You Down With PEAD?

The best scan to watch as we head into the Fall. Why I get bullish into breakdowns. How to spy on SPACs to beat the crowd. Two credit spread trades, a degen LEAP buy, and a clever setup in AEO.

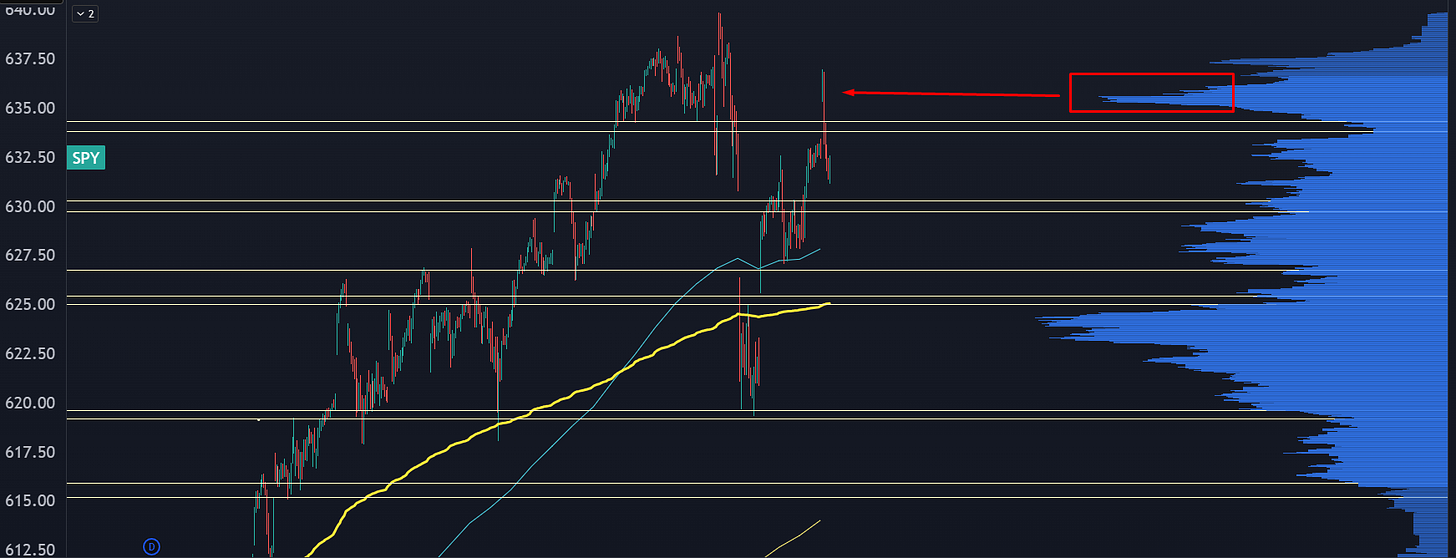

The S&P 500 had a “bagholders paradise” reversal, where the market jammed higher until it hit larger inventory levels and those traders managed to get out at breakeven.

If 635 isn’t recovered by the end of the week, then odds are setup for a range trade for a little while longer.

I’m still not looking for a cascade selloff. Don’t get me wrong, I’m very sympathetic to a bearish setup.

(Would it kill the market to make a lower low?)

One big problem… the options market is driving the bus and risk is still pricey. Since the Tariff Tantrum lows, there’s been a persistent bid in options as investors try and keep one foot out the door with hedges.

And if too many are hedged, you can’t get a pullback. With the gap down last Friday, vol has picked up a bit, yet if sellers can’t overtake what the options are pricing in, it’s a range trade at best.

How the Most Obvious Market Edge Still Works

It’s tough to be the CEO of a non-Mag7 company. It’s your job to sell the stock to investors, but you can’t get any play time on CNBC because they’re focused Jensen’s hyperscaler numbers and a few big banks.

You want to attract attention? Just have blowout earnings.

There’s a market phenomenon called “Post Earnings Announcement Drift.” The idea is that if a company has a fundamental catalyst leading to big upside moves, the stock will continue to drift in that direction.

The edge works because once the stock has a ton of eyeballs, it takes time for positioning to build out.

For most of us, we don’t have the kind of size to push a stock around, so we have the ability to ride that drift for simple profits without taking a lot of heat.

Want a shortcut? Use this scan. It tells you all the companies that moved big on earnings this week. Many of these names should go on your watchlists for continuation setups.

A Twist On The Most Obvious Market Edge

If you’re a large market player and you want to get into a stock, you need to fight for price. You can’t smash the ask and take out all the liquidity, because your fills will get you fired.

Instead, you have to play some games. Maybe flash some large offers to get the bid to drop out. This is technically illegal but lmao ok bro. Yet there’s a setup where you hunt down a “captain obvious” support level.

That level breaks, the bid drops out, and you get favorable prices.

Here’s a recent example in GDXJ:

Obvious support holds at 65, so traders place their stops under that.

Market trades heavy, a gap down breaks it and flushes the market. Then the bid holds, informed capital enters, and then the market jams to upper range.

Burn this pattern into your brain, especially on those post-earnings plays.

Using AI To Find SPACtion

In mid July, Grabagun listed on the markets using a reverse merger, also known as a SPAC. The holding company was CLBR, which doubled from $10 into the announcement.

This is a pure vibe trade, you’re looking to buy the rumor, and sell the news. And with the Trump family getting involved in a new SPAC, it’s game on.

Here’s another scan that lists all active SPACs, sorted by volume.

