Rockets At Both Ends Of The Risk Spectrum

Monster moves in a tech behemoth and sketchy China plays. We also take a look at unemployment data, and three setups for Convex Spaces Clients

Ceci N’est Pas Un Bulle

I’ve spent a few weeks considering that large cap tech may be ready for a pullback.

Maybe investor enthusiasm is waning after NVDA reported earnings and couldn’t find a bid.

Maybe productivity gains won’t match the current spend from the Hyperscalars.

Maybe I’ve nailed the top.

And then ORCL comes out with earnings and ramps 26%.

They didn’t even hit earnings! Their backlog of future revenue is up 359%, focusing on their AI cloud services.

Now we’re in a bubble. And until this kind of price action stops, you gotta play the parabolics.

The wild thing here is that ORCL isn’t even part of the Nasdaq. It’s a NYSE listing, and I think this is the first case of a tech AI company that’s not blindly owned by QQQ holders.

On the other side of the risk spectrum, it’s getting crazy out there.

The Chinese Riggers Are At It

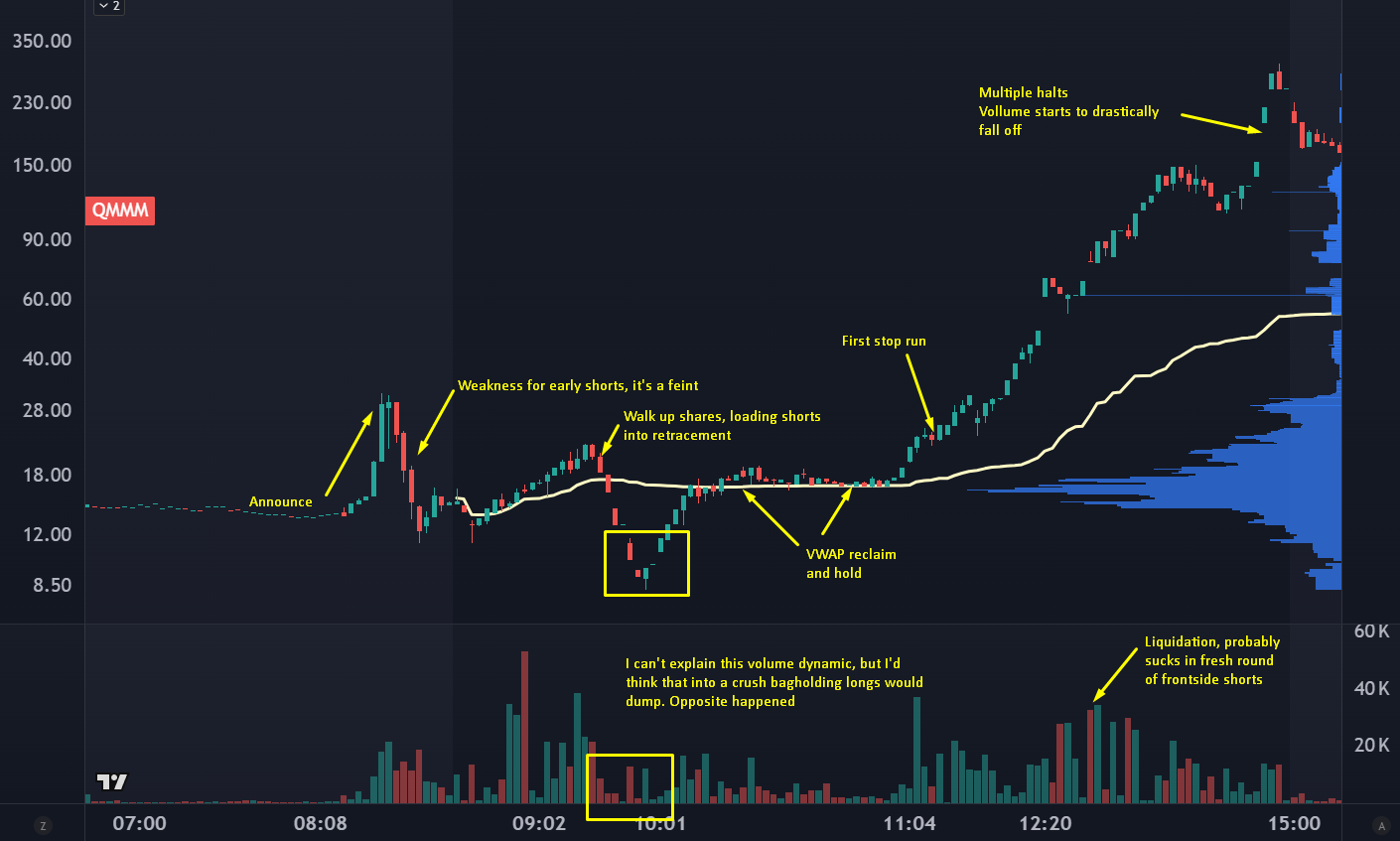

QMMM finished the day at $207. It was at $10 earlier.

