Triple Baggers Left and Right -- Convex Spaces August 2025 Trade Review

I'm pulling back the curtain -- we'll go over every single trade that I sent to Convex Spaces Clients In August

A month ago I had a soft-launch of the new Convex Spaces. My goal is to help you find the best setups in the market, and show you how to own Convexity on multiple timeframes.

The results have been solid. I’d like to share with you those results— not just cherrypicked— you’re getting the firehose. I’m doing this because I believe once you see my approach and how I think about the options market, you’ll become a full paying member of Convex Spaces.

How To Read This Trade Review

When I give CS Clients trade ideas, I expect you to know how to manage your risk, take profits, add back to positions, and size appropriately.

With that said, we’re going to take a “naïve” look at all of these setups. That means we will assume that each trade has been taken and held to today.

I believe that’s a fair way to look at it. There’s some names that are in very favorable positions like IONQ, and others that recently had hard pullbacks like ANET.

These trade setups are sorted by day, and I’ve unlocked every single one of these posts so you can go and look at my thoughts when the trade was alerted.

Most of the option trades are straight forward, but there’s a few advanced setups in there, and I provide some guidance on what to do with these spreads to help juice the returns or cut risk down.

Now is the Time To Join

I’m new to this platform, but I’ve been helping traders navigate these markets since 2009. For Convex Spaces to be successful I need your help.

There is a “network flywheel” in Substack that can allow me to grow this publication quickly, but I need users to join so that the signal is boosted in the algorithm.

That’s why I’m offering a 20% discount on all annual memberships. This offer is available for a short amount of time.

You can get access to the discount here. I look forward to seeing you on the other side.

Let’s look at our setups.

August 7th, 2025

COIN Bups

COIN had an earnings gap down and a second followthrough into some key levels (support, AVWAP).

I suggested the Sep 250/240 Bull Put Spread at 1.20, and those are going to expire worhtless, so that’s a return of 13.6%

LYFT Swing

The company had decent earnings and was coming into the gap fill from May. I looked at the options board, and the upside calls were dramatically underpriced, because the multi-year range highs were at 20 but the options were left for dead.

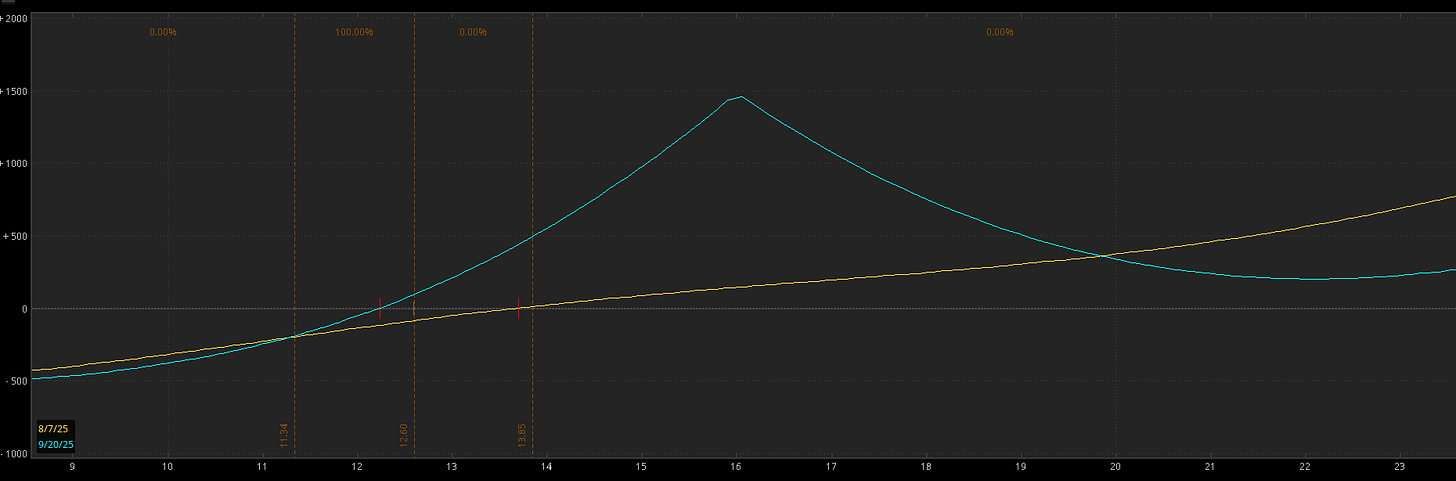

I recommended the Jan $20 calls at $0.45, with a planned add at $0.30.

Here’s how the option has traded during that time:

The 0.30 add almost hit, but the stock reversed right before it.

Those options are currently trading at $2.00, so that’s a return of 344%.

Vol Trade in AEO

The post Sydney Sweeney trade. Don’t underestimate the power of mimetic capital in this market.

The trade I suggested didn’t do very well, because I was trying to capture some volatility on short term options.

Here was the trade:

Buy +15 Jan’26 $20 Calls @ 0.70

Sell -10 Sep’25 $16 Calls @ 0.50

My bet was that there were too many traders loaded up on short term options, and those were a sell, but the longer term change of the stock was going to make it a buy.

Here’s what the setup looked like on initiation:

The problem was that the company did have monster earnings. This pushed the September options “in the money” and the trade lost the short vega exposure.

And the Jan calls, while they have paid out, saw a drop in IV and some theta kicked in. Here’s what the trade looks like now:

The trade has a debit of $550 on that size, but there’s margin on the trade of about $3500 due to the strike difference. That puts the return on this trade at -6%.

Could this trade workout? Sure, if there were a pullback into Sep opex. But a way to manage the trade would be to close the 10 Sep $16 calls, and then sell -13 Nov 20 Calls. It puts more cash on the table, but removes the margin and resets you into a bullish position:

August 9th, 2025

FTCI Moon

I highly recommend you read the research behind this trade. I think the SOLBAT thesis is still quite early, and electricity prices are going to matter much more as AI hyperscalars build out capacity.

We made the call to get long this name for a multi-month trade at 5.65. The stock’s at 7.11 so that’s a current gain of 26%.

August 11th, 2025

QQQ Hedge

This market has been a grind higher, but the options are still quite expensive relative to the actual price movement. Investors have been quite stupid trying to make bearish bets, getting long VIX calls and index puts.

Put butterflies give you a low cost way to protect yourself into moves lower.

I recommended the QQQ Sep 570/550/530 Put Fly for 2.32.

Here’s where the trade sits now:

Unless something absolutely wild comes out from the Fed meeting, I fully expect this trade to be at a -100% loss. And I’ll probably recommend a similar trade soon, because it’s a cheap way to sleep at night.

FIG Swing

I was eyeing the breakout above 82.20, with a first target at 88, and then a push to 97.

First target was hit, but after two attempts sellers showed up again… and then earnings hit and the stock’s trading all the way down at 53.

I recommended the Sep $90/$105 call spread, which unless you scaled, are sitting at a -100% loss.

