The Coca Cola Market

How the market will trade, correct, and ramp into the rest of the year.

We’re hearing the word “bubble” show up in the media now.

Paul Tudor Jones went on CNBC and talked about how the stars are lining up for a 1999-style run.

And the debate about quantum started to heat up as traders on X started investigating the headquarters of quantum companies and they came up lacking:

I’ve war-gamed out a trade thesis that I think is the most likely path for the market. You’re going to learn the shape of the trade, but the timing and magnitude are still to be determined.

This is my primary lens through which I will be speculating in the markets into the end of the year, and it will be useful to you no matter what market or timeframe you’re playing.

This is Not a Bubble

There’s a subtext in PTJ’s comments. He says we are “set up” for 1999, not that we are in 1999 currently. He’s right.

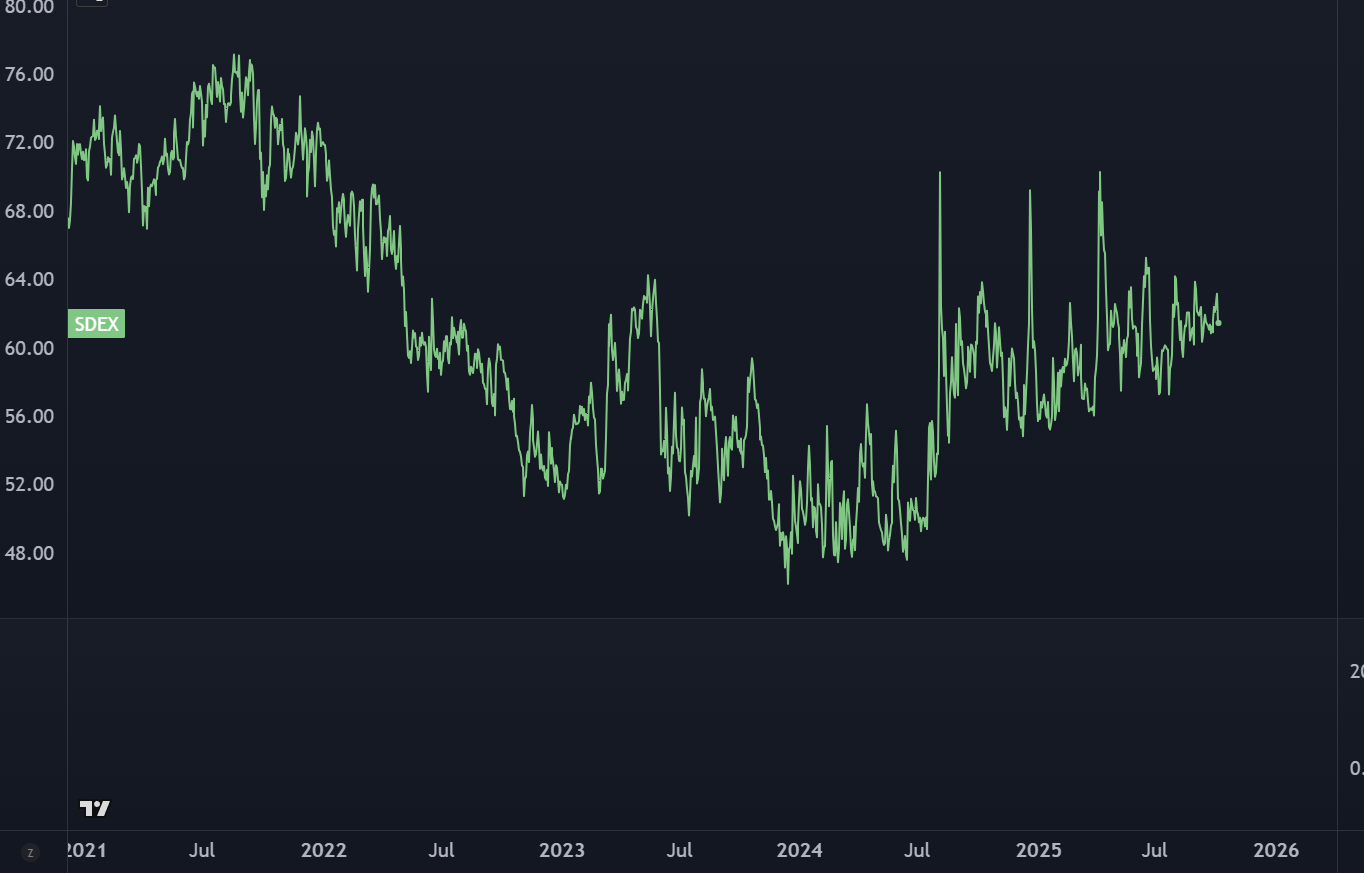

This is the Nasdaq with a disparity index, which shows you the percent distance between price and a key moving average. In this case we are looking at the percentage distance away from the 12 month average.

It’s much more difficult for the Nasdaq to go parabolic now than in 1999. Markets today are driven by the options market, and it leads to these rotational, grindy bull markets that never really see a blowoff.

Even if the stats don’t back out, it feels like a bubble, right? It depends. You’re reading a niche substack about options and markets, so you may have some selection bias.

