Using Men With Guns To Solve Inflation

Breaking out the CPI data, the squeeze in Ethereum, and how to actually bet against the Fed

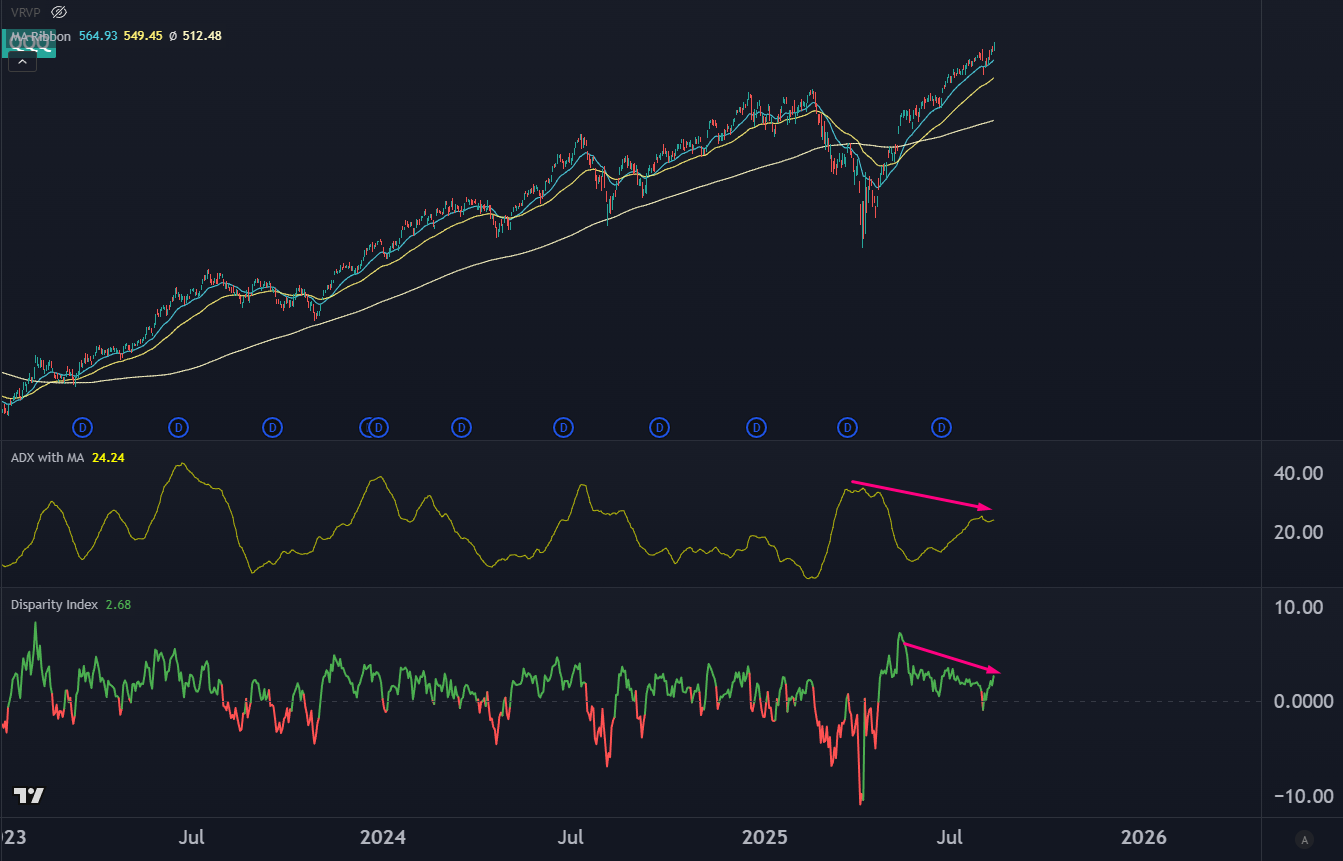

Yesterday I laid out pathing for how the Nasdaq could start a correction, using the 570s zone as a make or break point.