FLY Swing

Another IPO reversion trade. Focus was on the pullback to the Gap AVWAP, and provided that held, it’s a long.

It didn’t hold, and it was a no-trade. In a few weeks, this stock may setup for a nice push to retest $50, so keep it on your watchlist.

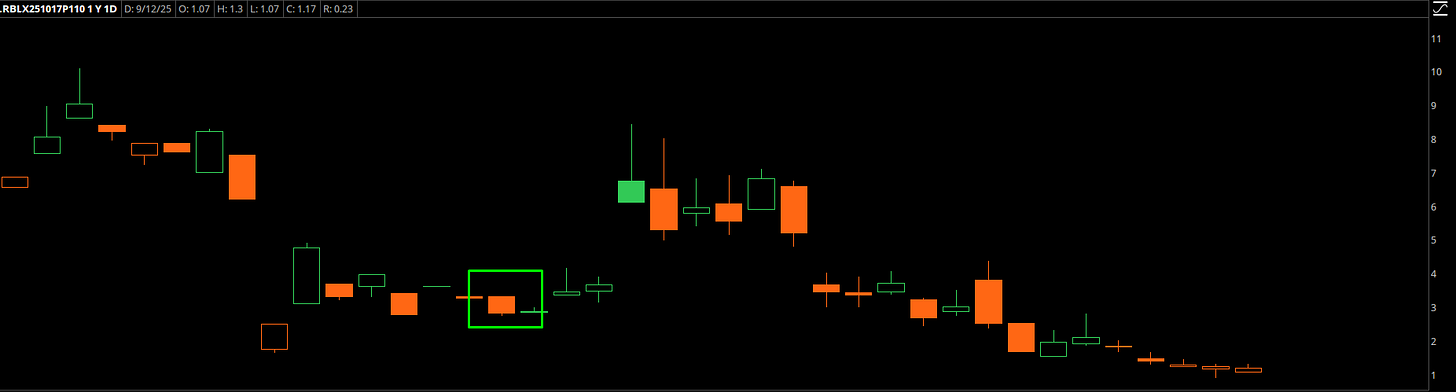

RBLX Short

Roblox had a monster move on earnings that was faded aggressively, and then new resistance formed in the 130s. I noticed the failure to retake that, and I called out the October $110 Puts at $2.90.

A few days later, there was a gap down into the 50 EMA and the options had a nice push higher:

If you had held through that, then the trade isn’t working out, and the option has a value of $1.17, which is a return of -60%.

The stock’s back into that 130-135 resistance zone. It could be good for a reshort here.

RR Swing

The stock came out with earnings and price action was solid with the EMAs curling up. I made the call to take it long at 2.11 with a 1.86 stop.

The stock is currently trading at 3.29, which is a return of 56%.

BULL Swing

I was looking for the takeout of the IPO AVWAP. It wicked over it briefly and then fell apart, so this trade ended up being a stinker.

Longer term setup is still valid, it just may need more time to base out and we may get a clean setup on a $16 breakout.

I called out a “set and forget” setup in the Oct $20/$30 bull call spread. At the time these spreads were going for 0.65, and the value of the spread is now at about 0.15, so that’s a return of -75%.

August 12th, 2025

BMNR Fade

This stock is the Ethereum treasury play that was parabolic back in July and had an echo bounce that I was looking to take short.

I wrote an essay on what I was looking for in order to trade this one, and the conditions didn’t hit. I wanted one more parabolic push higher to trade the unwind, but it didn’t give it to me.

No trade.

TEM Swing

This had been on my watchlist for a while. It had good earnings, and I was shooting for the $75 highs with a potential breakout.

I called out the Oct $80 calls at $4, which are currently trading at $11.30 for a return of 182%.

BABA Swing

Straight up China momentum trade. I alerted the October $140 calls at $3.50, and they’re currently priced at $17.95, which puts the return at 412%.

August 13th, 2025

ATOMUSDT and SCRTUST

I view these two as part of the same thesis.

With the crypto treasury play, and the current backdrop of digital tokens being created by both banks and nation states, we could see new L1 protocols come on board.

But you need to scale, and that requires network effects. And these tokens are “crypto as a service.”

ATOM is a blockchain ecosystem (Cosmos) that allows other blockchains to grow at a cost. It’s kind of like web hosting, but for new blockchains.

SCRT is in the same grouping as ATOM, but they provide privacy and the ability to have secret contracts on chain.

The price alert for ATOMUSDT is at 4.833, and it’s currently at 4.881, which is effectively flat.

The price alert for SCRTUSDT is at 0.19, and the token’s trading at 0.1884, so a small loss.

Don’t sleep on these two tokens.

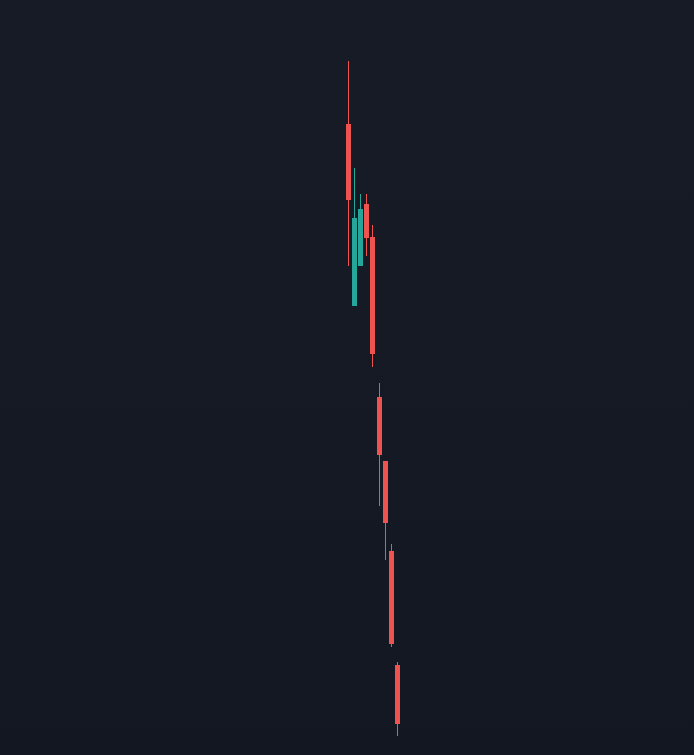

PLL Swing

I have to use a different chart because the company just merged with Sayona to make a larger lithium company. This was announced after I was looking for a breakout, and you can see how price reacted into the merger.

The new ticker is ELVR. If you’ve ever experienced what happens to prices when commodity stocks merge, this should not be a shock:

The trade I suggested was the November $12/$15 call spreads at 0.35, and unless some miracle happens those are going to be at a -100% loss.

LAC Swing

Another lithium trade, where I’m looking for the 3.25 breakout. It hasn’t happened yet, so it’s no trade but things could get interesting after the Fed cut.

NIO Moon

This was a similar setup to LYFT, where the options were underpriced on the upside.

