Two Trades To Bet On Reversion, But Not A Crash

Liquidity in the market is still strong, yet there's a few spots to trade if you want to snag some downside profits.

All day I heard traders complaining on social media about how the market looks terrible.

It looks fine. Not incredible, not the end of western capitalism, just fine.

We’re dealing with two hangovers right now. The first is how just a few weeks ago, names like OKLO and RGTI were “up only” and a very straightforward market to trade. Just buy some calls and you’re set.

Those names have started to reset, and the market seems to be overfocused on Mag7 stocks. It doesn’t feel good when your darling momentum stock kicks you in the teeth, and it’s starting to be reflected in short term sentiment.

The second hangover is from last week’s newsflow. We had a bunch of earnings, a China deal, and a Fed that is still playing footsie on whether they let it rip into 2026. Now, Monday comes around, there’s AI deal flow with { AMZN | DELL | IREN } and a debt issuance from GOOGL.

This news doesn’t have the same kind of meat on the bone relative to last week. Which means everyone’s miserable, chasing dopamine and getting pissed when reversion sets in.

The market looks fine. And with the VIX still trading above 15, we’re set for more of a grind.

You can still find some decent short setups out there, and here’s my top 2.

Amazon’s Extension

AMZN is sitting 10% above its 20EMA. This doesn’t happen often, much less in uptrending markets. The company had a solid earnings reaction on Friday, then stacked it up with the deal flow this morning.

On paper, it appears to be a layup short, but I’m wondering if there’s still some trapped option trades that need to be unwound first.

The Semi Complex Softens

On the other end of the AMZN deal is NVDA, which accounts for 19% of the weighting in SMH.

You’ve got TSM thrown in there which looks like it could breakout, but there are other pockets like MU, INTC, and AMD that are very extended.

It’s been justified! There doesn’t seem to be an upper limit on semiconductor demand right now, while supply is finite.

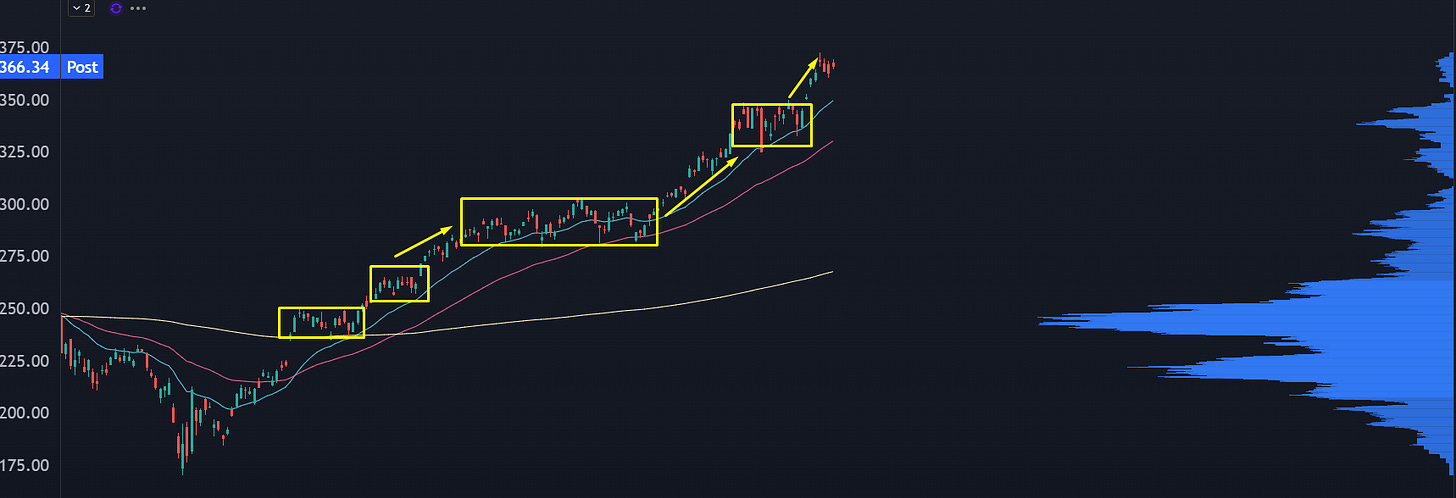

As an example, here’s a chart of the spot price for DRAM that’s been floating around:

This is behaving more like a commodity squeeze, a rush for silicon instead of gold.

How obvious is the trade right now? How much is currently priced in?

If the market does have some kind of risk off moment, then I’d expect positioning in some of these semiconductor names to be exceptionally vulnerable.

I’m not expecting a crash, but some kind of range to get knocked out.

Which is what SMH has done for 80% of its price action since April:

So how can we structure trades to profit without losing our shirt? How can we safely step in front of the AI | semi freight train to pull out 50% gains?

That’s where some creative option plays work well here.