Restructuring

Running the numbers on the government shutdown, a look at Wolfspeed's restructuring, and our favorite SPAC artist is back in town.

It’s starting to heat up in Washington, but only to a simmer. Betting markets are at 90% odds of a government shutdown, so that’s about a done deal.

On top of that, 100,000 federal workers are out of their jobs today. It’s not some “statement,” it’s about the deal they took for the Deferred Resignation Program.

100k is rookie numbers.

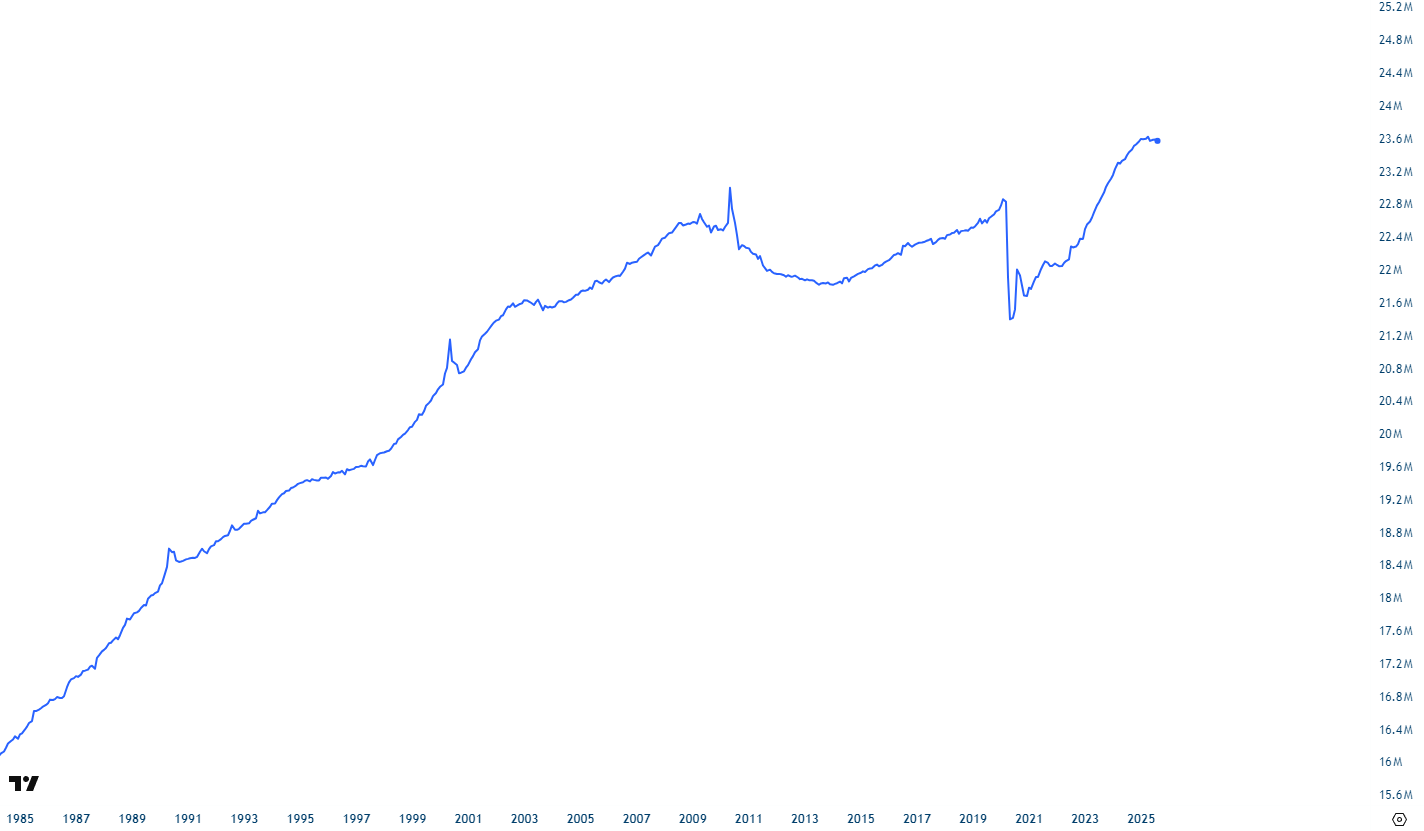

The US has about 23MM workers in government, which includes Federal, State, and Local. The range had been pretty stable until the COVID fiscal elephant gun opened up all new kinds of “opportunities” for employment.

