Evolution

How the silver trade is going to dash everyone's expectations, and breaking down a blown up options trade.

Equities are still stuck in the “paint drying with a small markup” trade. It’s a ton of chop, failed moves, and statistical noise.

Welcome to holiday trading. Institutional flows dry up and you get one or two smaller themes that go on a run.

Often it’s a hot narrative that gets some small-cap runners squeezing.

But this time, it’s silver.

It’s Different This Time

In my pre-Christmas post, I shared some thoughts on silver:

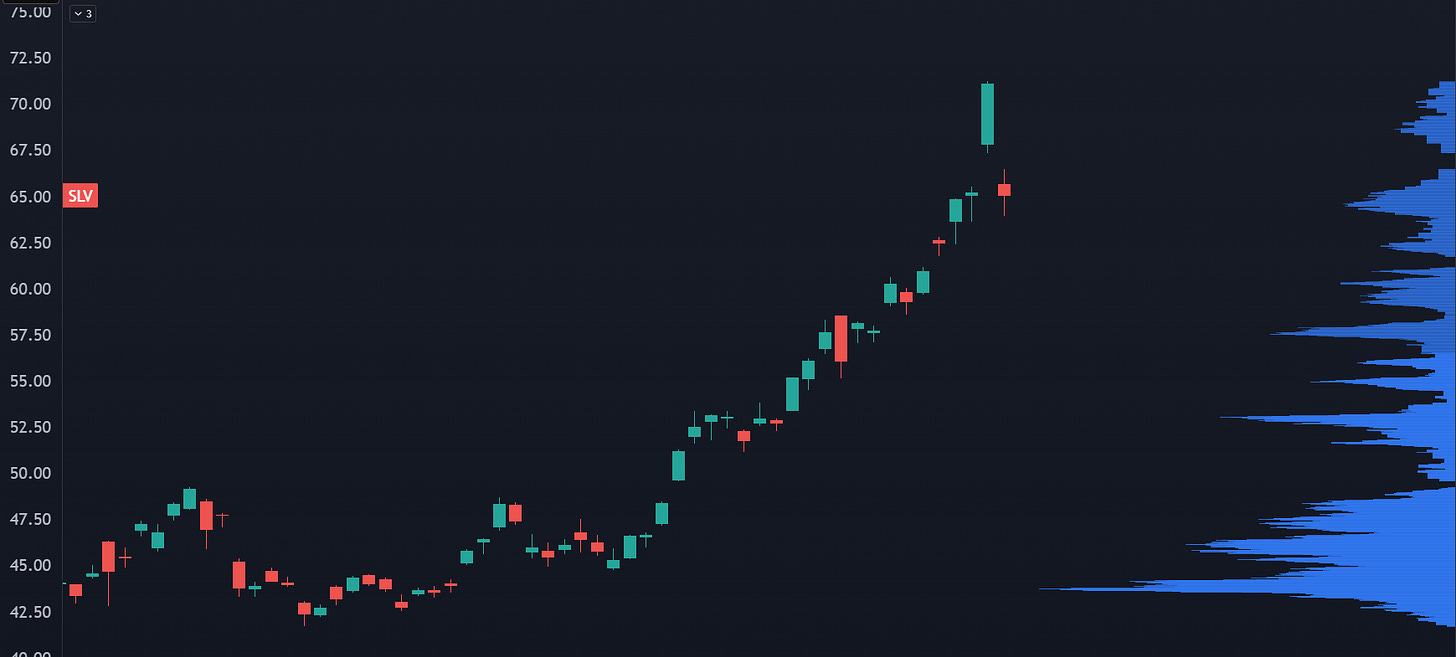

As I said above… this trade is still early. Silver just closed at highs, I wouldn’t be shocked of another gap higher and maybe a chase as shorts get blown out.

In fact, Friday December 26th is a trading day, and given the kind of liquidity environment you see in between holidays it could lead to the blowoff we’re looking for.

The call has been a good one (so far) but my expectation on pathing has changed.

