The Hundred (Thousand) Dollar Roll

Hidden breakouts from the recent trade deals, why Bitcoin is now tied to quantum stocks, and how the US fiscal situation will be fixed by a bunch of losers.

Crypto markets are being liquidated on what appears to be zero news.

Bitcoin is flirting with becoming a “five-figure” asset again:

Markets aren’t efficient, and they’re driven by investors who anchor on key prices. For example, when a stock is trading at $95 for the first time, there’s a high odds that it will trade to $100 because nobody wants to sell until they hit a nice round number.

So if BTC investors open up their wallets and see 99,999 on the screen, they’re going to feel terrible.

This is the risk of building the DeFi-TradFi bridge. As more ETFs have come online, as more crypto treasuries are listed, this puts crypto markets at the whims of Wall Street trading.

More liquidity means range. It means reversion. It means you’ll be disappointed 80% of the time and rewarded the other 20%.

Just like other risk assets. Shocker, I know.

I’m sorry crypto bros, but you’re now just part of the “risk on” liquidity bucket. So when RGTI gets killed, and PLTR fades on earnings, you’re going to see crypto correlated to those moves.

You also have continued adoption of HILARIOUSLY HIGH LEVERAGE, with some perpetual futures offering 50x to trade. It’s ghost liquidity… you think it’s there until the rug gets pulled and all of a sudden the bid size on the order book is thin as a wet tissue.

There will be a point where it will make sense to play this for a hard bounce. We’re not there yet. Mid to low 90s for BTC, and ETH as it heads into 3k.

The best structure here will be long out of the money calls. What happens during these selloffs is that the degens finally take a break from buying a bunch of calls, and they end up very cheap.

I’m still bullish, but I’d love some more blood in the streets.

Hidden Deficit Reductions

There are three inflations: monetary, fiscal, and government incompetence.

Part of the China trade deal is curbing Fentanyl precursors, as the cost of the Opioid crisis is now sitting at $1.5T per year. It’s a cheap fix that leads to stimulative effects in the economy without having to expand government spending.

Another win that could hit is in healthcare.

The Trump administration is working with GLP-1 providers to get the cost of these drugs down to about $149 per month.

I’m a huge fan of the peptide space, and have been for over a decade. There’s some issues with too high of a dosing, but done well it can significantly reduce obesity and other inflammatory markers.

If you’re still thinking of semaglutide, that’s old news. You’ve now got trizepatide and retatrutide that are truly game changing.

When you include broad economic impacts, obesity costs the US $1.5T per year.

These numbers start to add up! You get cost savings and that cash can go to other parts of the economy. It’s easy to get bearish on the US fiscal situation, but all of these non-traditional wins start to add up.