We’ve got AI now. This is a solved problem. We could get sub 20MM and not see any changes to government services, and possibly some improvements.

This also could be why economic data is acting “goofy.”

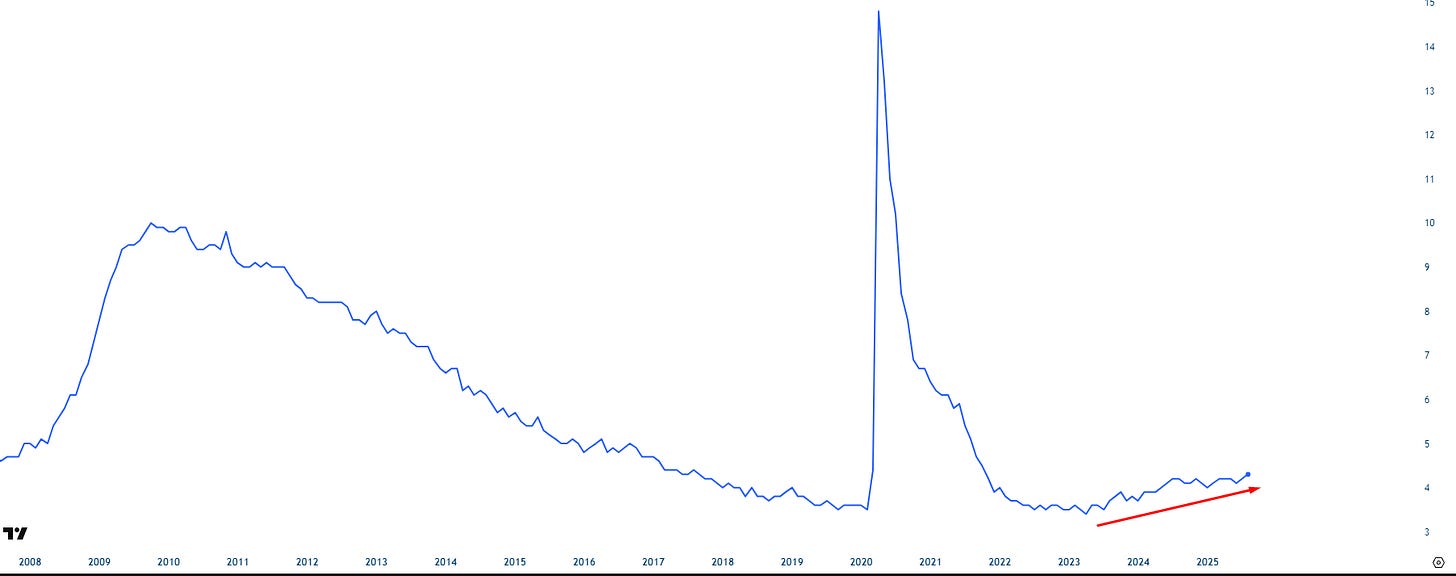

The unemployment rate continues to tick up, but GDP is still quite strong and input prices seem to be coming down. Maybe the people being fired were in fake jobs?

This government shutdown does not seem to have the same kind of “hype” as other times over the past decade. The political brinksmanship isn’t there, and I think there’s a trap being laid.

“If money is not appropriated for a position, then they have the authority to eliminate the position.”

That quote is from Kevin Hassett, who’s on the National Economic Council.

There’s a possibility that the shutdown gives the Trump Administration much more leeway on firing government employees.

This isn’t priced in.

AI Brainrot Acceleration

OpenAI just released Sora 2. The announcement video is below. Watch the first 2 minutes for the demo:

It’s incredible tech. A good analog is paints. Way back in the day, painters couldn’t just roll up to a crafts store and get every single pigment they needed. They had to manufacture their own paints, which were limited and often dangerous.

