Trading Like The Criminals

A Pivotal Moment From The Fed. A Look At The Crypto Carnage and How It Matters To Quantum Stocks

Over the weekend, crypto markets had a liquidation event. Some of it was natural, some of it was planned.

During high volatility events, well-informed traders can push the screws at the systems level for incredible profits.

It’s how crude ends up trading to -$40.

During the crypto crash, a few newly-funded wallets took out massive short positions on Binance. Crypto liquidity was already lower due to spillover from the stock market selloff, and it was also a weekend where there wouldn’t be TradFi inflows during bank hours.

The forced leveraged liquidations weren’t helping either.

The short position broke the exchange. Some altcoins traded to $0.

A few wallets ended up earning $192 million on the trade. The entire trade will be a fascinating deep dive once the dust settles.

These traders aren’t making a bet on lines on a chart or fundamentals of a stock, they are exploiting the structure of the market itself.

Big Hwang Energy

In 2021, a hedge fund was pulling off a flavor of this trade.

Archegos Capital Management, led by Bill Hwang, found a way to exploit the derivatives market. Instead of buying the stock outright, they would use total return swaps at prime brokers, which gave them an incredible amount of leverage.

What got them in trouble was that they weren’t telling the prime brokers that they had the same exposure at other firms. That’ll get you indicted.

On individual trades, there were reports of 20:1 leverage.

Were they trading high-momentum names? It didn’t seem like it at the time.

The fund had this weird concentration in Viacom, Tencent, and Discovery. It felt like a TV rollup play, but my guess is that their fund found some kind of exploit in the liquidity on these stocks and pressed the screws.

The trade did great until the prime brokers caught wind and forced them to close:

Even if you weren’t involved, you sat there trying to figure out why, out of all stocks in the market, was a television stock up 250%?

It’s because the fund was looking to profit based off a liquidity mismatch in the market, and used a ton of leverage for it.

Press The Screws

There was a lot of that in 2021. You felt it if you tried to fade the obvious parabolic names. Of course there was the { GME | AMC | BB | EXPR | KIRK } squeeze, but there were other names like Jinko Solar (JKS):

This was my white whale. I tried this short 3 times, and had the top absolutely nailed and the stock just wouldn’t rollover.

Because on a few timeframes higher than me, there was a titanic battle where larger players were trapped and other players knew it. You can feel it in the tape, where there’s swipes lower, hard v-bottom recoveries, and no sense of heaviness.

It’s as if buyers are using the structure of the market to force the short bagholders to finally give in. It goes from a slow water torture to capitulation.

