his son, that Dogecoin is the people’s crypto and the future currency of Earth, that Dogecoin might become the standard for the global financial system and the currency of the internet, that Musk agreed to become Dogecoin’s CEO, and that Musk might put a ‘literal’ Dogecoin in SpaceX and fly it to the moon and that Dogecoin would pay for the mission, that Tesla vehicles could be bought with Dogecoin, and the like.

These statements are aspirational and puffery, not factual and susceptible to being falsified. They cannot be the basis of 10b-5 lawsuit… and no reasonable investor could rely upon them.”

“Wait a minute, are you suggesting that Elon would take a memecoin and turn it into a global reserve currency… from space?”

YES.

Dogecoin is a fork of Litecoin, which was derived from Bitcoin. There’s nothing inherently “wrong” with the protocol, it’s just viewed as a shitcoin.

Here’s a question for you… what’s the value of the Dogecoin protocol if it’s exclusively used as a payment rail for a censorship-resistant internet?

What if Starlink satellites start acting as nodes and validators for the DOGE network?

If he’s crazy enough to do it, then this sucker is going to moon. The DOGE token attempted a breakout, but failed as it came back into the swing AVWAP from all time highs.

Pound the Table With a Small Hammer

I’ve had this investment thesis in my head for months. And it sounds stupid.

Every week that passes, it sounds less stupid.

The timing is important here. Musk is currently playing a dangerous game at a level few can even access. Becoming a challenge to the current SWIFT banking system would force a response that he wouldn’t make it back out from.

It’s now about politics. If Harris is elected, then crypto is going to be smothered in the West. The past 4 years of uneven regulation from the SEC and CFTC are enough evidence for this.

If Trump is elected, it’s game on. He’s got a team of smart and talented crypto people, and has already stated his policy positions.

This is the bull case for DOGE. It’s not hype or memes or fumes— it’s a thesis that both the protocol and token are drastically undervalued relative to the potential that the network has over the next few years.

See earlier disclaimers. Don’t be a dumbass. Financial disclosure: I own some DOGE