The tools for video creation have now flattened the playing field, and we’re going to see a flourishing of creativity in ways we have never seen before.

But it’s going to have its downsides.

Brains will be cooked. Screen addiction will go up. Entire bloodlines will die off.

A few days prior, Meta released “Vibes,” which is an AI video short feed. It’s about as “peak AI slop” as you can get.

Yet if video has some kind of a “Studio Ghibli” moment that we saw 6 months ago, then the AI infrastructure trade is still on. That means names like IREN and CRWV could still hold their bids, and maybe the Hyperscalar Capex will be completely warranted.

WOLF Is Having A Moment

A few years ago, the solar trade was doing exceptionally well. There were subsidies, green energy mandates, and carbon credits.

Then rates spiked, China flooded the US with cheap solar PV’s, and the political winds shifted.

Solar has just started to get up off the mat.

There were also power semiconductor companies that were hit hard. While everyone was focused on NVDA’s run, any company that had exposure to GaN or SiC got absolutely murdered.

Wolfspeed (WOLF) was one of those names. It didn’t help that the company was hilariously leveraged, with over a billion in secured loans from Apollo Global Management.

The company is coming out of restructuring, and WOLF’s equity ran from about $1.30 up to $30. Older equity holders most likely got smoked, but the bond holders that converted their debt to equity have now been significantly paid out.

This has Apollo’s fingerprints all over it. They load the company up with a ton of debt, the company runs out of options, and then the equity holders are killed while Apollo makes a killing.

The power semiconductor play could have some hidden gems in the space. While this has been tied to solar, I think the AI infrastructure buildout is going to require decentralized power, namely solar, and that’s going to give companies like ON Semiconductor some upside tailwinds.

The Man in the Arena

Chamath Palihapitiya is dipping his toe back into the SPAC trade. If you’ve not heard this name, allow me to give you some other SPACs he brought to market in 2021:

Virgin Galactic (SPCE) - Down 98% from peak

Opendoor (OPEN) - was trading sub $1 and the stock recently jammed back up to the SPAC listing price

Clover Health (CLOV) - Trading at $3. Down 70% from SPAC listing.

SoFi (SOFI) - Traded down into $4 but recently pushed to new all time highs.

It’s easy to be a hater, but I take a more good-faith approach. 2021 was wild with a ton of liquidity and companies were trying to get that liquidity as fast as they could. SPAC structures are faster than a traditional IPO process.

The devil is in the details. SPACs often have problems with misalignment between the sponsoring company, the early investors, and the buyers of the stock once it lists on major exchanges.

In his announcement, he mentioned that there’s no warrants attached to the stock and there are benchmarks that need to be hit in order for everyone to win. It’s a step in the right direction.

And because consensus on Wall Street is to short his listings, then you could see some incredible squeezes higher.

Other SPAC listings have started to hit, and they’ve announced the target company but haven’t finished the merger. They could be fun to trade.

SPAC Trades To Watch

CCCX - they’re bringing in Infleqtion, a quantum stock play with a stupid name

HOND - merging with Terrestrial Energy, a small modular reactor play. A molton salt reactor, which is pretty cool.

WLAC - a deal is struck with Boost Run, an AI cloud infrastructure play

GSRT - they’re calling up Terra Innovatum to the big leagues, which creates micro-modular reactors

Very soon, I’ll be speaking with Eagle Energy, which is merging with SVII. They’re looking to become a full-stack nuclear play, ranging from domestic uranium mining to building out SMR tech. It could be a fun one.