I recommended the Nov $8 calls at 0.13, and they’re currently trading at 0.60 for a 361% return.

August 14th, 2025

GLD Strangle

Gold had been dead in the water for months, and it looked ripe for a squeeze.

I called out the October 300/315 Strangle for 9.00. Here’s how prices have moved:

The value of the spread is at 22.71, which is a return of 152%

August 17th, 2025

JOBY FBD

I was looking for a failed breakdown in JOBY, where it would clear support and then reverse straight back. It never happened, so no trade.

GLXY FBD

Another failed breakdown setup, this time it triggered but melted down the next day. I didn’t have explicit price callouts, but if you had followed the breakdown setup, the worst case was an entry of 26.80, with a stop of 25.50 so a loss of -5%.

CVNA FBD

This was a remount setup on the most hated stock in the market. The stock had a nasty gap down and then recovered, with plenty of trade opportunities under the surface.

My setup was for the Sep 370/400 call spread which was going for about 6.50. There were some solid opps to take profits, but if you held through today, you’d be sitting at a return of about -7%.

As an aside, this is why I like call spreads on large priced hot names like this. You end up with traders trying to play out of the money options so they can “afford” it which kicks up the skew, and allows you to sell OTM calls while still being bullish on the stock. As you can tell from the screenshot above, there were about 6 different opportunities to earn 100% on this trade.

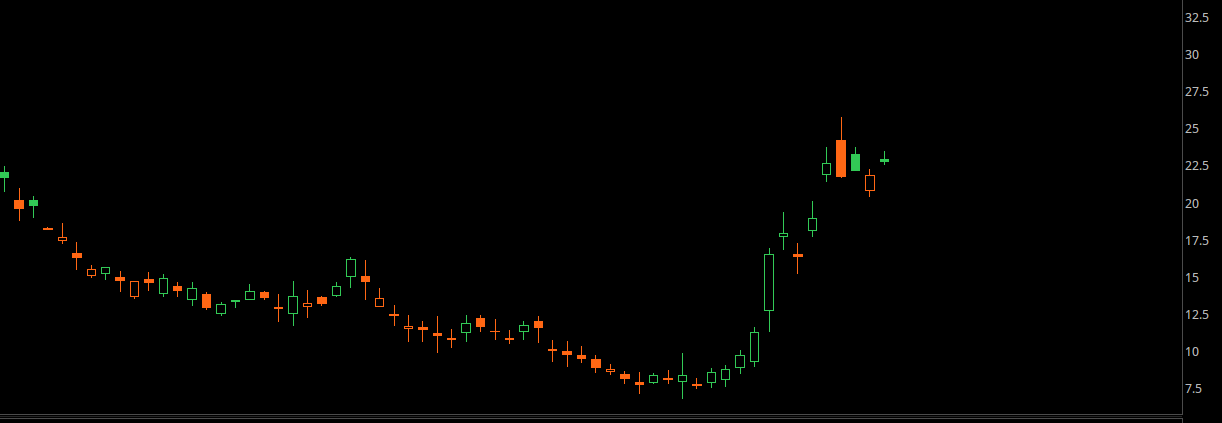

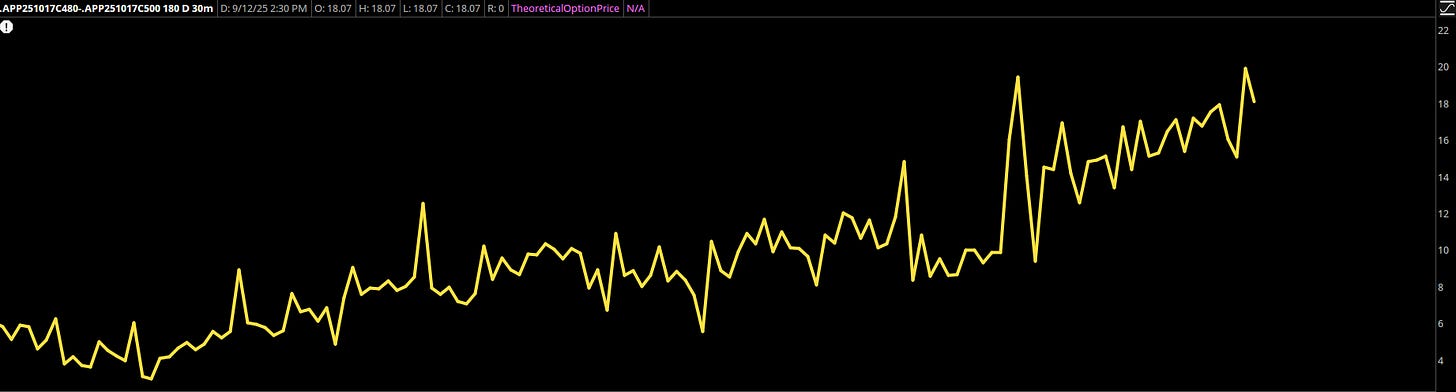

APP PEAD

I was targeting continuation after a solid earnings report in APP. The next day the stock gets killed, runs to the 50, and then retakes the 20.

As an aside, it’s incredible how responsive those levels are in this stock:

The stock jammed on S&P 500 inclusion. I called out the Oct 480/500 call spread, which was going for about 4.50 and has nearly maxed out due to the rally:

That puts it at a 300% return.

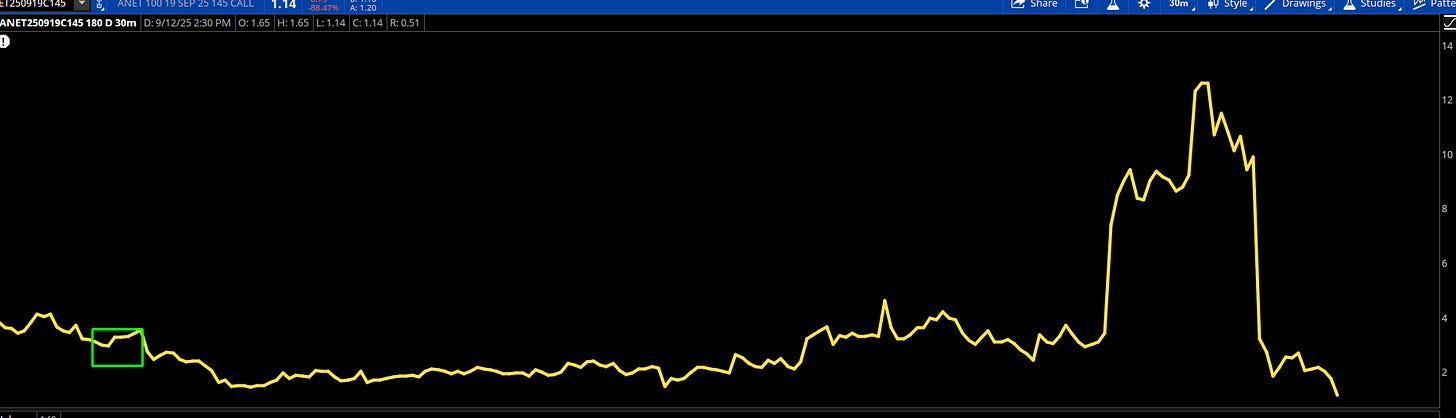

ANET PEAD

Another post earnings range trade that broke down, and rode the 20EMA before going parabolic this past week.

