The Nasdaq Just Did the Funniest Thing Ever

You're Now A Crypto Trader Whether You Like It Or Not

A small headline crossed my screens this week that made a few waves in my trading groups, but seems to have been lost in the noise of the markets.

Yet it will evolve into one of the most significant narratives in 2025. I want to tell you early so you can thank me later.

We are going to get to the “Microstrategy Problem” in a moment, but I need to lay scaffolding out first as to why this is a big deal.

You’ll hear about why I took a losing trade, the mechanics behind it, and how the MSTR news is going to lead to a much more fragile stock ecosystem going into 2025.

Why Do You Buy?

Traders love to argue their own dogmas. You’ll have the pure chartists that tell you the only way to earn a living is to buy when a signal hits. Then you’ll get the fundie traders, searching for GARP or value or “factor investing.”

It’s all bad framing.

The only thing that matters is liquidity. Unless an asset sees an infusion of liquidity, price doesn’t rise. And price can only stay up if there is persistent marginal liquidity infusions over time.

How Liquidity Comes Into the Market

Catalysts - things like earnings events, FDA catalysts, or PR

Narrative - shifts in the perception of risk in the stock, usually driven through fundamentals, but can also be sentiment

Liquidity - this isn’t just “technical analysis,” but also option flows and institutional positioning

I’ve found what works best for me is understanding all three in a holistic model, and it was why I was willing to gamble on a setup.

Bet On a “Liquidity Jump” With This Trade Setup

There’s a liquidity trade in the markets called index inclusion.

You have indices like the Russell 2000, S&P 500, Nasdaq 100, and the Dow 30. All of these indices have different compositions and will trade differently from one another.

Here’s the dirty secret about index investing— you’re still picking stocks, but you’ve outsourced the work. The composition of these indices is by committee.

The S&P has the U.S. Index Committee.

The Nasdaq has an internal selection process.

The Dow Jones is selected by three S&P representatives and two from the Wall Street Journal.

That’s right— if you buy the Dow 30 you’re putting stock selection in the hands of bureaucrats and the “high priests” of finance.

For the most part, it works. Winners stay winning, allowing index investors to benefit from broad gains in the markets. Passive investing is simply momentum investing on a very long time frame.

Every once in a while, these index committees will make some changes to their index composition. They’ll kick out some companies that are underperforming, and bring in new names.

Here’s where it gets fun. Fund managers that track the S&P 500 will need to push liquidity into the new stocks that have been moved into the index.

And if you pick the right horse, it can pay out big. Like what happened with Workday (WDAY) after it announced S&P 500 inclusion:

A 10% gap higher could be amplified with short term options. A big overnight win.

I didn’t pick WDAY, I picked SQ which didn’t make it in, so I took a loss on some call spreads.

Was it a gamble? Relative to more rigorous approaches it could be viewed as such, yet the entire trade thesis makes sense when you approach it from a “liquidity-first” framework.

This isn’t about the S&P 500, however.

The Nasdaq 100 Is About To Get Weird

Before the S&P inclusion news, I made a half-joke on X:

It’s impossible, of course. There’s very specific criteria that wouldn’t allow MSTR to be added to the S&P.

The Nasdaq doesn’t have those rules.

MSTR is now in the Nasdaq 100.

This is a watershed moment.

Think Three Steps Ahead

In late 2017, the market went parabolic.

That’s not a squishy term— the rate of change increased, forming a parabola shape:

This rally pissed me off. I had some “neutral” option trades that ended up net short and I was getting run over.

In February 2018, the market crashed.

There was a trading product called XIV that let you get short volatility exposure. The trade became so popular that the liquidity flows inverted, and short vol drove the markets higher.

Short vol until it doesn’t. The VIX market exploded, XIV got blown out, and the short vol complex crushed the equity markets.

It was the Volpocalypse.

This is a big lesson: Derivative flows end up affecting the price of the underlying asset to the point that the derivative becomes the primary asset.

After this event, the “wag the dog” mechanic migrated instead of disappearing. It’s how GME was able to have its rally. Everyone started talking about “gamma squeezes” and “flow.”

It’s been amplified. Short term options trading has increased to the point that the derivatives market is the now the real market.

Microstrategy is going to take this mechanic and accelerate it.

