Trading in Paradise

How to avoid the current market struggles, juicing the market with NVDA trades, and dodging space junk.

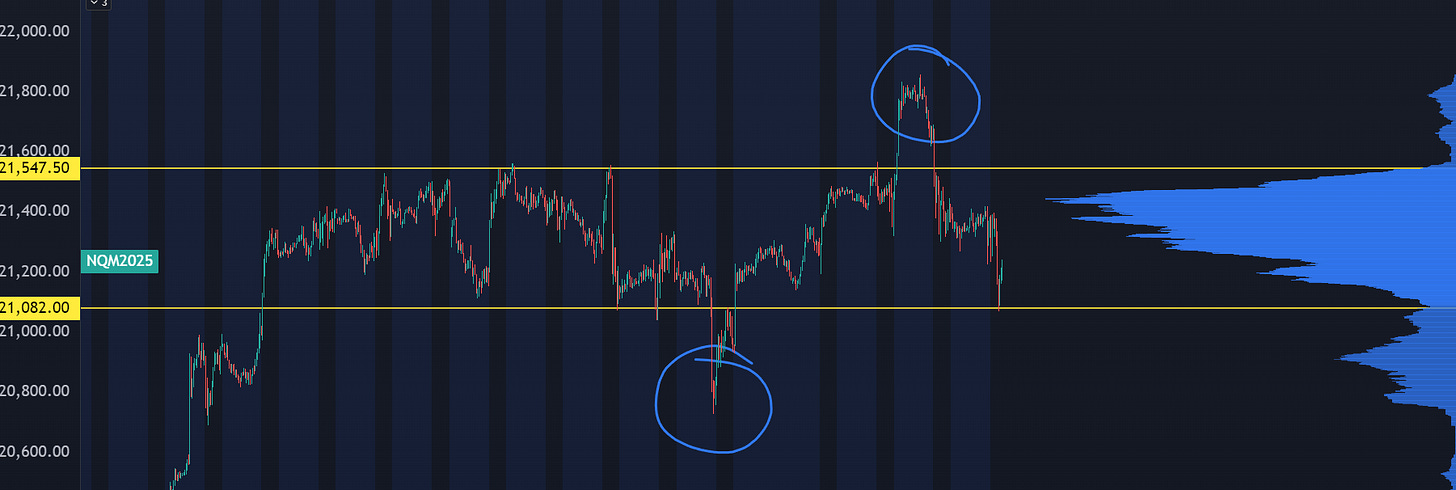

After the China Release valve, the market has entered a kind of balance that’s been sticky.

There’s been a few failed pushes on either side of the range. The failed breakdown had to do with some econ data or tariff news, and the failed breakout was the NVDA earnings fade.

Chasing the markets on either side has been a trashy trade since May opex.

Much of this is due to concentration risk— when 7 stocks are pushing around the indices, if they don’t move much then the market isn’t budging.

It’s been better to play the rotation momentum. For a few days it was nuclear stocks like SMR and OKLO, then a couple in-play stocks on earnings like BOX and ULTA.

Can a headline come out and knock us out of this trading range? Sure, it’s possible. But the more likely scenario is that the market will move when far fewer traders are positioned for it.

We’ve got participants who are still shell-shocked from April’s selloff and trying to top tick the market with put buys. They’re balanced by the institutional capital that is now drastically underperforming their benchmarks and trying to reposition through longer dated call option purchases.

Both sides need to have their option positions grind down into dust. Maybe one more options expiration cycle, and then we can get resolution out of this range.

20 Is The New 10

Even if you’re the most bulled up trader on the planet, you’re still looking over your shoulder wondering if you should buy some puts “as a hedge.”

Frankly, it’s probably not going to work. You’re too early. Instead, I’m going to show you how to time it better.

Headline risk isn’t going away. All it takes is a tariff deal, Fed announcement, or Deepseek drop and the market has a big gap.