I called out the Sep $145 calls at 3.50.

On the spike these traded above $12, but with that hard reversion they are now sitting at a return of -67%.

DASH Short

I think Doordash is about to get hit with margin compression as they lose their labor force, as well as signals from restaurants such as SG and CMG that are already signalling weakness in consumer spending.

Because I don’t want to pay $10 for a burrito, but I also don’t want to get charged $30 to deliver it to my house.

I called out the Oct/Jan $200 Put Calendar for $5.30 and the spreads are currently trading at a value of $4.43 which puts the return at -16%. If the stock hasn’t cracked into October, then the trade is to sell the Dec puts against the Jans to reduce the basis.

August 18th, 2025

HPP Deep

This is an incredibly contrarian reflexive bet. You should read the post for the full thesis, but here’s the breakdown:

AI spending is going up

Startups are coming back to San Francisco because of governance changes

Rates are going down

Hudson Pacific (HPP) is primarily an office space play in SF/SV. This is a deep value play that’s great for an IRA hold, just buy and close your eyes for two years.

We called it out at the price of 2.6, and the stock’s trading at 2.94, which is a return of 13%.

August 20th, 2025

IONQ FBD

IONQ had been trading in a range for a while and broke underneath obvious support and was bid up aggressively. I was looking for a retest of the upper end of the range, and Friday’s breakout was the icing on top.

I alerted the October $55 Calls at a price of 0.74. Those options are currently trading at 6.20, so that’s a gain of 737%.

UBER Swing

I was looking for a failed breakdown similar to IONQ. It had a test of the 20 EMA, and then reclaimed a big level. I recommended the Oct $100 calls, looking for the $100 roll.

The options traded at $2.70 on the open, and ran to $4 before the stock got got clobbered again. Depending on your executions it could have been a breakeven trade, but if you had held through the entire move, then you’d have options at $2.35, which is a loss of -13%.

(The stock’s ready for the $100 push now.)

PLTR Iron Condor

After the momentum unwind in PLTR, I made a bet that the stock would be rangebound. The volume that came in on the bid when the stock pushed to $140 was exceptional, but odds are there would be some bagholders who still had to unwind.

I made the call to sell an unbalanced iron condor:

Sell 2x Oct 120/110 Put Spread @ 1.10

Sell 1x Oct 200/210 Call Spread @ 0.70

Here’s what the trade looks like now:

The premium’s completely evaporated from the put side, and the trade’s sitting with a 9% gain on capital. This seems low, but the tradeoff is you get very high odds with iron condors.

I don’t think sticking around in the trade much longer is a good idea, but if you wanted to milk the trade further, then you’d roll up the put side to higher strikes for a credit, and then get ready to sell another round of call spreads into any kind of parabolic move into 180.

August 21st, 20205

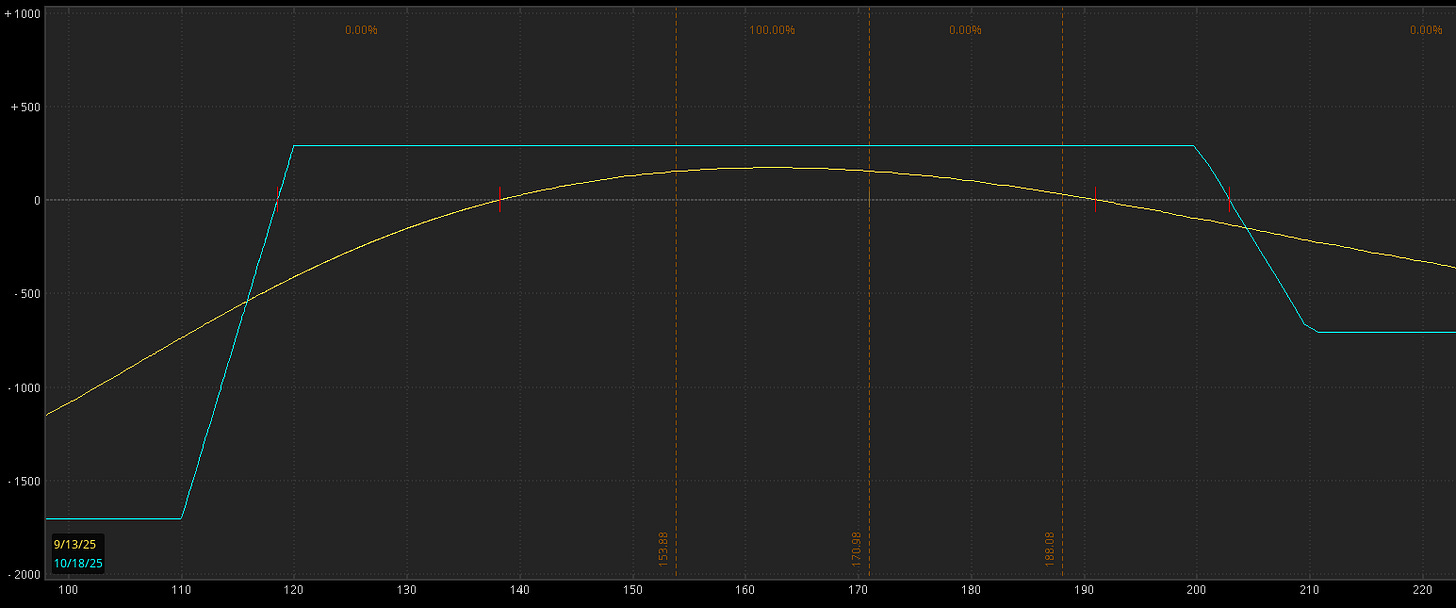

BIDU Swing

This former Chinese high-flyer had been compressing for a while, with steady higher lows throughout the entire summer. The company just had earnings, and the upside calls were very underpriced relative to what could happen.

I made the call to pick up the Jan $120 Calls at 1.80. These options are now sitting at 10.70, which is a solid gain of 494%.