Instead we had a mirror image of that pathing as we came into CPI data:

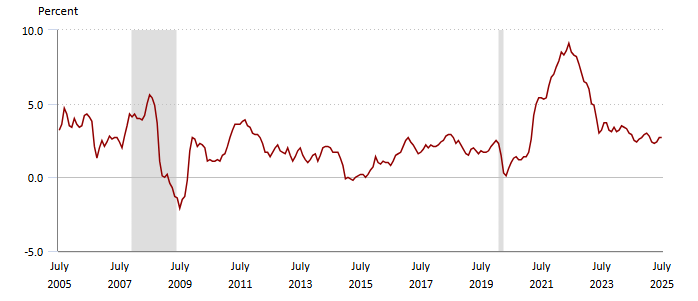

Markets ran hot premarket after CPI, the number was “good enough” and provides the Fed wiggle room to cut into September:

Do you really think there’s sideline cash that was waiting to go “all-in” on the Nasdaq after this number? Probably not. It felt more like the ask lifted and some option flows affected liquidity demand. This felt like a continued volatility unwind in the options market that drove prices higher.

Even if the liquidity wasn’t from pure buyers, it’s enough price action to bring a little FOMO in.

The market’s may feel overdone, but they aren’t parabolic:

For the QQQ, the ADX hasn’t reached peak “trendiness” like it has done on prior rallies. And the distance from the 20 EMA has shrunk, so with the shakeout a week or two ago, it hasn’t stretched to “Oh, this is stupid” levels.

I want to dig in a little more about the CPI data. Shelter has been a major influence on the upside, and even with mortgage rates elevated, we’re not seeing any large decline.

I think that’s about to shift. In fact, I think there’s a considerable “skip” risk in inflation data as we head into the end of the year.

In a moment, I’ll share with you a way to place a bet that the Fed’s going to be more aggressive in the future with deflationary evidence. But first, let’s talk about how shelter prices could dramatically fall.

How America Will Move The Needle On Prices

There’s three sources of inflation.

The first is monetary, from central banks printing currency.

The second is fiscal, from governments spending more than they take in and creating deficits.

These two are what most bow-tied economists are focused on. They’ll go on about M2 supply and how “shelter” is overweight on the index, and will have a dozen charts on a powerpoint that are nice to look at but not policy prescriptions.

Also, these claims brush up against the political. The kind of political that is anathema at the institutional level.

And if you’re blinders only see two inflation sources, then you could miss out on what’s about to move prices in a big way.

There’s a third source of inflation. And it has to do with violence.

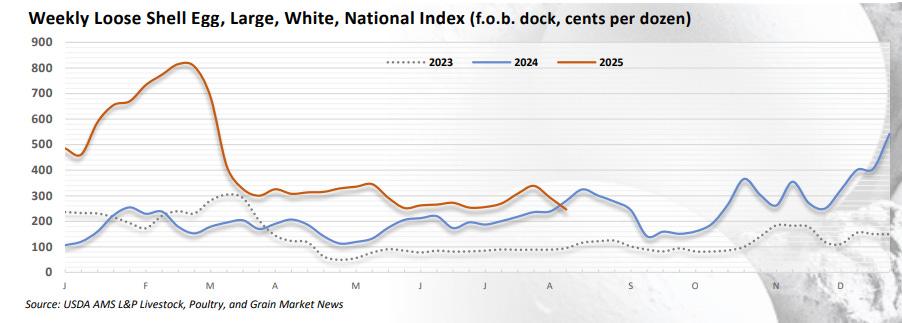

Let’s take eggs for example.

I was over the moon last week when I managed to buy 60 eggs for 13 bucks. These aren’t the fancy organic eggs, it’s literally the “Wal Mart Great Value Big Box O’ Eggs.” It’s what you have to do when your morning smoothie includes 4 raw eggs.

The egg shortage wasn’t from the Fed printing money, or government spending. It’s because the USDA under Biden panicked about a potential bird flu and culled the population.

Nation states are structured to have a monopoly on violence, and that can affect prices when men with guns require farmers to kill all their chickens.

It can run the other way as well. A sticky point in CPI is shelter… housing costs aren’t coming down.

Well, no shit.

In the 1980s, Time Magazine estimated there were between 3.5 to 6 million illegals in the country.

In 2005, Bear Stearns analysts put their upper estimate at 20 million.

