This Stock Is The Crypto Bridge Builder

A look at a DeFi play that you may not have heard of. Get my full analysis and an interview with company leadership.

It’s clear that investors have an appetite for crypto.

ETHA is the iShares Ethereum trust, which was launched this past June and has grown to $16B in AUM.

You also have the Federal Government explicitly endorsing stablecoins as they help provide liquidity in the treasury markets.

The {DeFi | TradFi} bridge is being built.

And I’ve found a smallcap crypto play that’s profiting, not just from the bridge building, but from collecting tolls.

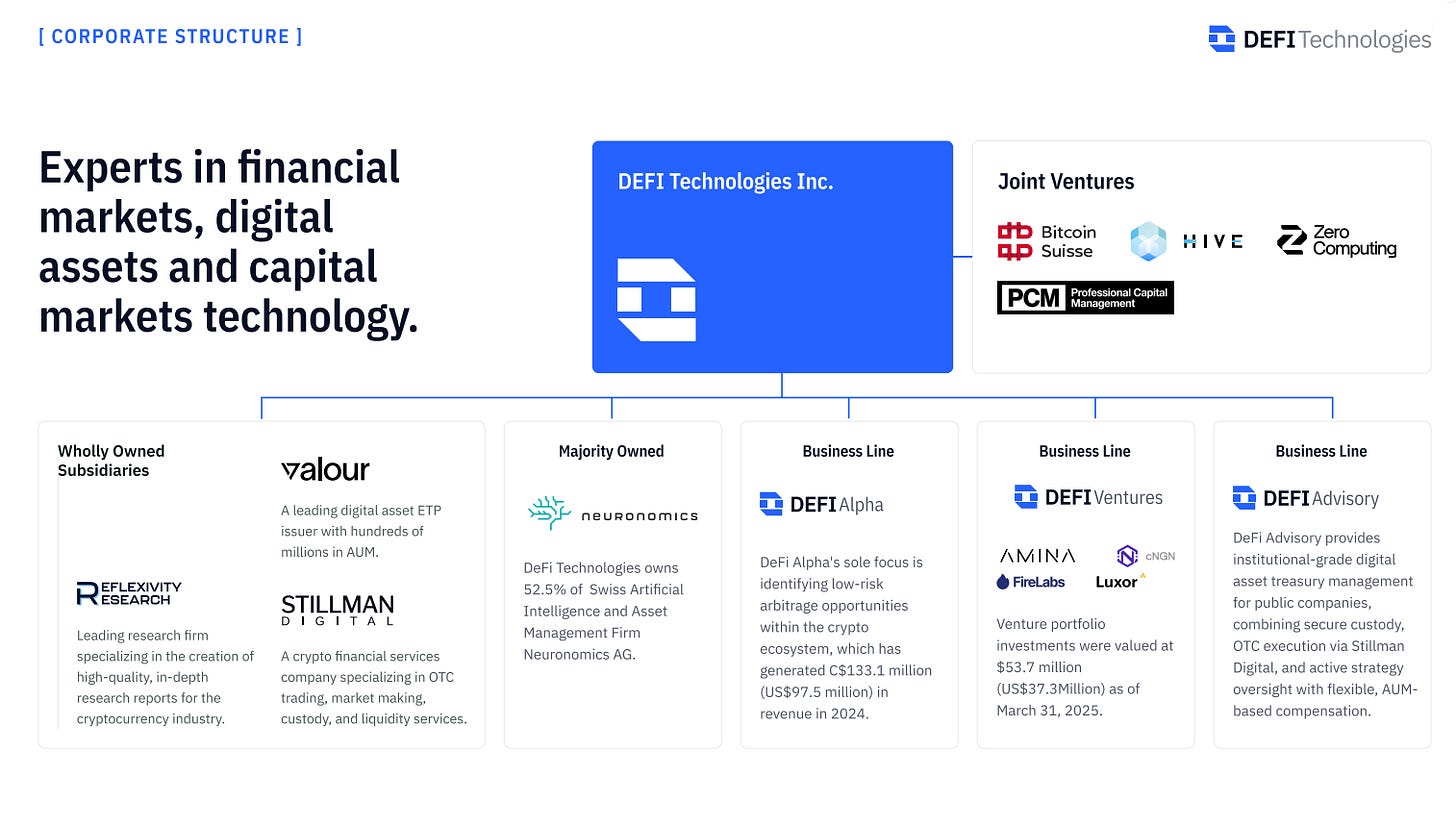

DeFi Tech (DEFT) is a digital asset platform that is starting to hit scale in international markets. They’ve got multiple subsidiaries that work exceptionally well together, and they’ve been smart about not getting overleveraged.

