Why The Market Keeps Getting Away With It

Want to make a killing trading stocks? You can't afford to ignore how this trade works.

This market rally isn’t about headlines, or earnings, or the Fed, or any other prevalent Narrative.

It’s about the structural liquidity that’s keeping a bid in the markets. And I don’t care if you’re just a passive index investor, you must understand how this works because it’s a key driver in your returns.

I’m going to show you how these mechanics work. It’s tough to explain, and harder to understand, at least on the first pass. But if you make it through, it’s like seeing the Matrix in the markets.

Because the stock market is not in the drivers seat. The options market is.

This market rally has been extraordinary. Literally. It’s extra-ordinary. This kind of grind higher without a recent doesn’t happen very often. For context, the market went 40 days with the 8 EMA above the 13 EMA, and that’s happened 4 times since 2006.

Something’s different.

It has to do with the combination of index concentration and short term option markets.

Concentration Risk, Or Concentration Reward?

The markets were on shaky ground on Tuesday, but when you have a major component have a legal overhang resolve, it does a lot to help the markets.

GOOG and GOOGL account for about 9% of the weighting in the Nasdaq, and about 5% of the S&P 500.

Winners win. If you’ve invested in a market-cap weighted index, you have dramatically outperformed compared to buying an equal-weight index.

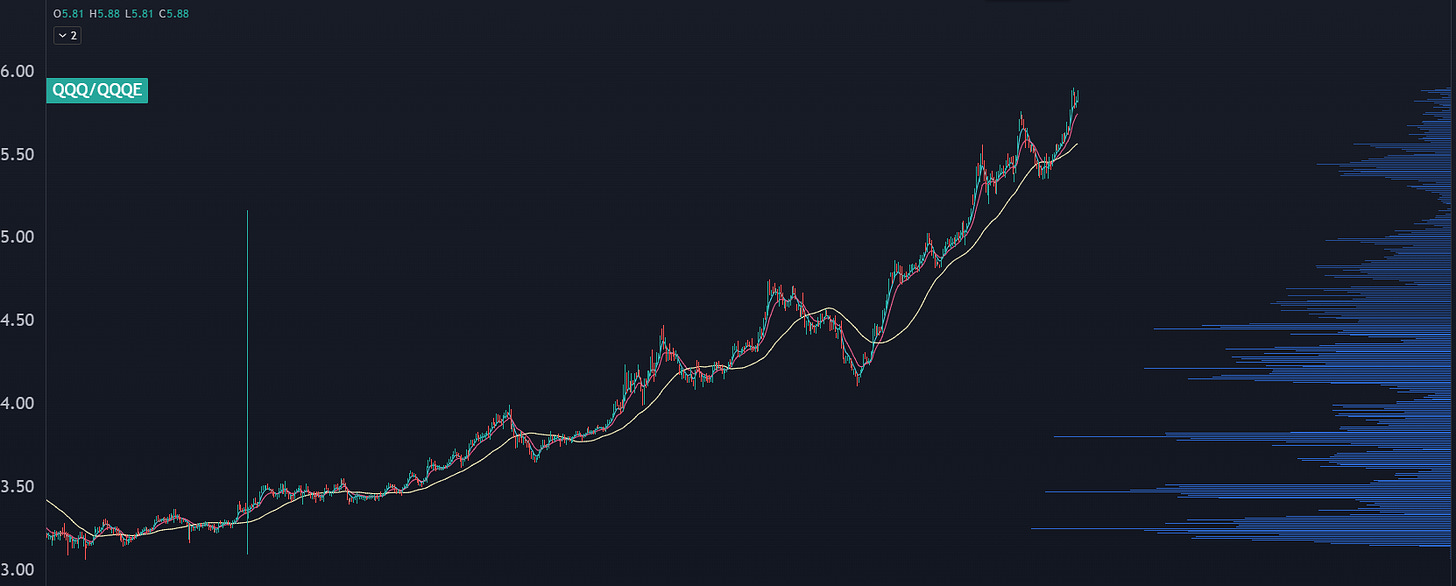

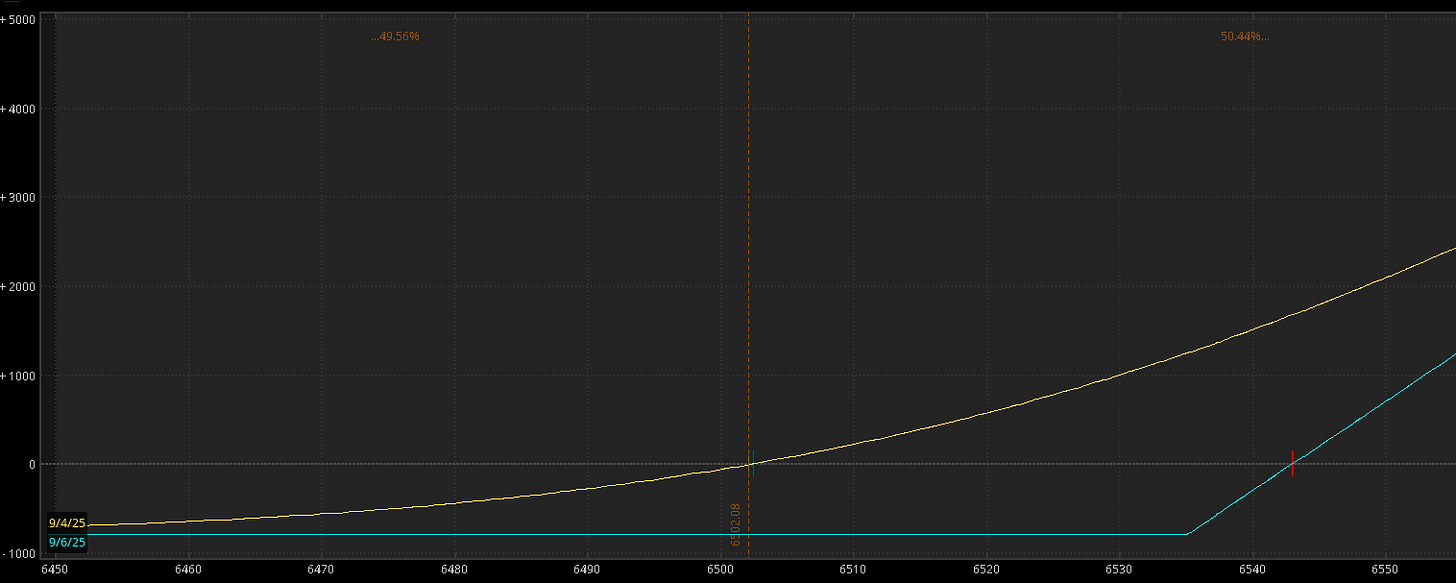

Here’s the performance of QQQ to QQQE:

Many traders and “in the know” pundits have been calling out this as a massive risk to the market. At times, I’ve been one of them. And it’s been dead wrong.

Passive investors have been reaping the gains of the AI hyperscalar trade without even realizing it. Unless there’s some kind of a “tech wreck” that takes out a few of the Mag7 stocks, then it’s incredibly difficult to make the call that this concentration risk is, you know, an actual risk in the market.

The last time there was a serious concentration unwind was in 2018, where META was trading near all time highs and then got absolutely killed on earnings:

That bear market was so bad it got the Fed to enact measures on Christmas Eve in order to stabilize the markets.

But right now? It’s still smooth sailing. AAPL underperformed since the Tariff Tantrum and is starting to heat up. AMZN is trying to push to new all time highs. And MSFT has had an incredibly tame pullback since its earnings gap fade.

This sets the stage. When funds and investors have no other choice, when they have to buy the stocks poised to take advantage of the AI bull market, then you get a liquidity flywheel effect.

AAPL rallies, Nasdaq rallies. AAPL gets a higher weighting in the Nasdaq, which causes more allocation from passive funds, which causes AAPL to rally. The Nasdaq rallies again.

This is the first piece of the puzzle. The second is on the Degen side.

