The Release Valve

How panicked hedgers just put in a floor in the market, and why the founder of OpenAI is wrong in his predictions.

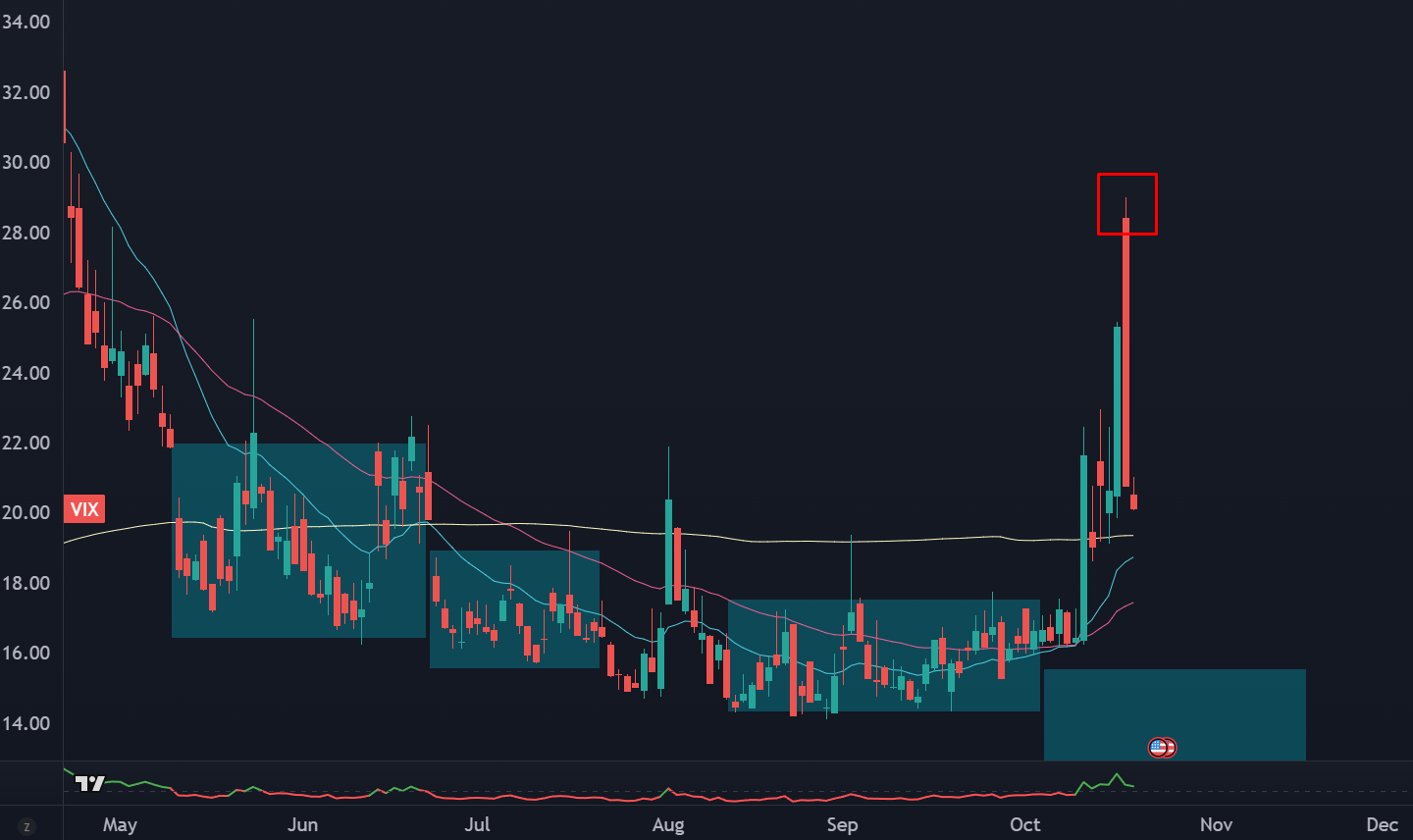

On Friday morning, spot VIX printed 28s. If I showed you this chart in a vacuum, you’d assume that the S&P 500 had a 2% gap down after trading ugly the prior day.

That’s not what happened. Thursday was red, but well off the lows, and there was a small gap down that was quickly recovered.

15 years ago, consensus opinion was the the options market was the “smart money” and could give you early warning signals against what the stock market was doing.

Now, it feels like a bunch of panicked idiots have overwhelmed options liquidity.

The headline risk is obvious— China trade talks, Mag7 earnings, and maybe some risks in private credit.

Yet I can’t recall the last time there was such a massive disconnect between spot and volatility.

