How to Bet On The Second Order Effects Of The Fed Cut

Discover the true source of inflation, how that's going to affect small cap stocks, and the exact location of where the puck will be.

It’s Fed week. Kinda like Woodstock but for the bow-tied class.

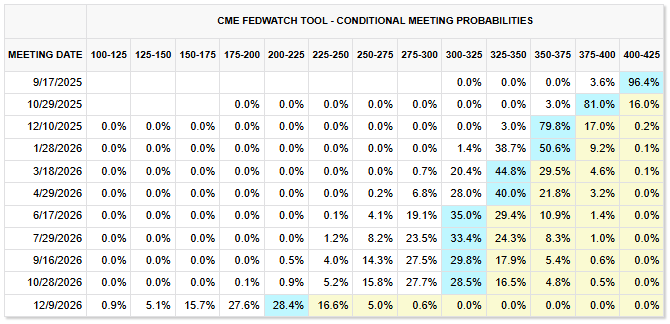

The 25 basis point cut is effectively a lock, but the real action is going to be in the minutes as they will provide future guidance over what to expect.

An incredible amount of commentary (read: noise) has been thrown out there on TV and social media as to whether a rate cut is a good idea.

I’ve not seen a single word spoken on how inflation is already being fixed.

The Data Point Nobody Wants To Touch

There’s two components that seem to worry economists, and the Fed.

Housing and Healthcare.

The Fed can’t fix it. There’s a reason they haven’t budged even though we’ve been above 4% for years.

There’s too many people. We’ve got between 30-50 million illegal immigrants in the country, with about 10 of them coming during the Biden administration.

That’s where sticky shelter inflation is coming from. Same goes for the marginal costs of healthcare with that many coming on board.

The DHS just got a budget the equivalent of the USMC. This is where deflation comes from— demand destruction through deportations.

You’re not going to hear about this in financial media, because it’s a political third rail, and a ton of people on Wall Street aren’t immigration hawks. But if they have their blinders on, then they’re not positioned to take advantage of it.

The Golden Swan

This is not an opinion that I hold strongly… but I we’re seeing the stars align on multiple fronts:

Immigration enforcement provides deflation without the usual risks

The Fed cuts, and while not guaranteed, could bring mortgages down

Housing has a pullback but without a ton of leverage in the system stabilizes quickly

All of a sudden, shelter is cheaper. Non-leveraged homeowners can start pulling cash out with lower-rate HELOCs. Everyone’s on peptides and TRT so obesity related healthcare costs go down by 30B per year. Insurance premiums drop from fewer people on the road and FSD technology. Manufacturing Onshoring. Robotics. Automation. Productivity from AI starts to finally kick in.

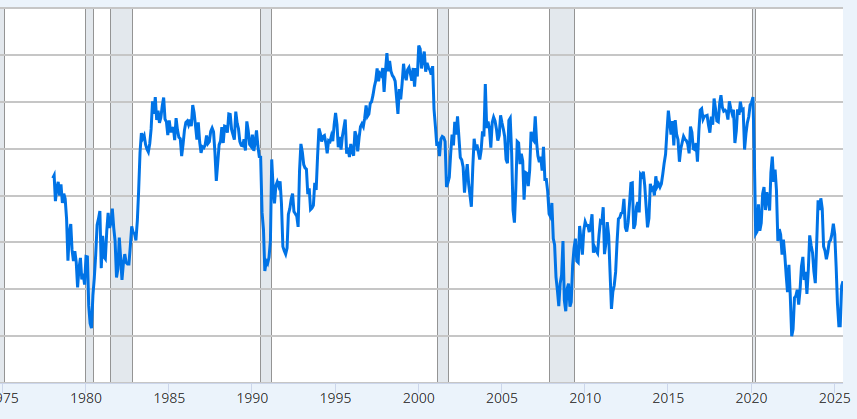

We’re looking at a resurgence of the consumer that we haven’t seen since the 1990s:

Look, I’m like a quarter Swedish so I’m always pessimistic. I can talk for hours about the debt-deficit spiral, commodity backed reserve currencies, and how the AI data center CapEx is way over its skiis.

But we can dream a little? Maybe the Soaring Twenties are closer than we think

Two Overlooked (And Undervalued) Companies To Trade

There’s one more “golden goose” that I see on the horizon that could drastically alter the trajectory of nearly half the stock market.

And I’ve uncovered two simple plays that are set to benefit from the Fed rate cuts, while having some potential tailwinds from a resurgent consumer.

This research is available for Convex Spaces Clients. If you aren’t one yet, you can choose to subscribe now. If you want to see what goes on when you’re a client, I just unlocked all content from August and provided a full trade review, so you can see what you get as a Client.