The 0DTE Savior

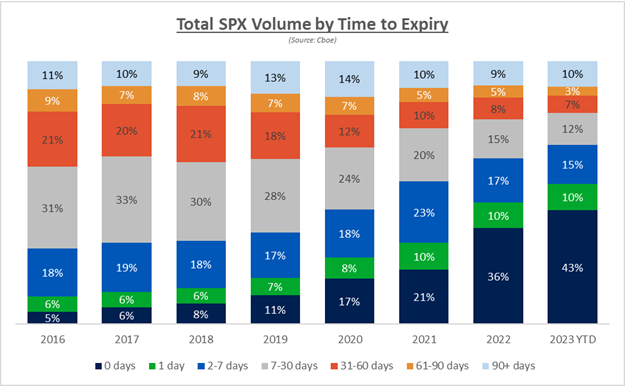

At least half of all SPX volume is on 0DTE options.

(0 Days To Expiration)

I’d wager that’s still increasing. Here’s an older chart from the CBOE showing the growth of these products.

And that’s just for SPX. There’s 0DTE options for SPY, QQQ, and XSP. On top of that, you have weekly options on every single Mag7 stock.

I’d wager that much of the trading on these options are price-insensitive. If you’re a retail trader looking to make a big score, you’re not fighting for price… you’re slapping the ask.

That’s a dream for an options dealer. They provide some liquidity, hedge it off in the futures market, and captures $150 on your 10 lot option trade.

This gives market makers and dealers a LOT of wiggle room when dealing with volatility shocks in the market.

If you’re an investor that’s scared because of some headline and you want to buy some protection, odds are you aren’t buying short term options. You’re probably in 30 day options.

But when the market gets loose, 0DTE options get INCREDIBLY loose. This gives dealers a way to easily work down the other side of a hedge.

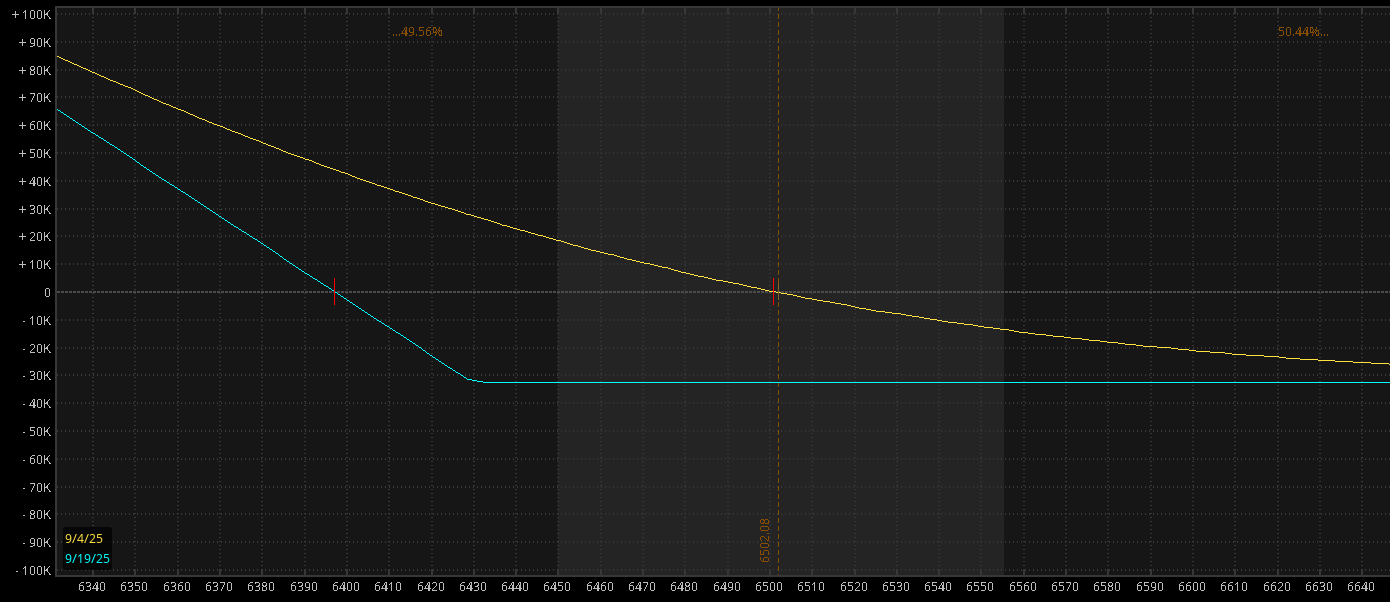

Here’s how it could work. Let’s say you have a customer that’s throwing on a hedge in October 30 delta put.