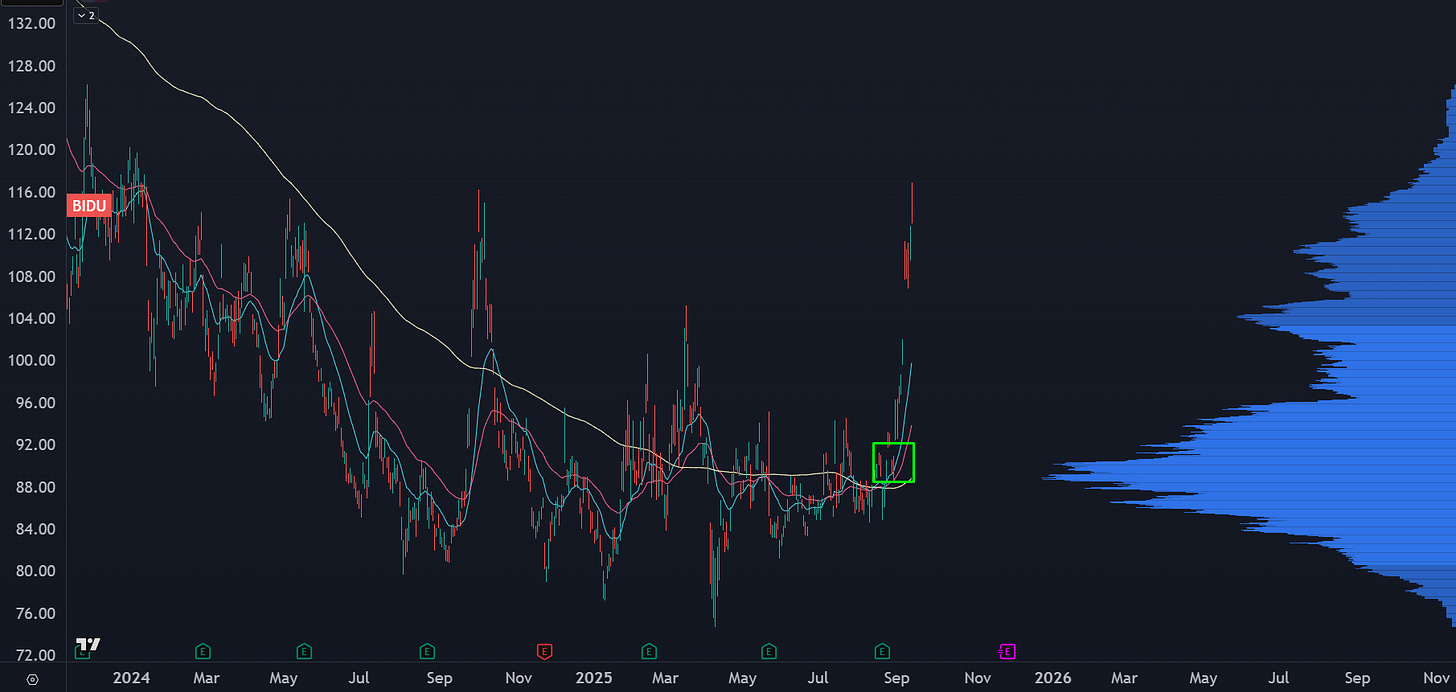

LULU LEAPs

One of the worst trades this month. I still like the idea, which is that longer term options (LEAPs) are a good way to take longer term exposure in LULU, and you can sell shorter dated options against the trade.

Given the downtrend, I did make the call to scale into this, so you can have spare capital to roll calls down if needed.

