The World Spins. The Sun Rises. The Nasdaq Rallies.

The Liquidity Flywheel video to watch and hilariously expensive hedges.

It turns out they can, in fact, keep getting away with it.

Megacap tech powered forward again today, this time driven by NVDA’s investment into OpenAI. A Tiktok deal looks to be completed with ORCL, and AAPL finally had a hard push to the upside in anticipation of iPhone sales.

The Nasdaq has had this rotational mechanic for months now. A few names provide the heavy lifting, and market-cap weighted indices rally. When those names get tired, then another set of leaders emerge.

It’s part of the Liquidity Flywhee. I explain more here:

The same kind of trade has been going on in momentum tech.

First, China started rallying in anticipation of the Fed rate cut, trade talks, and Chinese AI value becoming realized.

Then, the nuclear stocks hit. Then autonomous vehicle plays. Then quantum. Then hyperscalar service stocks. Then drones.

It’s a helluva party.

We’ve been well timed with anticipating some of the parabolics. Swings in UMAC and RCAT look like they’re paying out. Spreads in LMND and SOUN are starting to hit 100%+ returns.

And we’ve got a few plays in solar, self-driving, and rare earths that look ready to explode higher.

If you want the exact option trades that I send to Convex Spaces Clients, consider subscribing today. If you commit to an annual subscription, and send me a note, I’ll get you access to all my option trading courses. Thousands of dollars in value, all yours for becoming a First Mover.

We’ve seen markets like this before, and it’s tempting to try and nail the top. There are some plays to consider in some of the very extended names, but you still want to press your bets with some smart option trades.

Yet let’s consider for a moment what happens when the party stops and the hangover hits.

How are you going to prepare for that?

It’s incredibly difficult to find cheap hedges in this market

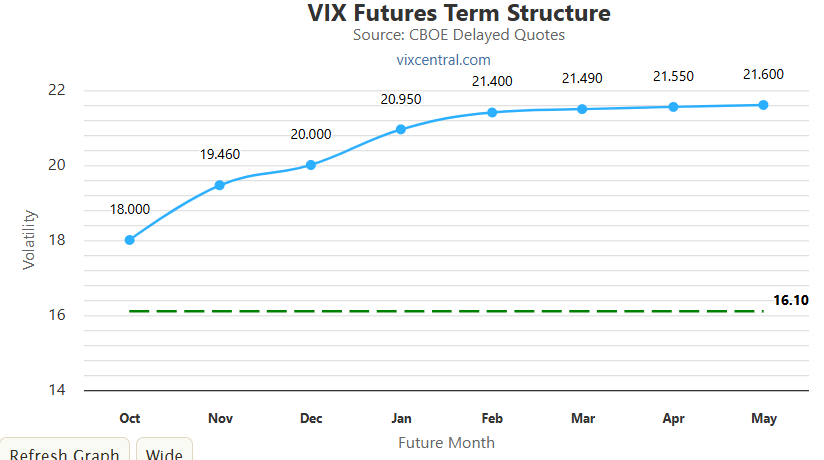

Here’s a look at the VIX futures curve. The December VIX is trading at 20.

The current realized vol in the SPX is now under 9. This is a massive gap. I have no idea who keeps bidding up vol, but I can tell you this.

The beatings will continue until investors stop buying hedges.

With that said, there are ways to get some downside exposure, because at some point there will be a pullback and if you want to press your best on the momentum stocks, then it’s reasonable to pack a parachute when you jump out of the plane.

For Convex Spaces Clients, we’ll be structuring some hedges in this market that are retail-friendly and don’t take a ton of capital but have solid payouts.

We’ll also be looking at another China name and a space name that’s ready for a “dash to trash” trade.