The Biden administration brought in at least 10 million that we know of.

So we’re sitting at 30-50 million, easy.

That’s a lot of housing demand, and we’re on the other side of the mountain. Because the Department of Homeland security just got a $165B infusion, a larger budget than the Marine Corps.

What happens to housing demand if the new enforcement causes 10 million migrants to leave? We’ve already seen 2 million migrants (legal and illegal) leave the country.

We can then look at a domestic policy: law and order.

Like “The Wire,” But The Good Guys Win

There’s plenty of affordable housing in Chicago. Problem is your neighborhood is a “no go” zone.

Again, men with guns can solve the problem. The Trump Administration just went hard into DC. The power law works in law enforcement, so it will require to capture 20% of the major criminals in the city. This shouldn’t be too difficult, it’s the most surveilled city in the nation and the drug dealers all have tikoks.

If the DC campaign works, then they’ve looked into expanding into other major cities.

Safe neighborhoods become occupied neighborhoods. And that increases supply.

I’m not sure how economists can model this out, but as we head into the end of the year I predict we’ll start seeing repricings in major metro areas.

There could be a reflexive moment where rates drop which can increase the speed of new housing and multifamily. More supply comes online.

And if US foreign policy can get a handle on the Russo-Ukranian war, then oil and ag commodities can come down. Couple that with a potential Chinese détente, then you have a deflationary peace dividend that comes into play.

None of this is priced in, because it’s gauche to talk about how men with guns can easily fix sticky inflation.

Ethereum Is Having A Moment

Ethereum is going parabolic as TradFi inflows are causing a reflexive loop. There’s an ETF, ticker ETHA, that is not only bringing in a ton of volume… the options market is also creating convexity in the ETF which bleeds over into spot.

I’m a fan of ETH. There’s some fun things you can do with the blockspace, and you can earn yield on your ETH holdings.

At some point, this is going to pop, but the best vehicle for a short won’t be the currency but one of the holding companies. Convex Spaces Clients will get a full options trade setup for this after the paywall.

How To Trade Macro The Right Way

If you’ve ever been to an investing conference, you have probably run into “Macro Mike.” This is someone who can go on and on about Fed policy, or how a typhoon in Japan is going to cause cattle prices to skyrocket, or why they’re investing in a Chilean Lithium miner right now.

(It’s because they know a guy who’s got an in with the Chilean government. He swears.)

We all have a little “Macro Mike” in us, and I’m guilty of it as well. Yet what I’ve noticed is that macro traders always end up with two conclusions:

Short US Stocks

Long Precious Metals

It doesn’t matter what the data is, what the price action looks like, it’s always those two trades. Which is dumb.

