The "Degen Investment" To Play The Solar Turnaround

The U.S. removing clean energy subsidies is "peak narrative" for the solar bear market. How I'm looking to play the Electron Arms Race

Last week, the US House passed the “Big Beautiful Bill,” which removes many of the tax credits that solar companies were relying on to keep the lights on at their companies.

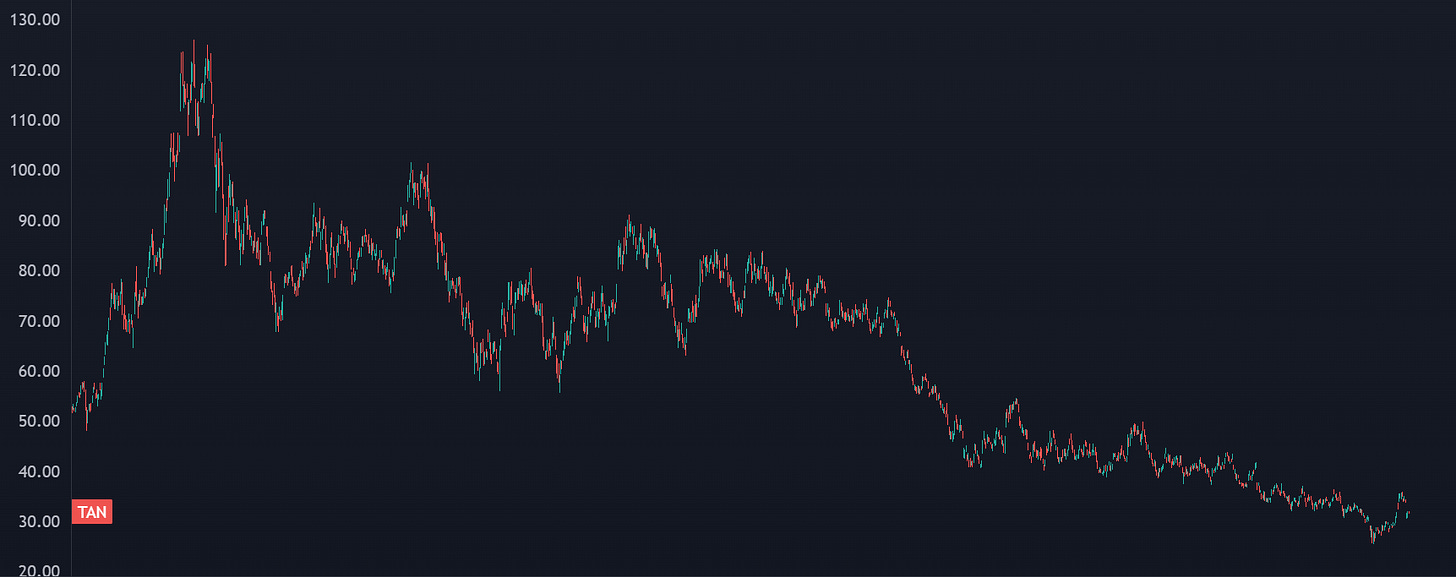

It led to a gap down in TAN, the solar energy ETF, but it held its lows against a key pivot level from back in March:

What gives? If the solar industry is going to collapse because of the government pulling away the punch bowl, how is the industry finding buyers?

Because it’s old news. Everyone knew that it was coming. In fact, the entire solar industry has been in a multi-year bear market:

75% off the 2021 highs. That’s how bad it is.

For good reason.

Some of these companies could not justify their valuations, and there are plenty of solar projects that have no business whatsoever being started. They’re clear-cutting forests in northern climates to slap down photovoltaics— which is lunacy and only works if a government is subsidizing the project.

Prepare For The Turn

We’ve got an industry stuck in a multi-year bear market with a bad news dump that isn’t causing a massive cascade lower in price.

That’s a signal. The Bottom may not be completely in, but it’s now time to look at prior assumptions on what upside is possible.

Larger solar stocks have already started to see capital flights back into them.

First Solar (FSLR) recently went parabolic on volume, showing us that there’s some appetite for these names:

I’ve found a name that’s a smallcap solar stock.

We’re talking a tiny valuation, with plenty of room for upside.

It’s a name with actual signs of a turnaround, where costs have been significantly cut, there’s signs of persistent revenue growth, and a solid backlog that could get them into a much better position very soon, and I expect it to be reflected in the stock price.

The cherry on top? It’s a tiny float, which means it can squeeze on a dime.