The "Four Letter" AI To Predict The Next Biotech Winner

The New Tech to Completely Upend the Biotech Investing Model

Lycos. Altavista. AskJeeves. Dogpile.

These were the early search engines, back when we still called it the “World Wide Web.”

It was incredibly competitive and cutthroat, and it was a few years before Google rose to domination.

The AI space is giving off the same kind of vibes.

Grok3 was released recently, and it’s quite good. OpenAI is rattling the sabers with GPT-5, and the rest of the AI ecosystem is accelerating to capture market share.

These are all “Large Language Models,” or LLMs. They hoover up as much text and code they can find, apply some weights, and give the end user the most likely combination of words for the prompt that was provided.

All in English.

Yet there’s a new AI out there that’s working off a different language. One where there’s only 4 letters.

The Tree of Life, Decoded

Stripe is a payments company that was bootstrapped by the Collison brothers, and is now sporting a valuation around $85 billion.

Patrick Collison took some of that cash and helped co-found the Arc institute, a biomedical research org that works with Stanford, UC Berkeley, and UCSF.

Last week, they released Evo-2, a Large Genetic Model (LGM).

Arc took the genomic sequencing from over 100,000 different species and threw it into their model.

Only four letters - A, T, C, G. The building blocks of life.

It’s incredible what they’ve been able to do with it.

For example, the model only has a single human genome in the model, yet it can predict how the BRCA gene mutation could lead to human breast cancer.

We now have the possibility of bespoke genetic therapies, novel drug discovery, and epigenetic research. Which is all incredible, world changing technology. But that’s not why I’m excited.

It can create new genetic sequences from scratch. We’re talking full blown synthetic biology.

Do you know what that means?

WE’RE BRINGING BACK DINOSAURS

JURRASIC PARK IS GOING TO BECOME REAL

And the best part? The entire project is open source. Not just the model, but the training data and the weights that they used.

Anyone can use this technology. Including publicly traded biotech firms.

Strap In, Biotech Investors

Faster and cheaper. That’s what a disruptive technology like Evo-2 can do to the biotech space.

And it’s not priced into the markets. There’s a massive edge.

Here’s how the “traditional” model works for biotech investing:

Find a company with a promising drug

Put some money into the stock, and spend weeks or months being disappointed as the stock drags lower due to cash burn and lack of liquidity

Hopefully take some profits into an FDA event before the company dilutes the crap out of their stock

The model doesn’t work anymore. Financial speculators don’t have to wait for FDA results to see the efficacy of a treatment— they can plug it into an applied healthcare AI to see if the mechanism is going to work.

This holds doubly true for any companies working in immunotherapy or genetic treatments.

Expect biotech stocks to see more volatility and trend before FDA events even hit, because information arbitrage is going to collapse, and this causes large price moves.

It’s Not About The Drug!

A few drugs in a pipeline is not going to be a viable model going forward. The value proposition in biotech is now about the ability to have a “launchpad” to quickly discover and develop new drugs.

I’ll provide two companies I’ve recently recommended to my clients. We’ve already scaled out of some profits, yet I think the upside could persist based off my thesis.

RXRX - Recursion Pharma

This isn’t a biotech company— it’s an AI company with a biotech arm. They have Recursion OS, that integrates live experiments, computational biology, and machine learning to screen and develop drugs.

They’re not trying to hit the lotto on a single drug. Instead, they’re going through thousands of potential drug candidates and finding the treatments with the highest efficacy to get through FDA trials.

They can move fast, use less cash, and get more drugs to market than a traditional model.

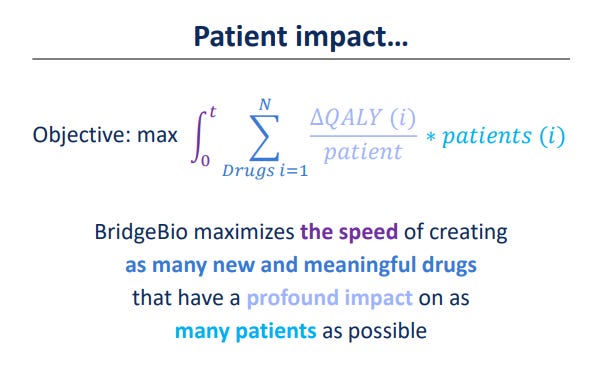

BBIO - BridgeBio

A slightly different model than Recursion— they use a “hub and spoke” model where they have centralized key parts of the business, then spin out smaller companies that target a specific theraputic.