The actual instrument doesn’t matter, because they’re all effectively in the same liquidity pool. It could be AAPL or QQQ or AMZN or SOXL… it’s all tied together. To keep it simple we’ll focus on the SPX.

It will look something like this:

Now there’s someone on the other side of the trade, most likely a market maker, dealer, HFT, whatever you want to call them. High odds it’s a computer. Here’s what their risk looks like:

You can hedge off this exposure by shorting futures, shorting a basket of Mag7 stocks, or having other synthetic positions on in the options market from the other trades.

If there’s too much flow in one direction, then you can end up with a gamma squeeze, which is what made GME such a famous trade in 2021. It still happens, but much less so in the leveraged liquidity environment we see.

Especially so with the 0DTE market. Remember, there’s a ton of price insensitive traders in these markets. Not just long calls and puts, but short spreads and condors and calendars and all sorts of trades.

This means that when market makers take on the other side of a hedge, they can effectively get paid to reduce their risk.

Second Order Effects

Time to go down the rabbit hole further.

The primary exposure in an options trade is the delta, that’s sensitivity to price movement.

Delta is not constant in an options position. It can change as price moves (gamma), as vol moves (vanna), or as time goes on (charm).

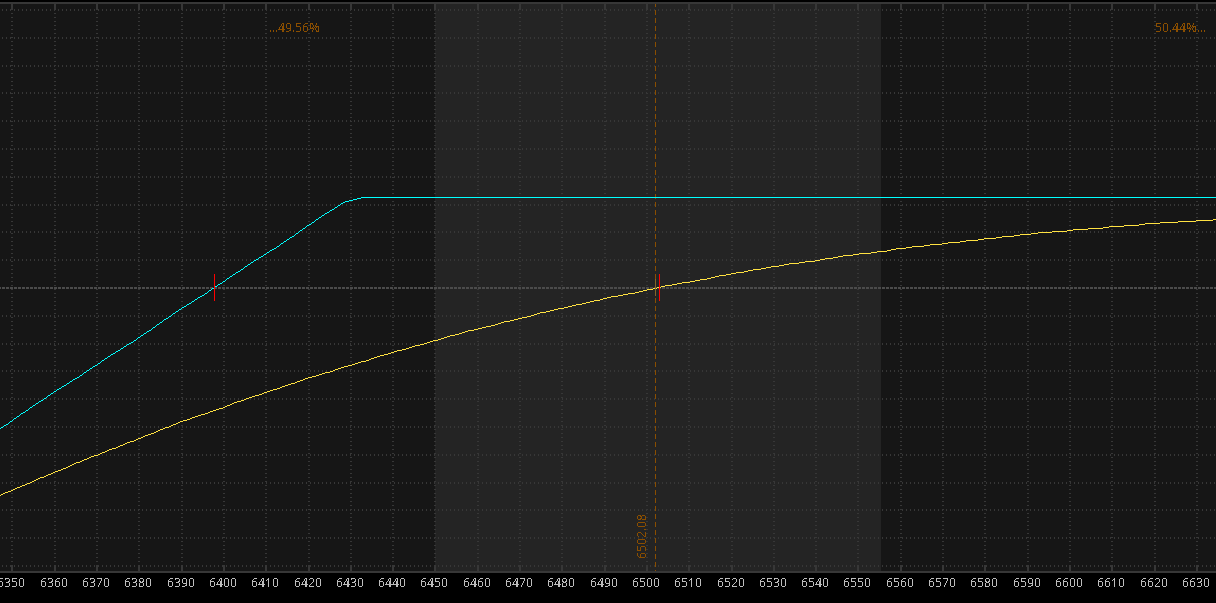

This is a 0DTE call that expires in about 18 hours. It currently has a delta of 28, but as time goes on, it will work down to a delta of zero.

