Quit The Pearl Clutching

Avoid the noise, it's a normal pullback. There's one headline that could take out the market, but investors aren't aware of it yet.

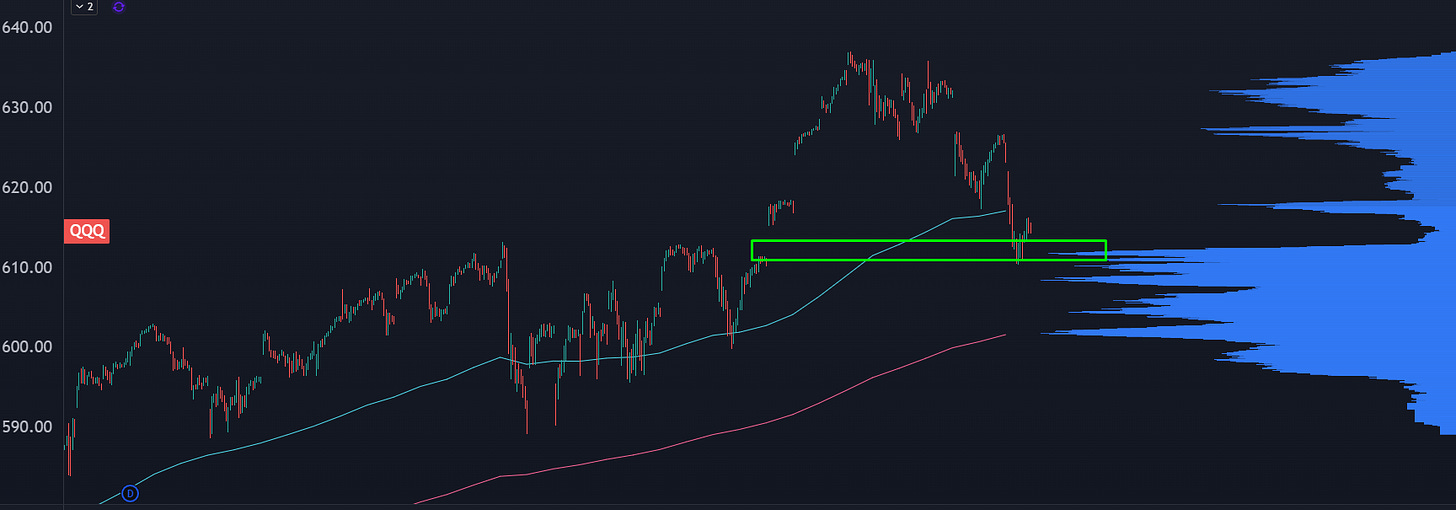

Stocks are in a pullback. A normal pullback. No increase in vol, nothing “getting loose,” just a simple gap fill.

The Nasdaq is still above a 50EMA, which is 5% from all time highs. Today’s selloff doesn’t even have to be the bottom. We could see continued short term liquidations and the indices would still be structurally healthy.

When you have a market dominated by a handful of names, you can have a stealth correction that resets a ton of names while the overall market still “looks” healthy.

Here’s a chart of the percentage of S&P 500 stocks that are still above their 50:

This leads to a split in sentiment. If you’re a passive investor that checks the market every once in a while, you’re still riding high. If you’re a degen trying to nail the bottom on broken momentum stocks, it’s been a rough ride.

If you want a detailed explanation behind these mechanics watch this live session here.

The market looks fine. The October speculative excess is shaking out, and there’s enough rotation in the megacap tech complex for the current correction to be a small one.

In fact, I think we are close to some solid setups on names like MSFT and META… but we need one more push to the downside.

One major issue with sentiment right now is that everyone is punching at the wind. The { China | Fed | Earnings } newsflow is in the rear view mirror, so price whips around until a new collective narrative can form.

Don’t be shocked if we just chop around for the rest of the year, and that means you can get some solid setups on option selling strategies.

There is one curveball that I want to keep an eye on…

Deepseek 2.0

In January of this year, Deepseek released an open source LLM that outperformed US tech on major benchmarks. This led to concerns about efficiency and how the demand for GPUs could go down, and it caused NVDA (and the Nasdaq) to get kicked in the teeth, punctuated by the April tariff tantrum.

Eventually it didn’t matter. Scale still reigns supreme, with the hyperscalars planning on a bajillion dollar Capex spend for the forseeable future.

But it’s enough to spook investors.

Another Chinese lab released an open source model called Kimi K2, with a thinking agent that is competitive against other benchmarks. The model is available at huggingface.

I’m not an expert on this, but the “bear case” for American AI companies is that these models drop the cost of inference, where you can build out cheaper bespoke LLMs instead of having to pay for mainstream software.

This headline is still early, and I’m not sure price action has attached to this narrative.

It may not yet matter… but NVDA will be coming into major decision points with this pullback:

The majority of liquidity in NVDA is from the summer trading range. This last move was a blowoff with some deal news, and the stock has now come into the upper edge of this range.

If NVDA selling accelerates towards the bottom edge of this range, and then bounces but can’t sustain… then I’ll start to get worried as it’s currently 7% of the S&P 500.

This narrative could push more capital into China tech names, which have been holding up exceptionally well. We’ve had some monster wins on names like BABA, NIO, and BIDU and I’m expecting the trend to continue.

For CS clients, we’ll be looking some option trades in the China space, as well as a plan on fading META to the long side. Plus, an energy kicker.

If you aren’t yet a ConvexSpaces client, we would be delighted to have you. You’ll get the best setups available in the market. If you sign up as an annual subscriber, let me know and you’ll receive access to all of my option trading courses, for free.