Then, go into your favorite AI platform and start up their “deep research” mode, and use this prompt:

I'd like you to do a deep dive into SZZL, which is a shell company (SPAC) that is going to bring a company to market. I'd like you to run due diligence on the management team of the SPAC. Who are they, what's their background, and have they brought any SPACs public since 2020 and how did those stocks do. I'd also like you to tell me about the company behind the SPAC and if they have any pedigree with these companies.

If you can sniff out any themes that would get some memetic energy going on social media, then the SPAC can easily run 50%. Just remember that after the announcement or Definitive Agreement, profits are taken and rugs are pulled.

Today’s Setups for Members

The Sydney Sweeney Jean trade is heating up in AEO, and that’s giving us a solid vol trade. We’re also seeing some decent pullbacks to sell spreads into, and I’ve got one “set and forget” trade in the EV space that is ready for a triple.

Want the best option trades on the internet? Become a Convex Spaces member today.

AEO Vol Trade

American Eagle had a memetic pivot with the Sydney Sweeney ad campaign. This has led to degens crowding into the market with the hopes of causing a gamma squeeze.

I think the trade has legs but I think we need to disappoint those who were looking for fast gains.

There’s a serious upside skew in September, and that can give you a way to stack a vol edge.

Here’s the setup:

Buy +15 Jan’26 $20 Calls @ 0.70

Sell -10 Sep’25 $16 Calls @ 0.50

It’s a ratio trade. Not sure it has a name.

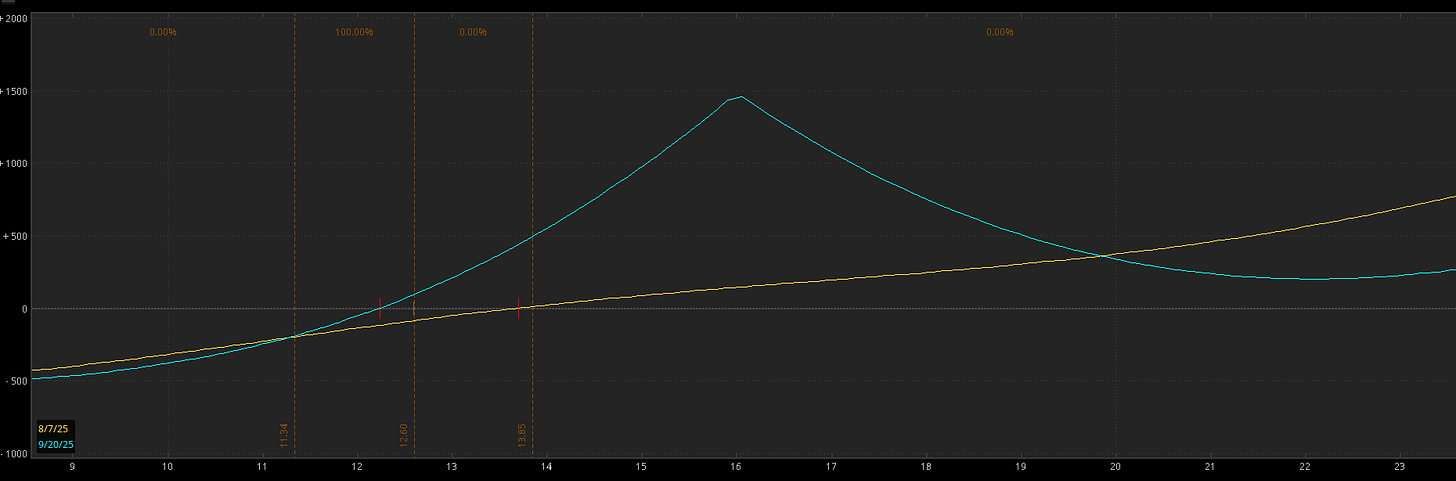

This is what it looks like:

This is a trade where each leg can be scaled in an out.

If the stock rips into prior resistance in the 16’s you can take some profits on the 20 calls and start to bet on reversion.

If we get through earnings and they aren’t a blowout, then vol should really come in on the Septembers. The idea here is to find a way to own some cheap upside tails without worrying too much about the timing.

Bups In COIN and SHOP

COIN had a hard pullback coupled with an earnings gap lower. They also announced a $2B convertible, and that news should help put a floor on the stock. It tested the swing AVWAP from the April lows, but if it has one more push sub 300 I think it’s a good time to scale into some bull put spreads.

The September 250/240 Bull Put Spread Works. It’s currently at a value of 1.20, but if you can get 1.50 with a 1.80 add, that’s a good setup.

SHOP had knockout earnings, but is seeing a fade as profits come in. I think they could take out the earnings open and shoot for the half gap fill, which is a good place to scale in to some spreads.

The 28Aug25 $125/$120 Bull Put Spread is currently at $0.12, but if it hits that half gap level, you’ll e able to sell them starting at $0.65. Look to add at $0.90 then scale out at $0.20.

LYFT Range Test

Always the bridesmaid, never the bride. LYFT hasn’t competed with UBER very well, but this is a monster base building out. The company just had earnings with decent numbers… current numbers were below consensus but they did raise guidance on bookings. Leadership is looking for improved margins as well as international growth.

Now that earnings are out of the way, the options drop as some air gets let out of the balloon. Yet I wouldn’t be shocked if we test $20 by the end of the year.

The Jan’26 $20 Calls are going for $0.45. This is a decent bet, and you could enter here and if enough time goes on without a pump, you should be able to scoop some more at $0.30.