I have keen memories of the 2011 parabolic in silver. It was a crazy market and the silver bugs were throwing out all kinds of fake news… like how Interactive Brokers was colluding with banks by raising margins on silver futures contracts.

Or how JP Morgan is stuck short and manipulating the market. That kind of news just got recycled overnight with a fake headline about a bank failure from the silver short.

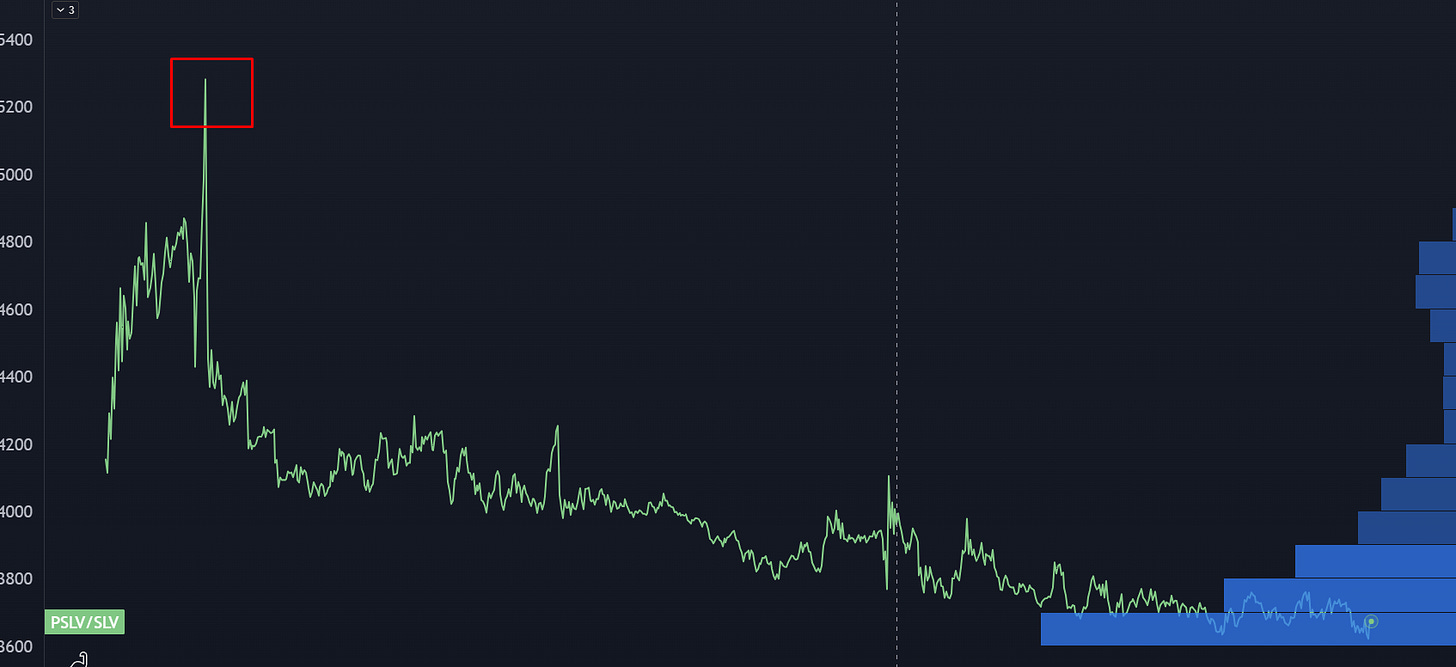

The fever pitch became a roar where silver bugs claimed you needed to own physical silver, and that the SLV fund had structural issues.

That caused a large premium to be introduced in PSLV (Sprott Physical Silver) compared to SLV:

Once silver faded, the premium collapsed.

And with this recent rally, we haven’t seen a similar kind of markup.

Because this time is different. It always is. The silver market is completely different from 2011. There’s more funds, more liquidity, and a LOT more traders in the derivatives market.

Which is why the backside slide is going to be so difficult to hit.