I’ve been seeing a ton of brokerage screenshots posting massive gains on a robotics or aerospace company. Odds are you see it too.

Go check “normie” social media. Back in 2021, people on facebook were talking about their massive market wins— and they had no business giving advice about investing.

We’re not seeing the same kind of broad mimetic energy anymore. It’s localized and concentrated.

This isn’t a bubble. It’s a lot of small bubbles.

Tap The Glass

Imagine a glass bottle of Coca-Cola. Like the ones in the commercials. Ice cold, refreshing, and plenty carbonated.

When you open the bottle, lots of little bubbles start rising to the surface. Eventually it slows down. But if you take a butter knife and hit the side, then a new round of bubbles pop off the sides and rise to the surface.

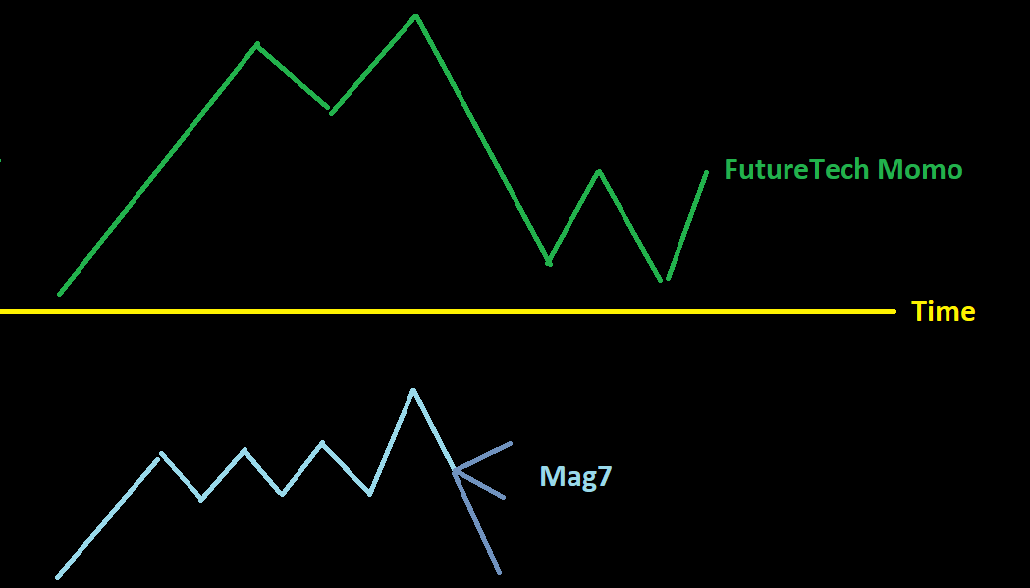

“Hyperscalar AI” is the Coke. The market proxy for this is the Mag7 stocks.

And when we get a new big AI headline, the headlines “tap the glass.” A bunch of mini-bubbles form. Sometimes themes join and rise even faster due to expanded surface area.

Back in 2021, the market took the bottle and shook it before it opened.

And in 1999, a mentos dropped in the bottle.

We’re not in that kind of market. At some point, the Futuretech stocks must justify their price levels… either confirming the narrative through growth, or through enough deal headlines that completely blow shorts out of the water.