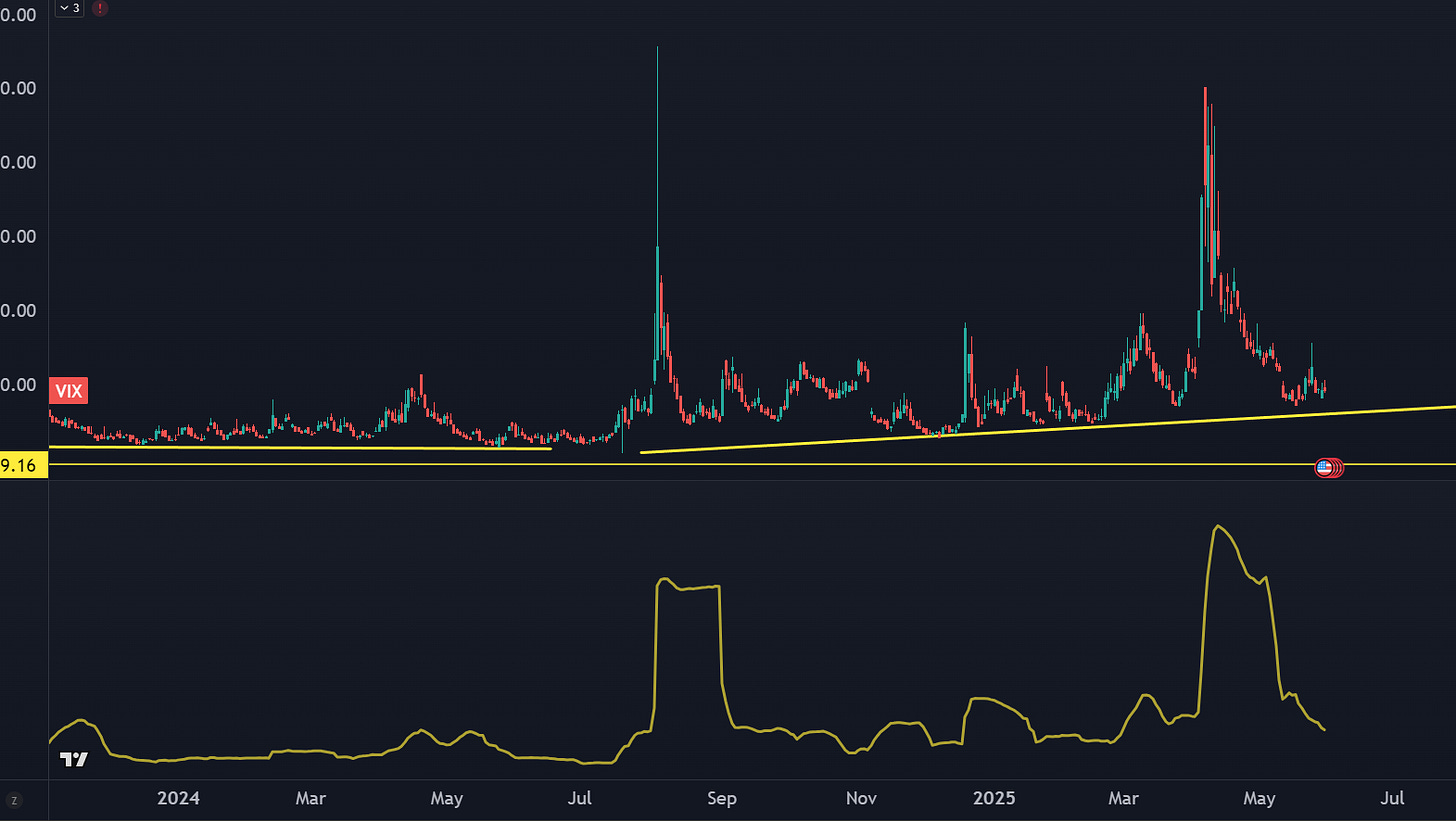

That’s now embedded into the risk markets. Here’s a look at the long term volatility regimes:

2017: everyone and their mother is short vol

Feb 2018: Volpocalypse

2019: new floor put in after tech wreck

2021: post COVID decline and market bubble

2022: shit, rates are going up

Late 2022: rates stopped going up

2024 - Now: We’re awash an a floating garbage island’s worth of global macro risk headlines

If you’re looking to buy market insurance, you can’t just say the VIX is low. Instead, focus on how long it stays low.

Here’s how:

Take your VIX chart and add a standard deviation indicator, using the highs as the input. 20 day window.

When the standard deviation reading gets very close to its 52 week lows, that’s the time to buy cheap insurance.

Why? Because if the stddev reading is low, it means we haven’t seen a good VIX spike in over a month, and we’re close to another event. Right now, we aren’t there yet, but we are starting to get close where you can start thinking about how to protect the downside.

(I bet you wish you had this advice 3 weeks ago when index puts seemed like a sure thing.)

(I should take my own advice sometimes.)

Is the AI Juice Squeezed?

All eyes were on NVDA earnings this week. It’s not just about the number, it’s the downstream effects of the entire AI (and tech) ecosystem.

And the report was a monster. $44B in revenue, and an earnings beat.

The stock faded… what gives?