In a broader context, shorting silver using options is a VERY high-risk and sophisticated trade. If you asked a financial advisor if you should take the trade, they would look at you like you had three eyes.

Yet the total participation and volume in Degen markets have skyrocketed since 2020. Option volumes are up and you have many more people out there trying to nail the short.

Odds are they’re not straight short with futures, and they’re not going to be selling a bunch of calls… they will be buying puts.

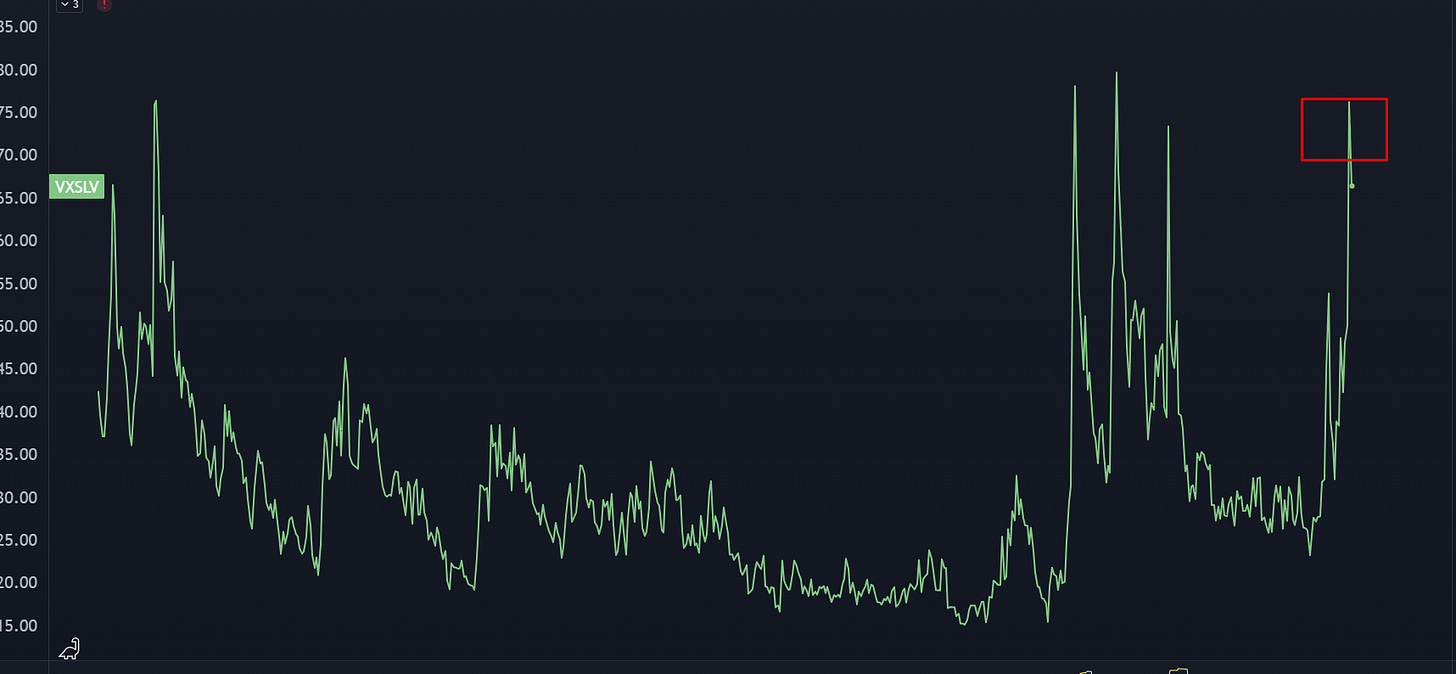

The silver VIX spiked up to 75, which has been close to a peak and higher than what we saw during the 2011 parabolic.

If you have a bunch of traders buying puts and trying to play a hard parabolic unwind… then the selloff will be cut off due to derivative driven adjustments from dealers and other market participants.