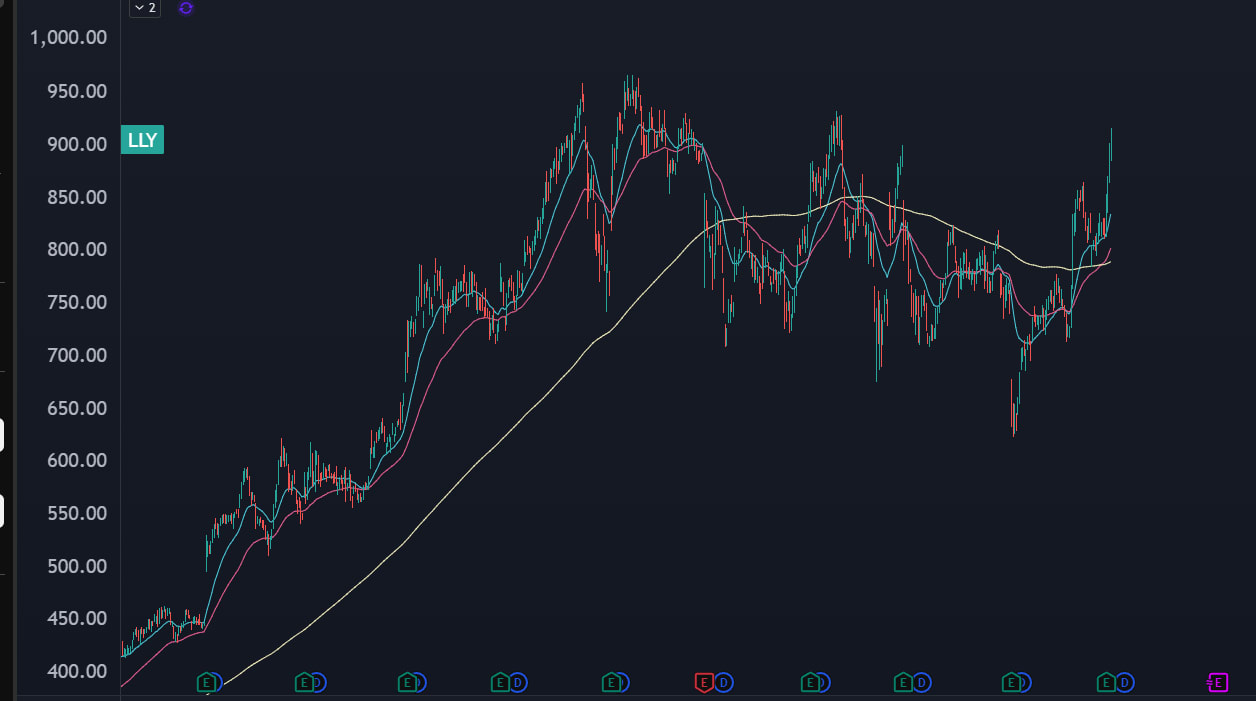

And just like that, Eli Lily (LLY) is back from the dead:

Meanwhile, Commodities

Soybeans are clearing a multi-year range as China announced that they’re upping purchases as part of the trade deal.

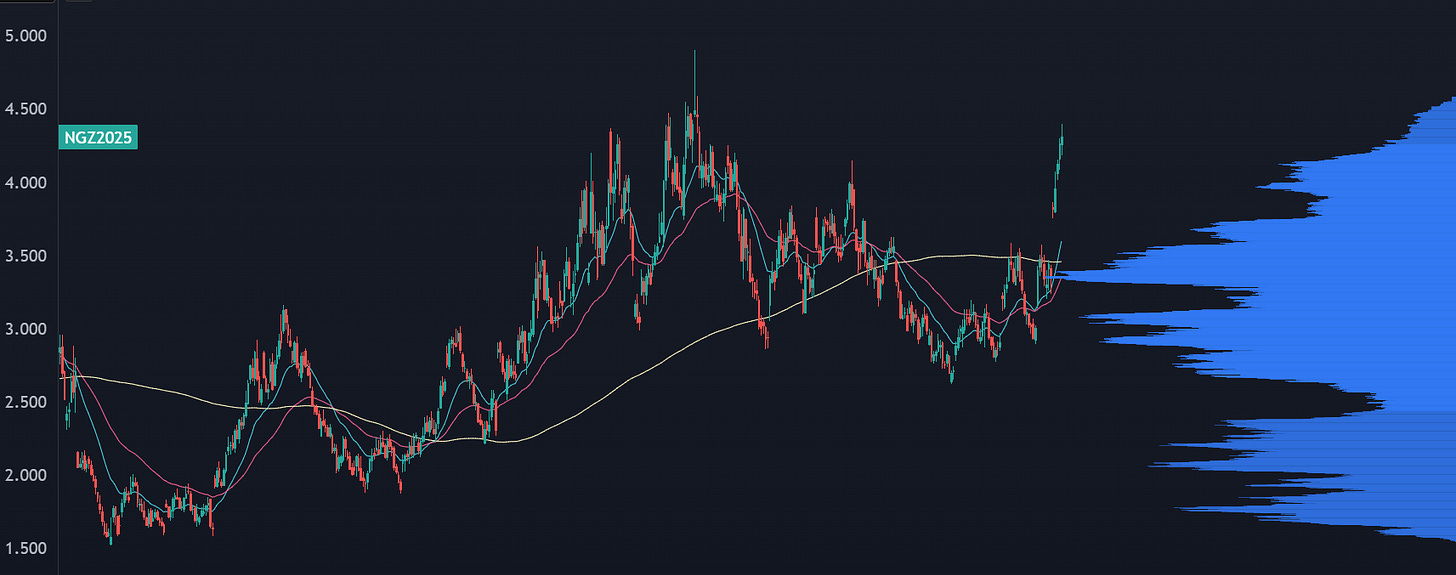

There’s another space that I’ve been stalking all year for some kind of a signal… Natural Gas:

In June, Japan’s leading utility company committed to tripling natural gas purchases from the US.

