Slowly, Then Suddenly

Taking a look at the FSD adoption curve and the stocks to trade.

About 20 years ago I was getting ready to graduate college and start my engineering career.

That means, it was time to pad my résumé. I started going to all the engineering club meetings and symposiums I could get my hands on.

One of them was the autonomous driving club.

The DARPA Grand Challenge was in its second year. This was a government-sponsored competition to build out autonomous driving. The competition was set in the Mojave desert, and it was rough.

Self-driving tech was still very early.

VERY early.

(I feel old watching this video. It’s like a different planet.)

In the first competition, no teams finished the course. The two standout teams were from Stanford and, for some reason, Carnegie Mellon University.

Fast forward about 8 years. Carnegie Mellon is now a juggernaut in this space. A tech startup called “Uber” had partnered with the university, but ended up poaching about 40 people to join their self-driving team.

It didn’t work out for Uber. They sold their self-driving unit to a firm called Aurora Innovation in 2020. But props to Uber for throwing a ton of money at the problem, because they helped kickstart the Self-Driving Revolution.

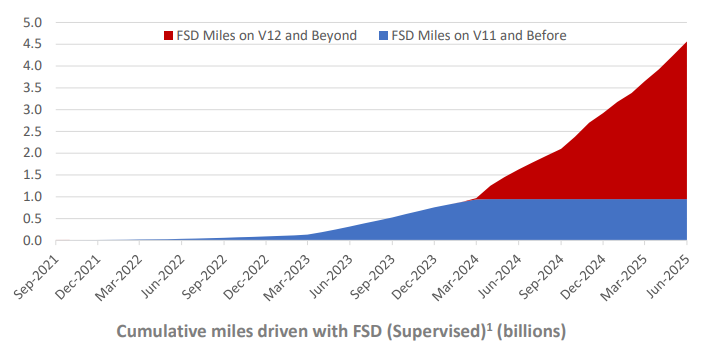

Yes, Revolution. This is going to hit faster than what people think, and global adoption is about to go parabolic.

Underpriced Curves

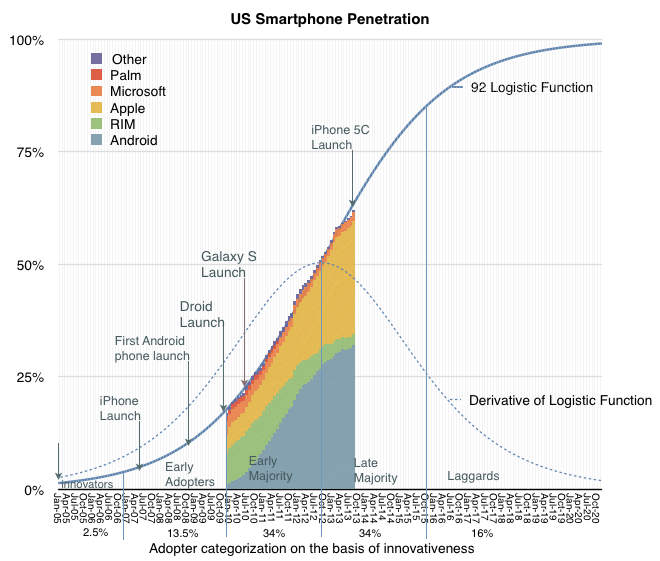

After I left college, I ended up working for a defense contractor focused on exploiting cell phones. 3G had just been rolled out, and the first iPhone was launched just a few months before.

I saw first hand how rapid adoption could hit. The market went from Motorola flip phones to Apple touchscreens in a short amount of time. An entire ecosystem of stocks had multi-year bull runs.

This is when social and mobile lined up to fully build out the mobile application layer. Names like FB, PINS, and ZNGA all had monster moves higher.

Tesla’s FSD rollout is the iPhone moment. The tech has been around for a long time, and iterative improvements were overtaken by AI models effectively “solving” the problem. Tesla’s product is incredibly user-friendly and is starting its parabolic adoption curve.

This is not priced into the market. And just like AAPL and the iPhone release, there’s other companies that are set to benefit from this move.

It’s why I recommended the Jan $20 Calls in LYFT at 0.45, and they’re now trading at 3.10 for a solid 588% win.

It’s why I called out the Nov $8 Calls in NIO at 0.13, which are trading at 0.45 for a 246% gain.

This trade is just getting started, and the adoption curve could be faster in international markets.

For example, here’s a daily chart of GRAB:

This company’s rolling out robotaxis in Singapore. Dense urban Asian cities are going to completely transform within a year.

Second order effects are going to be just as massive. In the US, the lifetime risk of dying in a car crash is about 1:100. That’s an incredibly high rate! I’m sure you know people who have died in an accident.

Self-driving drastically reduces the risk of all accidents. Economic costs are about 1.4% of GDP.