Some of these bubbles are going to pop. But it’s not going to kill the market.

Rotational Supports

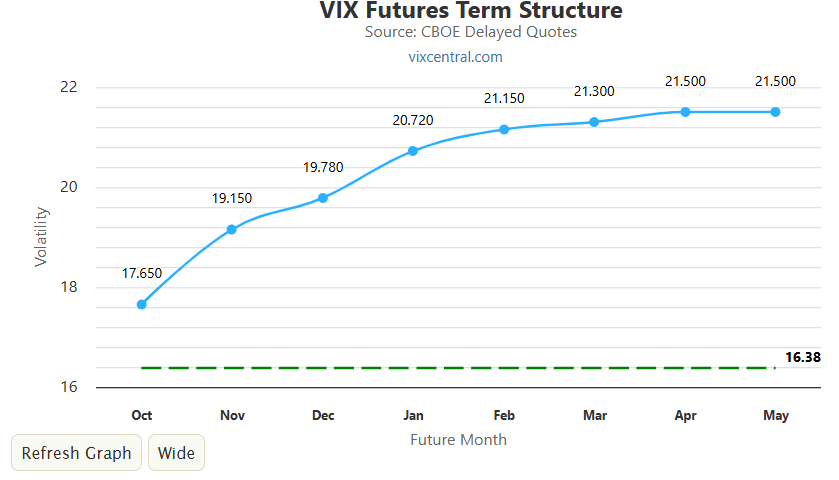

In large-cap land, the hedging complex is still rich. SPX is at a single digit vol while VIX products still act like another tariff headline will kneecap the markets.

The Nations Skew Index shows that OTM puts are still at a premium.

There are market participants who think that buying QQQ puts will protect their trade in IONQ. Or hedgers who have seen all the parabolic runners and go buy protection in the VIX markets.

It’s not going to work!

The Mag7 stocks have been in a correction for 3 weeks. META and AMZN have had a hard reset, and MSFT just started to lift off its lows. NVDA retested its breakout level and held.

Part of the sticky bid in large cap tech has to do with the overhedging in index and VIX products. And the only way a sustainable top gets put in this market is if the VIX finally caves to pressure and establishes a new lower regime in 12-15 instead of 15-20:

The most likely market outcome is the one that will disappoint the most market participants.

Stale Drinks

If you leave a bottle of soda open long enough, it starts to go flat. It still has some fizz to it, but it’s been diminished. The bubbles rise just as quickly, but there are fewer of them.

There are still pockets of this market that have plenty of room to run. And a few of the obvious shorts are going to jam another 500% before the shorts are forced to cover.

(Most likely quantum. Lol.)

We are at that point in the cycle where it makes sense to tactically short some of these hot areas. It doesn’t have to be full-blown bearish scenario, just that if we have a broad “risk off” event (remember those?) then your other positions will be fairly well protected.

It’s is a much better option than buying QQQ puts straight up.

That’s the first part of the Disappoint Everyone correction. The second will be when the index puts don’t pay out.

I don’t think a 50% pullback in a Futuretech bubble is going to hit the Nasdaq, much less the S&P 500 that hard. There could be a 5% correction but it wouldn’t be the end of the world for most traders.

That’s when all of that expensive insurance starts to grind to dust. Those 10% OTM SPX puts in November weren’t actually sensitive to downside price action, and investors will start to close them out just to get a small profit.

Are we setup for a bear market into the end of the year?

Well, which market?

For momentum traders that turn into bagholders, it’s going to be a massive sentiment shift. For passive investors, they just open up their YTD statements and still see an incredible 12 months.

My MSPaint Framework Into 2026

Here’s how the Coke Bottle trade will play out.

We’re going to see momentum traders get kicked in the teeth, and large cap hedgers end with less protection than they think. Mag7 earnings will be a decision point, and is the most likely cause of any future vol. If not, vol could get crushed into the end of the year.

Note that I’m not giving a specific timeframe for this. My guess would be something like 2 opex cycles of a reset. I’m not sure this mechanic has started, but we’re starting to see a few spaces with awful price action and look ready to trap some longs.