In August, the EU signed an agreement to buy $750B in energy products, with the majority being LNG.

In October, South Korea agreed to buy 3.3MM tons of LNG.

This trend is still early, and the recent run in natty is the first time I’ve seen price react to these deals.

A monster trade this year was investing in the AI ecosystem. Not just chips, but HVAC/cooling, data centers, power, turbines, the list goes on.

I predict that next year we will se a large markup in the natural gas supply chain. You’ve got export terminals, LNG tankers, pipelines, and other distribution.

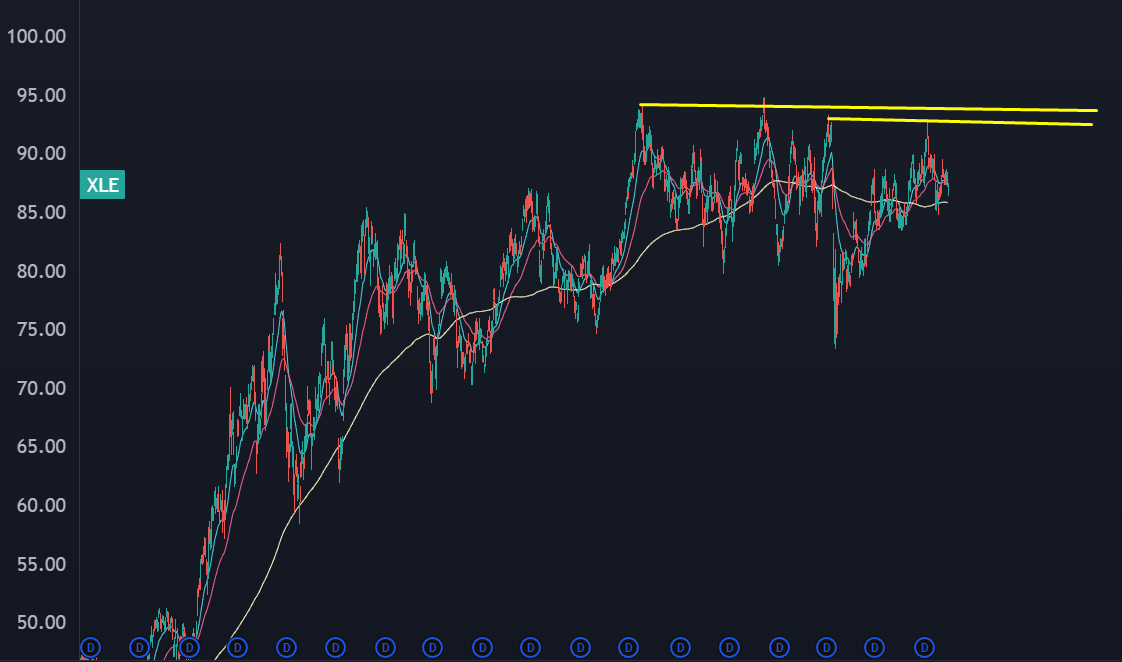

Maybe, just maybe, we could see a big breakout in large cap energy stocks:

