Two Minute Drill Investing

Where the pain trade sits, Michael Saylor's sticky situation, and why I'm bullish on OPEN but still hate it.

There’s a point in a football game where you know that the comeback is secured.

The team is down by 4, there’s a few minutes left in the game, they’ve got two timeouts, and they have to march down the field to score and win.

For some teams, it’s a lock.

Casual fans will think it’s due to an all star QB, like Brady or Mahomes.

But there’s another factor in play… and you see this a ton with college teams…

The Prevent defense. Defensive coordinators will make this call because the last thing they want to do is get beat deep for a fast score. So they’ll have their players back off the ball an extra 10-15 yards and make sure that nobody ends up behind them.

Yet when I see this formation, I know what’s going to happen next.

The QB will throw a slant route for 15 yards. Then a quick out for another 7. Then they’ll clear out the middle but have a curl route for the tight end, and that’s where they call the first timeout.

All of a sudden, the offense is 30 yards out from scoring into the 2 minute warning.

Can the strategy work? It can in specific situations, but when you are playing “not to lose,” then often you don’t end up winning.

For my non-American readers, this is like “Parking the Bus” in soccer, where you stack every player behind the ball as a way to preserve the score.

Institutional market participants have been playing Prevent Defense since April. The market has stayed overhedged and underexposed, which has allowed equities to slowly markup into higher prices.

And every little shakeout, every little wick lower has been met with an incredibly sensitive options market where traders fly back into hedges.

Because you can’t sell your exposure in NVDA, no, that would be bad because your clients would be pissed that you don’t have that trade on. Instead, you think you can just take some downside risk off the table, causing the VIX to jam back up to 20.

With Friday’s rug pull, the markets do feel a little shakier than normal. My base case is still reversion and chop, but if you take a look under the hood you’ve got AAPL and GOOGL right under their all time highs. AMZN and NVDA have reset to prior ranges which could act as support, and META is oversold enough that it could bounce easily.

I take no pleasure in saying this, but the pain trade is still up.

Strategy’s Convergence

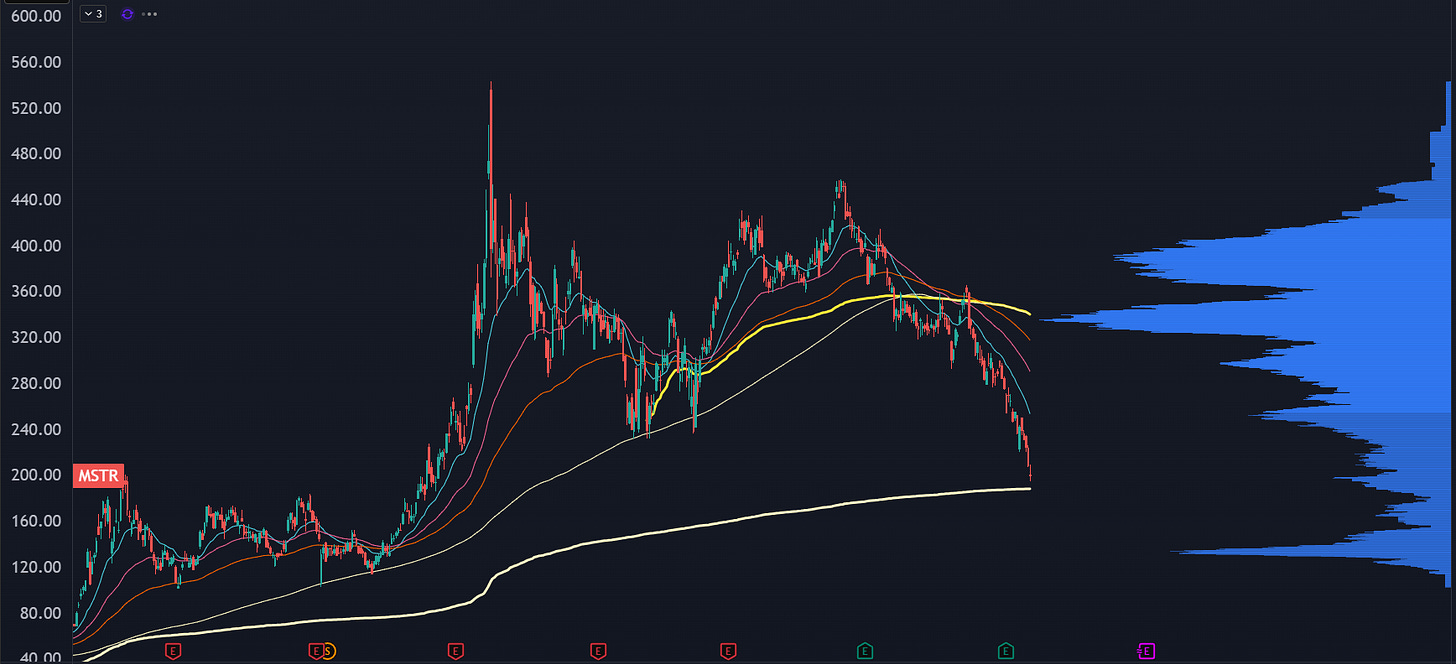

The stock formally known as Microstrategy has been kicked in the teeth this month.

Turns out, leverage runs both ways.

The company ran hot as it issued convertible debt to buy bitcoin, which in a bull market causes the stock to trade at a large premium relative to its bitcoin holdings.

But as the crypto craze never really hit this year, the stock is seeing forced sellers, and the premium that the company once had has nearly been erased.

There’s rumblings that Strategy will be forced to sell BTC under certain levels, causing a price cascade in the crypto sector. I’m not so sure.

For BTC, the bottom doesn’t seem to be in yet, but we are approaching price and sentiment extremes where if you get one more good selloff it will be into levels that make sense:

This is the price distance from the 50EMA, which is approaching full reset conditions. It could stretch lower, but this isn’t 2021. We don’t have a huge hangover from the crypto bull craze, and risk assets overall appear to be fine. Crypto is also a much more liquid market, which means we should expect volatility to be reduced.

If you want to see how I’m trading it, watch Friday’s video at the 29:00 mark:

Meanwhile, Wall Street’s Stupidest Stock Is Relatively Strong

Last week everything got hit. Nuke, quantum, AI, you name it, there were massive liquidations across the board.

But Opendoor (OPEN) still looks good!

I’m not a true believer in the company. It’s an interesting business model, and it could work, but OPEN bulls are screaming like it’s going to cure cancer. They go on and on about the TAM and how it’s going to revolutionize the US housing market.

This is where I get bearish. Not because I disagree with the thesis, but because it’s just so damn cringe. It has the same flavor of sentiment that we’ve seen in other over-loved retail stocks like GME, LCID, and other stocks that have turned into a bagholder paradise.

But the chart, the actual market structure of the stock, looks pretty good!

I don’t want to get stuck with being a bagholder, and if the market does truly go risk off it’s easy to see how the name could finally crack 5 and drift down into the single digits.

Or… it can clear 10 and all of a sudden a new short squeeze hits. And given we’re headed into the holiday season where liquidity drops, retail squeezes tend to hit harder and faster than what most expect.

That’s the starting off point on my trade thesis, and I’ve got a great setup for our Convex Spaces clients.