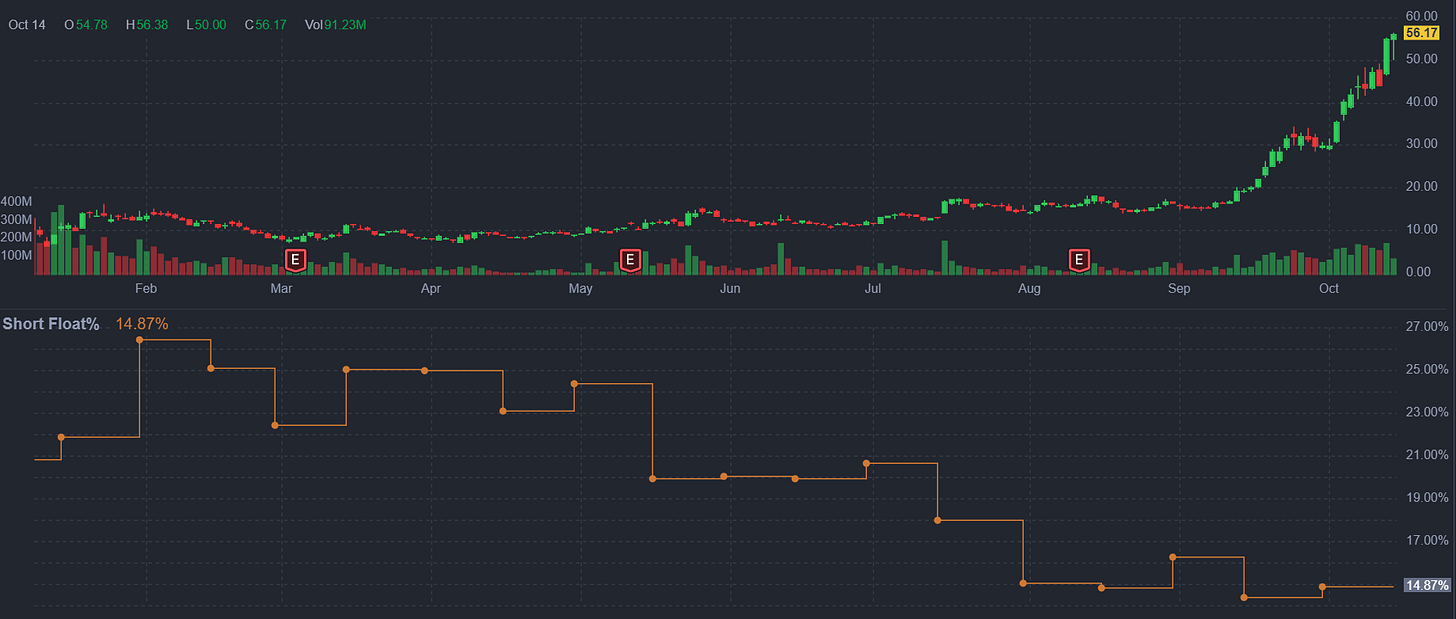

With that in mind…. HOW’S THAT RIGETTI SHORT GOING?

The green arrows on the RGTI 30 minute chart show some key decision points where the stock could have rolled over. Over the last few instances, there are lots of participants that think the stock should rollover.

They’re stuck, and bleeding.

The stock’s still at 14% short interest. While still being up a triple from the range break. Phew.

The only thing that can save them would be an options-related rug pull as we’re headed into October opex. Until then, the pain trade is to the upside.

The Pivot

Earlier today Jerome Powell accepted an award at the National Association for Business Economics (NABE) Conference.

I wasn’t paying attention to it until the news hit the wires that they’re ending balance sheet runoff. This is a major policy decision!

I’m not an expert on the Fed, but I understand metasignals. Let me give you an example.

If you ask your wife if she ate the last Reese’s out of the pack, and she says “no,” then that could have completely different truths depending on how she says it, or the timing of what she says. Those are the metasignals. Embedded information beyond the words.

(We know she ate the third Reese’s and you only got one.)

What were Jerome Powell’s Metasignals Today?

He Announced a Major Policy Decision At An Awards Ceremony

I don’t think anybody was expecting this. There’s a quiet period that’s going to hit soon, so the fact that he chose to do it now gives us a sense of urgency.

The Policy Change Happened Without Public Data

Due to the government shutdown, public economic data hasn’t been released. At the end of the speech, Powell talked about how they have contacts and private sources to help make their decision. It’s also possible that he saw official data but didn’t disclose that fact. The fact that he mentioned this at the end of his speech means that his team knew this would be an elephant in the room.

It Felt Like We Were Missing Context

The speech read like it would have made more sense after we had an ugly jobs report. He used the phrase “significant downside risk” in the labor market, which implies they’re a little spooked. The back half was chock full of qualifiers which is normal, but it feels like we’re missing something.

It’s possible that I’m way too zoomed in. They’ve been talking about this change for a while, but they couldn’t wait until the Fed meeting at the end of the month?

Consensus

The markets responded aggressively to the Fed news. The idea here is that by ending balance sheet runoff, it helps to put a floor in longer dated yields. With support from crypto stablecoins on the short end of the curve, this could induce stability in the treasury market.

Better stability leads to more leverage which puts more liquidity into the stock market that causes prices to go up. It could also help mortgage rates go down.

That’s the mainstream opinion. Of course none of this is guaranteed. I remember when the Fed started its rate cuts in 2007, and how they were just a lagging economic indicator at this point. I also know how brutal intraday fades can be after a Fed announcement.

Read The Room

Let’s put away our macro hat for now, and I’d like you to answer this question:

How many stocks are up 50% on the year and up on the week?

The two day selloff was ugly in equities and worse in crypto.

Yet the VIX overreacted and we’ve now got an overhedged stock market (again) with 0DTE liquidity keeping actual volatility down (again). And the headline risk from Friday seems to be a function of a trade deal that is supposed to be buttoned up by the end of the month.

How many stocks are hitting highs this week after having insane momentum this year? When I ran this scan I was expecting maybe 30. I assumed that the high-flyers all got kicked in the teeth on Monday and were struggling to recover.

Currently there’s 200 stocks on this scan.

Run through the charts, give them the eyeball test. It’s still a hot market, price action and momentum are still there. Until this changes, risk is still to the upside.

Some names familiar to CS Clients have already started to break out.

SOUN easily cleared last week’s high, and our Nov 18/22 Call Spread is almost fully in the money.