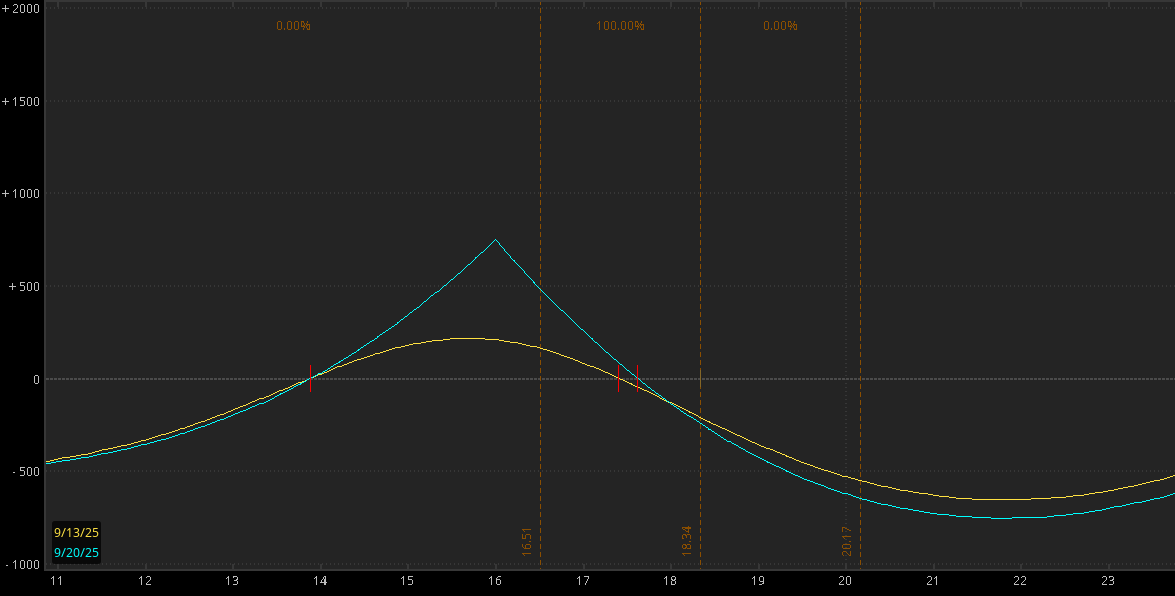

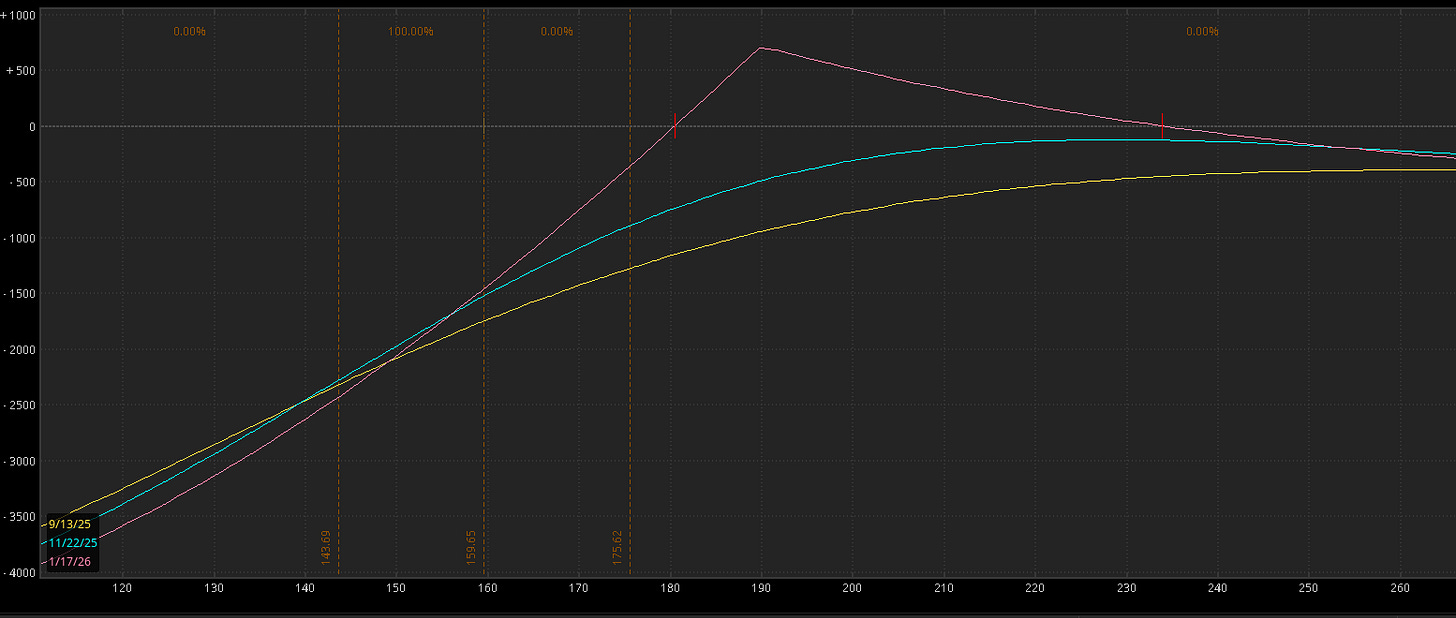

This is the trade setup:

Buy to Open LULU 18Dec26 $180 call for $57

Sell to Open LULU 21Nov25 $240 Call for $8.10.

The trade is down 64%, which is about right given the earnings gap.

Let me show you what an adjustment would look like. Here’s the current trade:

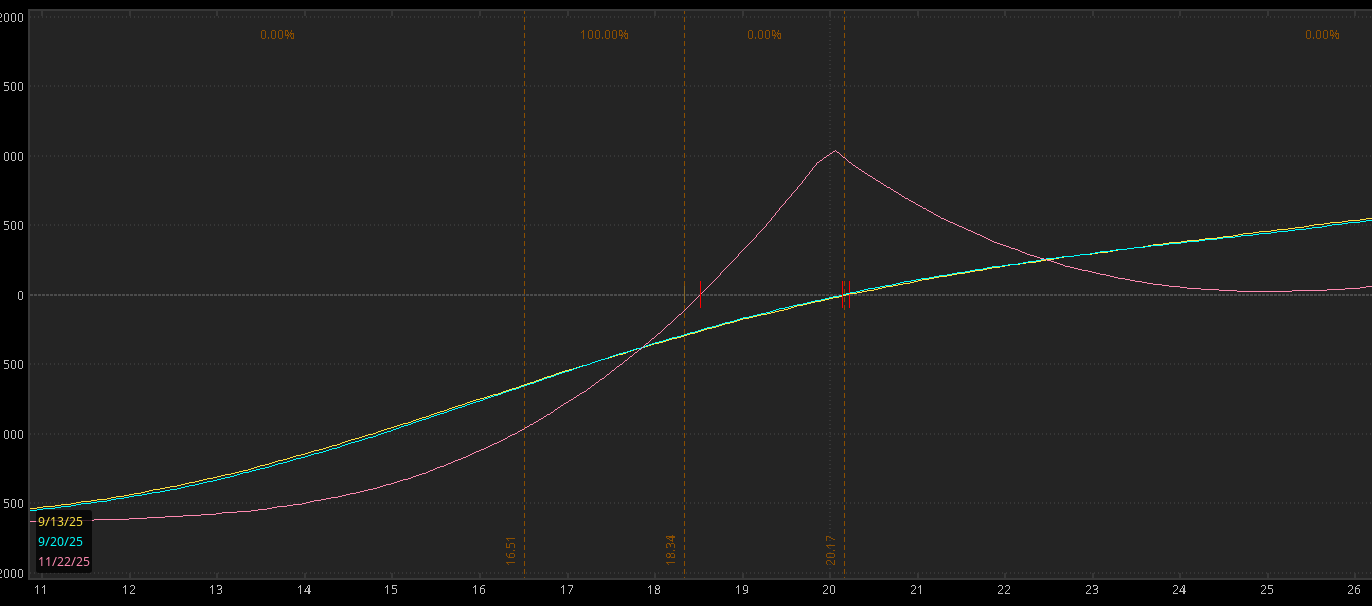

If you roll the Nov $240 calls out to the Jan $190 calls, and then roll the Dec26 $180 calls down to the $155 calls, then the trade evolves to look like this:

The roll cost for the long options is about $8, and the roll yield from the long options is also about $8. That means you can keep exposure without adding additional capital.

Longer term, LULU is coming into its 2020 lows and the range from 2019. I’m not expecting the stock to double overnight, but if it builds out a base, and you can continue to sell calls against LEAPs as the stock bases, then I think it will pay out big in about 6 months from now.

ZETA Swing

I like this company. It got killed on a short report last year, they defended it but bagholders needed to get cleared out. It recently had a solid move on earnings, and I was expecting trend continuation.

It hasn’t happened yet, but it is knocking on the door of that $20 breakout.

I recommended the Dec 22.5/30 Bull Call Spread at 0.84. The spread is currently trading at 1.45, which is a return of 72%.

August 24th, 2025

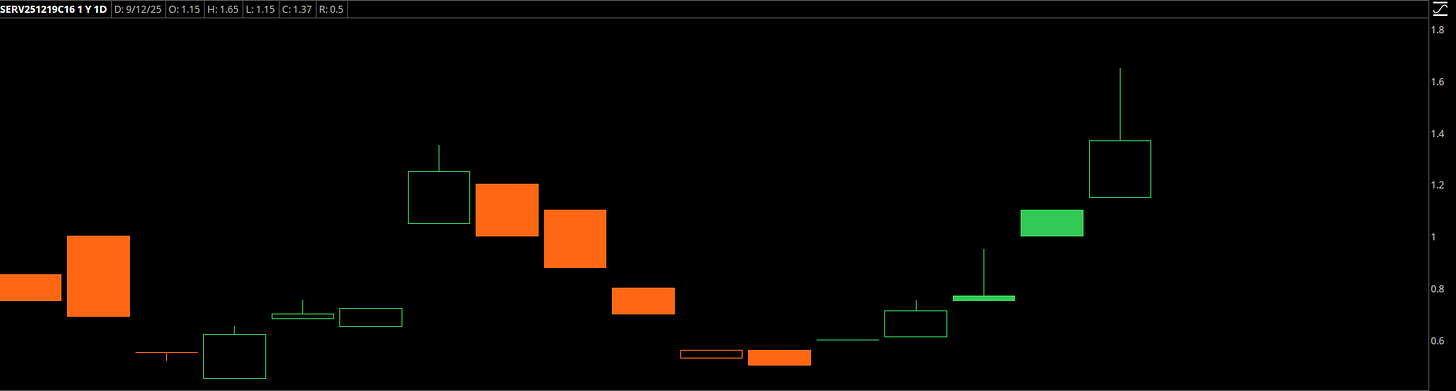

SERV Swing

Robotics play, and I was anticipating the breakdown to fail. I made the call to get long the Dec 16 calls if the stock cleared $11.

