Why There's Still Plenty Of Time To Kill It In This Market

Another Elon hot take, fighting through anchoring bias, and the hot sector for this January

I’ve never understood why New Year Resolutions exist. You get all jazzed up about losing that extra 15 (you really mean 35) pounds or cutting sugars or going for a jog.

But odds are you woke up on New Years Day with a little hangover and zero dopamine. Guess you better wait until next year!

We’re terrible at keeping track of time, which is probably related to how we are terrible at thinking about compounding interest.

But we do have days that act as totems. We talk in terms of quarters and earnings, and even though it’s arbitrary, Wall Street uses a Year-To-Date benchmark.

So it’s a paradox. The new year can bring in new capital flows, but it’s not like there’s a new emergent investment theme that’s going to pop up over Christmas.

(Except Venezuela)

There’s also this tendency that I have to immediately consider fading the consensus from 2025.

Which would be AI. But that simply doesn’t track.

We are still in the Coca Cola market. We aren’t seeing a Bubble with a capital “B,” but a series of small bubbles where capital jams into a bunch of stocks all surrounding a narrative.

That’s still the trade. Space and sats are in play right now, and the AI-storage plays like SNDK still have legs.

And there’s still biotech and banks on a run, industrials are at new highs, and overall breadth looks solid.

But if you’ve been playing NVDA, it’s been 3 months of disappointment:

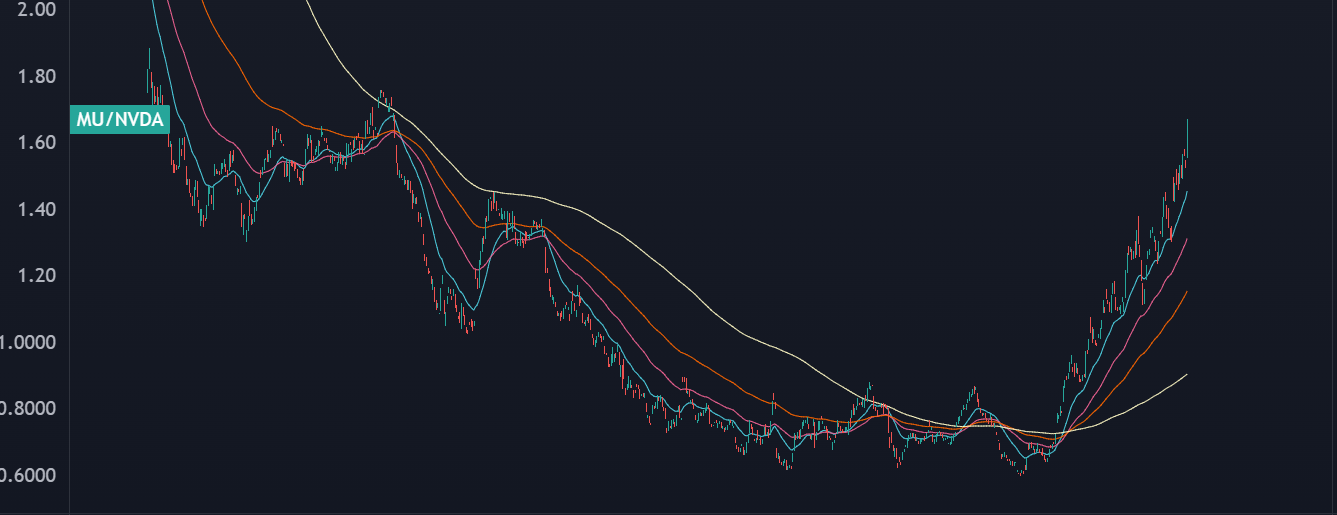

It looks even worse when you consider the relative performance of MU over NVDA:

This is a stock picker’s market.

With the VIX holding under 15 and the dispersion of returns we’re seeing from Megacap stocks, it could be “boring” for passive investors while there are some incredible plays underneath the surface.

Chip of Theseus

Another problem with time is anchoring bias. A big event happens, and even if it was a decade ago, you still operate within that original environment.

It’s how sentiment stayed bearish through the first half of the 2010s, because we were all anchored onto the GFC.

Investors can also anchor onto the vibes of a company and assume that it’s going to be the same every year.

I remember getting smoked on GE becoming a value trap with a reverse split, and I just assume that the stock has sucked ever since. Nope, it’s up 750% from the 2022 lows:

Companies can change. You fire the CEO, bring on different directors, have a “turnaround,” acquire a company at too high of a price, burn through too much cash, lose market share…

Sometimes the turnaround manages to work. Enough overhead gets cut and cash flow improves, and some innovations get the stock moving again.

General Electric has been around for a long time, but the company looks completely different than it did a century ago.

This kind of transformation can take years. Unless you have the government throw you a wad of cash and grease the skids.