Think about a dealer on the other side of this trade. They start off net short 28, but by the end of the day, they have to buy back the equivalent of 28 SPX shares in the market.

This can end up putting a natural bid in the markets.

Now imagine that this is happening on 0DTE options on SPX, SPY, QQQ. It’s also happening on weekly options in Mag7 stocks. With the markets awash in price-insensitive liquidity, it ends up dampening intraday price movements.

And those longer term customer hedges I mentioned earlier? They end up burning off… putting yet another bid into the markets.

Where’s the Breaking Point

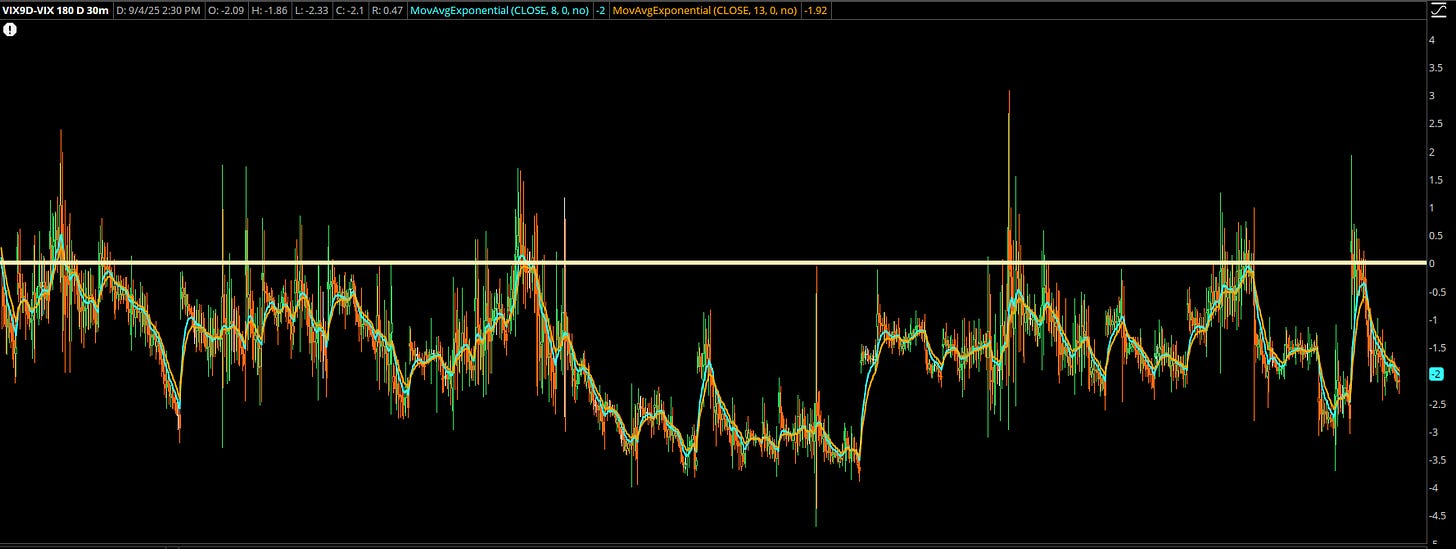

This chart shows the difference between the 9 Day VIX and the 30 Day VIX. I’ve not found a “pure” way to measure the rolling IV for 0DTE options so looking out 9 days is close enough.

When the market gets a little loose to the downside, the short term option liquidity gets blown out. This reading breaks above 0. Dealers just step back and walk the ask up, and there’s still plenty of willing traders on both sides to play it.

The reason the market can’t rollover is because 0DTE liquidity is dampening the actual volatility in the market, which then creates another kind of liquidity flywheel that has the market grinding higher.

Extra-ordinary.

At some point, this has to give right? I’m not sure.