Any company that puts this in their pitch deck is worth a look:

They’ve got some FDA approvals under their belt, and it appears they’ve got a good flywheel of drug discovery and development so you don’t have to worry about the dilution trap seen in biotech so often.

What happens when BBIO adds a genomic research AI assistant? How much upside is not priced in?

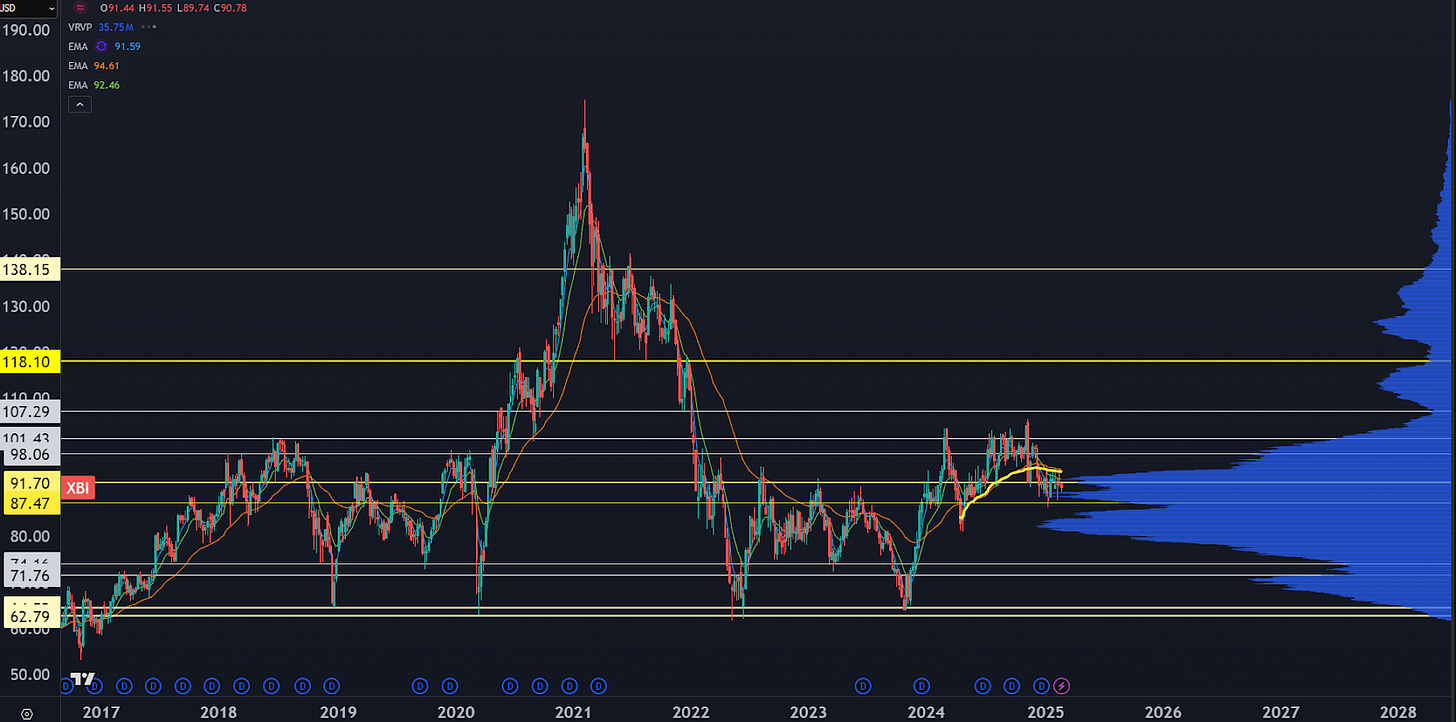

Prepare for the Turn

As a group, biotech has sucked for years. XBI has been stuck in a trading range for well over a year.

High interest rates don’t help… money isn’t cheap, and neither is funding trials.

There’s also the FDA and the uncertainty around the new regulatory environment.

These are “rear view mirror” risks. In the future, healthcare AI models are going to give investors a predictive ability as to what therapeutics will have the best outcomes before the trials complete.

I’ll be watching for relative strength and “surprise momentum” in the biotech space. If a stock starts catching a bid with volume, and there’s no catalyst anywhere close, that signals that some market participants found value in a company using Healthcare AI.