Here’s my best guess: you have a ton of capital that panicked during the Tariff Tantrum in April. They waited for a retest to get back in, but it never showed up. This forced them back into the markets, but they’re still skittish, which explains the persistent risk premia in equities since the April lows.

And with a confluence of risk events hitting, they can’t sell their equity positions because last time they did, they looked like absolute idiots. So they hedge. Poorly.

By resetting the volatility markets with a spike… this can lead to a grind higher in large cap stocks as these hedges start to burn off.

That’s how you get AAPL to break to new highs:

Not because of news or fundamentals, but because a bunch of panicked apes loaded up on SPX puts. In order for them to be right, something has to come out that is hilariously not priced into the markets. I just don’t see it.

There are some edges to these trades, which we’ll get to in a moment.

Meanwhile, Japan

Nikkei futures are at new highs. That is all.

Karpathy’s Cold Shower

The cofounder of OpenAI went o n the Dwarkesh Podcast to explain his outlook for the future of AI.

He’s bullish, but skeptical of the timeframe.

He’s calling for AGI to be solved a decade out instead of years. He also talked about how agentic AI is still pretty stupid, and that scaling the physical infrastructure will have diminishing returns.

The outcome of the stock market hinges on acceleration over the next few years. The entire data center buildout trade is the scaffolding that’s keeping liquidity in the market. Not just chips like NVDA, but power and fiber and turbines and data centers and cooling.

For the oldheads, the AI data center buildout feels like fiber optics from the first tech bubble. The telco’s spent a ton of cash creating the backbone of the internet, but it was early which turned out to be a disaster.

Timing matters. Especially when you have debt to service.

I disagree with his take. Which is hilarious because he’s literally the founder of OpenAI, but that’s why he’s myopic on the outcome. He’s dealing with bleeding edge tech and thinking in such an abstract way, that he can’t look up and consider the lagging effects that current AI will bring to the market.

For example…

5 Drinks A Day

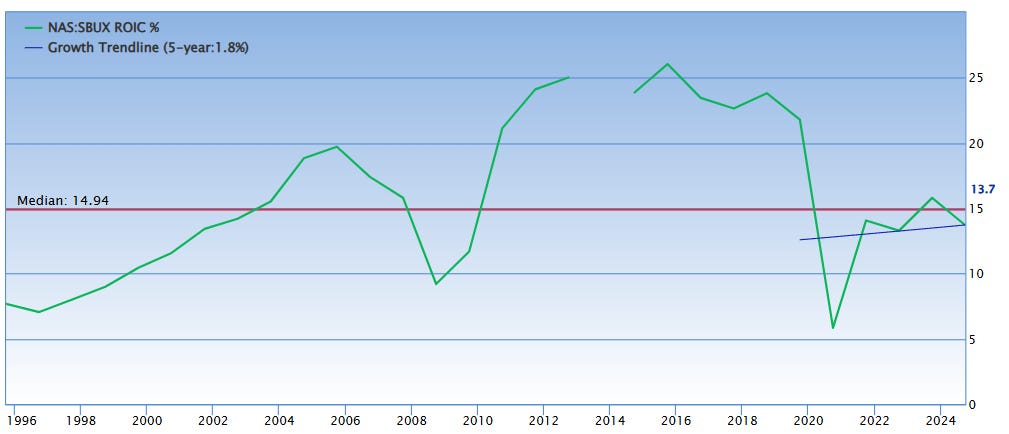

Starbucks (SBUX) hasn’t had a good few years:

It doesn’t help that labor costs are up. It doesn’t help that coffee prices are up 200% from the 2020 base.

Here’s a longer term look at return on invested capital (ROIC):

It’s a tough business. It’s why the CEO just said they’re going “all in on AI.” On first glance, it seems that they’re going to pivot to robotics and completely remove their baristas.

Which could happen, but there’s some much lower hanging fruit. Semi-famous twitter poster Trung Phan pointed out that if each Starbucks store sells just 5 more drinks per day, that’s an extra $1B collected each year.

It’s easy to poke fun at the baristas, but if you watch them for a 30 minute rush, you’d notice that it’s an incredibly complex system.

If AI can find signal in that complexity, it’s a massive win for the company.

I’d wager that they could use AI models from last year to get the same kinds of results. Because in large organizations, it takes time to deploy tech. And if you’re the founder of OpenAI, you assume that everyone moves with the same speed as your network.

The AI Productivity Boom hasn’t shown up because it has a lag to frontier technology.

Which means it isn’t priced in… and we haven’t even moved to the robotics phase of this narrative.

Up Next

Convex Spaces Clients are going to see some solid trade structures to play the volatility unwind/equity grind in megacap tech.