Back in 2017 there was a super crowded trade where everyone was piling into short volatility ETPs, with XIV being the main vehicle. There was a clause in their prospectus where if VIX futures broke a certain daily percentage, then they would be forced to unwind the entire short on the open market.

That was Volmageddon.

This time is different. 0DTE traders are not all running in the same direction. Some are constantly trying to nail the next market crash, others are systematic iron condor traders.

The only way I see this ending poorly is a catalyst that comes out of left field and we get multiple days where the trade runs in reverse… where the selling in actual stocks overwhelms the liquidity pools in the options market.

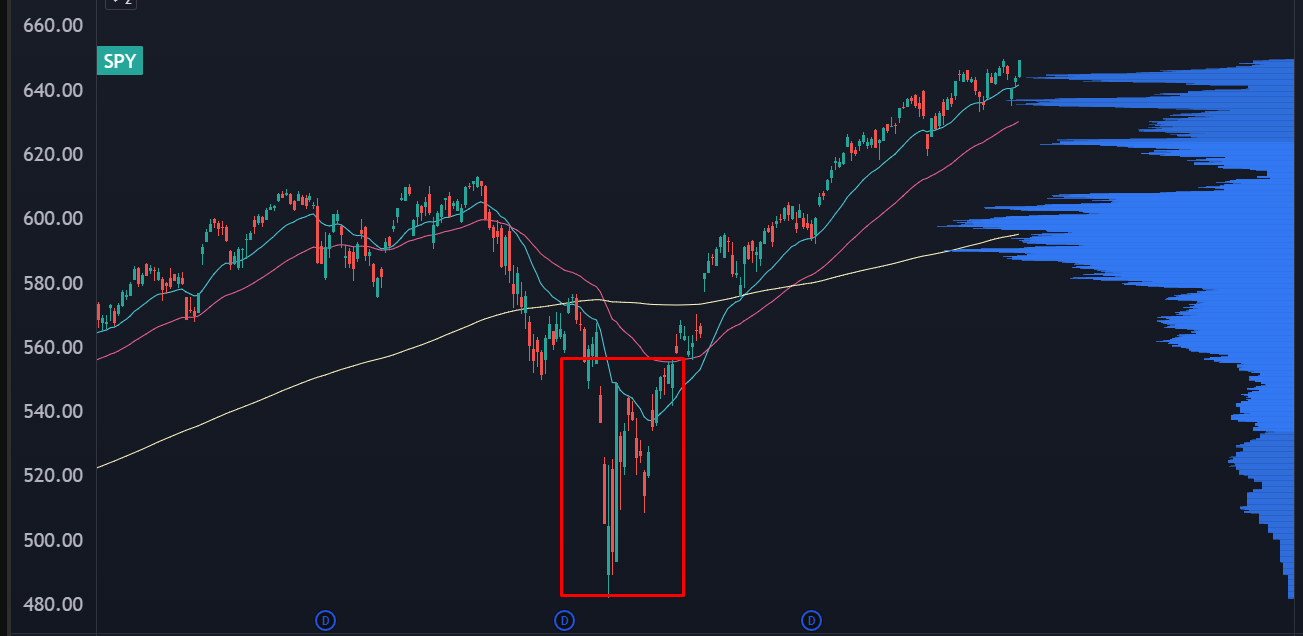

Which is what happened in the Tariff Tantrum:

Large cap stocks are behaving like a sold put option. You get a daily decay in the options market that keeps a bid in stocks, and concentration risk continues to be concentration reward.

This may be the new normal. It’s now just ordinary. Volatility has always clustered, and now it just may be much shorter in timeframe and much more violent in price action.

Know What You Own

I know that financial advisors and other fiduciaries traditionally don’t like to recommend options to their clients. Nobody likes to see a position get marked down -100% after 6 months.

But whether you like it or not, if you own the S&P or the Nasdaq, you are now an options trader. You must learn these mechanics, there’s no other choice anymore.

If you want a little more, back in 2022 I spoke at a conference about “Wag The Dog,” the same kind of mechanics we’re dealing with today.

You can watch it here:

Thank you. This is an excellent summary for those of us who are not expert vol traders.