The Party At Jekyll Island

Frats and the Fed. What I'm looking for in NVDA, and the "Physical AI" rotation trade.

Back in college, I was the president of a fraternity and I made the mistake of having an “unsanctioned” event during the summer. After a COMPLETE SHAM OF A SHOW TRIAL, we ended up on social probation.

No parties, no grabadates, nothing.

Which is why, at the end of the year, we decided to host a “get together.”

Across state lines, in Georgia.

Jekyll island is a solid vacation destination on the Atlantic. You have a single bridge going in, and after about 7PM the entire island closes down. No clubs, no restaurants, no fun.

The families at this family friendly resort had no idea what hit them.

This island is also the site where the Federal Reserve was drawn up. If you’re one of the “grumpy macro” traders, you’ve probably read The Creature From Jekyll Island.

Being a Fed-Skeptic is easy in principle but a terrible trade. I remember in the 2010s there was rendering of garments as inflation was just around the corner and the global financial system was just a house of cards.

It was a golden age for the markets. Inflation was stable, equities ripped, and the second crash never came.

They can still screw up. They’re humans. Hell, we could replace the Fed rate decision with a volatility band on the 2 year treasury yield. They were stubborn about persistent inflation in 2021 and kept yields entirely too low, and we’re still paying for that.

Today they refuse to cut. I don’t think it’s data dependent; it’s because half of them are DC swamp rats with a political axe to grind. You’re not going to see inflation if you deport 10 million people.

Fed governor Lisa Cook was fired from the Federal Reserve today. CNBC spent an unusual amount of time clutching pearls over this, talking about the Fed’s independence.

Look, if you want to have a position at the highest levels of government, you probably shouldn’t commit any crimes.

The signalling coming out of Wall Street is not a good look. The uncomfortable truth is that America’s Central Bank is not the most Constitutional organization. I completely understand that you don’t want interest rate policy set by the President, but how about all of you idiots show some humility and gratitude that Congress allows the organization to exist.

Because it’s starting to feel like we could create a National Monetary Smart Contract that would do a better job than what we’re seeing now.

Pricing the Risk in NVDA

The behemoth yawns.

Wall Street’s favorite AI proxy play reports earnings tomorrow. If it’s a snoozer, then I’m expecting low vol as we head into the long weekend.

We can use the options market to get a feel for what’s expected into the move. The Aug2 straddle is going for about $11.70. Here’s what that looks like on the chart:

About a 6% range, which isn’t huge. The stock has a tendency to take the “under” on earnings unless there’s some kind of monster blowout.

This is going to be the gauge for investor appetite for Megacap tech. It’s not about the number, but the reaction. If we get a gap up above 185 but it doesn’t hold into the end of the week, then we could easily push to 170 to test the lower end of the range.

If 185 sticks, then we’ve got high odds for an options-driven grind higher in the name.

Dead Man Walking

I’m getting more beared up on software stocks. Here’s IGV:

The ETF has held up due to exposure in ORCL, PLTR, and MSFT… but a lot of the names under the surface are in full blown bear markets. Nobody needs Photoshop anymore. You can build a bespoke CRM in replit in under 4 hours.

Go into the holdings listing of this fund, and you’ll find some solid setups if you’re looking for some kind of bearish exposure.

I’d keep the cybersecurity names in a “bull” list however… because all of these vibe-coded web apps are going to be absolutely chock-full of security holes.

One way to view this relationship is the relative performance of cybersecurity (CIBR) to software (IGV):

I’m structurally bullish on this relationship.

Robotics Rotations

Richtech Robotics is going parabolic. It helps when the company claims to be tied at the hip to NVDA. This was a setup for Convex Spaces clients with a long at 2.11, so I hope this sucker jams up into $10.

The physical AI layer could start catching a bid, quickly. Chipotle is flying burritos in drones, and humanoids like Optimus and Figure are starting their rollouts soon.

I absolutely would pay $600/mo to lease a robot that folds my laundry.

Take the long weekend and start digging into the Robotics ecosystem. Servos, rare earths, robotics as a service… many of these names are starting to heat up with solid structure in the stocks.

Next Up For Convex Spaces Clients

The financial releverage trade is heating up, so we’re going to take a look at some large banks. We’ve also got two earnings con’t longs that I’ve been watching for a few weeks, and a clever way to play OPEN once the bagholders get cleared out.

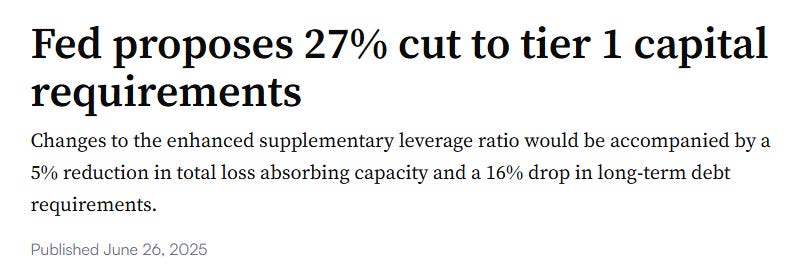

The Tier1 Bank Trade

This narrative has not received a ton of play:

This hasn’t yet taken effect. If it does it will be towards the end of the year, setting up a “buy the rumor” kind of event.

JP Morgan is pushing highs, and I don’t think many are looking for momentum in the name.

I like the JPM Jan 320/340 call spread (ref: 5.15) with a stop under the lows from 2 days ago (290.13).

Two Con’t Longs

ALAB

ALAB is an AI chip play. I know that NVDA could be a risk but a clearance above the volume shelf at 181 and I’m looking for the 200 push. Options are wide, but consider the Sep 205 calls at 4.00 for some momentum.

RNA

Biotech bull flag. Higher risk, but THAR could cause a momentum bleed as biotech shorts don’t want to get runover again.

Long stock on $48 breakout.

OPEN Round Trip Income

This stock is full of idiots trying to pull a gamestop. I don’t think they have enough participants to cause a squeeze, and there was a nasty kill candle yesterday. When these stocks have hard pullbacks, they tend to be rangebound for a while.

If the stock pulls sub $3, then look to sell the Oct $2 puts. They should be going for something like 0.30, which is a good yield on a $3 stock.