You know the playbook. Low float play with involvement from either Macau or Hong Kong. The company announces a crypto treasury holding, they suck in early shorts and then trap the float, not allowing any buybacks.

Into the last hour of the day, the stock traded about 50,000 shares. Shorts got smoked. Again.

Here’s the Narrative on the chart:

There was a similar trade in OCTO yesterday, where the stock was up 5000% above it's prior day close:

I don’t trade these stocks. And if this is the first time you’ve seen these charts, you shouldn’t trade them either.

You can see the “game” being played here. Traders on both sides are fighting to get the best price, trapping each other to push liquidity in their favor, and using the other side’s psychology in their favor.

This game happens in every single market and timeframe. You can find a lot of edge this game as your framework. And the reason most people don’t see the game is that when a market is liquid and efficient, then there’s more noise that is truly random.

But when a stock is in play, or a market comes into a key level, you can get glimpses of the game.

For me, my job isn’t to pick stocks or nail a market top. It’s to bet on the winners of the game.

Maybe They Deserved To Be Fired

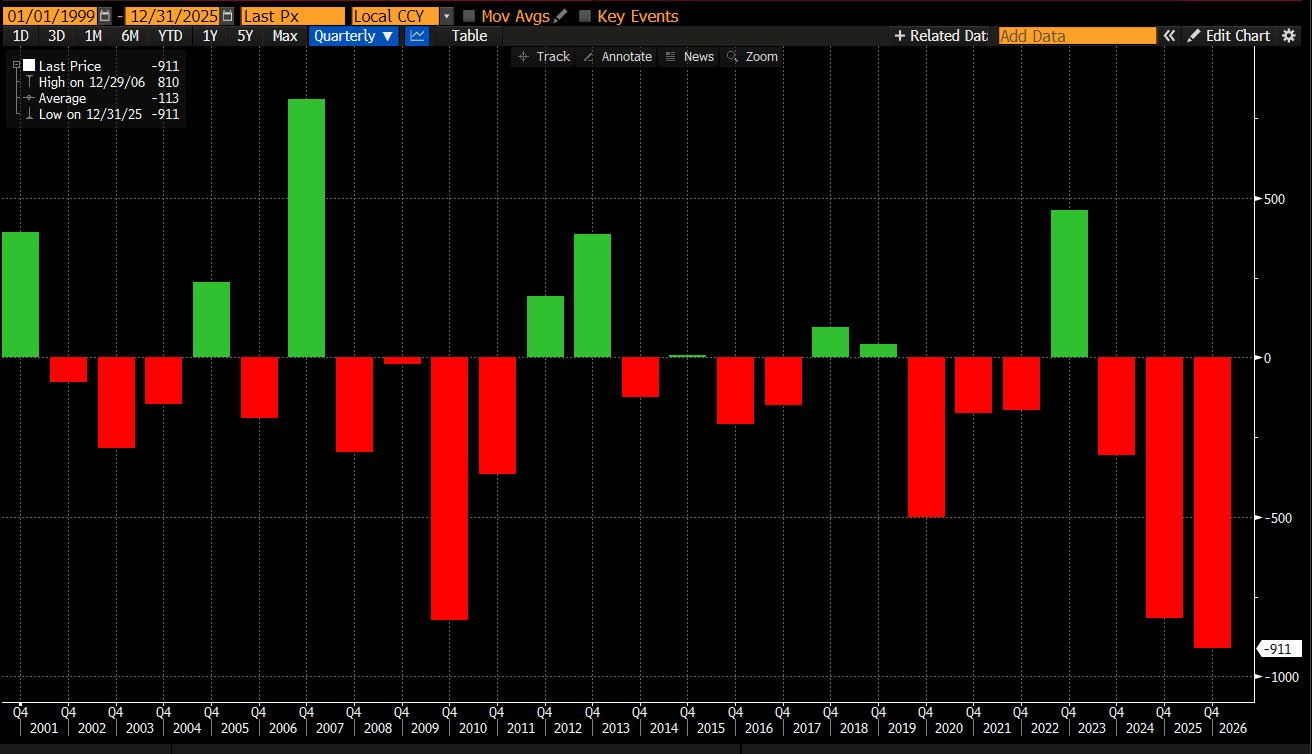

The BLS came out today with a report revising down the jobs data by nearly a million.

For those of us with short memory, a month ago President Trump fired the head of BLS after a completely different revision. Pundits freaked out that it was a political hiring, but after today’s numbers it’s increasingly likely that a Federal organization isn’t competent at their jobs.

The worst case is that they were juking the stats for political reasons.

Either way, it’s looking bad:

At some point this could bleed into the unemployment rate, and it will turn out (again) that the Fed was late to adjusting to the data (again) and market volatility picks up as the market has to price in the ramifications of a faster lower rate regime.

Fed cuts don’t necessarily mean good times for the markets. But as I said above, if we keep seeing reactions to earnings like ORCL, then macro factors are not in the drivers seat.