Farming Out In Left Field

Wargaming the next month, the resurgence of the space race, and a commodities sector you can't afford to ignore.

Every morning when I’m cooking breakfast, I put Bloomberg on my iPad in the background. Lisa Abramowitz and the Plucky British Guy are usually on, talking about the “front and center” narrative for the markets.

It’s been getting repetitive.

Market participants have been hyperfocused on inflation and rates throughout the summer. Prices are moving on CPI and PPI data, and everyone’s focusing on the Fed into the (potential) September rate cut.

I predict that the next big move will be driven by a catalyst or fast narrative to shift to something that comes out of left field. The Fed has become a distraction.

Some Speculative Headlines

Here’s a sampling of what could happen in the markets in the future:

Downside skip risk in housing due to deportations shows up in data

AI hyperscalar capex has overshot potential future cashflows, which becomes evident with another “Deepseek” efficiency event

Or, emergent agentic AI proves itself fast and we’re off to the races, again

Russo-Ukrainian détente causes unwind in defense stocks, PLTR unwinds which takes out the momentum complex

US government becomes more aggressive with single company investments; MP and INTC are the start of a new sovereign strategy that causes industrials to ramp

China hack of DoD leads to investigation in MSFT, unwinding the tech trade

My sense is that I’m early on this idea, and it could be one more opex cycle, as we near the Fed September decision, where something else captures the market narrative

The Next Phase of the SOLBAT Trade

Solar stocks had a hard push on Friday:

The catalyst was that the Feds provided new guidance on tax credits for clean energy projects.

Given how Hyperscalars are building out, the solar trade makes sense. I’ve stated the case here and here.

Solar doesn’t need subsidies, AI power demand is too great. Yet if the Trump administration is going to continue interventions in markets, don’t be shocked if they allow solar subsidies to stick around as they are (hopefully) aware that the AI arms race is actually an Electrons arms race.

There’s another part to the SOLBAT trade, and that’s batteries. If solar buildout hits hard, then energy storage is just as lucrative of a trade.

One battery ecosystem play to watch is lithium. SQM just saw a big push last week:

And LIT, a lithium ETF, is starting to show signs of a bottom:

If you’ve traded lithium stocks before, you should know the tickers. If you haven’t traded them before, just know at some point your heart will get broken.

Names to watch: LAC, LITOF (OTC), LAR, SGML.

Free Alpha in EOs

The speed of this administration is incredible. They’re using a “flood the zone” tactic, moving on multiple fronts so that it’s difficult for political opposition to mount a defense, much less any spin in the media.

This is also giving us incredible opportunities to play under the radar stocks. When the Trump administration issues an Executive Order, I’m immediately throwing it in GPT to process it.

The most recent EO that has my interest: Enabling Competition in the Commercial Space Industry. I think you can guess what stocks to look at— RKLB, PL, ASTS.

There’s also one name that’s new to the markets - VOYG

It’s had a rough go of it:

I’m not interested in bottom-fishing, but if it does start to show signs of reversal, then this could have some solid tailwinds going for it into the end of the year.

Up On Deck

For Convex Spaces Clients, we’ll be focused on two themes:

Simple pullbacks after post-earnings runs

Failed breakdowns on momentum high flyers

How to Knifecatch a certain oversold yoga pants merchant

We also did just have last week’s deep dive pick hit our trigger on Friday.

If you’re a Client, thanks for being here. If you aren’t, then sign up today.