This past Friday, I sat down with Andrew Forson, the President at DEFT, where we talked about his company, future prospects, and the state of the Crypto Bridge being built.

Here’s the video:

The Asset Management Flywheel

This model is what attracted me to the company.

One of their subsidiaries is Valour, and they issue exchange traded products (ETPs) that provide exposure to the crypto markets.

Like the “Blackrock of Non-US Crypto.”

They have BTC, ETH, DOGE, AVAX, RNDR, SOL, along with several others… about 80 ETPs in total. They’re scaling up to 100 ETPs by end of year, with an expectation of 200-300 total products.

The secret sauce is that they take a cut of the staking yield from the crypto assets in the ETP. That’s on top of the average 1.8% management fee that they receive from customers.

They have started to build out ETPs that provide staking revenue to clients at a higher fee.

As their AUM grows, their take grows and their staking yields compound.

FTX, But Good

Here’s a look at what’s under the hood:

They’ve got the asset management with Valour, a market making firm with Stillman, and an arbitrage desk with Defi Alpha. They’ve also got a Venture arm that could give them some serious upside.

FTX had a similar model. They had an exchange, a market making firm, an “alpha” firm, and a venture arm. Their downfall was mixing customer funds with trading funds. If they hadn’t done that, there were venture bets in Anthropic that paid out big.

The model is lucrative, provided the execution is there. You take in some assets, make the markets, stake your profits, and compound your wins. Every once in a while you score a big win on an arb trade or a venture bet payoff and all of a sudden you’ve got the attention of investors… and that gets reflected in price.

Risks

I like the stock. I think it’s a solid model, and there’s some compounding effects that could end up being reflected in the stock price over the next 12 months.

Yet there’s some potential downsides to be concerned about. Some of them are industry related, others are in the reflexive arena.

What are some problems in the Narrative that would cause institutional investors to pass on this company?

Profitability

Here’s a fun quote from the show Silicon Valley:

“Revenue? No, no, no. If you show revenue, people will ask how much—and it will never be enough. The company that was the hundred-xer, the thousand-xer, becomes the 2x dog. But if you have no revenue, you can say you’re pre-revenue, you’re a potential pure play.

It’s not about how much you earn—it’s about what you’re worth. Who’s worth the most? Companies that lose money: Pinterest, Snapchat. Amazon lost money every quarter for twenty years, and Bezos is the king. Nobody wants to see revenue.

I don’t want to make a little money every day. I want to make a ton of money all at once.”

On an adjusted basis, the company is making money. The hilarious part is that could be viewed as a risk by investors. If you aren’t burning cash to grow as fast as you can, then how can we get the stock price to go up?

American Liquidity

The company’s current focus is overseas. Which makes sense, they’re a smaller shop so it may be a better play to operate in smaller liquidity pools compared to trying to compete against iShares.

There’s a tradeoff. Their ETPs in total have $1B in AUM.

As a comparison, Blackrock’s IBIT has $82B in AUM.

Can the company continue to grow by accessing exchanges in Sweden and Germany, when the majority of degen capital is in the US?

There could be an interesting play if they managed to get access to Singapore as that’s an off-ramp for Chinese liquidity, but for now their TAM could be a risk.

Lumpy Revenue

In May 2025, the company said that they pulled in 17.3MM on a single arbitrage trade. That alone is a major contributor to their revenue.

But can investors count on those kinds of “wins” over the long term?

Compounding Upside

At the time of this writing, DEFT is trading around 2 bucks with a market cap of 680MM.

If they can get their flywheel spinning, and continue to innovate with building the {DeFi | TradFi} bridge.

They do have some announcements that I know are coming but I’m not sure on the details, so that may change the upside case in short form.

Here’s the structure of the stock:

It had an exhaustion gap on earnings back in May, and sellers have continued to unwind their positions which led to a pretty harsh push to the other end of a multi-month range.

Given the downtrend, it’s reasonable to either DCA in.

If you don’t want to hero long this, consider using the swing AVWAPs from the May earnings gap up as well as the 14Jul gap. If the stock crosses above those, then consider taking a position.

Standard disclaimers apply, I’m not your FA, Do Your Own Research.