The stock had a hard rally off the April lows but there’s still concerns that Chinese revenue impacts are going to be a problem for a few quarters.

There was also another Deepseek model that showed up the day of NVDA earnings, which was not a coincidence. It’s beating benchmarks which means efficiency gains lead to less chip demand.

But here’s the primary reason NVDA had a failure to launch.

IT’S A THREE TRILLION DOLLAR COMPANY. That’s a big boat, and to get that boat to move it takes a lot of fuel.

The liquidity required to turn NVDA into a momentum stock is massive, and if the stars aren’t aligning, then it’s not going to rip.

The AI hype is real. Every day I get a news story that blows away any expectations I had on the industry.

Yet… NVDA is not an AI company. They’re a bottleneck supplier in a very competitive field. And unless there’s a new catalyst or narrative shift, what’s going to drive marginal liquidity into this name?

It’s time to look at the other bottlenecks. Instead of chips, consider the other limiting factors. Power infrastructure. Fiber buildout. Nuclear. Data centers.

There’s more juice left to squeeze in some of these other spots of the market.

Space is Big.

My entire life I’ve heard horror stories about space trash and how it’s going to cause the end of the world as we know it.

Yet the more I look into it, the more the consensus view is stupid.

New satellites have been miniaturized, maneuverability has improved, and intra-satellite telemetry continues to improve. Of course there’s going to be screw ups, often from the Chinese… but there’s a lot of room to work with.

“Low earth orbit” is not a single line in a diagram. This is a region that’s between 100 miles and 1200 miles above earth. That’s LA to Portland. Or Chicago to Jacksonville.

There’s a lot of room to operate… which means the space economy can grow even further.

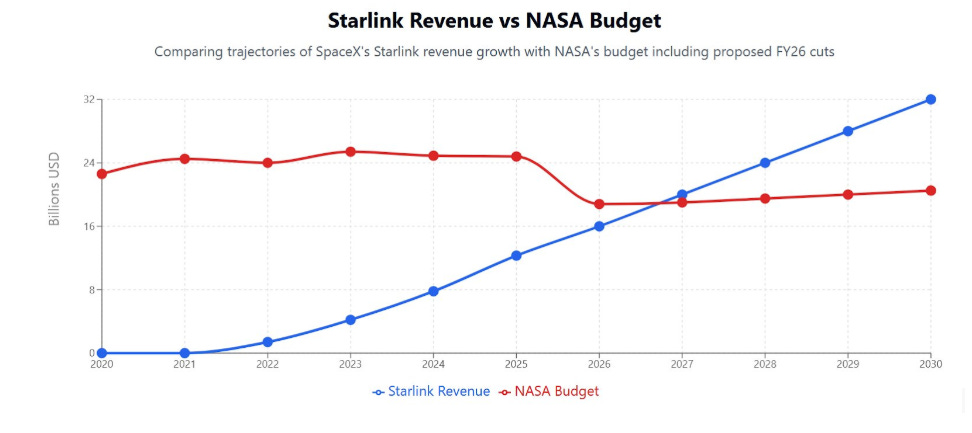

Here’s my eye-popping chart of the day:

In the next few years, the revenue generated from Starlink’s internet service is going to be larger than the entire budget of NASA.

This is how Elon is financing his vacation to Mars, and it also shows the commercial viability of space companies if you can get enough payloads to provide value.

And if Space is Big, there’s plenty of room for competition.

Viasat (VSAT) is a company that has sucked for a couple of years. It doesn’t help when you’re a direct competitor to Starlink, who is beating you in every way imaginable.

Every gap down can be matched to either a bad earnings report or a Starlink Press Release.

It’s dire enough that Viasat has a “Space Equity” page on the website where they complain about Starlink.

Maybe the company can just make better products? Space is Big. If Viasat can differentiate on their product and target different customers, it has a clear path forward. We’re starting to see that narrative reflected in conference calls, company presentations, and the stock price.

If this manages to break out, it’s game on for a double by the end of the year.

How to Trade in Paradise

Summer is a rough time for me as a trader, because the water always calls.

We’ve got crystal beaches, sheltered bayous, and spring fed creeks that stay cold year round.

It’s tough to stay indoors with action like this. Fortunately, I’ve got a “Desert Island” trading strategy that is excellent for summer trading.

A few years ago I asked myself… if I were on a Desert Island and could only do a single trade, what would it be?

Now, I can throw on some trades on my phone and not worry about them as they pull in profits. It’s the stress-free path to profits that doesn’t require a ton of screen time.

I’ll be sharing more about this soon, as the conditions are ripe for some of my DI trades.

Talk Soon,

Steve