SPCE somehow is holding its bid and looks ready for the 4.50 breakout.

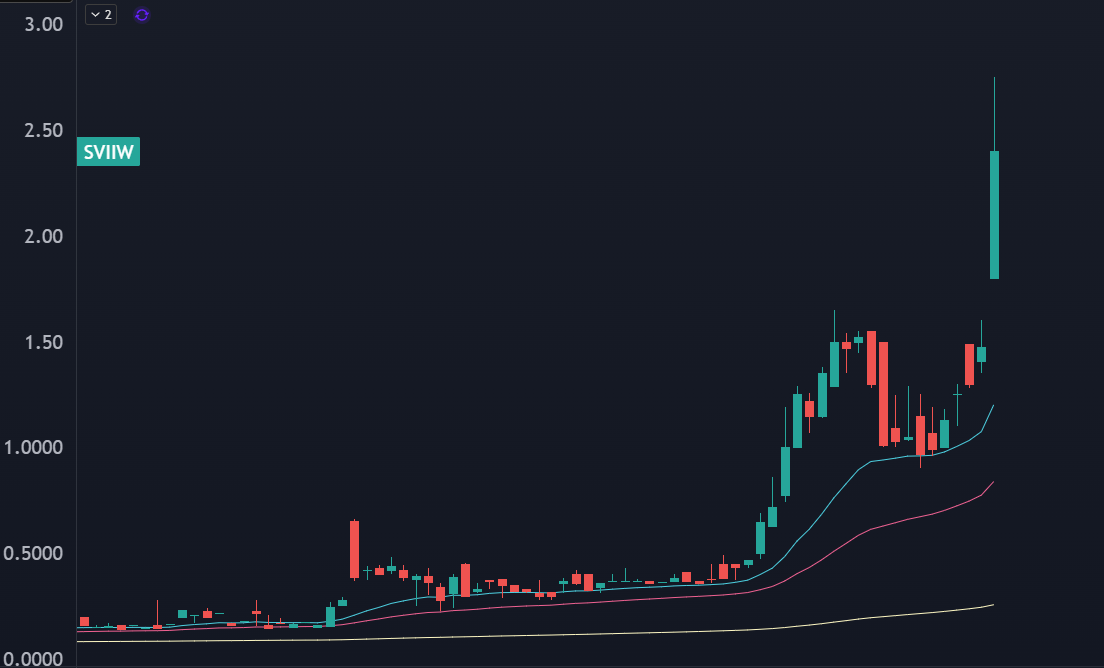

And one of our SPAC Warrant lottos is paying, up well over a double after the $1 hold.

How To Find The Best Stocks To Buy

If you go through the screener I shared above, you’re bound to throw a dart and hit a big winner.

For me, I’m looking at a few things.

First are the stocks that I won big on and are currently in a pullback.