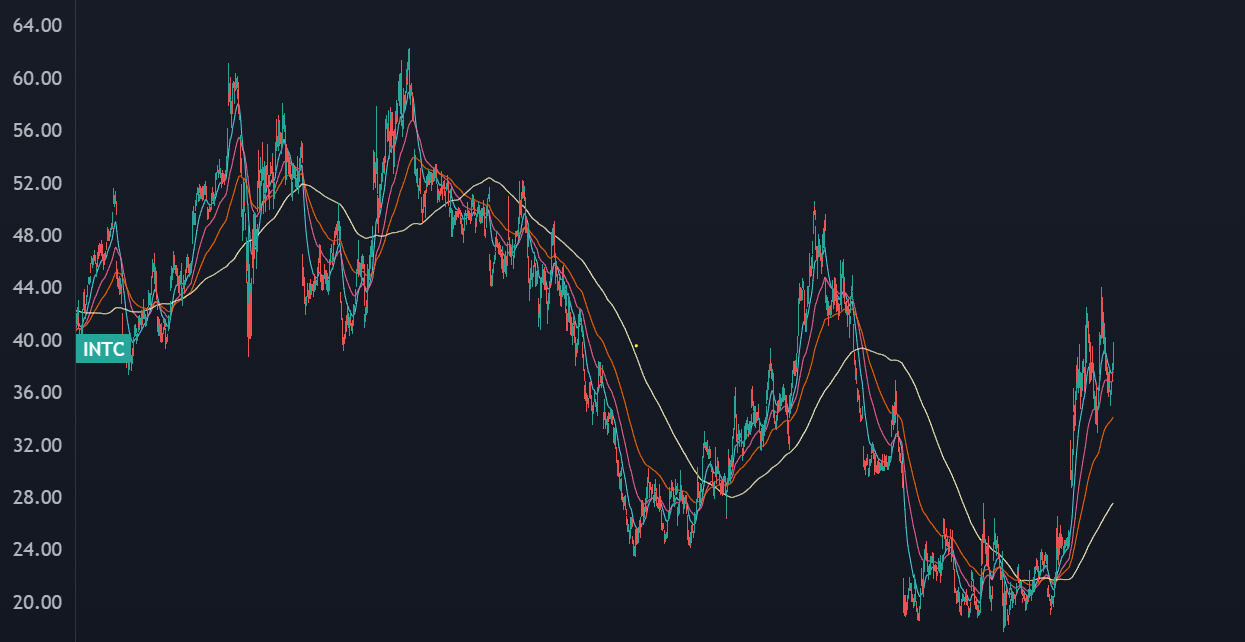

I have anchoring bias with Intel. I think it’s the same, vertically integrated CPU giant from just a few years ago.

But with the CHIPS act, the Fed investment, and a ton of fundamental pivots from the past two years…

… and it’s a new company. I wish they would change their ticker.

This matters because the stock is coming into large levels of “resistance” back from 2018-2021. But I’m thinking that these levels may not even matter due to the structural changes of the company.

Wait, How Much?

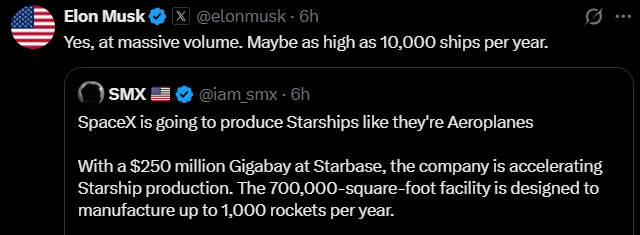

SpaceX is expected to IPO this year, which means our boy Elon is out hyping it up. That means the numbers can be a little hyperbolic… but it’s still an eyepopping amount.

Here’s the math…

Starship currently carries 100 metric tons of payload into LEO. With 1,000 rockets that’s 100,000 tons that you could put into space.

And the rockets are reusable, that’s not even per-year.

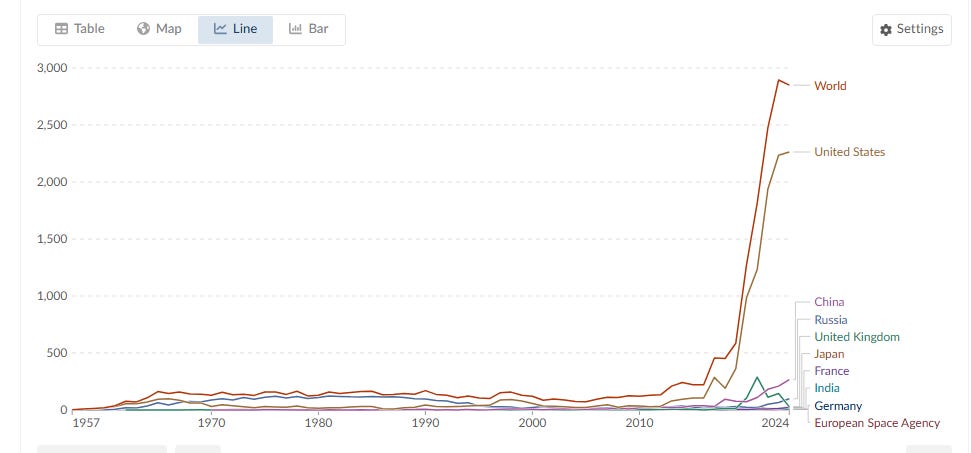

The U.S. is currently sending over 2,300 “things” into space per year. It’s a hockey stick:

The total payload weight is about 3,000 tons per year.

With Elons projections on rocket buildout, that means we could see a 30x-100x increase in space payload capacity.

Another way we’re bad with time is that investors think the stock and a company are the same thing. We’re looking for immediate results in the form of share price appreciation, but it takes time for companies to do things. I know, it’s hard to hear.

The “hype cycle” in the market has been so compressed that a stock can rally and crash before the company can even deliver on results!

We’ve had multiple bubbles pop in the AI infrastructure space… but the AI data centers aren’t even built!

Elon can manufacture at scale, but space capacity still has a while to go before it’s built out.

It’s still early.