The breakout hit on Aug 27th, and then fell apart 2 days later. The stock’s giving it another shot and traded up to $13.

If you had bought the calls on the breakout, you got them for around 1.10. The options are currently trading at 1.37 which makes it a 24.5% gain.

GLNG Swing

As a rule, Energy stocks are tough to play for breakouts. I thought this one had legs, and it still might, as the LNG trade is still emerging as a result of energy demand and tariff resolution.

I made the call to take it at $44.84, with a stop at $41.59. That got hit on September 8, so that’s a loss of -7.2%

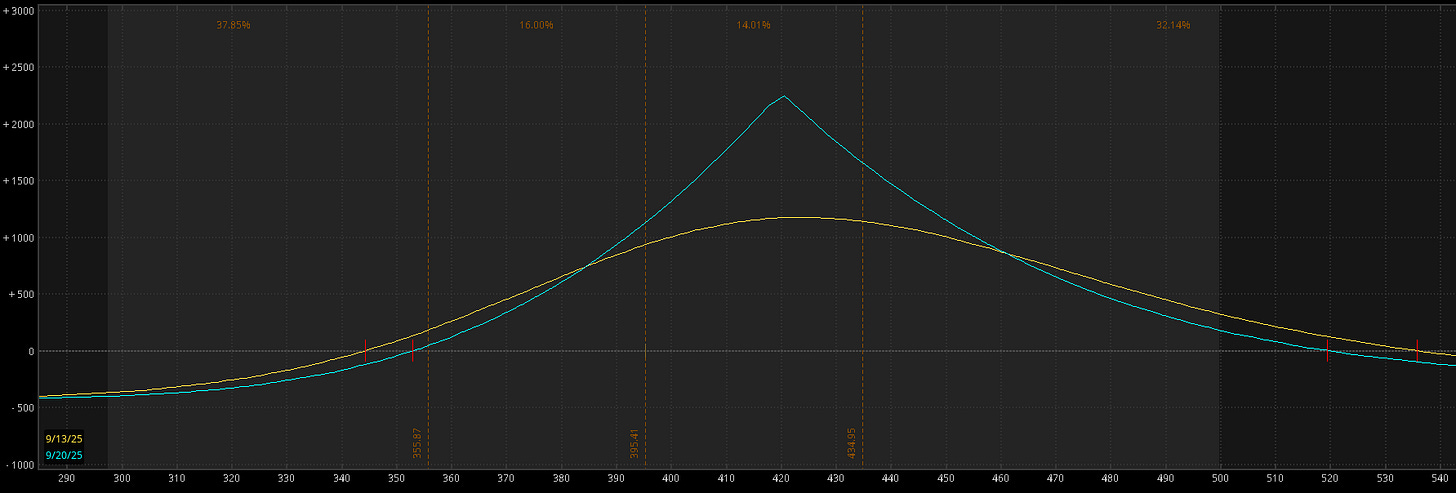

TSLA Swing

I started getting bullish on TSLA as the stock hadn’t moved through the entire summer, and the Optimus/FSD Narrative was about to hit.

Traders often try and nail the move with short term options, so I made the call to get bullish but fade them a little bit with a calendar spread.

I recommended the TSLA Sep/Oct 420 Call Calendar @ 4.31, this calendar is currently trading at 13.65 for a gain of 217%

If TSLA is trading under 420 by opex, you can close out the short calls, and then sell the Oct 450 calls to cut risk down while still staying in the trade.

DAVE FBD

Software stock with a power earnings move. It tried to breakdown and failed, then reclaimed support.

The setup is currently long at 199 with a stop under 182. Current price is 229 so that’s a return of 15%.

RBRK FBD

This is a cloud data management company, similar structure as DAVE where it had a solid run late spring but went nowhere in the summer.

There was a failed break under support, and the setup was long 88.77 provided it holds above 83.

It worked for a few weeks, then got killed on earnings. The 83 stop puts the loss at -6.5%

SOLBTC Perps

The bet here was that capital would rotate out of BTC and into SOL as it would be the next Layer 1 to move. This is a trade in crypto perps.

The plan was a starter at 0.0018096 and an add at 0.0017.

It’s currently trading 0.0020886 (so many decimals), but that’s a return of 15.4%.

August 26th, 2025

JPM Swing

While tech was rotating, I saw that banks were holding their bids, and they have some tailwinds into the end of the year with SLR ratios and rates getting cut.

I called out the Jan 320/340 call spread at 5.15, and it’s currently trading at 6.43 for a gain of 25%.

ALAB Swing

I had an internal pivot level that I was expecting to clear out and see some momentum. It did for a day or two, gapped down into the 20EMA, and then reclaimed it before going on a monster run.

I made the call to get long the Sep 205 calls at $4.00. They’re currently trading at 25.50, which is a gain of 537%.

RNA Swing

The joys of biotech trading! This was a straightforward continuation pattern with a long on a $48 breakout. There was one day of followthrough, then sellers showed up aggressively…

… and then they had a stock offering. Massive gap down. The offering was bought, which is a good sign, but it’s probably dead money for a while.

If you bought the $48 breakout, your max DD was -26%, and current loss is -6.8%.

OPEN RTIH

This is a “post-meme stock mania” trade I like to put on, where if a parabolic has a hard selloff, I want to sell puts into it because the stock tends to go rangebound after that.

This trade didn’t trigger, but I’m still looking at something similar as we head into October.