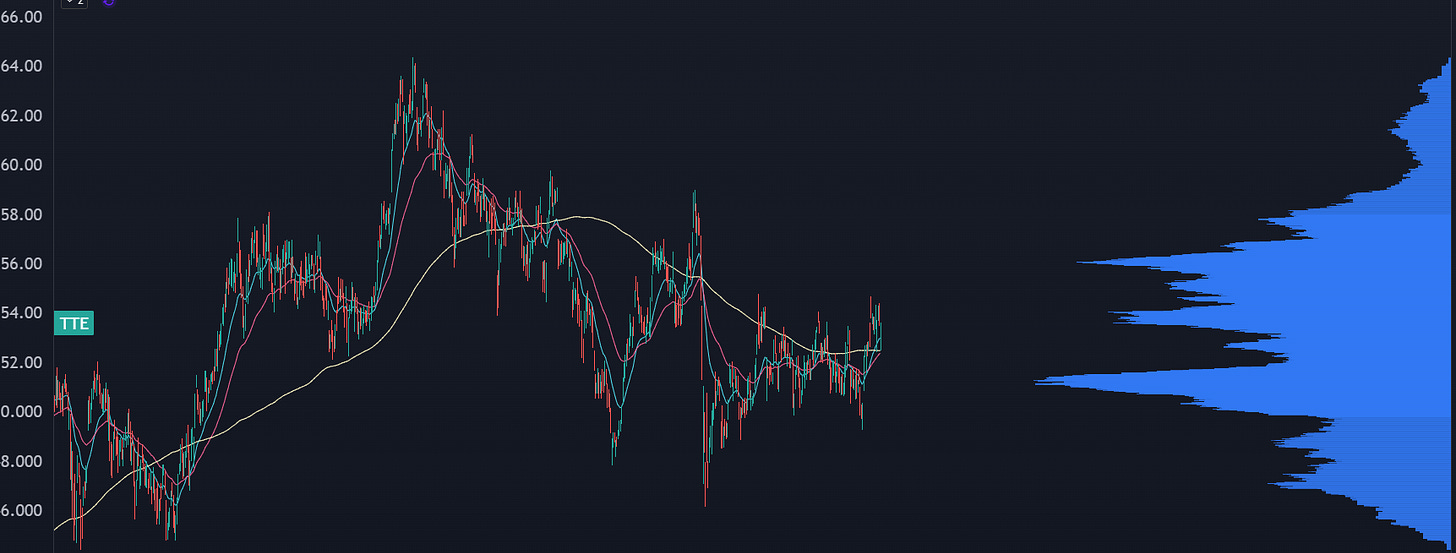

And there’s other names that also have traded in garbage ranges and may be ready to trend.

For example, here’s TTE, which reclaimed its 200 EMA:

Or GLNG, which took me for a ride on the failed breakout above 43, but a second push should get it going to 50 bucks:

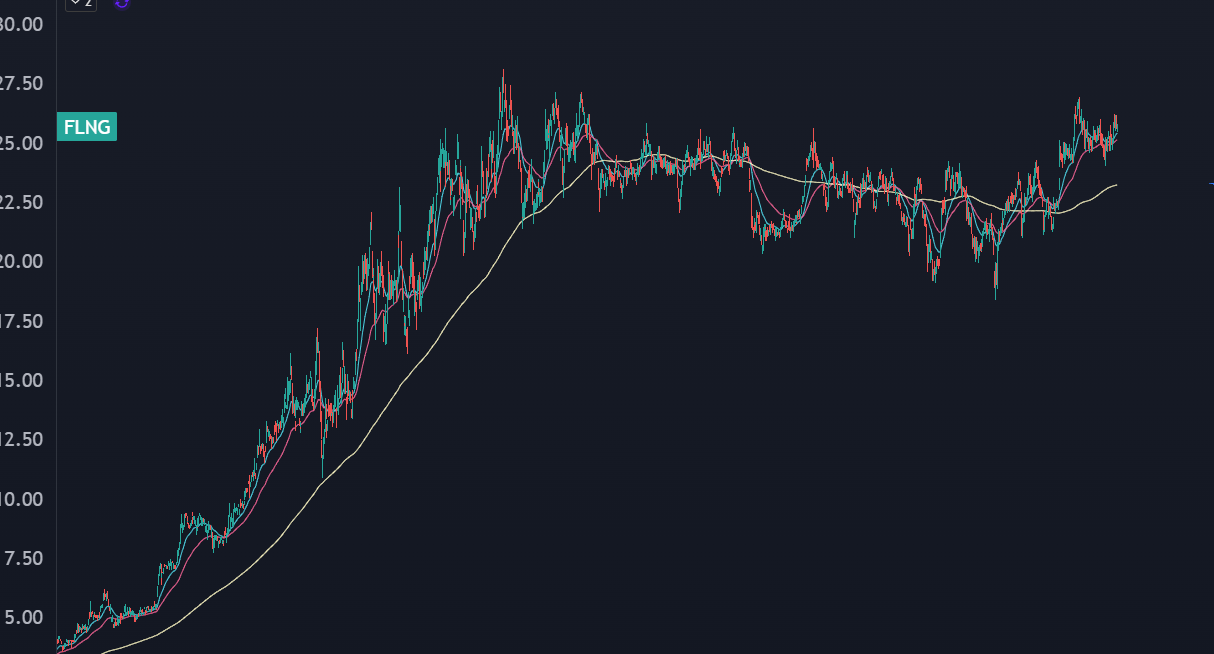

Maybe FLNG, on a multi-year breakout:

We might get some solid trending markets in the energy space again. And it’s an easier trade than trying to nail the bottom in quantum stocks.