How To Make A Ton Of Money Trading The Indices

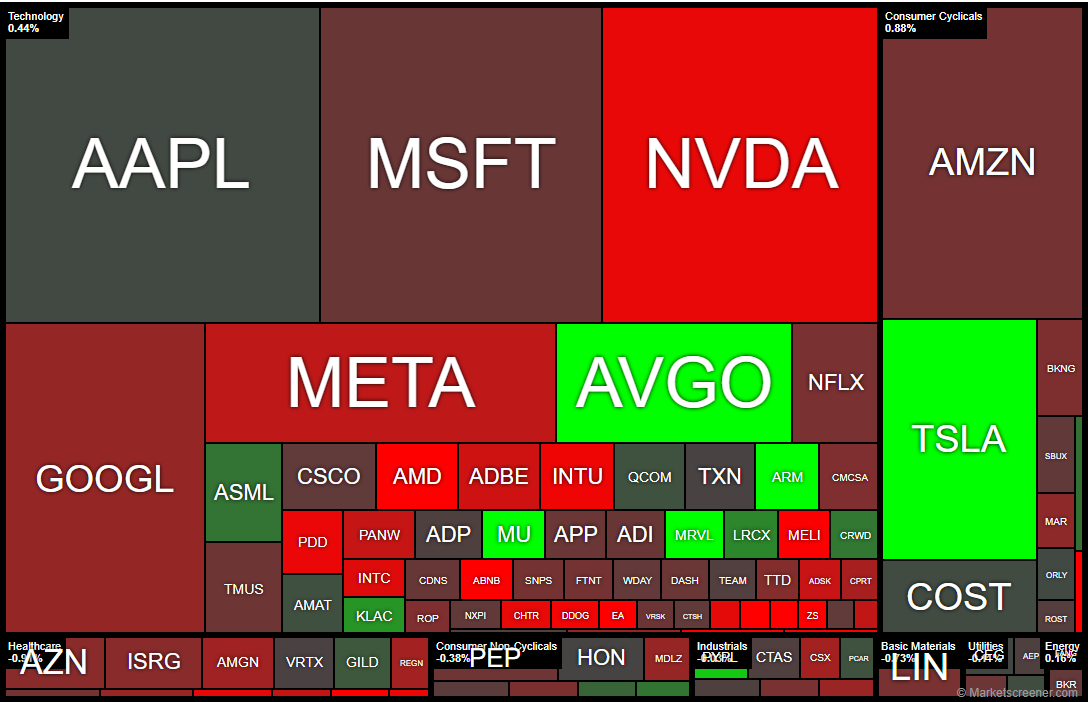

This is a heatmap of the S&P 500:

This is a market cap weighted index, meaning that the larger the company, the more it affects the index.

There are 7 stocks on this map that account for 35% of the movement in the S&P 500.

If you can get a feel for how each of these stocks are trading, then you can make informed decisions speculating in the S&P 500. It also means if a handful of these names go on a big run, it’s going to drag the rest of the market higher with it.

Here’s the weighting heatmap for the Nasdaq 100:

The big stocks matter even more. There are 8 stocks that make up 51% of the weighting in this index. This is not diversified in ANY WAY WHATSOEVER.

As long as mega-cap tech wins, then index owners win big.

The MSTR inclusion isn’t going to matter to the index. Yet.

Its valuation is 10% of the big names, so it can’t have an outsized effect. Yet.

Convexity Is King

Microstrategy has put on a masterclass in financial engineering. They issue 0% convertible debt and use it to buy BTC.

It’s not just a crypto play, it’s a leveraged crypto play. We saw that play out as BTC hit 100k for the first time, and MSTR had an outsized move relative to the rally in BTC.

Here’s a chart of the relative performance of MSTR to BTC.

The stock’s rally was not just driven by BTC, but several blown out arbitrage plays in the equity and the options market.

And now MSTR is part of the Nasdaq. The company will keep issuing as much debt as the market can bear, and their leveraged exposure will grow.

If crypto has another bull run, then MSTR will have a leveraged run. Now that it’s part of the Nasdaq, that means we are going to see crypto directly affect the stock market.

Congrats, your parents are now crypto investors. Has their financial advisor told them this?

Lessons You Must Learn Before It’s Too Late

When convex trades get oversubscribed, they break markets.

There could be a time. Not tomorrow, but maybe in 2025, where a move in the crypto markets fully bleeds over into equity indices.

Here’s the flow:

Crypto → MSTR → MSTR Derivatives → QQQ Derivatives → QQQ

Each of those steps can lead to increased leverage and fragility. At some point, the unwind will hit hard.

Now you’ve got foreknowledge of a volatility event that could happen next year. You’ll see it coming.

Some other takeaways from this:

Lesson #1: Passive Doesn’t Exist

You can buy an index, but that index is chosen by committee. Sometimes there are unintended consequences, and unless you TRULY understand the nature of what you own, you could end up getting runover.

This sounds crazy, but investing in single stocks is a form of diversification and risk management. You have to look for opportunities outside of Nasdaq components.

Lesson #2: TradFi Doesn’t Exist

This year Blackrock launched IBIT, which is one of 11 ETFs that trade against BTC spot instead of futures.

Now we have MSTR inclusion, which means all Nasdaq investors are now de facto BTC owners. The liquidity bridges are being built, and they will be permanent.

Financial advisors can’t afford to ignore crypto anymore, because doing so betrays their fiduciary responsibility to their clients.

Does your FA know this yet?

Lesson #3: Delta One Doesn’t Exist

The most liquid equity markets in the world are now driven by option flows in the short term. There’s gamma squeezes, vanna unwinds, and all sorts of tricks in the options market that will drive the underlying.

Your approach to the market can’t just be bullish/bearish. You need to have opinions on expected volatility, drift, and time. And you should know how to structure risk in the options market to enhance your edge.

Long term investors can’t avoid this. In fact, long term investors have MASSIVE opportunities in the options market as attention is all focused on weekly and 0DTE options.

I Don’t Make The Rules, I’m Sorry

This is the relative performance of VTV (value) compared to VTI (broad markets) going back about 20 years:

Since 2007, value investing has been a stinker. Tech was the big winner, and with low interest rates, there simply hasn’t been an environment where focusing on price/book or ROIC has worked.

You adapted, or you lost capital. You can complain about the environment, or you can find ways to win.

The market regime is changing, faster than I’d like. The 2007-2020 market is going to be nothing like we see in the future as more liquidity bridges across the TradFi-DeFi chasm. Regulatory risk was the primary block from this happening, and it’s going away in 2025.

It’s time to adapt again.

Time to Ask Some Hard Questions

If you control and move capital… if you’re a fiduciary in any way… if you daytrade the markets…

You’ve got to get spun up on how crypto works if you haven’t yet. You had over a decade to prepare for this, even if you didn’t own any DeFi assets.

But now you do, whether you like it or not. So do your clients.

And if you are a client of someone who acts in your fiduciary interest, maybe email them a link to this post and ask them:

WTF are you going to do about it?