During this time, there can be some emergent themes that can go on runs, but most traders will be distracted trying to trade out of their favorite AI infrastructure company instead of playing the obvious momentum in the crypto space.

How To Trade and Invest In The Coke Bottle Market

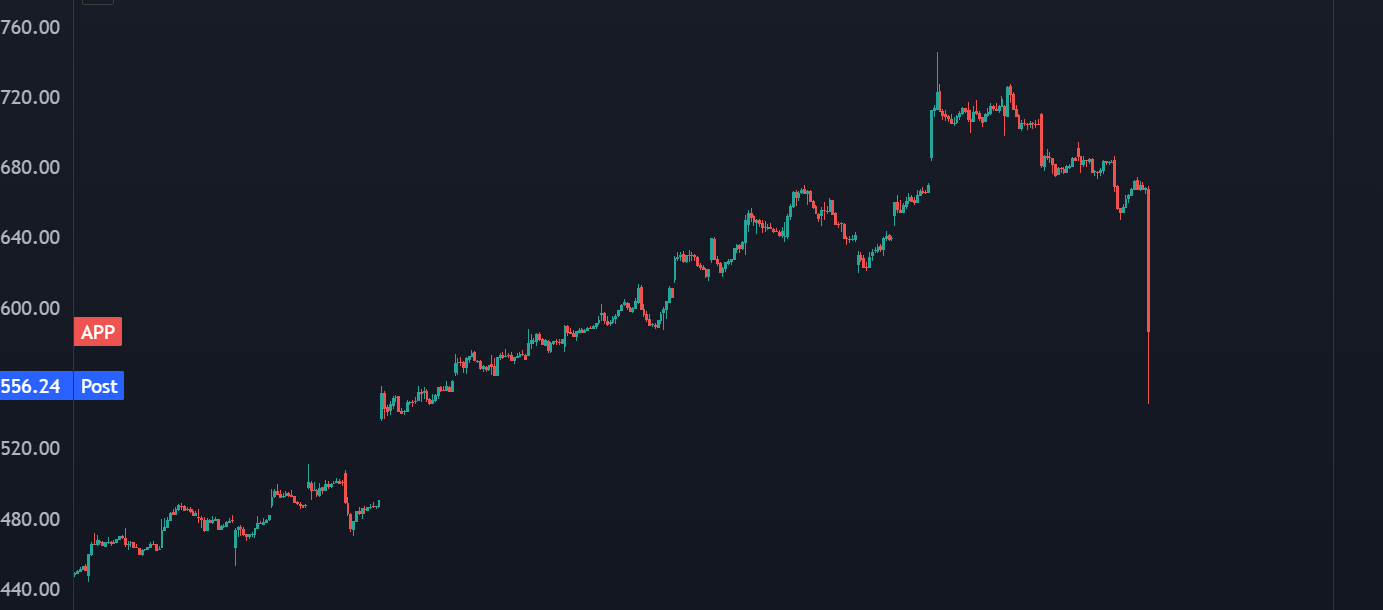

Our core thesis is that there will be aggressive rug pulls in some of the momentum darlings, due to length of cycle, sentiment, and price action.

And that’s what these stocks do! They get cut in half all the time. The current leaders don’t have to be 2026 leaders. Remember CRCL? Or CRWV? Or HIMS?

If you want an example, APP just lost all of its gains from the September gap higher:

The second core thesis is that the broad markets are not setup for the same kind of rug pull. There are still structural tailwinds in both narrative and liquidity for the Mag7 Names. That means if you want to take on index hedges, trade structure matters. That also means buy the dip.

A Bump In The Curve

The Nasdaq has been above its 50 day moving average for 108 days. Over 5 months. This doesn’t happen often. Yet it’s not an incredibly bearish setups, just higher odds of reversion.

We’re still investing in the Exponential age. Investor attention is going to laser focus on robotics as they’re getting rolled out, and while it’s easy to be skeptical of all the AI Capex, I can easily envision a scenario where their ROI hits faster than what the market is expecting.