Buy The Stop Runs

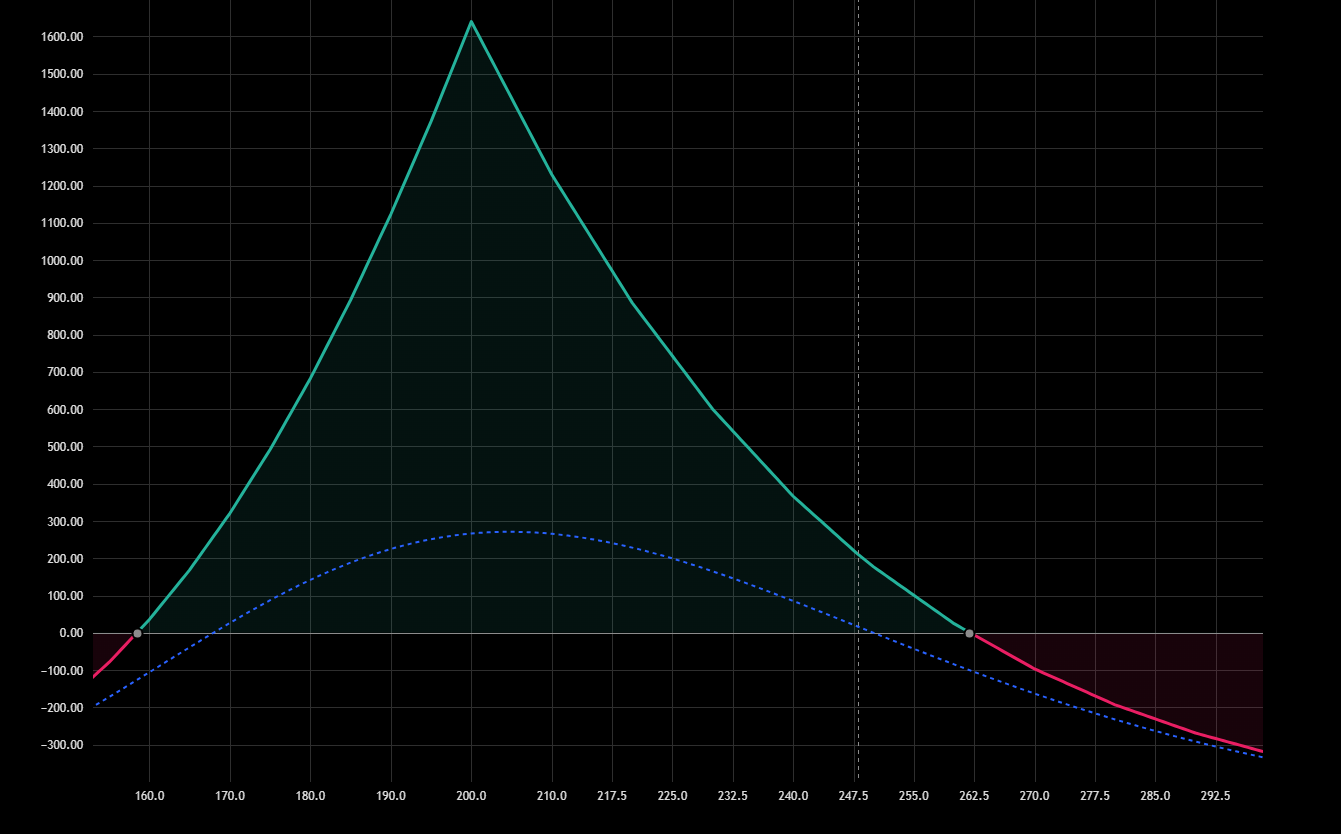

This is from one of last week’s picks, NIO:

This pattern is starting to show up on some other momentum names to play. You don’t buy the breakdown, you wait for a confirm and then look for a push to the other end of the range with a potential continuation breakout.

JOBY

GLXY

CVNA

30 Min chart, remount hit on Friday. Still a hated stock with crowded shorts. Sep 370/400 call spread good bet if you can catch a fill.

Post Earnings Con’t Longs

These have a similar structure as above, but on a shorter term basis.

APP

Options liquidity is not the best but if you can get the Oct 480/500 call spread against that low, it’s a reasonable setup.

ANET

Sep $145 Calls Around 3.50 good entry

DASH Regulatory Killshot

The Feds are in D.C., and we’re starting to see Doordashers being picked up for deportation. Doordash has an issue with fraudulent users of their app. It recently had a blowoff after earnings, and if it could retrace into 255-260 that’s a solid place to short.

I like the Oct/Jan $200 put calendar (ref: $5.30) for a downside bet. On a bounce, those calendars should be available for 5 bucks.