Pumpkin Spiced Trading

What happens when price action runs against consensus? Simple-- build out setups knowing that other traders are going to hurt

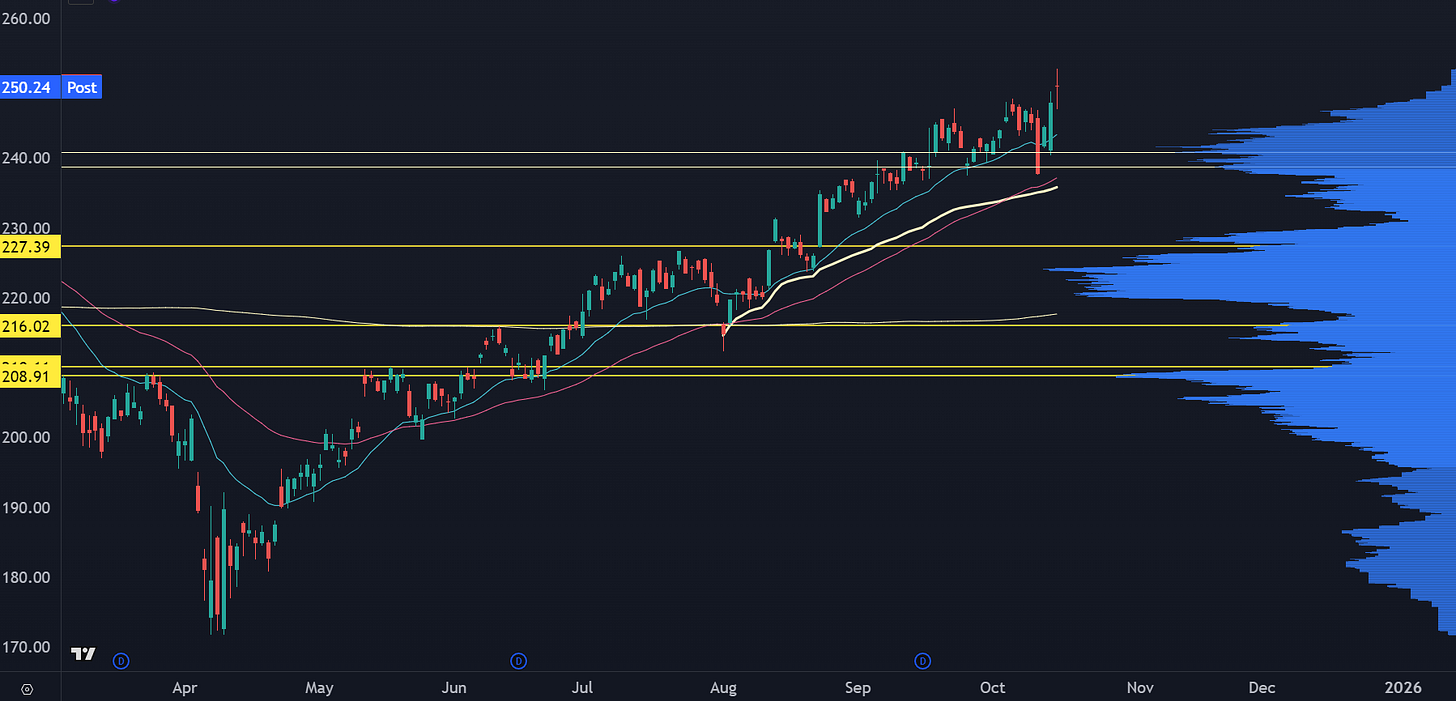

There’s a lot of collective breath holding going on in the markets. Large cap tech is trying to hold up after Friday’s unwind:

And in “hilariously up too much” momentum land, RGTI gets away with it, yet again:

It’s noisy out there but without any real substance. The USGOV shutdown is a non-issue, and the China trade negotiations have headlines popping up, but it’s kind of a chopfest.

But if we wanted to narrow it down to a single consensus opinion, what would it be?

Certain spots of the market (nuke, quantum) are frothy and could be close to a cycle top

Large cap tech has earnings/China risk so don’t place a ton of directional index bets. Maybe hedge.

Even if we pullback, that’s a buying opportunity

That’s reasonable, right? It’s the “pumpkin spice latte” take for the markets.

What if we wanted to think about trade setups that would run counter to that consensus?

Here’s one:

The Futuretech short is so crowded that it’s either going to take a lot more time before the rollover happens, or we see a proper blowout.

That’s certainly happened in UUUU, where there has been a systematic short cover at the open for nearly every day in October:

How about another contrarian take:

Load up on GOOGL, don’t worry about the macro risk.

Price action is confirming that, with the stock never retesting the Friday low and is already at the highs of the month:

What about the pullback? It’s easy to say to buy the dip after the pullback. It’s just as easy to make the call for a deeper crush than what the market expects.

But what if that was it? What if that was the pullback?

The Russell 2000 just printed a new high! We’re already starting to see price action run against the PSL Consensus. And I don’t want that to happen! I want a clean, vanilla pullback in the markets with some momentum stocks getting kicked in the teeth.

That’s going to be the theme for today’s setups.