It’s a massive societal value unlock. It reduces demand to purchase cars, and insurance premiums could crater, which frees up cash to put in other places of the economy.

Building the FSD Watchlist

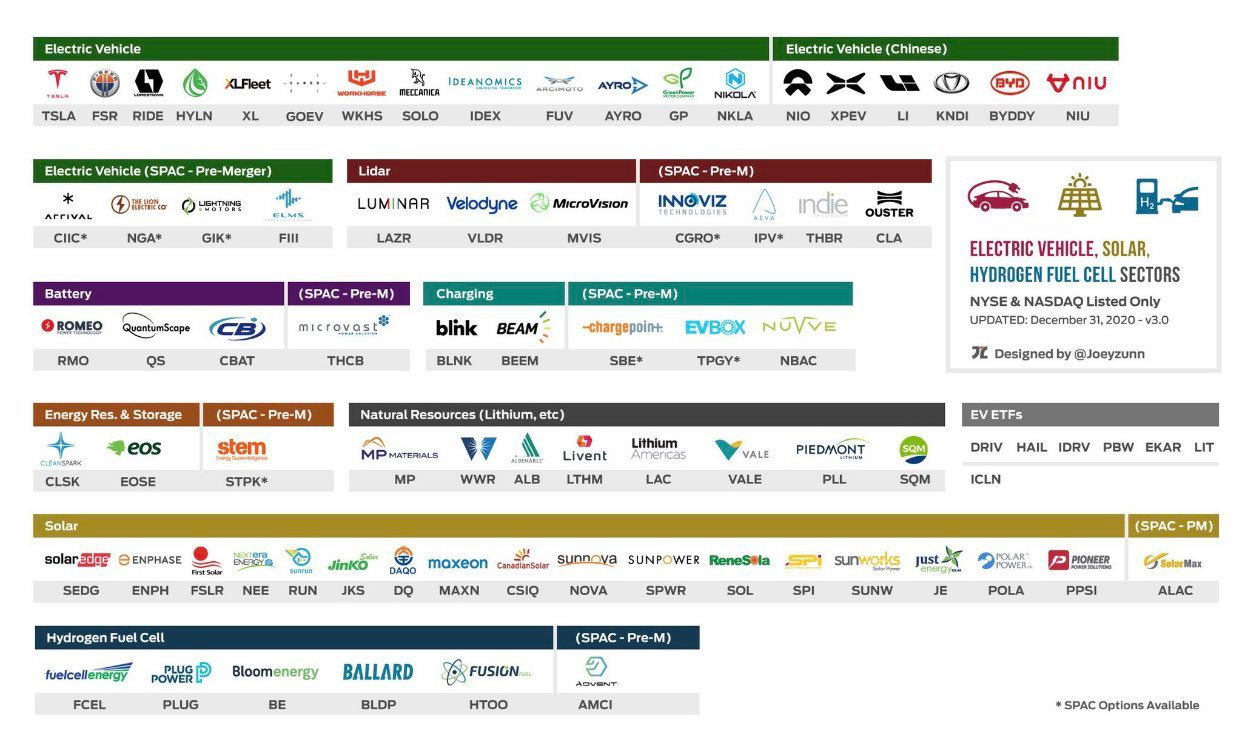

Back in 2021, a hot trade was in electric vehicles, and a (now defunct) twitter user made this infographic:

Some of these names have gone bankrupt. Some have seen so much dilution they’re not getting back up off the mat.

Others have survived and are hitting new highs. It’s a good time to build out a watchlist… or you can become a Client of Convex Spaces and I’ll hand you the best opportunities I see in the market.

If you’re not a Client yet, you can sign up as an annual subscriber for a discount. This is available for just a short amount of time.

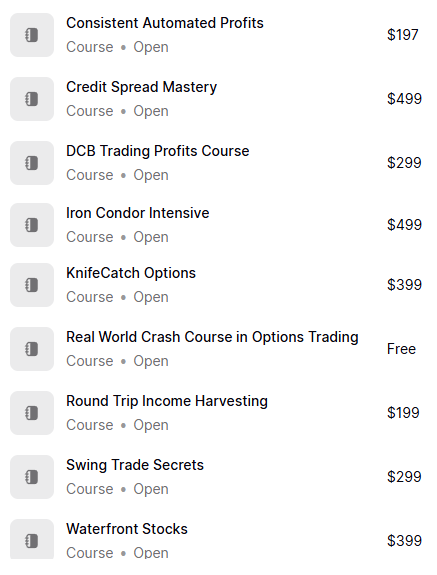

And if you signup today, and send me a chat message, I’ll get you access to every options trading course that I’ve ever made. Here’s the list:

All of this training is available to you when you become an annual Client. To join and get the special discount, go to convexspaces.com/deal

If you’re already a Client, then we’ve got some solid setups for you, including what I think is the best way to play the Fed event this week.