August 27th, 2025

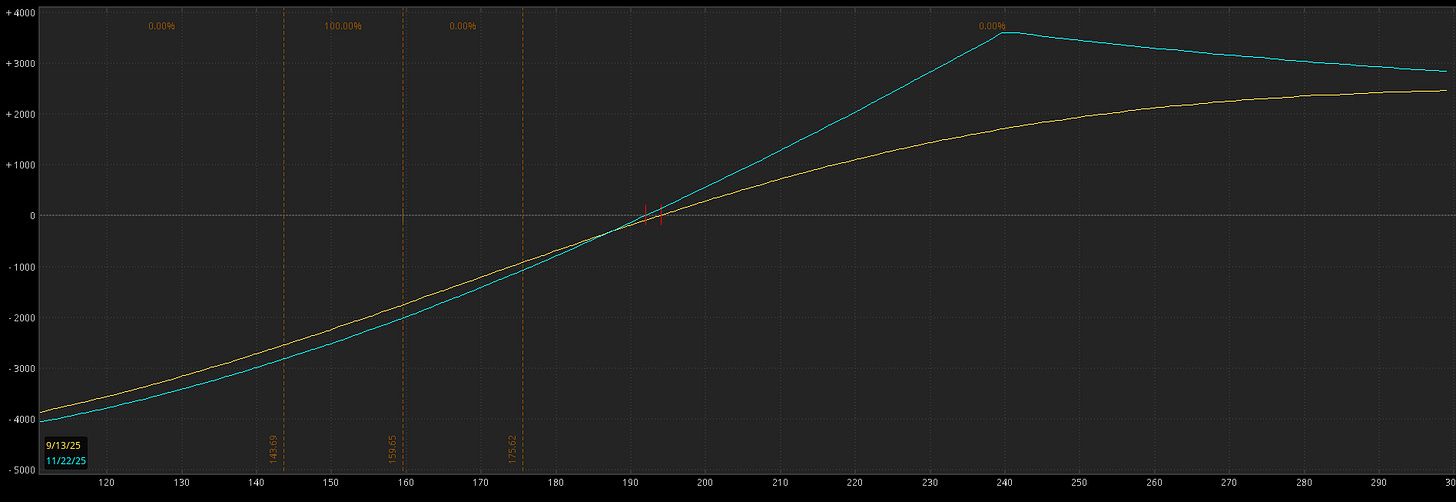

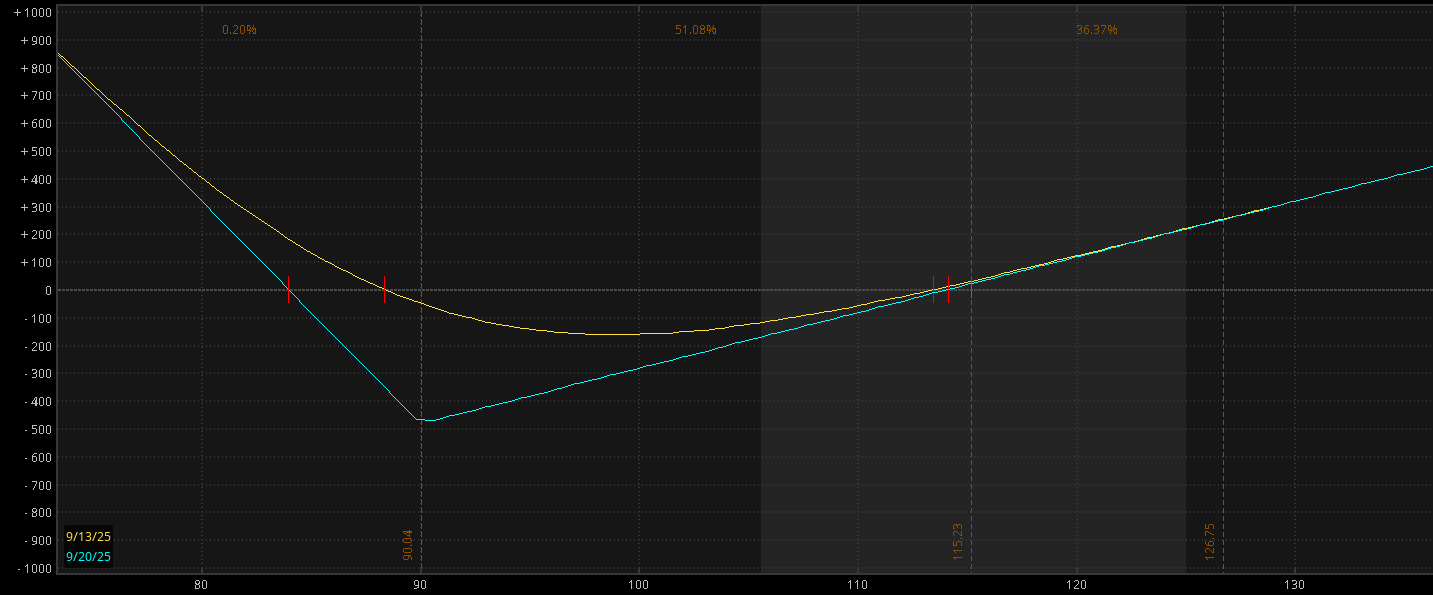

HOOD Put Overbuy

This is a kind of long volatility trade I like when you expect a liquidity pull but a bounce. Similar to what we saw in PLTR.

Basically, you buy some puts, and then you get neutral by purchasing the stock. If the stock gets crushed, you buy more shares and scalp them long, and your long puts protect you if the name gets very loose to the downside.

That means it doesn’t matter which way the stock goes, you just want it to move big.

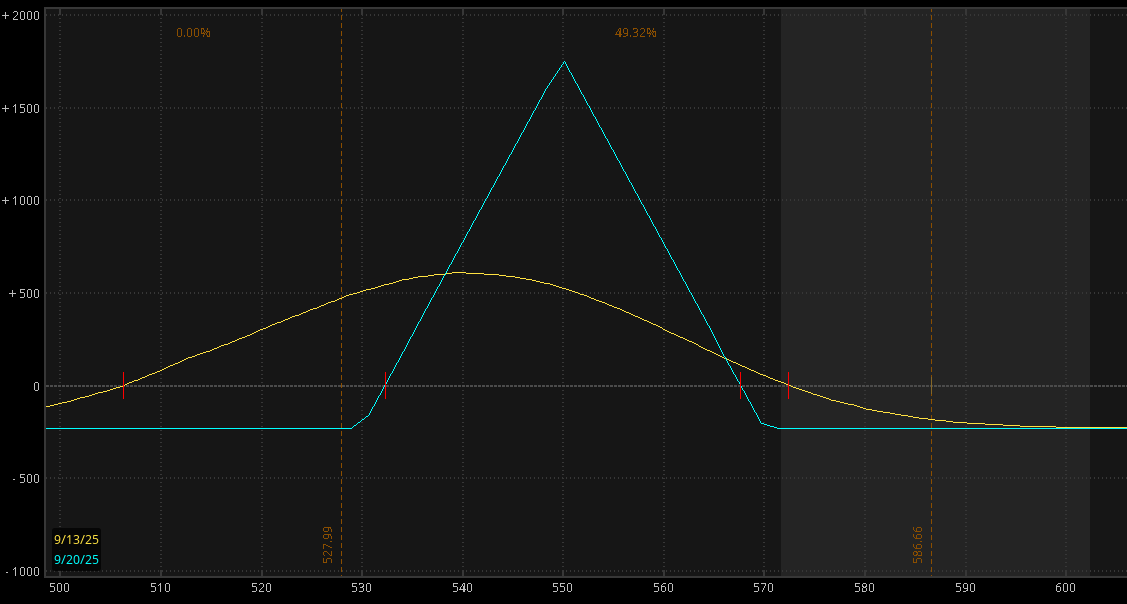

The setup was to buy the HOOD Sep $90 puts at 2.23, and then buy 20 shares of HOOD stock at 103.

Here’s the trade setup at initiation:

Now if you were an incredible trader and bought more shares on the breakdown to 97, then you were rewarded on the gap up news on the S&P 500 inclusion.

Yet even if you just kept this trade on going into opex, you would be up a small amount:

So about $30 per trade on total (non-margin) capital requirement of 2032. So it’s about breakeven.