My best (and incomplete) analogy is what has happened in OPEN:

This stock had a ton of eyeballs on the $10 move, and everyone got beared up with buying puts and looking for the “obvious” parabolic unwind. And then it didn’t hit… it just chopped around for well over a month.

Don’t be shocked when the games start! Silver had a gap down this morning but can’t rollover because it’s so crowded:

The trade setup I shared with Clients is still the best one I’ve got— it is bearish but also captures some time decay and positions us for the eventual unwind.

Captain Icarus

Holiday trading can be a widowmaker for traders. You’re bored, searching for an edge, and you take on a trade with a little too much size in a market that has a lot less liquidity than you think… and then you blowup.

Sometimes that blowup can be public.

“Captain Condor” is a trader that hit the spotlight this year. He’s an options trader that runs a service specializing in selling 0DTE iron condors. This is a trade where you bet on the market to be in a range for the next day.

It’s worked very well this year. I speculate that part of the success of the trade has been the elevated risk premia on longer dated options, which created a kind of liquidity flywheel that helped an edge bleed over into the short term options market.

Captain Condor is such a large trader in a specific niche that we can see the strikes of the trades he takes. They’re massive positions, and because we know the payout of the trade we can see where the paint points are on the trade.

Holiday trading means much lower liquidity available in the market… and the trade got runover.

Twice. It was rough enough that it required a twitter post on Christmas Day

I’m not here to pile-on the suffering… but sometimes it’s better to learn from other people’s losses instead of making the same mistake on your own.

I’ll share those lessons in a moment, but first let me take you back in time a decade…

The Supertrader

Late 2013 to 2016 were the golden age for iron condors. Vol and skew were still elevated but more importantly the market was in a high reversion mode.

Even in the post QE uptrend, the S&P would have normal pullbacks that would get you out of trouble if you were betting on a range.

It was such a good environment that there were traders who seriously leveraged into these trades and became famous.

Like Karen the SuperTrader. Her story made the rounds and she took a couple interviews, talking about her size and how she’s moving from retail into running other people’s money.

The trouble hit in October 2014— this was the Ebola selloff.

This selloff was different, because it was the first proper “V” we had seen in modern markets. In other prior pullbacks there were retests and ranges, but this was different because it was event risk and options were starting to influence markets for the first time.

If I recall the story correctly, Karen rolled down some short calls and ended up getting runover on both sides of the trade.

Even through that, iron condors still worked incredibly well. There was a 6 month period in 2015 where the S&P traded at 2100 the entire time. Easy money.

After the 2016 election, the trade stopped working:

Short volatility got crowded. You had instruments like XIV and SVXY that started to drop the premium available, and call options had their IV tank, which meant you were taking on a lot more upside risk. And while realized vol remained low, there was very little reversion on the table.

The CBOE have benchmark indices, which allow you to track various strategies.

Here’s CNDR, which simulates the performance of a 1-month, 20 delta iron condor:

Had you done this blindly and with no risk management, you’re breakeven over a decade.

Traders like Captain Condor are searching for systematic option trading strategies. A kind of sustainable edge in harvesting risk premium.

And they exist— but they aren’t persistent and the edge shifts to different strategies over time.

The problem with systematic options trading is that it’s naïve - not in a derogatory sense but in terms of lacking context.

Are you going to systematically sell a straddle? What if it’s a 9% vol and tomorrow’s a Fed day?

Here’s the takeaways:

Systematic option trading will always evolve to have hidden left-tail risks due to edge erosion or very adverse markets.

Adding filters to a strategy will significantly reduce your blowout risk. For example, there are strategies that you probably shouldn’t do when the VIX is at 50.

Option traders overfit on vol and not enough on trend. If you sell an iron condor at a 15% vol and the market trades at a 9% vol, you can still lose money if all of that vol is spent moving in a single direction

You must understand that volatility and liquidity are different perceptions of the same object. When you sell vol, you’re making a bet that liquidity supply will be high enough so price doesn’t move that much. But if you’re a 0DTE iron condor whale who put on a trade during the holidays, the liquidity risk exists not just from low volume but because other traders will shoot at your position