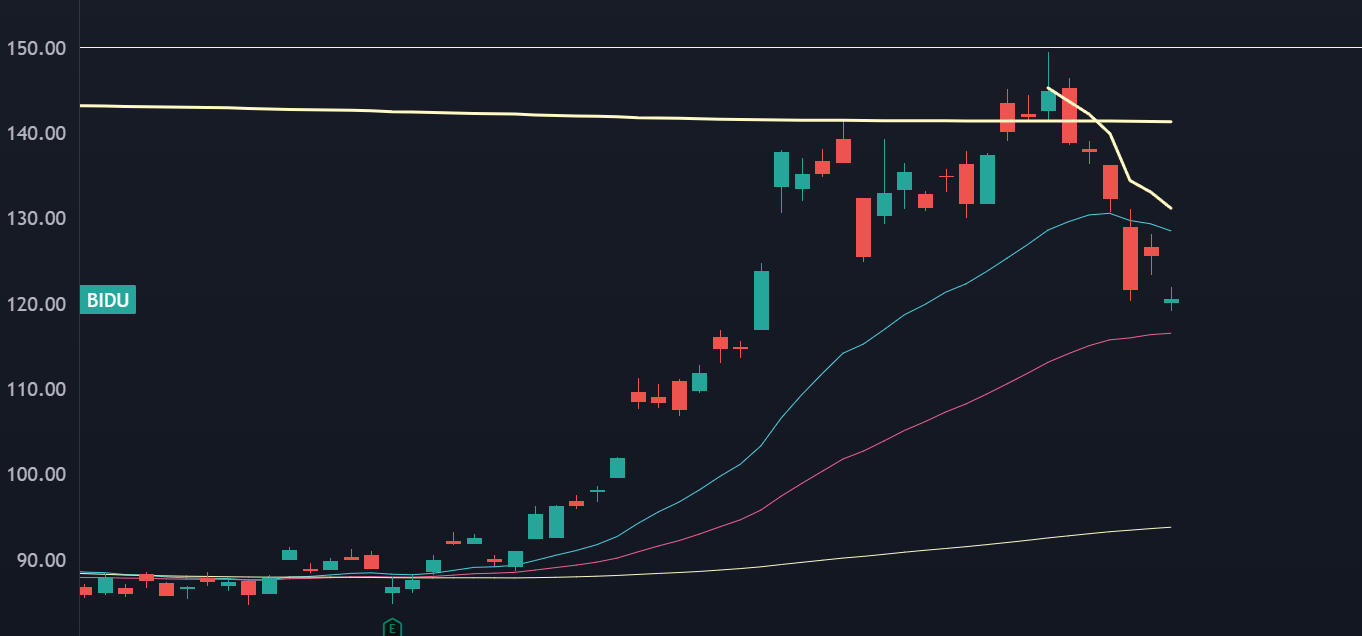

I’m closely watching China stocks like BIDU and BABA to see if it can hold its retracement into the end of month tariff uncertainty:

Next are emergent narratives that haven’t gone parabolic.

For example, a lot of pot stocks (MSOS) had a pullback but their emergent catalyst hasn’t been announced:

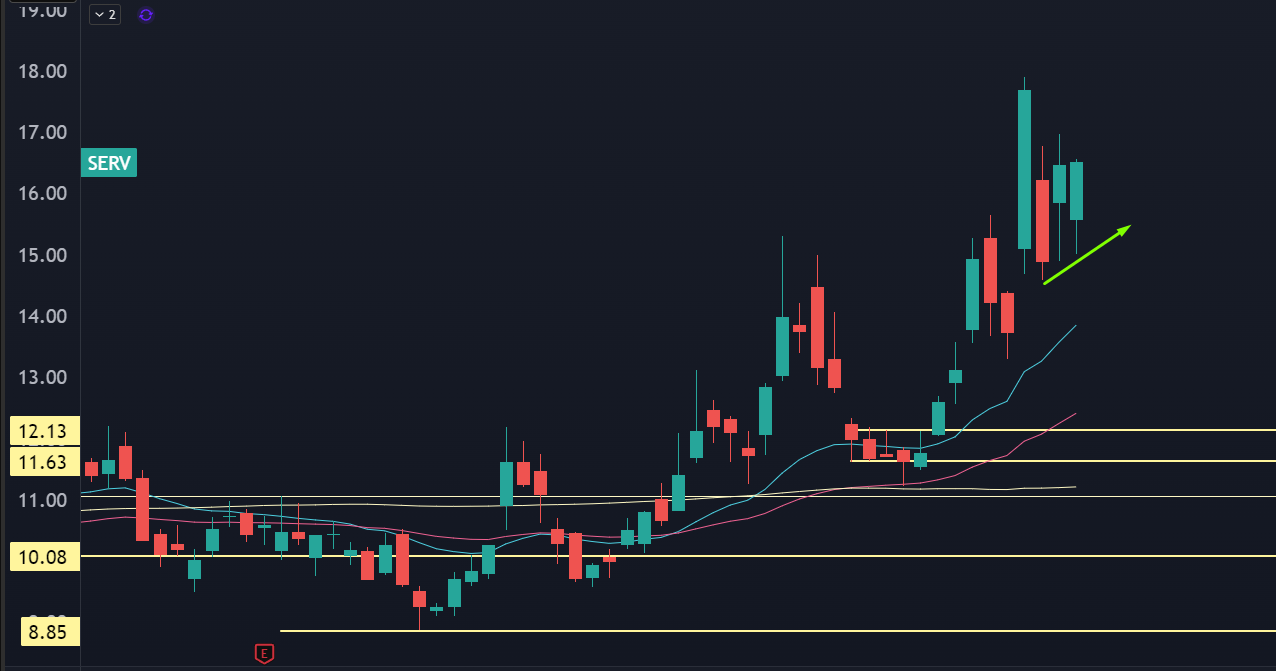

I’m also on the hunt for potential momentum flyers where their Monday’s low was above their Friday’s high. A very simple relative strength reading.

SERV is a good setup with this context:

With that context, Convex Spaces Clients have a look at some names with monster upside potential. When markets pullback, much of the demand for call options goes away, and you end up with owning cheap upside exposure.