Up Next For CS Clients

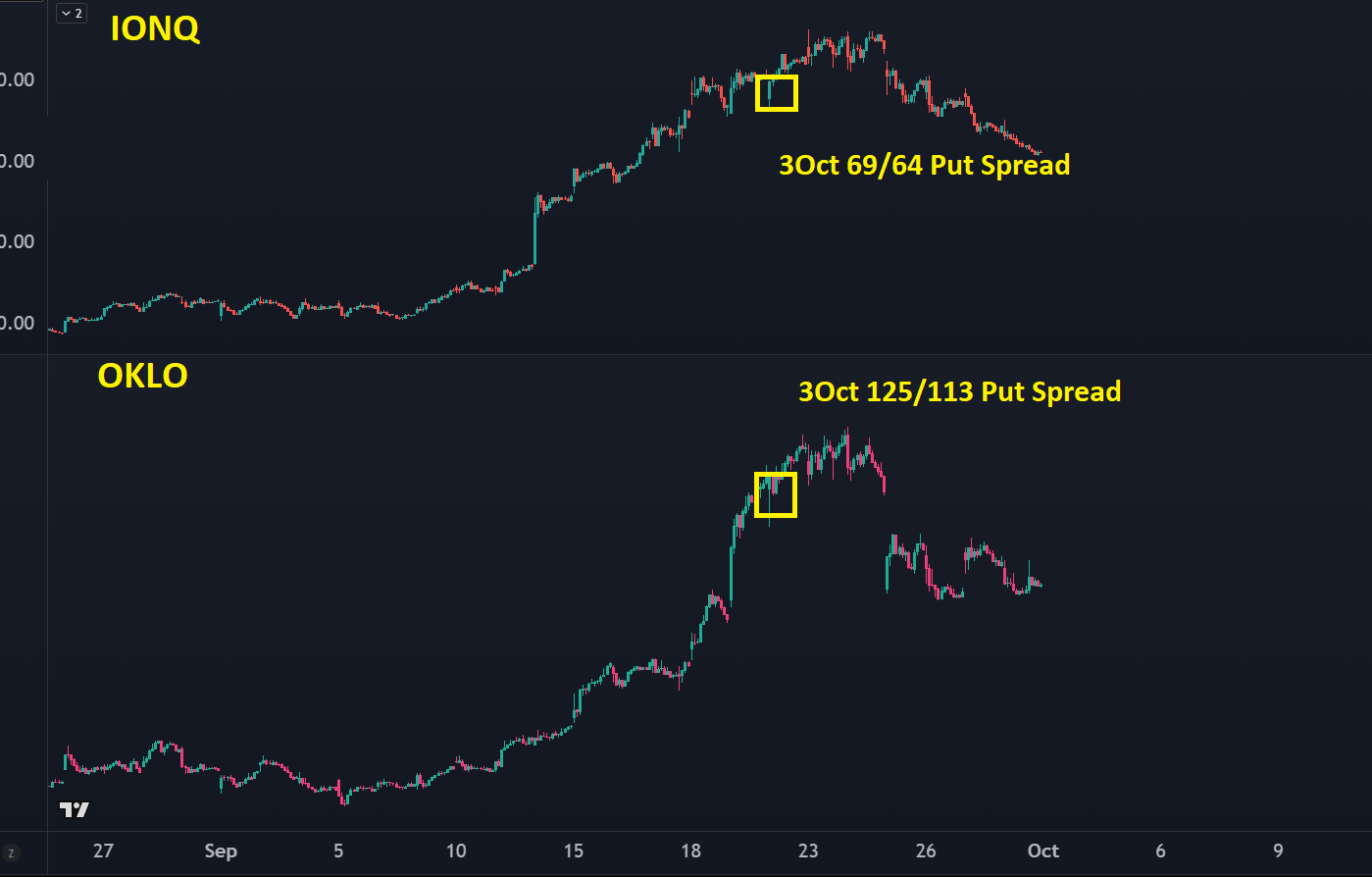

We’ve had a couple solid plays, even to the short side. I called out bear put spreads in both OKLO and IONQ, and they’re both up big as these stocks took a hit.

We also got “lucky” with some positioning in LAC at about $3, and the stock ran above $7 on the news that the Trump administration is getting invovled:

There was also a solid gap up in DPRO today and CRON yesterday, also picks for Convex Spaces Clients.

Today we’ve got a few AI names lined up that haven’t had their narrative-driven pushes. We’re also looking at a post-catalyst continuation, and then a very clear way to get bearish large cap tech while keeping your risk low.

Not a Client yet? Become one today to discover the best setups in the market that Wall Street is ignoring.