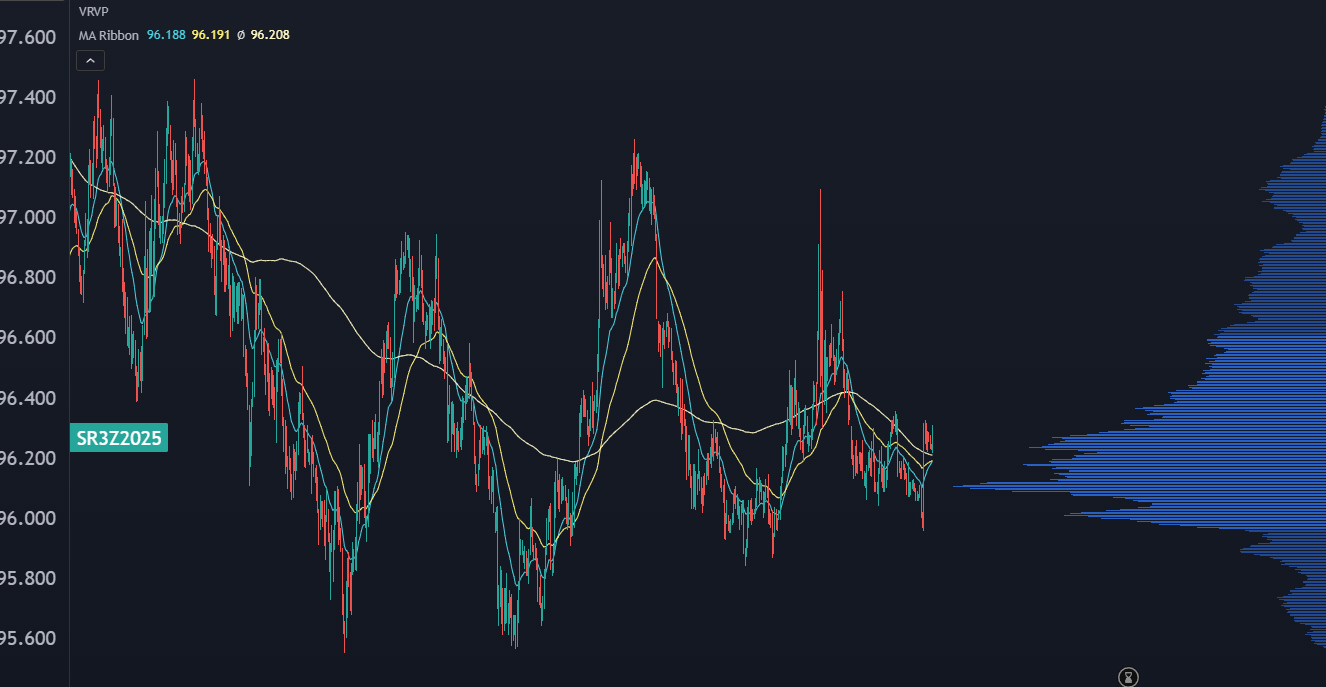

There’s a better way to play the macro game, especially in predicting what the Fed is going to do.

It’s a very liquid market, with liquid options, and exceptionally retail friendly.

SOFR Futures.

This is a market that tries to predict the “Secured Overnight Financing Rate,” which is (pretty much) the Fed rate. This market is NOT efficient, and it’s a better way to bet on CPI data than trying to game the S&P 500 futures market.

Here’s a look at SR3Z2025. This is the contract that expires in December. If price is up, that’s expecting a rate cut. If price is down, a hike. It recently had a hard spike on the jobs report last week, but there could be room to run if you expect that the Fed will have to cut multiple times as we head into the end of the year.

For those bearishly inclined, this may be an easier market to bet on than trying to top-tick the Nasdaq.

For Convex Spaces Clients, we’ll be looking at another AI breakout setup, how to fade the parabolic ETH rally, and an overseas market that finally looks ready to breakout.

BMNR Short Setup

I just realized today that Tom Lee is involved in Bit Mine. Good on him for the play. This is an Ethereum treasury play, and they currently have 1MM ETH

Ethereum is on a tear, and these kinds of crypto rallies either go nuts to the upside or fall apart. This is not a prediction on direction, but on vol.

BMNR feels like it has one more squeeze in it. It should have broken down premarket today, but the bid held against the 1 day VWAP all day, even into the aftermarket session:

I’m looking for one more squeeze as we head into the end of the week. We did see 35,000 contracts trade at the $70 strike, which could be the start of a gamma squeeze, especially if it hits on Wednesday morning as that gives the options enough juice to keep the price lifting higher.

If that happens, I’m looking for the unwind to start. I’m not going to trade this week’s options, I’ll be looking to buy put spreads on the 22Aug25 options. I’ll be looking to buy a 10 wide spread, I know that the volatility skew probably won’t work in my favor, but selling the other put is can give me more flexibility if I’m really wrong and the stock continues to blow out, because I can then buy back the short puts and have a very cheap convex bet if the stock rolls over.

In the previous parabolic run, bagholders start to come into play as the $90 level gets hit. If I wake up in the morning and we are somehow at that level then I’ll start to scale in on the put spreads with the idea that we could jam to 115 if I’m wrong.

Conversely, if the parabolic run doesn’t happen and the bid stays heavy with continued holds under VWAP, then I’ll be looking to play the 45/35 put spread on the 22Aug Spread.

TEM Breakout

Has another date with $75. I like the Oct $80 calls at $4.00 with a $3.00 scale, and a S/L under 59.70.

BABA Takeout

Momentum is there, October $140 Calls at $3.50 with $2.75 scale, stop on 10 day low takeout.