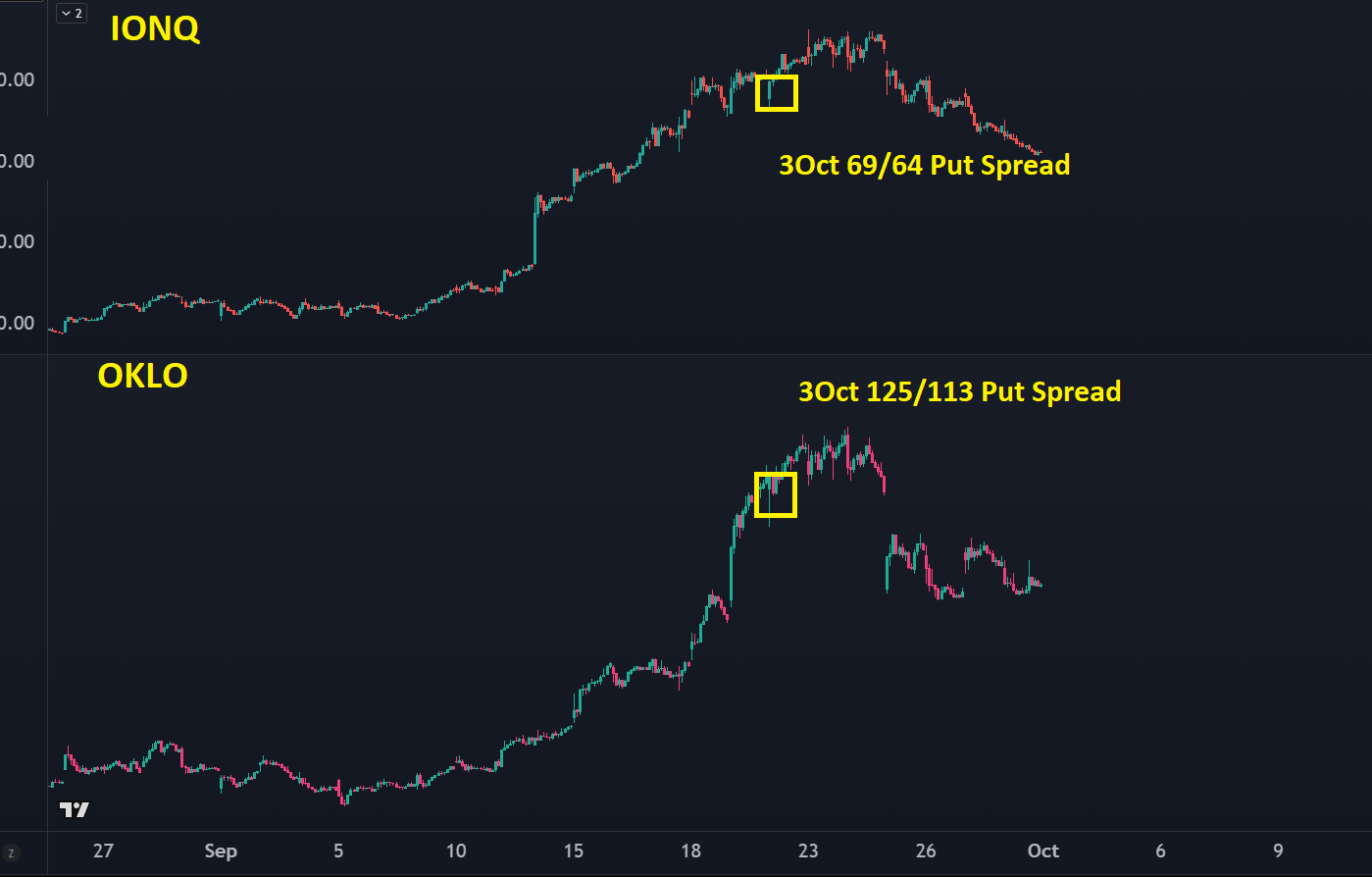

For our trade setups, we’re going to look at a basket of momentum stocks that are showing signs of overextended prices relative to the liquidity that can support them. The last time we took trades like this, they both paid well.

We’ll also take a look at two sector rotation bets, and a crypto momentum trade. Our most recent crypto bet was in BMNR, with the call spread currently up 30% and looks ready to rip. This time we’ll be crypto native about it.